& meet dozens of singles today!

User blogs

iSTOX, a digital securities platform that wants to make private equity investment more accessible, has added new investors from Japan to its Series A round, bringing its total to $50 million. Two of its new backers are the government-owned Development Bank of Japan and JIC Venture Growth Investments, the venture capital arm of Japan Investment Corporation, a state-backed investment fund.

Other participants included Juroku Bank and Mobile Internet Capital, along with returning investors Singapore Exchange, Tokai Tokyo Financial Holdings and Hanwha Asset Management.

Founded in 2017 and owned by blockchain infrastructure firm ICHX, iSTOX’s goal is to open private capital opportunities, including startups, hedge funds and private debt, that are usually limited to a small group of high-net-worth individuals to more institutional and accredited investors. (It also serves accredited investors outside of Singapore, as long as they meet the country’s standards by holding the equivalent amount in assets and income.) iSTOX’s allows users to make investments as small as SGD $100 (about USD $75.50) and says it is able to keep fees low by using blockchain technology for smart contracts and to hold digital securities, which makes the issuance process more effective and less costly.

iSTOX’s Series A round was first announced in September 2019, when the company said it had raised an undisclosed amount from Thai investment bank Kiatnakin Phatra Financial Group while participating in the Monetary Authority of Singapore (MAS) FinTech Regulatory Sandbox. The Singaporean government has been especially supportive of blockchain technology, launching initiatives to commercialize its use in fintech, data security, logistics and other sectors.

iSTOX completed the sandbox program in February 2020, and was approved by the MAS for the issuance, custody and trading of digitized securities. The new funding will be used for geographical expansion, including in China, where it already has an agreement in the city of Chongqing, and Europe and and Australia, where it is currently working on issuance deals. iSTOX also plans to add new investment products, including private issuances that investors can subscribe to in “bite-size portions.”

In a press statement, iSTOX chief commercial officer Oi Yee Choo said, “Capital markets are transforming rapidly because of advancements in technology. The regulator MAS and our institutional investors have been far-sighted and progressive, and they support the change wholeheartedly.”

The company is among several Asia-based fintech platforms that want to democratize the process of investing. For retail investors, there are apps like Bibit, Syfe, Stashaway, Kristal.ai and Grab Financial’s investment products.

Since iSTOX works with accredited and institutional investors, however, its most direct competitors include the recently-launched DBS Digital Exchange, which is also based in Singapore. iSTOX’s advantage is that it offers more kinds of assets. Right now, it facilitates the issuance of funds and bonds, but this year, it will start issuing private equity and structured products as well. The company’s securities are also fully digitized, which means they are created on the blockchain, instead of being recorded on the blockchain after they are issued, which means iSTOX is able to offer faster settlement times.

Indian stock exchanges approved the $3.4 billion deal between retail giants Reliance Retail and Future Group on late Wednesday in yet another setback for Amazon, which has invested over $6.5 billion in the world’s second largest internet market and sought to block the aforementioned deal.

The Bombay Stock Exchange said in a notification that it had spoken with India’s markets regulator, the Securities and Exchange Board of India (SEBI), and had no objection or adverse observation on the deal.

Wednesday’s notification is the latest setback for Amazon, which had written to SEBI and Indian antitrust watchdog to block the multi-billion deal between Future Group and Reliance Retail, the two largest retail chains in India. Last year, India’s antitrust group gave a go ahead to the deal to the Indian firms.

“We hereby advise that we have no adverse observations with limited reference to those matters having a bearing on listing/de-listing/continuous listing requirements within the provisions of Listing Agreement, so as to enable the company to file the scheme with Hon’ble NCLT [National Company Law Tribunal],” the notification read. SEBI has advised Future to share various aspects of its ongoing litigation with Amazon to NCLT, whose approval for the deal is pending.

Amazon bought 49% stake in one of Future’s unlisted firms in 2019 in a deal that was valued at over $100 million. As part of the deal, Future could not have sold assets to rivals, Amazon has said in court filings.

Things changed last year after the coronavirus pandemic starved the Indian firm of cash, Future Group chief executive and founder Kishore Biyani said at a recent virtual conference. In August, Future Group said that it had reached an agreement with Ambani’s Reliance Industries, which runs India’s largest retail chain, to sell its retail, wholesale, logistics and warehousing businesses for $3.4 billion.

Amazon later protested the deal by reaching an arbitrator in Singapore and asked the court to block the deal between the Indian retail giants. Amazon secured emergency relief from the arbitration court in Singapore in late October that temporarily halted Future Group from going ahead with the sale.

The two estranged partners also fought at the Delhi High Court last year, which in a rare glimmer of hope for the American giant rejected Future’s plea for an ad-interim injunction to restrain Amazon from writing to regulators and other authorities to raise concerns over — and halt — the deal between the two Indian giants.

