& meet dozens of singles today!

User blogs

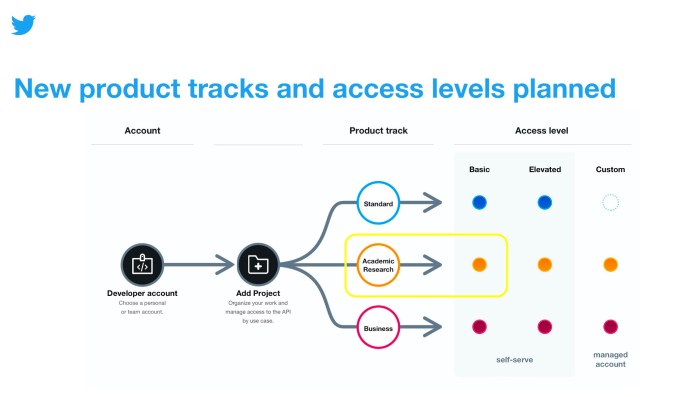

Twitter today is rolling out a new product track on its API platform, as part of its ongoing efforts to rebuild the Twitter API from the ground up. The track, which aims to serve the needs of the academic research community’s efforts, offers broader access to the Twitter archive and fewer restrictions on tweet retrievals, so researchers can access the entire history of the public conversation on Twitter’s platform.

In addition to gaining access to all the Twitter API v2 endpoints released to date and elevated access, researchers will gain access to more precise filtering capabilities.

Specifically, they’ll be able to access the full-archive search endpoint, which offers access to everything being said on Twitter. They can narrow searches for these historical tweets using start time and end time parameters.

Image Credits: Twitter

Researchers will also gain a significantly higher monthly cap on the number of tweets they can pull using the Twitter API v2. While on the Basic level of API access, this cap is set to 500,000, the Basic level of access on the Academic Research track is an initial monthly cap of up to 10 million tweets. This applies to the Recent Search, Filtered Stream, Full-archive search, and user tweet and mentions timelines endpoints, Twitter says.

The Academic Research track will gain access to certain operators that aren’t otherwise available, too, with the goal of helping them pull more precise user data. Today, these include: $ (aka cashtag), bio, bio_name, bio_location, place, place_country, point_radius, bounding_box, -is:nullcast, has:cashtags, and has:geo.

Researchers can also add 1,000 concurrent rules when using the filter stream endpoint, instead of the limit of 25 available in the Standard track. Queries in the recent recent search endpoint can be 1024 characters long, compared with 512 characters in the Standard track.

Because of the elevated levels of access, those who want to gain access to the Academic Research product track have to first submit an application.

All applicants have to either be a master’s student, doctoral candidate, post-doc, faculty, or research-focused employee at an academic institution or university. They will also need to have a clearly defined research objective, and must be able to detail their specific plans for how they intend to use, analyze, and share Twitter data from their research.

Plus, the data used from the Academic Research product track can’t be used for any commercial purposes, Twitter notes.

Image Credits: Twitter

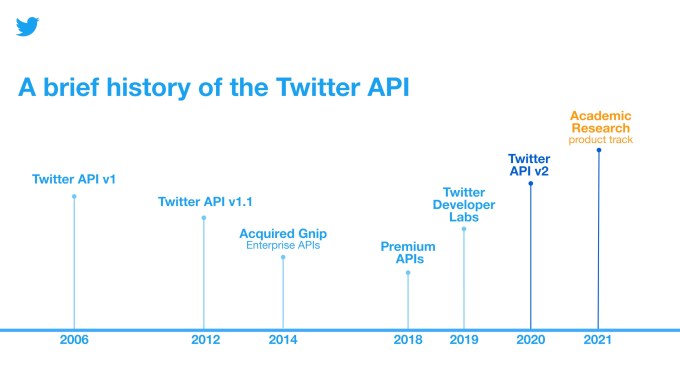

Academic researchers have been taking advantage of the Twitter API since its first introduction in 2006 and have used the data to study a variety of topics, Twitter says, like state-backed efforts to disrupt the public conversation, floods and climate change, attitudes and perceptions about COVID-19, and efforts to promote healthy conversation online.

