& meet dozens of singles today!

User blogs

The United States’ GPS system, which is operated by the Defense Department, offers every one of us critical infrastructure around what is known as positioning, navigation and timing (PNT). Positioning and navigation is obvious every time we open up a maps app, but timing is also a critical function of GPS — offering our smartphones and devices precision timing to ensure that compute processes are accurately synced.

As more of the economy relies on these systems, they have increasingly become a target of hackers through GPS spoofing. The government wants to create additional redundancy and resiliency in the sector, and has explored using commercial alternatives to augment or backup parts of the GPS system.

The Department of Transportation, under a Congressional mandate added to the defense authorization bill for fiscal year 2018, ran a comprehensive evaluation of commercial alternatives to government-owned and operated GPS that could serve as a backup to our existing infrastructure.

Among the 11 companies considered in the study were a number of prominent positioning startups, including Satelles, which raised a $26 million round of capital in 2019; NextNav, which has raised a total of nearly $300 million including $120 million from Fortress a year ago; and Hellen Systems, which according to Crunchbase raised a small seed round last year.

You can read the full report from the DOT, which runs to 457 pages long and covers all 14 measures the researchers explored in evaluating these different PNT platforms.

The summary though is that there are a number of companies that offer decent backup capabilities for GPS, although the performance and cost vary widely. NextNav came out furthest ahead according to the researchers, who stated that “All [Technology Readiness Level]-qualified vendors demonstrated at least some PNT performance of value, but only one vendor, NextNav, demonstrated in all applicable use case scenarios.”

Beyond that, the DOT researchers said that “… none of the systems can universally backup the positioning and navigation capabilities provided by GPS and its augmentations.” Given the range of needs that GPS fulfills, they recommended that “a diverse universe of positioning and navigation technologies” be used to add resiliency in this infrastructure.

Finally, costs remain quite complicated to determine. Given the way that different positioning systems operate, the fixed and variable costs for each system are highly dependent on desired coverage area and necessary transmitter density. The researchers weren’t able to devise a clear opinion on the cost effectiveness of different systems, although they do offer some initial data that can provide early insight.

Given the importance of GPS and the desire for companies and the government to have reliable alternatives, VCs have dumped money on the PNT sector in recent years. Now, we have some hard data on which vendors are potentially picking up steam in terms of functionality and utility.

The dating and networking service Bumble has filed to go public.

The company, launched by a former co-founder of the IAC-owned Tinder, plans to list its share on the Nasdaq stock exchange, using the ticker symbol “BMBL.” Bumble’s planned IPO was first reported in December.

Bumble CEO Whitney Wolfe Herd was on the founding team at Tinder before starting Bumble. She filed suit against Tinder for sexual harassment and discrimination, which was at least somewhat inspirational in her quest to build a dating app that put women in the driver’s seat.

In 2019, Wolfe Herd took the helm of MagicLab, renamed to Bumble Group, in a $3 billion deal with Blackstone, replacing Badoo founder and CEO Andrey Andreev following a harassment scandal at the firm.

The company is targeting the public markets at a particularly heady time for new offerings, with investors embracing venture-backed IPOs throughout late 2020 and the start of 2021. Previously privately held companies like Airbnb, Affirm, and others have seen their fortunes soar on the back of prices that public investors are willing to pay, perhaps inducing more IPO filings than the market might have otherwise seen.

You can read its IPO filing here. TechCrunch will have its usual tear-down of the document later today, but we have pulled some top-line numbers for you to kick off your own research.

But before we do, the company’s board makeup, namely that it is over 70% women is already drawing plaudits. Now, into its numbers.

Inside Bumble’s IPO filing

Let’s consider Bumble from three perspectives: Usage, financial results, and ownership.

On the usage front, Bumble is popular, as you would imagine a dating would have to be to reach the scale required to go public. The company claims 42 million monthly active users (MAUs) as of Q3 2020 — many companies will try to get public on the strength of their third-quarter results from 2020, as it takes time to close Q4 and the full calendar year.

Those 42 million MAUs translated into 2.4 million total paying users through the first nine months of 2020; the percent, then, of paying users to MAUs is not 2.4 million divided by 42, but a smaller fraction.

Turning to the numbers, recall that Bumble sold a majority of itself a few years back. We bring that up as Bumble’s financial results are complicated thanks to its ownership structure.

