& meet dozens of singles today!

User blogs

Xiaomi, the world’s third largest smartphone maker, today unveiled “Mi Air Charge Technology” that it says can deliver 5W power to multiple devices “within a radius of several metres” as the Chinese giant invited customers to a “true wireless charging era.”

The company said it has self-developed an isolated charging pile that has five phase interference antennas built-in, which can “accurately detect the location of the smartphone.”

A phase control array composed of 144 antennas transmits millimeter-wide waves directly to the phone through beamforming, the company said, adding that “in the near future” the system will also be able to work with smart watches, bracelets, and other wearable devices.

A company spokesperson said Xiaomi won’t be rolling out this system to consumer products this year.

Here’s how the company has described the mechanics of its new tech:

On the smartphone side, Xiaomi has also developed a miniaturized antenna array with built-in “beacon antenna” and “receiving antenna array”. Beacon antenna broadcasts position information with low power consumption. The receiving antenna array composed of 14 antennas converts the millimeter wave signal emitted by the charging pile into electric energy through the rectifier circuit, to turn the sci-fi charging experience into reality.

Currently, Xiaomi remote charging technology is capable of 5-watt remote charging for a single device within a radius of several meters. Apart from that, multiple devices can also be charged at the same time (each device supports 5 watts), and even physical obstacles do not reduce the charging efficiency.

German startup Trade Republic is rolling out its app and service in France this week. This is a significant expansion move as Trade Republic has only been available in Germany and Austria so far.

Trade Republic lets you buy and sell shares or exchange-traded funds (ETFs) from your phone with low, transparent fees. The company charges €1 ($1.21) in fees per order, whether you’re buying a single share worth €100 or allocating €10,000 of your savings on an ETF. The company promises that it doesn’t add any commission on top of that €1.

The startup lets you buy European shares as well as stock in Asian or American companies. Overall, there are 7,500 shares and ETFs available in the app. While the service is relatively new, Trade Republic has been working on its infrastructure for several years.

Behind the scenes, the company has partnered with Solarisbank, a German banking-as-a-service platform regulated by German authorities. It means that your deposits are covered up to €100,000 ($121,000) in case of bankruptcy. When you’re submitting an order, Trade Republic works with LS Exchange and HSBC Transaction Services to handle those shares.

Trade Republic wants to position itself differently from Robinhood. The company thinks there are currently two options when it comes to trading.

You can open a trading account with your bank or a legacy broker, but they’ll charge a lot of money. Or you can use a mobile-first broker, but they’ll push you toward risky assets and day-trading. And we’ve seen this week with the GameStop saga that the second option can lead to some backlash.

Trade Republic is promoting a third way — low fees and low risk. The company wants to promote savings plans for instance. Those plans let you buy shares progressively, which should protect users against volatility.

The company raised a €62 million funding round ($75.22 million at today’s rate) last year. The Series B round was co-led by Accel and Founders Fund.

As for French users, don’t forget that you have to declare that you have a foreign bank account when you file your taxes. Foreign brokers also don’t necessarily send information to tax authorities to pre-fill your tax reports. But if you’re fine with that, Trade Republic is most likely cheaper than your bank.

Source: https://techcrunch.com/2021/01/29/stock-trading-app-trade-republic-expands-to-france/

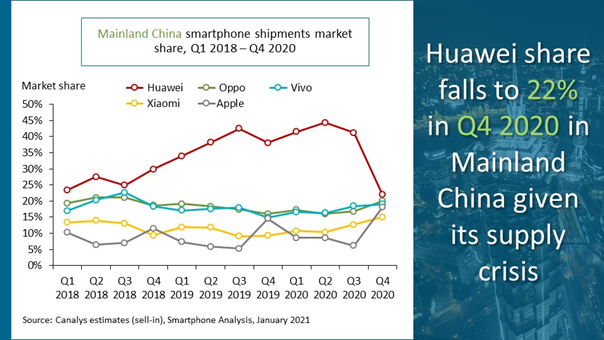

The impact of United States government sanctions on Huawei is continuing to hurt the company and dampen overall smartphone shipments in China, where it is largest smartphone vendor, according to a new report by Canalys. But Huawei’s decline also opens new opportunities for its main rivals, including Apple.

Canalys says Apple’s performance in China during the fourth-quarter of 2020 was its best in years, thanks to the iPhone 11 and 12. Its full-year shipments returned to its 2018 levels, and it reached its highest quarterly shipments in China since the end of 2015, when the iPhone 6s was launched.

Overall, smartphone shipments in China fell 11% to about 330 million units in 2020, with market recovery hindered by Huawei’s inability to ship new units. Even though demand in China for Huawei devices remains high, the company has struggled to cope with sanctions imposed by the U.S. government under the Trump administration that banned it from doing business with American companies and drastically curtailed its ability to procure new chips.

In May 2020, Huawei rotating chairman Guo Ping said even though the firm can design some semiconductor components, like integrated circuits, it is “incapable of doing a lot of other things.”

This left Huawei unable to meet demand for its devices, but gives its main rivals new opportunities, wrote Canalys vice president of mobility Nicole Peng. “Oppo, Vivo and Xiaomi are fighting to win over Huawei’s offline channel partners across the country, including small rural ones, backed by huge investments in store expansion and marketing support. These commitments brought immediate results, and market share improved within mere months.”