An Amazon spokesperson told TechCrunch that the firm will continue to pursue legal remedies. “The letters issued by BSE & NSE clearly state that the comments of SEBI on the ‘draft scheme of arrangement’ (proposed transaction) are subject to the outcome of the ongoing Arbitration and any other legal proceedings. We will continue to pursue our legal remedies to enforce our rights,” the spokesperson said.

At stake is India’s retail market that is estimated to balloon to $1.3 trillion by 2025, up from $700 billion in 2019, according to consultancy firm BCG and local trade group Retailers’ Association India. Online shopping accounts for about 3% of all retail in India.

Source: https://techcrunch.com/2021/01/20/bse-sebi-amazon-reliance-retail-future-india/

Genflow, a London an0d LA-based brand building agency that offers an e-commerce and mobile tech platform to let influencers start companies, has raised $11 million in funding.

Leading the round is U.K. investor BGF. The injection of capital will be used by Genflow to further scale its offering and for international expansion.

Founded in 2016 by entrepreneur Shan Hanif to help social media influencers develop their brands and extract revenue from their audiences, Genflow combines aspects of a traditional branding agency — such as strategy, design and planning — and a tech company with its own software stack.

This sees Genflow position itself as a brand-as-a-service (BaaS) platform, which helps influencers develop their own digital and physical products instead of promoting other brands, and enables them to launch their own membership club, gated community, mobile app or direct to consumer brand.

“Genflow offers the complete infrastructure from design, development, manufacturing and logistics through to strategy, marketing and content creation to drive revenue and profit,” explains the company.

Genflow says its client base are established influencers who typically have large followings on Instagram and YouTube.

“Genflow allows an influencer to start their own business instead of the traditional brand deals so if someone with an audience wants truly their own audience and business Genflow does that for them,” says Hanif. “We provide them the complete infrastructure to launch a business: design, manufacturing, development, content, strategy and marketing all in one place. This gives us the unique ability to execute to a very high level that drives revenue”.

Hanif says influencers typically approach Genflow either with an idea or when they need help figuring out what brand they can launch. “We use ‘Genlytics,’ our in-house built software, to see what the best brand they can release by checking their analytics, breakdown of their followers, what brands they have worked with in the past and to see how much they can potentially sell,” he explains.

Next, Genflow onboards the client and begins the brand building process, offering broadly two options: Gated content, membership clubs, community and mobile apps, or developing direct to consumer brand with physical products.

The first is akin to having your own OnlyFans, Patreon or social media platform. The second is a classic D2C e-commerce play and includes designing the products, and working with factories to create samples, manufacture the products and then handle all logistics etc.

“In both cases then we plan the launch of the brand, the marketing strategy and then work with the influencer to launch the brand itself,” adds Hanif.

“What’s interesting is that traditionally in startups you find a problem, get a team, some funding then try to find customers. What we have invented is the ‘audience first approach’ where we already have the audience and now just need the right products and it’s instantly a success. The metrics that I see for our brands are not normal: conversion rates that are 5-30%, 20% repeat purchase buys and around 6:1 return on Facebook ads.

“We are proud that every brand we have launched to date is profitable and growing year on year so we know our approach works.”

On his way out the door, President Donald Trump pardons a former Googler, Jack Ma reappears and Wattpad gets acquired. This is your Daily Crunch for January 20, 2021.

The big story: Trump pardons Anthony Levandowski

Although Donald Trump is no longer president of the United States as I write this, he still held the role on Tuesday evening, when he included former Googler Anthony Levandowski (who had been sentenced to 18 months in prison for stealing trade secrets) in his final set of 73 pardons. The pardon had been supported by Founders Fund’s Peter Thiel and Oculus founder Palmer Luckey, among others.

Today, of course, Joe Biden was inaugurated, prompting immediate changes to the White House website. And Amazon wasted no time offering the new president help with rolling out the COVID-19 vaccines.

Also, we have a piece from former White House deputy chief of staff Jim Messina about the relationship between the Biden administration and Silicon Valley.

The tech giants

Alibaba shares jump on Jack Ma’s first appearance in 3 months — Alibaba’s billionaire founder resurfaced as he spoke to 100 rural teachers through a video call.

Valve and five PC games publishers fined $9.4M for illegal geo-blocking — In addition to Valve, the five sanctioned games publishers are: Bandai Namco, Capcom, Focus Home, Koch Media and ZeniMax.

TikTok’s new Q&A feature lets creators respond to fan questions using text or video — The feature is currently only available to select creators who have opted into the test.

