& meet dozens of singles today!

User blogs

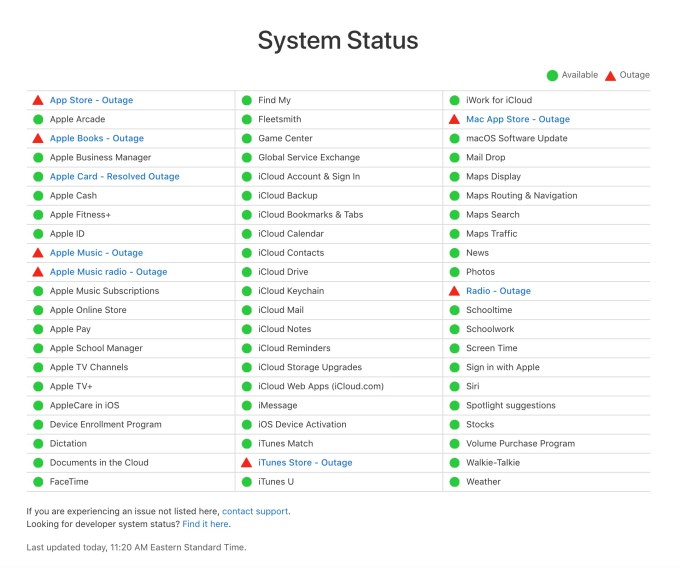

Several high-level Apple services are experiencing issues and outages on Wednesday morning, Apple has confirmed. These issues are impacting a number of consumer-facing services including Apple Music and Radio, Apple Books, and the App Store platforms across both iOS devices and Mac.

For some users, the services are down. For example, there were reports circulating this morning that users were having problems streaming music through Apple Music or using iTunes. Other have noticed strange problems cropping up on the App Store — like app search results that only returned a small handful of top apps related to the search term.

Even when the services are partially up, they’re sometimes much slower to load than usual — meaning users may see blank pages for several seconds before the page is populated with its usual content.

Image Credits: Apple

At the time of the initial reports, Apple’s Status page didn’t reflect these issues, as it showed all services as being available. That has since changed. Now, the page displays outages are occurring across the App Store, Apple Book, Apple Music, Apple Music Radio, iTunes Store, Mac App Store, and Radio.

The Apple Support Twitter account has also posted about the outage, but has yet to provide details about what has happened or when it might be resolved.

What’s concerning is that the account replied to a tweet with a complaint from a user who said they couldn’t reset their password — an indication that the outages could be impacting other types of backend services, as well.

Some services are currently experiencing an outage. Hang tight and keep checking back: https://t.co/waNYZdXpJm If you’d like to connect with us in DM, we can look further. https://t.co/GDrqU22YpT

— Apple Support (@AppleSupport) February 3, 2021

Apple says it’s working to provide us with more information on this, and we’ll update when the company has more to share.

Techstars Los Angeles, the local Los Angeles-focused branch of the global accelerator network, has named Matt Kozlov as its new managing director.

Kozlov, a longtime Techstars network fixture, has previously served as the head of the organization’s healthcare accelerator through a partnership with Cedars-Sinai and as the head of the Techstars Starburst Space Accelerator, which was focused on space and aerospace startups.

Now, Kozlov turns his attention to the Los Angeles ecosystem broadly.

“I’m humbled to have the opportunity each day to support incredible founders who are solving some of humanity’s greatest challenges,” said Kozlov, in a statement. “As I begin this new role, my goal is to continue to leverage my experience to help generate opportunities for future Techstars LA companies to make meaningful, long-term impact.”

Kozlov’s appointment comes as the Los Angeles tech ecosystem is having something of a moment. As the diaspora out of Silicon Valley continues, the Southern California tech world has proven to be a tempting landing pad during the COVID-19 pandemic. And remote work means that Los Angeles could be a fixture for more investors looking to escape the Bay.

Beyond Southern California’s coastal appeal is a vibrant technology ecosystem that encompasses enterprise software, financial services, healthcare, aerospace and defense, robotics, ecommerce and social media. It’s the home of social networking favorites Snap and TikTok’s U.S. base of operations and SpaceX’s significant presence has born a number of talented hardware and engineering startups.

LA is truly having a moment and Kozlov’s experience with some of the less-well-known corners of the city’s tech ecosystem could be a boon for the Techstars program.