After the IPO, Bumble Inc. will “be a holding company, and its sole material asset will be a controlling equity interest in Bumble Holdings,” per the S-1 filing. So, how is Bumble Holdings doing?

Medium? Doing the sums ourselves as the company’s S- 1 is fraught with accounting nuances, in the first nine months of 2019, Bumble managed the following:

- Revenues of $362.6 million

- Net income of $68.6 million

And then, combining two columns to provide a similar set of results for the same period of 2020, Bumble recorded:

- Revenues of $416.6 million

- Net income of -$116.7 million

For those following along, we’re using the “Net (loss) earnings” line, for profitability, and not the “Net (loss) earnings attributable to owners / shareholders” as that would require even more explanation and we’re keeping it simple in this first look.

While Bumble saw modest growth in 2020 through Q3 and a sharp swing to losses on a GAAP basis, the company’s adjusted profitability grew over the same time period. The company’s adjusted EBITDA, a very non-GAAP metric, expanded from $80.0 million in the first three quarters of 2019 to $108.3 million in the same period of 2020.

While we are generally willing to allow quickly-growing companies some leniency when it comes to adjusted metrics, the gap between Bumble’s GAAP losses and its EBITDA results is a stress-test of our compassion. Bumble also swung from free cash flow positivity during the first nine months of 2019 to the first quarters of 2020.

If you extrapolate Bumble’s Q1, Q2, and Q3 revenue to a full-year number, the company could manage $555.5 million in 2020 revenues. Even at a modest software-ish multiple, the company would be worth more than the $3 billion figure that we discussed before.

However, its sharp unprofitability in 2020 could damper its eventual valuation. More as we dig more deeply into the filing.

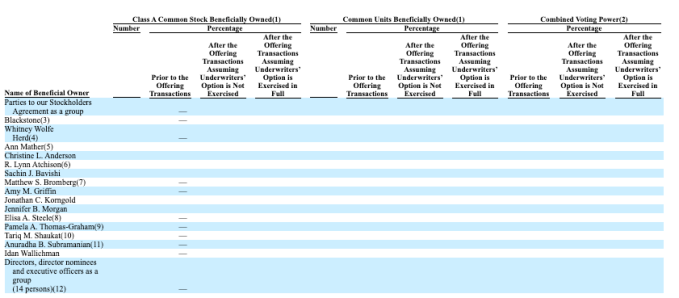

Finally, on the ownership question the company’s filing is surprisingly denuded of data. Its principal shareholder section looks like this:

When we know more, we’ll share more. Until then, happy S-1 reading.

Source: https://techcrunch.com/2021/01/15/bumble-files-to-go-public/

German startup Moss has raised a $25.5 million (€21 million) funding round led by Valar Ventures. Existing investors Cherry Ventures and Global Founders Capital are also participating. Moss provides credit cards and a spending platform to small and medium businesses in Germany.

The company has developed its own risk engine to come up with a credit card limit for your company. Like Brex in the U.S., Moss promises higher credit card limits compared to credit cards offered by traditional financial institutions.

Again, Moss doesn’t offer prepaid or debit cards — it focuses on credit cards. You can spend within your limits and pay at the end of the month. You don’t need to top up your Moss account to start using it.

Credit cards work on the Mastercard network. Admins can issue a physical card for each employee or each team. You can also issue virtual cards for online payments and subscriptions. You can set different limits for each card.

From the administration panel, you can track expenses, search for specific expenses and see your ongoing subscriptions — it helps you identify duplicates. Users can attach receipts and information to each transaction for accounting purposes.

The company has issued 1,000 credit cards and has processes 10,000 transactions so far. Right now, its clients include startups and tech companies. But Moss expects to expand to other industries soon thanks to today’s funding round.

Moss competes with Spendesk, Revolut Business and others. These corporate card products focus on debit cards. Let’s see if offering credit cards turns out to be an important differentiating feature.

Source: https://techcrunch.com/2021/01/15/corporate-credit-card-platform-moss-raises-25-5-million/

The European Medical Agency (EMA) has warned that information on COVID-19-related medicines and vaccines, which was stolen in a cyber attack last December and leaked online earlier this week, includes correspondence that’s been manipulated prior to publication “in a way which could undermine trust in vaccines”.

It’s not clear exactly how the information — which includes schematics of drug structures and correspondence relating to evaluation processes for COVID-19 vaccines — has been doctored.

We’ve reached out to the agency with questions.

