& meet dozens of singles today!

User blogs

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here — and make sure to check out last week’s main episode and companion chat about Robinhood.

This morning we ran into quite a lot of the same material, with Robinhood back in the news and the stock market looming large. Here’s what we talked about:

- American stocks are set to rise, bitcoin is flat, and meme-stocks are mixed.

- In India, news is out that a new law could ban bitcoin (whatever that means), and this morning India forced Twitter to take down some accounts that had been critical of government policy. That’s a pretty bad look. And it comes as we see a coup in Myanmar leading to a decline in internet connectivity; there is a clear link between authoritarianism and a desire for Internet control.

- Robinhood’s CEO went on Clubhouse, where he was interviewed by Elon Musk about last week’s mess; it turns out the National Securities Clearing Corporation, or NSCC, had asked Robinhood for $3 billion in deposit requirements. That number was reduced to $700 million, with Robinhood limiting some consumer behavior, allowing the company to open Friday morning.

- This morning the key news stories include the mess that is Facebook Groups, and the EU is appealing a tax decision that could impact tech company structure for years to come.

- Ben raised $2.5 million

- Phocas Software raised $34 million

- DesignCrowd raised $7.6 million

- And, finally, we are heading into earnings season, so strap in and get ready for a deluge of results.

All that and we are back Thursday, if not before. Hugs and hellos from the Equity crew!

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts

The GameStop debacle has been hailed by many as a first of its kind form of digital activism, with the ‘crowd’ coming together to stick it to Wall Street, and specifically hedge funds that are in the business of short selling.

However, what if you’re a startup or scale-up caught in the middle of such an unprecedented and unstoppable set of events, requiring you to make rapid business and product decisions almost seemingly on the fly. Especially if there is significant reputational damage at stake when things don’t go to plan.

That’s exactly the position that trading platform Robinhood found itself in last week. Despite promising to make finance accessible for all, the company temporarily limited trading on GameStop, AMC, and other memestocks, leaving users upset that the fintech darling wasn’t living up to its name. The specific reasons may have been short-term and technical, but the choice was viewed with suspicion by much of Robinhood’s users, not least because Robinhood has a large hedge fund as a customer. This saw the Robinhood app receive hundreds of thousands of 1-star ratings on the app stores, which Apple and Google helped remove.

But what role did UX play in all of this and how could better UX choices have mitigated the Robinhood backlash? That’s the question we asked together with Built for Mars founder and UX expert Peter Ramsey, who tracked Robinhood’s product changes throughout the GameStop crisis.

If you want more UX content, Peter and Steve write a regular UX column over at Extra Crunch, so do also check out other recent UX teardowns:

- Hulu UX teardown: 5 user experience fails and how to fix them

- Disney+ UX teardown: Wins, fails and fixes

- Coinbase UX teardown: 5 fails and how to fix them

- (How to fix) 5 common UX mistakes in online banking

Specifically, we highlight 5 UX fails and suggest ways to fix them. As you’ll see, the fast moving events meant it was a continuously moving target and would have been very challenging for any product team. With that said, there are many learnings that can be applied to other existing digital products or ones you are currently building, regardless of whether or not you’re hit by the next GameStop-styled crisis.

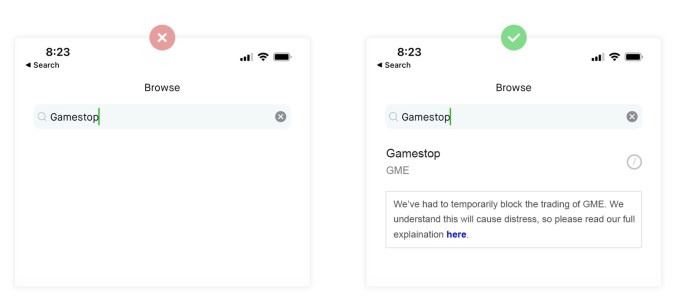

Removing Gamestop from search results

Robinhood wanted to stop people buying GME shares, so they just removed Gamestop from the search results.

Image Credits: Built For Mars

The fail: Robinhood didn’t want people to find the page to purchase Gamestop shares, so they just removed Gamestop from the search results.

The fix: Robinhood absolutely should have left Gamestop in the search results. By removing it entirely the company did three things: created ambiguity, provided no explanation, and looked suspicious.

The rule: Great UX is about being definitive and clear, and the absence of information is the opposite of this.