“I’m thrilled by the selection of Matt as the new Managing Director for Techstars LA,” said Anna Barber, former Managing Director, Techstars LA, who stepped down from the role in November to join venture firm M13 as Partner, in a statement. “He is a talented investor and longstanding leader in LA’s Techstars community, and has been an essential and valued mentor for the program for the past four years. He embodies the Techstars values of #givefirst and I have every confidence that he is the right leader to continue building on what we’ve established in the LA community.”

Collectively, the 40 alumni companies who have participated in Techstars Los Angeles accelerator program have raised over $126 million and have a combined market cap of $328.6 million.

“Techstars LA plays a critical role in the Los Angeles tech ecosystem as the premier startup accelerator, providing valuable mentorship and funding for dozens of companies a year,” said Spencer Rascoff, Chair of dot.LA and Los Angeles angel investor. “I’m very excited that Matt will be the new Managing Director of Techstars LA. He brings extensive experience in healthcare and aerospace investing and has been an incredible mentor and leader to the companies of the Techstars Starburst Space Accelerator over the last several years.”

Revel, the shared electric moped startup, is building a DC fast-charging station for electric vehicles in New York City, the first in a new business venture that will eventually spread to other cities.

The company said Wednesday that this new “Superhub,” which is located at the former Pfizer building in Brooklyn, will contain 30 chargers and be open to the public 24 hours a day. This will be the first in a network of Superhubs opened by Revel across New York City, the company said.

Revel didn’t build the EV charging infrastructure in house. Instead, it is using Tritium’s new RTM75 model for the first 10 chargers at its Brooklyn site, which will go live this spring. These chargers are designed to delivery with 100 additional miles of charge to an electric vehicle in about 20 minutes, according to Revel.

The EV charging business has been couched by Revel as a mission to electrify cities. The move comes as a growing number of automakers, including legacy companies like GM, Ford and VW Group along with new entrant Rivian and EV leader Tesla add more electric vehicles to their portfolios.

Revel’s expansion into charging marks its first new product line since launching a shared fleet of electric mopeds in 2018. Revel, founded by Frank Reig and Paul Suhey, started with a pilot program in Brooklyn and later expanded to Queens, the Bronx and sections of Manhattan. It has been on a fast-paced growth track thanks to the $27.6 million in capital raised October 2019 in a Series A round led by Ibex Investors. The equity round included newcomer Toyota AI Ventures and further investments from Blue Collective, Launch Capital and Maniv Mobility.

Several thousands mopeds are available to rent in New York City today. Revel expanded its shared moped business to other cities such as Austin, Miami and Washington, D.C in its first 18 months of operation. Last year, the company launched in Oakland and received a permit in July 2020 to operate in San Francisco.

Shared mopeds haven’t been successful everywhere. Revel pulled out of Austin in December. Reig said at the time that the COVID-19 pandemic, which has caused ridership to fall across shared micromobility services, along with the city’s deep-rooted car culture was proven difficult to penetrate.

Source: https://techcrunch.com/2021/02/03/electric-moped-startup-revel-launches-an-ev-charging-business/

Box announced this morning that it has agreed to acquire eSignature startup SignRequest for $55 million.The acquisition gives the company a native signature component it has been lacking and opens up new workflows for the company.

Box CEO Aaron Levie says the company has seen increased demand from customers to digitize more of their workflows, and this acquisition is about giving them a signature component right inside Box that will be known as Box Sign moving forward. “With Box Sign, customers can have a seamless esignature experience right where their content already lives,” Levie told me.

While Box has partnerships with other eSignature vendors, this gives it one to call its own, one that will be built into Box starting this summer. As we have learned during this pandemic, the more work we can do remotely, the safer it is. Even after the pandemic ends and we get back to more face-to-face interactions, being able to do things fully in the cloud and removing paper from the workflow will speed up everything.

“The massive push to remote work effectively instantly highlighted for every enterprise where their digital workflows were breaking down. And eSignature was a major part of that — too many industries still rely on paper based processes,” he said.

Levie says that the signature component has been a key missing piece from the platform. “As for our platform, when you look at Snowflake, they’re the data cloud. Salesforce is the sales cloud. Adobe is the marketing cloud. We want to build the content cloud. Imagine one platform that can power the entire lifecycle of content. eSignature has been a major missing link for critical workflows,” he said.