However, the earlier version of the Twitter API didn’t make it easy for researchers to gain access to Twitter data — something the company wanted to correct with API v2.

Twitter to date has catered to the research community in other ways, with additions like a website dedicated to academic research, updates to its developer policy to make it easier to reproduce and validate others’ research, and even special endpoints, like the COVID-19 stream endpoint released in April 2020. But it hasn’t fully thought through, until the API v2, how it could build tools that would actually aid researchers in doing their work, instead of the researchers having to figure out ways to work around Twitter’s limitations.

The Academic Research product track was tested in private beta starting in Oct. 2020, and now this is being opened more broadly, where it will be made freely available.

Twitter says it’s planning to add higher levels of access across all its product tracks in the future, including this one, in time. The later levels will help researchers who need even more data than what’s being offered with today’s launch. Twitter also noted it’s looking into adding flexible access as well, which would help account for times when developers were consuming more or less data throughout the year.

Source: https://techcrunch.com/2021/01/26/twitters-new-api-platform-now-opened-to-academic-researchers/

In 2019, female-led companies received less than 5 percent of the global venture capital. Bringing it to Africa, only 10 percent of the West African startups that cumulatively raised $1 million had at least one female co-founder in the past decade.

There are many stats to back up the underrepresentation of women in starting a company, raising money and general involvement in technology where the global tech workforce comprises 28.8% women.

In a male-dominated space, programs geared toward supporting female entrepreneurs have emerged to close the gap on all fronts. However, for those centered around female founders, most are quick to offer mentorship and training but tend to ignore the importance of raising money.

FirstCheck Africa, a female-focused angel fund that launched yesterday, is hoping to address this challenge. According to its website, “fixing capital access for female tech entrepreneurs in Africa needs an intentional, female-led approach.”

FirstCheck Africa was founded by Eloho Omame and Odunayo Eweniyi. Omame is the MD of Endeavor Nigeria, a program for high-impact entrepreneurs, and Eweniyi is the co-founder and COO of Piggyvest, a Nigerian fintech startup.

Omame’s experience working with founders and managing a VC firm (Amari Ventures) and Odunayo’s as a founder will prove vital to what FirstCheck Africa hopes to achieve: Making it easy for African women to raise capital and invest in tech.

The fund will provide between $15,000 to $25,000 in six women this year in exchange for modest equity. FirstCheck Africa plans to see each woman or female-led team through the ideation stage to a significant pre-seed round within 12 months.

“We know we can generate solid long-term returns by investing in women, so we’ll write female founders’ first checks and be their earliest believers. We’re not afraid to invest ridiculously early in great women,” an excerpt in the statement read.

The fund also specifies that it is open to investing in mixed co-founder teams, with at least one woman. But the caveat is “only where it’s clear that the woman is a true partner and decision-maker, with a significant, equitable split of the founder equity.”

Already, FirstCheck has received over 600 applications from African female-led startups, Omame told TechCrunch. But she iterates that while only six will be selected, FirstCheck is in no hurry to announce the deals when asked how soon the firm expects to write its first check.

“We’ve been transparent with our investment goal as we’re backing up to six women-led, technology-driven businesses this year,” she said. “Outside that, there’s little interest from Odun or me to rush to announce deals. The work we’re doing is important and necessary, but it will take time.”

When you think about it, backing six startups in its first year is an impressive goal. For context, Microtraction, an already established early-stage VC firm, invested in seven startups last year. To achieve that, FirstCheck will need to garner support from local and international investors that are intentional about closing the gender funding gap on the continent. Without providing specifics around how much the fund is looking to raise, Omame says this is already happening.