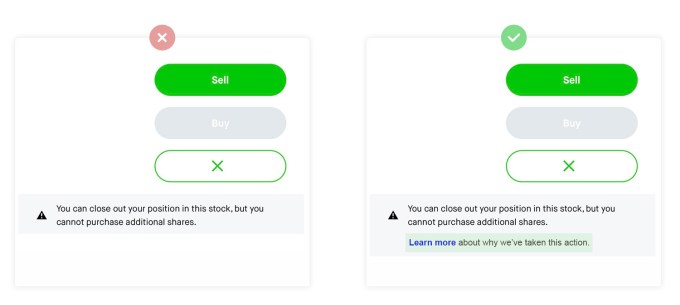

Blocking people from buying Gamestop shares

People could still get on to the GME stock page, so Robinhood simply disabled the buy button and showed this generic message:

Image Credits: Built For Mars

The fail: Robinhood stopped people buying shares—essentially closing the free market—and disabled the buy button with a generic message.

The fix: This is an unprecedented move from a brokerage, and most Robinhood users will never have considered this to be a possibility. They should have included a link to more information about why they had to take this decision. In this instance, with insufficient info, users flocked to Twitter but found no explanation on the Robinhood Twitter account either.

The rule: When delivering bad news which will directly affect customers, you need to have spent the time to properly explain why this has happened, how it affects them, and what happens next.

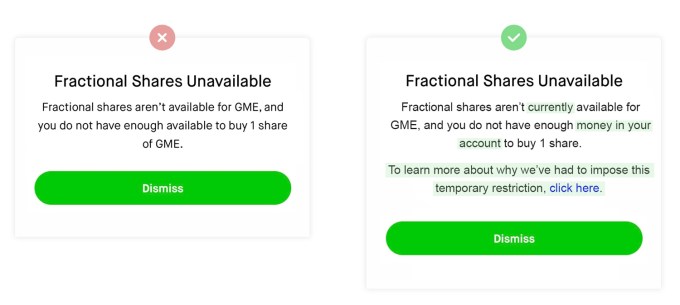

Fractional shares are unavailable

Robinhood is known for fractional shares, but it temporarily blocked people buying fractional shares of Gamestop. This was after Robinhood re-allowed people to buy shares, but with limits:

No fractional shares

Limited number of shares

Image Credits: Built For Mars

The fail: When people tried to buy fractional shares, they would put in their order, and see this error message. It explains what you can’t do, but doesn’t provide any context as to why.

The fix: Simple: add context explaining why they’ve had to make this decision. The company removed one of the key USPs of Robinhood, and it didn’t even mention if it’s temporary.

The rule: You shouldn’t just add an explanation in one place and expect all your users to see it. You should proactively place links to your detailed response in all of the places and features that are affected by your restrictions.

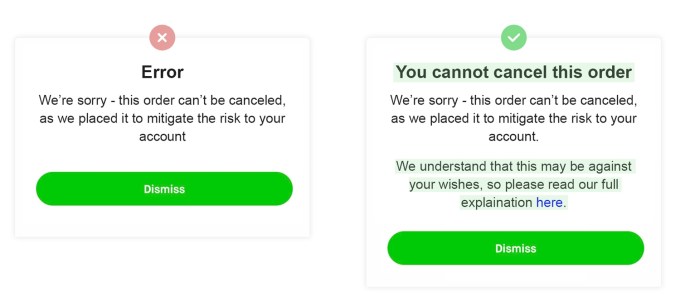

Creating sell orders on your behalf

People were claiming on Twitter that Robinhood were automatically creating sell orders, and not allowing people to cancel them. (As it turns out, the T&Cs state that Robinhood has the legal right to do this.)

Image Credits: Built For Mars

The fail: If this is true, it means that Robinhood was taking drastic action to mitigate their liquidity issues. This action directly affects the finances of their users, and still, there’s no explanation why.

The fix: Whilst good UX can’t make this okay, a decent explanation in context of why they’re having to do this at least provides a good rationale. Also, it’s not an ‘error’, so labelling it an error feels disingenuous.

The rule: Stopping your user from doing an action is one thing, but taking control and doing something that may be against their will is another. This should only be done with sufficient context, explanation and empathy.

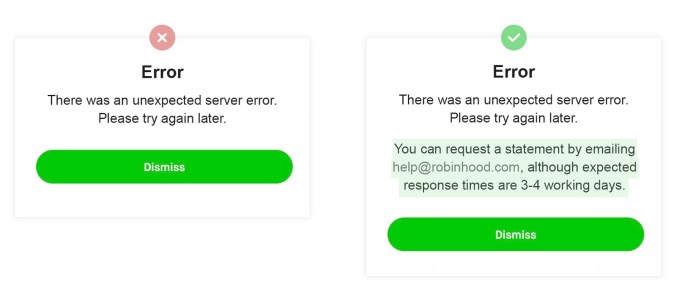

Failing to get statements

People wanted to leave Robinhood, and were claiming that other brokerages needed a ‘statement of portfolio’ to initiate a switch.

Twitter blew up as the ‘download statement’ function was broken for people all weekend. We never saw Robinhood address it, and naturally people assumed it was a dirty tactic to keep customers from leaving.