Startups, funding and venture capital

Wattpad, the storytelling platform, is selling to South Korea’s Naver for $600M — Naver plans to incorporate at least part of the business into another of its holdings, the publishing platform Webtoon.

SpaceX delivers 60 more Starlink satellites in first launch of 2021, and sets new Falcon 9 rocket reusability record — This puts the total Starlink constellation size at almost 1,000.

Landbot closes $8M Series A for its ‘no code’ chatbot builder — The startup has grown to around 2,200 paying customers.

Advice and analysis from Extra Crunch

Fintech startups and unicorns had a stellar Q4 2020 — The fourth quarter of 2020 was as busy as you imagined.

Dear Sophie: What are Biden’s immigration changes? — The latest edition of Dear Sophie, the advice column that answers immigration-related questions about working at technology companies.

Hello, Extra Crunch community! — Tell us what else you want from Extra Crunch.

(Extra Crunch is our membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

MIT develops method for lab-grown plants that eventually lead to alternatives to forestry and farming — The process would be able to produce wood and fibre in a lab environment.

Reflections on the first all-virtual CES — We’ve long questioned whether in-person trade shows are a thing of the past. This year, we put it to the test.

Remote workers are greener, but their tech still has a real carbon cost — A new study examines tentative carbon costs on the connectivity and data infrastructure that make working from home possible.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/01/20/daily-crunch-trump-pardons-anthony-levandowski/

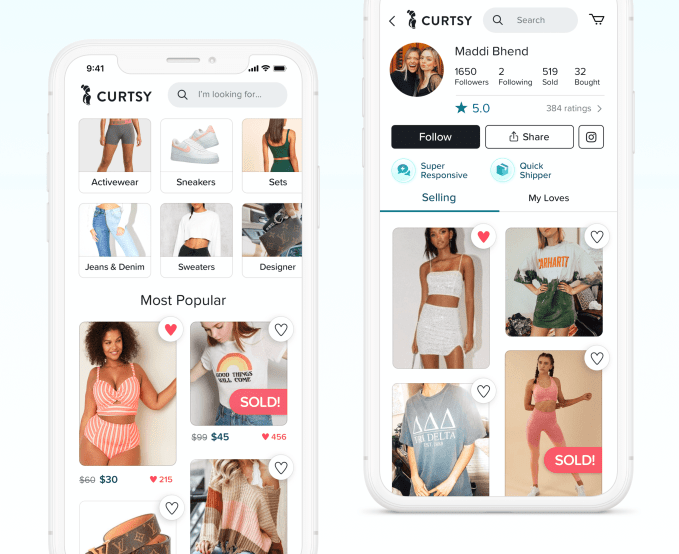

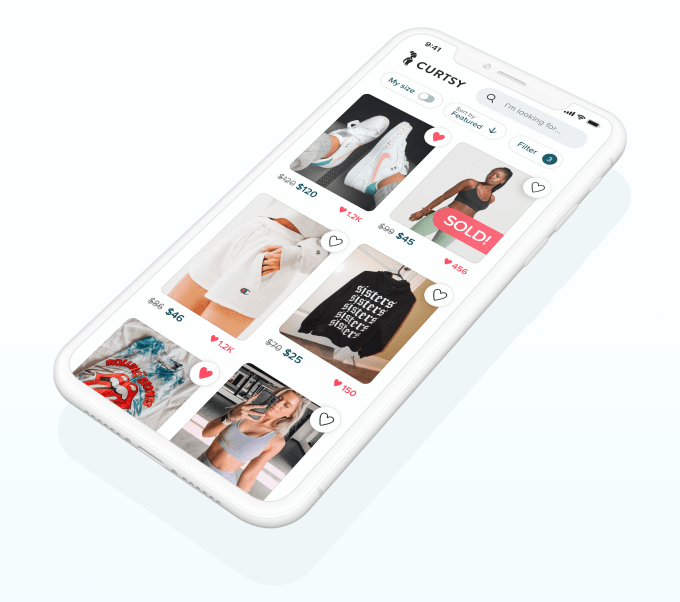

Curtsy, a clothing resale app and competitor to recently IPO’d Poshmark, announced today it has raised $11 million in Series A funding for its startup focused on the Gen Z market. The app, which evolved out of an earlier effort for renting dresses, now allows women to list their clothes, shoes and accessories for resale, while also reducing many of the frictions involved with the typical resale process.

The new round was led by Index Ventures, and included participation from Y Combinator, prior investors FJ Labs and 1984 Ventures, and angel investor Josh Breinlinger (who left Jackson Square Ventures to start his own fund).

To date, Curtsy has raised $14.5 million, including over two prior rounds which also included investors CRV, SV Angel, Kevin Durant, Priscilla Scala, and other angels.