That said, FirstCheck will be building a female-led investor community for women interested in backing startups by writing smaller checks. The notion behind this is to create opportunities for women around the continent to invest at more comfortable levels. And for African female entrepreneurs who need pre-seed and seed funding, the launch of FirstCheck is a plus to their selection pool.

The firm now joins Rising Tide Africa and SA-based Dazzle Angels among others as one of the few angel funds targeted to African female-led startups.

As Facebook and Apple begin to fire up more projects in the AR/VR world, Google has spent the last year shutting down most of their existing projects in that space.

Today, the folks at Google announced they had ended active development of Tilt Brush, a VR painting app that was one of virtual reality’s early hit pieces of software. The app allowed users to use virtual reality controllers as brushes to construct digital sculptures and environments.

While the company will not be pushing any new updates to the app, they did announce that they will be open sourcing the code on github for developers to build their own experiences and customizations. Google also notes that the app will continue to be available in the app stores on VR headsets.

“[W]e want to continue supporting the artists using Tilt Brush by putting it in your hands,”a blog post from Google reads. “This means open sourcing Tilt Brush, allowing everyone to learn how we built the project, and encouraging them to take it in directions that are near and dear to them.”

Google acquired the small studio behind Tilt Brush called Skillman & Hackett back in 2015.

Earlier this month, Tilt Brush co-creator Patrick Hackett announced he was leaving Google and would be joining the studio I-Illusions, the game studio behind VR title Space Pirate Trainer. According to LinkedIn, co-founder Drew Skillman stopped working on the VR project back in 2018 and now is part of the Stadia team at Google.

Last month, Google shut down Poly, its 3D object library which allowed users to share digital art including design made in the Tilt Brush software.

A Google spokesperson declined to comment further.

Annddd here we go:https://t.co/dRfC5jR5Yg

To some, this may look like the end of Tilt Brush. To me, this is immortality.

Cheers to the team who helped get us here!— Patrick Hackett (@phacktweets) January 26, 2021

Speculation around the Qualtrics public offering is nothing new. All the way back in 2016, CEO Ryan Smith was dropping not-so-subtle hints about his intentions to file for IPO. After a decade bootstrapping, and growing to $50 million in annual revenue, the company was swayed into taking outside capital from Sequoia, and then again from Sequoia, Accel, and Insight Venture Partners.

TechCrunch has written about the entire journey, and considering the unusual circumstances of the public offering paired with Qualtrics’ position outperforming its peer group, we thought it smart to take a look back at how the whole thing came together.

2017

After years of dodging the question, or offering up vague answers, Smith said the following in an interview with TechCrunch back in 2017:

We know that there’s a huge opportunity here and we’re being very thoughtful about it because it’s not about going public. Going public is super easy to do. Just file the S-1 and we’re out,” Smith told [TechCrunch]. “It’s about being public and how that works and getting the house in order to make sure that that’s the case. We’re going to be a great public company. We’re going public.

Just a couple days later, literally, Qualtrics raised $180 million at a $2.5 billion valuation, again from Sequoia, Accel, and Insight Venture Partners. At the time, it was the biggest investment Accel had ever made. The growth of the company was staggering — the experience management startup had gone from $50 million in revenue in 2012 to $250 million in revenue in 2017.

TechCrunch and many others speculated that the massive raise may not signal a delayed IPO, but rather a final financial push before listing on the public markets.

Smith was coy about whether that speculation was warranted:

We raised the money because we can. An IPO isn’t an exit. It should be the beginning and we wouldn’t be going out if we didn’t think that more wealth could be created post-IPO.

The company also launched its XM platform in 2017, an experience management platform that Smith implied would one day be as ubiquitous as Workday or Salesforce software in every office, but for managing internal feedback and helping organizations uncover key business drivers, predict future customer needs, and retain employees.