The fail: When trying to download a statement users saw this error message. This didn’t just happen once, but users were claiming that it was broken and they were unable to download their statements.

Image Credits: Built For Mars

The fix: Unlike the other examples, this doesn’t require more context, but does need an alternative method of reaching the same result. Some features are vital and urgent, some aren’t.

The rule: Some actions are important enough that it’s not good enough to just fail. In these instances, you need to provide an alternative way to reach the same goal.

Source: https://techcrunch.com/2021/02/01/5-rushed-ux-changes/

Rapid7, the Boston-based security operations company, has been making moves into the cloud recently and this morning it announced that it has acquired Kubernetes security startup Alcide for $50 million.

As the world shifts to cloud native using Kubernetes to manage containerized workloads, it’s tricky ensuring that the containers are configured correctly to keep them safe. What’s more, Kubernetes is designed to automate the management of containers, taking humans out of the loop and making it even more imperative that the security protocols are applied in an automated fashion as well.

Brian Johnson, SVP of Cloud Security at Rapid7 says that this requires a specialized kind of security product and that’s why his company is buying Alcide. “Companies operating in the cloud need to be able to identify and respond to risk in real time, and looking at cloud infrastructure or containers independently simply doesn’t provide enough context to truly understand where you are vulnerable,” he explained.

“With the addition of Alcide, we can help organizations obtain comprehensive, unified visibility across their entire cloud infrastructure and cloud native applications so that they can continue to rapidly innovate while still remaining secure,” he added.

Today’s purchase builds on the company’s acquisition of DivvyCloud last April for $145 million. That’s almost $200 million for the two companies that allow the company to help protect cloud workloads in a fairy broad way.

It’s also part of an industry trend with a number of Kubernetes security startups coming off the board in the last year as bigger companies look to enhance their container security chops by buying the talent and technology. This includes VMWare nabbing Octarine last May, Cisco getting PortShift in October and RedHat buying StackRox last month.

Alcide was founded in 2016 in Tel Aviv, part of the active Israeli security startup scene. It raised about $12 million along the way, according to Crunchbase data.

Source: https://techcrunch.com/2021/02/01/rapid7-acquires-kubernetes-security-startup-alcide-for-50m/

DesignCrowd announced today it has raised $10 million AUD (about $7.6 billion USD) in pre-IPO funding. The capital will be used on hiring and product development, with the goal of accelerating the growth of BrandCrowd, its DIY platform.

The new funding comes as DesignCrowd gets ready for a potential initial public offering on the Australian Securities Exchange. The round’s investors include Perennial Value Management, Alium Capital, Ellerston Capital, Regal Funds Managemetn and CVC, along with returning backers Starfish Ventures and AirTree Ventures. DesignCrowd has now raised more than $22 million AUD in total.

Founded in 2007 and based in Sydney, Australia, DesignCrowd built its reputation as a design crowdsourcing platform, allowing users to get proposals from designers around the world. BrandCrowd was launched to complement DesignCrowd’s crowdsourcing/marketplace model, expanding its potential user base and differentiating it from other sites people use to find designers, like 99designs and Fiverr.

While there are other DIY logo makers aimed at entrepreneurs and small brands, including tools from Design Hill, Canva and Tailor Brands, BrandCrowd had an advantage from the start because it already has access to more than 800,000 designers through DesignCrowd, allowing the company to find the best logo designers from around the world for its library, said co-founder and chief executive officer Alec Lynch. BrandCrowd prefers to buy designs upfront before publishing them, since all logos are exclusive to the platform (users can pay an extra fee to remove logos from its library).

BrandCrowd customers pay a one-off fee to download a logo and can sign up for monthly or annual subscriptions. Many use both platforms, Lynch said.

“For example, if a small business wants to start by getting a custom logo design from a designer on DesignCrowd, we then allow them to use that logo in our DIY design tools on BrandCrowd to make everything else they might need, from business card designs to Instagram posts and email signature,” said Lynch. “They can even make modifications to their logo on BrandCrowd using our logo editor tool.”

DesignCrowd’s net revenues in 2020 grew 54% year-over-year, due primarily to BrandCrowd. The company says BrandCrowd saw over five million sign-ups over the past 12 months, with more than half of its revenue from the United States.

During the COVID-19 pandemic, the company experienced some headwinds in March and April 2020, Lynch said, but then global demand for online design rebounded and began increasing.

“Our hypothesis is that the pandemic led to more people starting new businesses in the second half of 2020 and more people needing design for those businesses, which was helpful for us,” he added. “In addition to this small ‘boom’ in small businesses starting, we think the pandemic has probably accelerated an existing trend of businesses sourcing design online rather than offline.”