Apple benefited from Huawei’s decline because the company’s Mate series is the iPhone’s main rival in the high-end category, and only 4 million Mate units were shipped in the fourth quarter. “However, Apple has not relaxed its market promotions for iPhone 12,” wrote Canalys research analyst Amber Liu. “Aggressive online promotions across ecommerce players, coupled with widely available trade-in plans and interest-free installments with major banks, drove Apple to its stellar performance.”

During the fourth-quarter of 2020, smartphone shipments in mainland China fell 4% year-over-year to a total of 84 million units. Even though it held onto its number one position in terms of shipments, Huawei’s total market share plummeted to 22% from 41% a year earlier, and it shipped just 18.8 million smartphones, including units from budget brand Honor, which it agreed to sell in November.

Huawei’s main competitors, on the other hand, all increased their shipments at the end of 2020. Oppo took second place, shipping 17.2 million smartphones, a 23% increase year-over-year. Oppo’s closest competitor Vivo increased its quarterly shipment to 15.7 million units. Apple shipped more than 15.3 million units, putting its market share at 18%, up from 15% a year ago. Xiaomi rounded out the top five vendors, shipping 12.2 million units, a 52% year-over-year increase.

Huawei’s decision to sell Honor means the brand may rapidly gain market share in 2021, since it already has brand recognition, wrote Peng. 5G is also expected to help smartphone shipments in China, especially for premium models.

For American importers, finding suppliers these days can be challenging not only due to COVID-19 travel restrictions. The U.S. government’s entity list designations, human rights-related sanctions, among other trade blacklists targeting Chinese firms have also rattled U.S. supply chains.

One young company called International Compliance Workshop, or ICW, is determined to make sourcing easier for companies around the world as it completed a fresh round of funding. The Hong Kong-based startup has just raised $5.75 million as part of its Series A round, boosting its total funding to around $10 million, co-founder and CEO Garry Lam told TechCrunch.

ICW works like a matchmaker for suppliers and buyers, but unlike existing options like Alibaba’s B2B platform or international trade shows, ICW also vets suppliers over compliance, product quality, and accreditation. It gathers all that information into its growing database of over 40,000 suppliers — 80% of which are currently in China — and recommends them to customers based on individual needs.

Founded in 2016, ICW’s current client base includes some of the world’s largest retailers, including Ralph Lauren, Prenatal Retail Group, Blokker, Kmart, and a major American pharmacy chain that declined to be named.

ICW’s latest funding round was led by Infinity Ventures Partners with participation from Integrated Capital and existing investors MindWorks Capital and the Hong Kong government’s $2 billion Innovation and Technology Venture Fund.

Supply chain shift

In line with the ongoing shift of sourcing outside China, in part due to the U.S.-China trade war and China’s growing labor costs, ICW has seen more customers diversifying their supply chains. But the transition has limitations in the short run.

“It’s still very difficult to find suppliers of certain product categories, for example, Bluetooth devices and power banks, in other countries,” observed Lam. “But for garment and textile, the transition already began to happen a decade ago.”

In Southeast Asia, which has been replacing a great deal of Chinese manufacturing activity, each country has its slight specialization. Whereas Vietnam abounds with wooden furniture suppliers, Thailand is known for plastic goods and Malaysia is a good source for medical supplies, said Lam.

When it comes to trickier compliance burdens, such as human rights sanctions, ICW relies on third-party certification institutes to screen and verify suppliers.

“There is a [type of] qualification standard that verifies whether a supplier has fulfilled its corporate social responsibility… like whether the factory fulfills the labor law, the minimum labor rights, or the payroll, everything,” Lam explained.

ICW plans to use the fresh proceeds to further develop its products, including its compliance management system, product testing platform, and B2B sourcing site.

Source: https://techcrunch.com/2021/01/28/icw-supply-chain-5-8-million/

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Natasha and Danny and Alex and Grace hopped online for our weekly show, sans Gamestop news (which you can find here) to talk about all the other busy news happening in startup world right now.

Here’s a taste of what we got into:

- Qualtrics IPO pricing, and the future of major acquisition pricing schemes. This company’s path to the public markets has been a long-time coming, so we had plenty to say.

- How Atlanta’s Calendly turned a scheduling nightmare into a $3 billion company. This story was not only neat, but also operated as a sort of palate cleanser for the team.

- Rhino‘s interesting insurtech play, and how it is pre-IPO pretty damn early. Revenue questions, the power of insurtech, and public markets impacting startups? This story had it all!

- Alex talks about how Fast is raising fast money ($102 million to be exact). Even more, the Fast story fits into a broader narrative of online checkout startups raising a zillion dollars in recent weeks.

- A boom in food delivery and restaurant startups, and why Danny is bearish on a plastic-free play. Natasha is in favor. Alex gets a company’s model mixed up with Spoon Rocket.

- Natasha explains how Clubhouse isn’t the first company to raise millions off of millions of users with no known near-term monetization plan. Her piece on ClassDojo illustrates how a quiet edtech giant finally turned its 51 million users into a profitable base. There’s also a new edtech investor survey for you to check out (Discount code: EQUITY).

- TCV’s record fund, and a female-focused angel fund coming out of Africa.

As always, it was a ton to get through because there is just so much going on. More Monday morning, until then stay cool!

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts

Source: https://techcrunch.com/2021/01/28/calendly-3-billion/