Sequoia Capital partner Bryan Schreier said at the time:

Qualtrics is an outlier. They have delivered outstanding, accelerating growth at nine-digit revenue numbers all while staying cash flow positive. That is practically unheard of. It’s an incredible sign of confidence in Qualtrics’ continued growth trajectory and the huge market for its new XM Platform that all of its investors have come back to buy as many shares as they could at this new valuation.

2018

In October of 2018, Qualtrics filed its S-1, which included third quarter results for the firm. Revenue was more than $100 million (up $8 million from the quarter before) and nearly 75 percent of that was gross profit. It was a strong quarterly performance and the perfect primer for a public offering.

The original plan was to sell 20.5 million shares in its debut for $18 to $21, which would have grossed up to $495 million, putting its valuation between $3.9 billion and $4.5 billion.

And then the unexpected happened.

SAP swooped in with an $8 billion acquisition offer. An offer that Qualtrics did not refuse. Its public offering was delayed (or scrapped, depending on how you look at it) yet again.

The idea was that SAP’s operational data combined with Qualtrics’ customer and user data would be a devastating blow to the competition and give the duo an unmatched level of power. Think Facebook’s acquisition of Instagram. Think Eye of Sauron.

SAP CEO Bill McDermott said at the time:

The legacy players who carried their ‘90s technology into the 21st century just got clobbered. We have made existing participants in the market extinct.

If it wasn’t clear, he was talking about competitors like Oracle, Salesforce, Microsoft and IBM.

As part of the acquisition announcement, Qualtrics offered yet another revenue update, saying it expected excess of $400 million in revenue for 2018 and a forward growth rate of more than 40 percent, synergies from the acquisition notwithstanding.

2020

Post-acquisition Qualtrics was a quieter Qualtrics, so we’ll skip past 2019 to 2020. Just 20 short months after being acquired, another twist in the plot: SAP announced it would spin out Qualtrics in a new IPO.

Noting the company’s cloud growth had been in excess of 40 percent, SAP said the company would continue to be run by founder Ryan Smith and, interestingly, mentioned that Smith intends to be Qualtrics’ largest individual shareholder. SAP, of course, would retain majority ownership of the company.

Though the announcement lacked much meat with its potatoes, it implied that Qualtrics could grow even more rapidly if not encircled by SAP’s corporate arms.

The spin-out strategy was a rare move for a company like SAP.

As my colleague Danny Crichton wrote at the time:

While private equity firms will take a company private and sometimes quickly turn it around in an IPO, it is rare to see a large company like SAP make such a dramatic last-minute bid for a company only to reverse that decision just months later.

Here at TechCrunch we were excited about the impending IPO. Here was a company that had nearly gone public, now going public again.

And just as the year was coming to a close, Qualtrics dropped its first (second, technically) S-1 filing. After digging through the numbers this was our takeaway from the data:

Qualtrics is growing at over 30%, and after enduring some post-acquisition costs that appear at least partially related to how SAP handled equity compensation, is back to a more acceptable level of losses on a GAAP basis and is doing perfectly fine when we observe its adjusted (non-GAAP) results.

As often happens when a company goes public while having a large corporate owners, Qualtrics’ accounting was harder to parse the second time around, but the bones of a nicely growing software company at scale were still there. How investors would value Utah’s giant was the next question.

2021

A few weeks later, Qualtrics dropped what would prove to be its first IPO pricing interval, targeting a range of $22 and $26 per share, giving the company a far larger value than it had targeted during its first run at the public markets. Of course, Qualtrics was not only benefiting from its own growth and whatever boost it received from synergies with SAP, but also from frothy SaaS valuations and a frenetic public market.

At that price, with 50 million shares up for grabs, the target raise was north of $1 billion. If that sounds high recall that Qualtrics posted a revenue run rate of around $800 million. The company’s growth has kept up as well, with the company’s Q4 2020 midpoint revenue expanding more than 23% compared to its Q4 2019 performance.