In 2018, Carbon, a Nigerian fintech startup, made its financials public for the first time. Although typical for foreign private startups, it’s almost an anomaly in Africa. There have been rare cases in the past, for instance, when Rocket Internet had to include Jumia’s financials in its yearly reports after going public. At the time, the German investment outfit was a founding shareholder in the African-based unicorn.

While Carbon has been hailed for transparency and openness, it remains to be seen if it’s a trend other African startups are willing to follow. Posting audited financials can prove detrimental for a private African company for several reasons ranging from bad marketing and PR if huge losses are incurred to regulatory clampdown if the company performs well.

A $15.8 million VC-backed company, Carbon was founded by Chijioke Dozie and Ngozi Dozie in 2012. The brothers started the company in a niche digital lending market, but now, the company offers a plethora of services from savings to payments and investments.

When Chijioke Dozie, the CEO, spoke to TechCrunch in 2019, he cited recruitment purposes and clientele trust as reasons why the company made its financials public — an exercise it has done every second quarter for two years. It’s a tradition Dozie hopes the company will keep this year.

“Our annual report will be released in the second quarter after our financial audit has been concluded. If you recall, we released a year in review in January 2020 before we released the fiscal year of 2019 report,” he told TechCrunch.

The company’s annual reports reveal numbers on gross earnings, profit/loss before and after-tax, net impairment loss, total assets, liabilities, and equity, among others. The company’s year on review, on the other hand, highlights payments processed, customer base, loans disbursed, and investments made on the platform.

As we wait for its annual report for 2020, its year in review offers a sneak peek into how Carbon grew the past year.

For the fiscal year 2020, the company which has about 659,000 customers said it processed ₦96.54 billion (~$241.35 million), up 89% compared to the same period a year ago. For its lending arm, disbursement volume was ₦25.21 billion (~$63 million), up 9.1% from FY2019. Also, ₦13.02 billion (~$32.55 million) worth of investments was made on the platform, representing a 365% increase from the previous year.

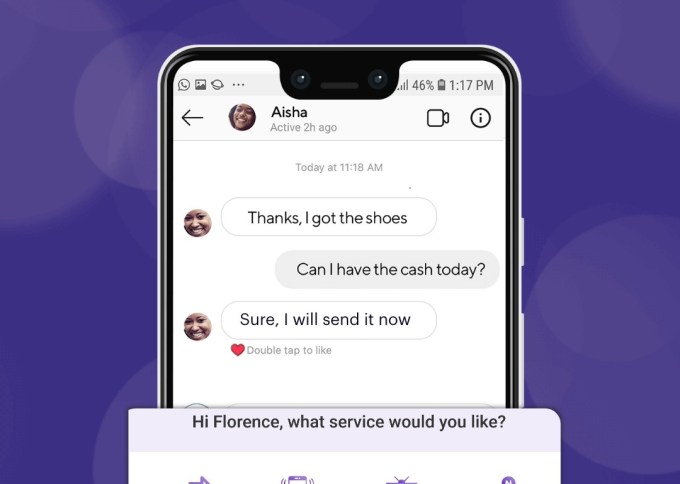

According to the company, factors that influenced these numbers last year included launching an iOS app that drove customer acquisition, introducing its USSD banking feature for lower-income customers; and a social chat feature to enable faster transactions.

Image Credits: Carbon

Also, in its quest to become a digital bank, Carbon acquired a microfinance bank license. According to Dozie, the license means that Carbon’s customers are afforded additional protection through depositors’ insurance via the NDIC. The Nigerian Deposit Insurance Corporation, a federal insurance agency, protects depositors and guarantees the settlement of insured funds when a financial institution can no longer repay their deposits. With that in place, Dozie says the typical Carbon wallet is now a full-fledged bank account, and customers can perform transactions on the platform as they would with any bank.

Like Carbon, other startups on the continent have followed suit by releasing year-on-year metrics. In recent memory, most of these startups play in the fintech and crypto-exchange space. But Carbon remains unique amongst these crop of companies as it releases both transaction stats and real insights into its financial performance.

Whereas transaction stats tend to highlight a seemingly explosive year-on-year growth of a company, a comprehensive view of financials will likely show a mixed performance. For instance, Carbon generated $17.5 million in revenue for FY2019, up 68% from 2018. For that same period, it recorded a 23% decrease in its profit after tax numbers, a 222% rise in total liabilities and 107% increase in assets finishing the year off with a 6% increase in total equity.

It’ll be interesting to see what these numbers look like for 2020. But that’s not the only event to keep an eye on. In addition to its $10 million Series A from SA-based Net1 UEPS Technologies and a $5million debt financing in 2019 from Lendable, Dozie says the digital bank which also has a presence in Kenya is ramping efforts to raise a Series B round soon to consolidate its position on the continent.