He believes this will open up the platform for a number of scenarios, that while possible before, could not flow as easily between Box components. “Having SignRequest gets us more natively into mission critical workflows like customer contracts, vendor onboarding, healthcare onboarding and supply chain collaboration,” Levie explained.

It’s worth noting that Dropbox acquired HelloSign for $230 million two years ago to provide it with a similar kind of functionality and workflow capability, but analyst Alan Pelz-Sharpe from Deep Analysis, a firm that follows the content management market, says this wasn’t really in reaction to that.

“I think what is interesting here is that Box is going to integrate SignRequest and bundle it as part of the standard service. That’s what really caught my eye as the challenge with eSig is that it’s typically a separate product and so gets limited use. They bought it partly in response to Dropbox, but it was a hole that needed fixing regardless so would have done so anyway,” Pelz-Sharpe explained.

As for SignRequest, the company was founded in the Netherlands in 2014. Neither Pitchbook nor Crunchbase has a record of it raising funds. The plan is for the company’s employees to join Box and help build the signature component that will become Box Sign. According to a message to customers on the company website, existing customers will have the opportunity over the next year to move to Box Sign, and get all of the other components of the Box platform.

Levie says the basic Box Sign function will be built into the platform at no additional charge, but there will be more advanced features coming that they could charge for. The deal is expected to close soon with the SignRequest team remaining in The Netherlands.

Many founders only know their own experience fundraising and don’t hear much about what other founders went through. On Extra Crunch Live today, we’re going to remedy that.

Grafana Labs has raised upward of $75 million since it launched in 2014. Lightspeed Venture Partners, and partner Gaurav Gupta to be specific, led both the startup’s Series A and Series B rounds. As far as commitments go, that’s a pretty significant one.

The new and improved Extra Crunch Live pairs founders and the investors who led their earlier rounds to talk about how the deal went down, from the moment they met to the conversations they had (including some disagreements) to the relationship as it exists today. Hell, we may even take a peek at the original pitch deck that made it all happen.

Then, we’ll turn our eyes back to you, the audience. That same founder/investor duo (in this case, Grafana Labs CEO Raj Dutt and LVP’s Gaurav Gupta) will take a look at your pitch decks and give their own feedback. (If you haven’t yet submitted a pitch deck to be torn down on Extra Crunch Live, you can do so here.)

The hour-long episode is sandwiched between two 30-minute rounds of networking. From start to finish, it goes from 11:30 a.m. PST/2:30 p.m. EST to 1:30 p.m. PST/4:30 p.m. EST. And Extra Crunch Live will come to you at the same time, every week, with a new pair of speakers.

So let’s learn a little bit more about Gupta and Dutt.

Before becoming an investor, Gupta enjoyed a rich career in the product development sphere, holding positions at Elastic (where he led product management), Splunk (VP of Products), as well as Google, Gateway and the McKenna Group. He joined Lightspeed in 2019 as a partner, focusing primarily on enterprise software. He’s led investments in Impira, Blameless, Hasura and Panther, and of course, Grafana. He sits on the board of the last three companies in that list.

Dutt is the co-founder and CEO at Grafana Labs, but the fast-growing company isn’t his first go at entrepreneurialism. Dutt also founded and led Voxel, a cloud-hosting startup that was acquired by Internap for $30 million in 2012.

We’re absolutely thrilled to have Gupta and Dutt join us on our first episode of Extra Crunch Live in 2021. As a reminder, Extra Crunch Live is for Extra Crunch members only. We’re coming to you with a new pair of speakers every week, and you can catch everything you missed on-demand if you can’t join us live. It’s worth the cost of the subscription on its own, but EC members also get access to our premium content, including market maps and investor surveys. Long story short? Subscribe, smarty. You won’t regret it.

Oh, and here’s a look at other speakers you can expect to see on Extra Crunch Live:

Aydin Senkut (Felicis) + Kevin Busque (Guideline) — February 10

Steve Loughlin (Accel) + Jason Boehmig (Ironclad) — February 17

Matt Harris (Bain Capital Ventures) + Isaac Oates (Justworks) — February 24

And that’s just the February slate!

All the details to register for this upcoming episode (and more) are available below. Can’t wait to see you there!