One security researcher, Lukasz Olejnik, who has raised concerns about the leak via Twitter suggested the doctored data will be “perfect for sowing distrust” because the biotechnical language involved in the leaked correspondence will not be widely accessible.

Now I understand why this data is perfect for sowing distrust. (disinformation). The documents are extremely hermetic, using niche biotech-technical language. No layperson is able to understand this. Perfect for conspiracy thinking, because it does have the numbers-percents. https://t.co/e0qfYoV3R0

— Lukasz Olejnik (@lukOlejnik) January 15, 2021

Equally, it also seems possible that the high bar of expertise required to properly parse the data could limit how much damage the manipulated versions can do by limiting their viral appeal.

But it’s notable the EMA has raised concerns over the risk to trust in coronavirus vaccines.

“Two EU marketing authorisations for COVID-19 vaccines have been granted at the end of December/beginning of January following an independent scientific assessment,” the EMA writes in the latest update on the hack.

“Amid the high infection rate in the EU, there is an urgent public health need to make vaccines available to EU citizens as soon as possible. Despite this urgency, there has always been consensus across the EU not to compromise the high-quality standards and to base any recommendation on the strength of the scientific evidence on a vaccine’s safety, quality and efficacy, and nothing else.

“EMA is in constant dialogue with the EC, and other regulators across the network and internationally. Authorisations are granted when the evidence shows convincingly that the benefits of vaccination are greater than any risks of the vaccine. Full details of the scientific assessments are publicly available in the European Public Assessment Reports on EMA’s website,” it adds.

At the time of writing a criminal investigation into the cyber attack remains ongoing.

The attack has not been attributed to a specific hacking group or state actor and there’s no confirmation of who is responsible for trying to sew coronavirus-related disinformation by seeding doctored medical documents online.

However, last November Microsoft warned that hackers backed by Russia and North Korea had targeted pharmaceutical companies involved in the COVID-19 vaccine development efforts.

Back in June, the European Commission also raised concerns about the risks of coronavirus vaccine disinformation spreading in the coming months — simultaneously name-checking China and Russia as foreign entities it said it had confirmed as being behind state-backed disinformation campaigns targeting the region.

So suspicion seems likely to fall on the usual ‘hostile suspect’ states.

We’ve seen similar ‘doctored leak’ tactics attributed to Russia before — typically related to attempts to interfere with elections by smearing candidates for high political office.

Researchers have suggested that the hackers responsible for the 2015-16 breaches of the Democratic National Committee’s network snuck doctored data into the leaked emails — an attack that was subsequently attributed to Russia.

While, more recently, there was the infamous ‘Hunter Biden’ laptop incident — which supporters of president Trump sought to leverage against his challenger for the White House (now president-elect) in last year’s presidential race.

In that case, any disinformation punch fizzled out amid a raft of dubious claims around the finding and timing of the claimed data cache (along with much greater general awareness about the risk of digital fake smear tactics in political campaigns in the wake of revelations about the scale of Russia’s social media influence disops in the 2016 US presidential election).

In an earlier incident, from 2017, emails linked to the French president Emmanuel Macron’s election campaign also leaked online shortly before the vote — coinciding with a document dump on an Internet forum that suggested the presidential frontrunner had a secret bank account in the Cayman Islands. A claim Macron’s political movement said was fake.

While in 2019 Reddit also linked account activity involving the leak and amplification of sensitive UK-US trade talks on its platform during the UK election campaign to a suspected Russian political influence operation.

It’s not clear whether that leaked trade dossier had been doctored or not (it was heavily redacted). And it certainly did not deliver a landslide election win to Jeremy Corbyn’s Labour Party — which used the leaked data in its campaign. But a similar, earlier operation which was also attributed to Russia had involved the leak of fake documents on multiple online platforms. (That disinformation operation was identified and taken down by Facebook in May 2019.)

The emergence of leaks of doctored medical data linked to COVID-19 vaccines and treatments looks like a troubling evolution of hostile cyber disops which seek to weaponize false data to generate unhelpful outcomes for others — as there’s a direct risk to public health if trust in vaccine programs are undermined.

There have been state level hacks targeting medical data before too — albeit without the pandemic-related backdrop of an ongoing public health emergency.

Back in 2016, for example, the World Anti-Doping Agency confirmed that confidential medical data related to the Olympic drug tests of a number of athletes had been leaked by the Russia-linked cyber hacking group, ‘Fancy Bear’. In that case there were no reports of the data being doctored.