Like other online clothing resale businesses, Curtsy aims to address the needs of a younger generation of consumers who are looking for a more sustainable alternative when shopping for clothing. Instead of constantly buying new, many Gen Z consumers will rotate their wardrobes over time, often by leveraging resale apps.

Image Credits: Curtsy

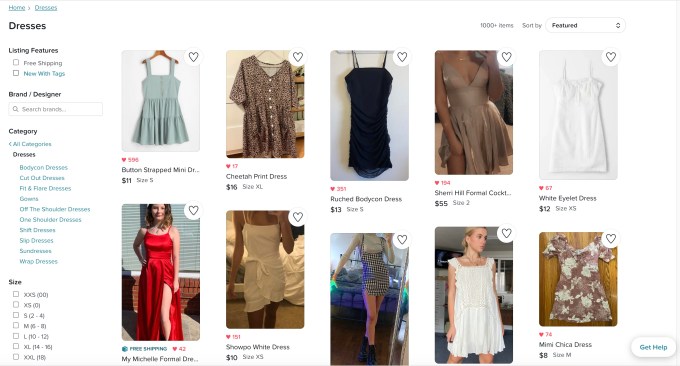

However, the current process for listing your own clothes on resale apps can be time consuming. A recent report by Wired, for example, detailed how many women were spinning their wheels engaging with Poshmark in the hopes of making money from their closets, to little avail. The Poshmark sellers complained they had to do more than just list, sell, package and ship their items — they also had participate in the community in order to have their items discovered.

Curtsy has an entirely different take. It wants to make it easier and faster for casual sellers to list items by reducing the amount of work involved to sell. It also doesn’t matter how many followers a seller has, which makes its marketplace more welcoming to first-time sellers.

“The big gap in the market is really for casual sellers — people who are not interested in selling professionally,” explains Curtsy CEO David Oates. “In pretty much every other app that you’ve heard about, pro sellers really crowd out everyday women. Part of that is the friction of the whole process,” he says.

On Curtsy, the listing process is far more streamlined.

The app uses a combination of machine learning and human review to help the sellers merchandise their items, which increase their chances of selling. When sellers first list their item in the app, Curtsy will recommend a price then fill in details like the brand, category, subcategory, shipping weight and the suggested selling price, using machine learning systems training on the previous items sold on its marketplace. Human review fixes any errors in that process.

Also before items are posted, Curtsy improves and crops the images, as well as fixes any other issues with the listing, and moderates listings for spam. This process helps to standardize the listings on the app across all sellers, giving everyone a fair shot at having their items discovered and purchased.

Another unique feature is how Curtsy caters to the Gen Z to young Millennial user base (ages 15-30), who are often without shipping supplies or even a printer for producing a shipping label.

First-time sellers receive a free starter kit with Curtsy-branded supplies for packaging their items at home, like poly mailers in multiple sizes. As they need more supplies, the cost of those is built into the selling flow, so you don’t have to explicitly pay for it — it’s just deducted from your earnings. Curtsy also helps sellers to schedule a free USPS pickup to save a trip to the post office, and it will even send sellers a shipping label, if need be.

“One of the things we realized quickly is Gen Z does not really have printers. So we actually have a label service and we’ll send you the label in the mail for free from centers across the country,” says Oates.

Later, when a buyer of an item purchased from Curtsy is ready to resell it, they can do so with one tap — they don’t have to photograph it and describe it again. This also speeds up the selling process.

Overall, the use of technology, outsourced teams who improve listings, and extra features like supplies and labels can be expensive. But Curtsy believes the end result is that they can bring more casual sellers to the resale market.

“Whatever costs we have, they should be in service of increased liquidity, so we can grow faster and add more people,” Oates says. “In case of the label service, those are people who otherwise wouldn’t be able to participate in selling online. There’s no other app that would allow them to sell without a printer.”

This system, so far, appears to be working. Curtsy now has several hundred thousand people who buy and sell on its iOS-only app, with an average transaction rates of 3 items bought or sold per month. When the new round closed late in 2020, the company was reporting a $25 million GMV revenue run rate, and average monthly growth of around 30%. Today, Curtsy generates revenue by taking a 20% commission on sales (or $3 for items under $15.)

The team, until recently, was only five people — including co-founders David Oates, William Ault, Clara Agnes Ault, and Eli Allen, plus a contract workforce. With the Series A, Curtsy will be expanding, specifically by investing in new roles within product and marketing to help it scale. It will also be focused on developing an Android version of its app in the first quarter of 2021 and further building out its web presence.

“Never before have we seen such a strong overlap between buyers and sellers on a consumer-to-consumer marketplace,” said Damir Becirovic of Index Ventures, about the firm’s investment. “We believe the incredible love for Curtsy is indicative of a large marketplace in the making,” he added.