All said and done, the S-1/A pegged Qualtrics’ early 2021 valuation at anywhere from $11.2 billion to $13.3 billion. Alex Wilhelm is much better at breaking down the numbers than me (or anyone, really) so I urge you to take a look at his coverage.

Wilhelm was also astute enough to recognize that the share pricing for Qualtrics’ IPO would likely be adjusted higher. And it was!

Yesterday, Qualtrics raised its share price from $22 – $26 to between $27 and $29, putting the valuation range between $13.8 billion to $14.8 billion. Yowzah!

- New Qualtrics low-end IPO run rate multiple: 16.2x.

- New Qualtrics high-end IPO run rate multiple: 17.4x.

Wilhelm noted that the Qualtrics share price may go up yet again, but also explained that while the multiples in play may feel low, it’s tough to be certain:

Those do not seem to be particularly high multiples for Qualtrics, given recent market norms. However, trying to decipher the public market lately has been similar to reading the Rosetta Stone, but written in Wingdings. While on acid. So, you never know what is going to happen when a company starts to trade.

There is one thing we know for sure: Qualtrics has showed growth in revenue and more profitability than most software companies during its entire existence. We’ve been waiting for this IPO for years now, literally, and while many pieces of the puzzle are uncertain, we’ll get our answers soon enough.

Unless of course some giant firm swoops in with a $20 billion acquisition offer. Now wouldn’t that be fitting?

Source: https://techcrunch.com/2021/01/26/qualtrics-ipo-everything-you-need-to-know/

Club Feast, a startup with a more affordable approach to meal delivery, is announcing that it has raised $3.5 million in seed funding led by General Catalyst.

The company was founded by Atallah Atallah, Ghazi Atallah and Chris Miao. The basic concept is pretty simple: Restaurant delivery that only costs $5.99 per dish — cheaper than almost anything you’d find on other delivery services. (The startup also charges diners a $2 delivery fee, as well as a $1 fee for single meal orders.)

Atallah Atallah, who previously co-founded restaurant rewards company Seated and serves as Club Feast’s CEO, said the startup works with restaurants to select a few meals that they can afford to offer at the $5.99 price. Diners, meanwhile, sign up for a weekly meal plan and place their orders at least 24 hours ahead of time. The restaurant then knows exactly how much of a dish will be purchased, so they can plan ahead and cook in an efficient and economical way.

“We really work with them to create a meal that they can make at a price that works for their users,” Atallah said. Plus, he noted that with all the orders placed ahead of time, Club Feast and its partners can plan efficient delivery routes without having to build sophisticated algorithms for optimizing on-demand deliveries: “Sometimes the best solutions are the simplest ones.”

Club Feast CEO Atallah Atallah. Image Credits: Club Feast

Of course, that requires more planning and upfront commitment from diners. However, Atallah noted that while meal credits are bought via weekly subscription, they can be paused or spent at any time. He also suggested that he doesn’t see Club Feast as a direct competitor to on-demand food delivery — instead, he suggested that he continues to use DoorDash and Uber Eats for spur-of-the-moment orders or special occasions, while Club Feast is a more affordable option for regular meals.

“With our price point, our average user orders eight times a month,” he said. “Why not make the pie much bigger?”

Atallah added that Club Feast is diversifying the food options on the platform by adding side dishes and desserts. And it could eventually introduce higher prices for fancier meals, but he said, “We want to make sure that does not affect the $5.99 concept.”

The startup currently makes deliveries in San Francisco and San Mateo, where it works with restaurants including The Halal Guys, Kasa Indian Eatery, HRD and Kitava. With the new funding, it plans to expand throughout the Bay Area and into New York City.

“The pandemic exposed significant gaps in the food delivery industry, and we’re proud to support Club Feast on their mission to make the experience more affordable for both restaurants and consumers,” said General Catalyst Managing Director Niko Bonatsos in a statement.

Source: https://techcrunch.com/2021/01/26/club-feast-seed-funding/