Another Uber spinout is in the works.

Postmates X, the robotics division of the on-demand delivery startup that Uber acquired last year for $2.65 billion, is seeking investors in its bid to become a separate company, according to several people familiar with the plans.

The startup is being referred to as Serve Robotics, a nod to the yellow and black-emblazoned autonomous sidewalk delivery bot that was developed and piloted by Postmates X. The Serve robot, which recently partnered with Pink Dot Stores for deliveries in West Hollywood, will likely be the centerpiece of the new startup.

Uber declined to comment.

Under the deal, which is being shopped to investors, the company would be run by Ali Kashani, who heads up Postmates X and leads the Serve program. Anthony Armenta would lead the startup’s software efforts and Aaron Leiba would be in charge of hardware — keeping the same positions they hold at Postmates X.

Uber would retain an ownership stake in Serve Robotics and maintain a commercial agreement with the startup. Serve would get the IP and assets in exchange. Uber is in discussions to retain about a 25% stake in the new startup, according to one source familiar with the deal.

There is not a legal entity — as of yet — named Serve Robotics. However, a website domain serverobotics.com was registered January 6.

Uber’s path to profits

The spinoff would be in line with Uber’s streamlined business strategy that began to take shape after its public market debut in May 2019 and accelerated last year as the COVID-19 pandemic put pressure on the ride-hailing company. Two years ago, Uber had enterprises across the transportation landscape from ride-hailing and micromobility to logistics, public transit, food delivery and futuristic bets like autonomous vehicles and air taxis. CEO Dara Khosrowshahi has dismantled the everything-but-the-kitchen-sink approach as he pushes the company towards profitability.

In 2020, Uber offloaded shared scooter and bike unit Jump in a complex deal with Lime, sold a stake worth $500 million in its logistics spin off Uber Freight and rid itself of its autonomous vehicle unit Uber ATG and its air taxi play Uber Elevate.

Aurora acquired Uber ATG in a deal that had a similar structure to the Jump-Lime transaction. Aurora didn’t pay cash for Uber ATG. Instead, Uber handed over its equity in ATG and invested $400 million into Aurora, which gave it a 26% stake in the combined company,

In a similarly crafted deal, Uber Elevate was sold to Joby Aviation in December.

Delivery remained the one area that Uber has invested in. The company, seeing an opportunity as demand skyrocketed for its Uber Eats delivery service, started looking for an acquisition to strengthen its position. Uber tried and failed to buy Grubhub, losing out to European heavyweight Just Eat Takeaway.

Uber landed on Postmates and in July 2020 agreed to buy the delivery startup in an all-stock deal valued at $2.65 billion. The deal closed in December.

Serve, the friendly robot

Postmates’ exploration into sidewalk delivery bots began in earnest in 2017 after the company quietly acquired Kashani’s startup Lox Inc. As head of Postmates X, the company’s R&D arm, Kashani set out to answer the question: ‘why move two-pound burritos with two-ton cars?’

Postmates revealed its first Serve autonomous delivery bot in December 2018. A second-generation — with an identical design but different lidar sensors and few other upgrades — emerged in summer 2019 ahead of its planned commercial launch in Los Angeles.

Instead of working with a partner, Postmates used its own delivery data to form the foundation of how it would design and deploy a sidewalk bot, according to comments Kashani made during TC Sessions: Mobility 2020 event in October.

“When you look at the data and see that over half of deliveries are within a short distance it becomes a no brainer — these robots can actually complete them,” Kashani said at the time in reference to the application of autonomous delivery bots for delivery.

The Postmates X used historical delivery data from the company to develop a simulation, which was then used in the design of the Serve bot. It helped the team determine what battery life would be needed and the size of the cargo hold, among other features.

The bot only represented a sliver of Postmates’ delivery business. However, the company has seen an increase interest in the bot in Los Angeles and San Francisco — the two cities where it commercially operates — as COVID-19 fueled demand for contactless delivery.

Kashani noted back in October that the bots had completed thousands of deliveries in Los Angeles and was preparing to expand into the city’s West Hollywood enclave. That expansion launched late last year with a twist. The Serve robots were changed to a bright pink to match the signature color of the Pink Dot stores.

Source: https://techcrunch.com/2021/01/15/uber-planning-to-spin-out-postmates-delivery-robot-arm/