& meet dozens of singles today!

User blogs

While China bans cryptocurrency exchanges and initial coin offerings, the government is set to leverage the underpinning technology — often without the decentralized part. Blockchain, for instance, could help track the shipment of luxury goods and authenticate court evidence. In the process of adopting blockchain applications in its own interest, China also wants to become a world leader of the new technology.

Last year, an ambitious, government-backed blockchain infrastructure network launched in China. The Blockchain-based Service Network, or BSN, acts as an operating system for blockchain programs so developers won’t have to design a framework from the ground up. Importantly, it’s part of the country’s goal to set industry standards and build the underlying infrastructure for blockchain applications worldwide.

The brains behind BNS are the State Information Center, an affiliate to China’s top economic and reform planner, the country’s credit card processing giant UnionPay, telecoms carrier China Mobile, and a little-known Beijing-based startup called Red Date which cut its teeth building smart city technology in China.

There are two main types of blockchains: permissionless, which is public, decentralized and transparent; and permissioned, which is operated by one or multiple stakeholders of a given industry, respectively called private and consortium blockchains.

BSN is designed as a global infrastructure to support both consortium and public blockchains, it says in a white paper published last March. “Just as with the internet, the BSN is also a cross-cloud, cross-portal, cross-framework global infrastructure network.”

An English version of the website is available for dApp developers, and major public chains like Ethereum, EOS, Tezos, NEO already have nodes on the network.

Now BNS is working on the more private part of its infrastructure. This week, it announced it will roll out a permissioned version of Cosmos. Introduced in 2019, Cosmos is a network comprised of many independent blockchains and calls itself the “internet of blockchains.”

The development work for the Cosmos-based chain is done by Bianjie, a Chinese blockchain startup, and the permissioned chain is named after the city Wenchang in China’s southernmost Hainan Province, home to China’s first blockchain pilot zone.

The intentions of the Wenchang Chain are to provide a “public infrastructure network that allows the low-cost development, deployment, operation, maintenance and regulation of consortium blockchain applications,” Bianjie said in an announcement.

Global developers can now deploy their dApps on the Wenchang Chain via BSN, which makes their dApps concurrently compliant with Chinese regulations, a Bianjie spokesperson explained via email.

“In this way, it’s possible for their dApps to gain a large number of Chinese users and enter the Chinese market.”

The Wenchang Chain is intended not just for enterprise services but also business-to-consumer and consumer-to-consumer programs. For example, Uptick, a consumer-facing e-ticketing dApp, will soon become the first dApp to launch on the permissioned chain, according to the Bianjie spokesperson.

Source: https://techcrunch.com/2021/02/03/bsn-china-national-blockchain/

Storyblok, a ‘headless’ CMS for developers and marketers to deliver content, has raised an $8.5 million Series A funding round led by Mubadala Capital, alongside existing Storyblok investors firstminute capital and 3VC.

The Austria-founded company’s platform counts Pizza Hut, Adidas, UPC, Greggs, Decathlon and others among its roster of clients, alongside many thousands of solo developers that use its CMS. That means it’s currently powering more than 60,000 projects, it says.

Storyblok says its CMS provides ‘highly customizable content blocks and visual editing tools’ in n contrast to other headless CMS solutions which are flexible for developers but might be less so for actual editors to edit.

Dominik Angerer, Co-Founder and CEO of Storyblok, said in a statement: “The marketing world is in a state of transition. Fragmented channels and rapidly changing consumer behavior as a result of the Coronavirus pandemic have made it much more challenging to efficiently and quickly keep brand messaging consistent across multiple platforms. On paper, headless CMS technology solves a lot of these problems, but in practice, most platforms are only geared towards developers, which makes them incredibly difficult for non-technical people to use. Storyblok’s solution marries the needs of both editors and developers, which has given us a unique position in the market and resulted in rapid growth.”

Fatou Bintou Sagnang, director at Mubadala Capital said: “In a vast but relatively homogenous market, Storyblok has impressed us with a truly differentiated product that resonates with small and large enterprises. The organic traction is proof of the customer love from both developers and marketers.”

Competitors to Storyblok include ContentStack, Contentful, Sitecore, Adobe Experience Manager and Prismic.

Speaking to TechCrunch Angerer said: “A lot of headless CMS platforms are easily integrated into legacy systems but when it comes to actually using them on a daily basis marketers or other editors find them incredibly difficult to use. In practice, they end up having to go back to their IT or developer teams to sort out problems or make major changes which ends up wasting the time and money that headless CMS’s perport to save.”

Mobile Premier League (MPL) has raised $95 million in a new financing round, just five months after it secured $90 million as the two-and-a-half-year-old Bangalore-based esports and gaming platform looks to grow in international markets.

The new $95 million round, a Series D, was led by Composite Capital and Moore Strategic Ventures and gave the Indian startup a post-money valuation of $945 million, it said. (MPL was valued at about $465 million in its previous financing round in September, TechCrunch had reported.) Base Partners, RTP Global, SIG, Go-Ventures, Telstra Ventures, Founders Circle and Play Ventures also participated in the round, which brings its total to-date raise to $225.5 million.

MPL, which counts Times Internet among its backers, operates a pure-play gaming platform that hosts a range of tournaments. The app, which has amassed more than 60 million users in India and 3.5 million users in Indonesia, also serves as a publishing platform for other gaming firms. MPL, which does not develop games of its own, hosts about 70 games across multiple sports on the app today.

“As we grow our presence and expand, this fresh round of funds will help us focus on our core value propositions — a robust platform with the best features for gamers and onboarding the best eSports titles. The esports community in India is thriving, and we believe this is the perfect time to take Indian-made games to the world as well as help Indian gamers get recognized for their talent,” said Sai Srinivas, co-founder and chief executive of MPL, in a statement.

The Bangalore-based startup also offers fantasy sports, a segment that has taken off in many parts of India in recent years. Because fantasy sports is only one part of the business, the coronavirus outbreak that shut most real-world matches has not impeded the startup’s growth in recent quarters.

“We’re competing with battle-hardened, decade old companies with much, much deeper pockets but it’s incredible what the young team has achieved over the past couple of years. When we were on the Play Store, a couple of years back, MPL was the fastest app to reach a 1M DAU ever in India!” tweeted Abhishek Madhavan, SVP of Marketing at MPL, last year.

“We signed Virat Kohli (pictured above), when we were a 3-month old company! When we got out of the Play Store, we were told growth will be very very hard to come by, every single marketing metric would fall.”

The startup, which bought stakes worth $500,000 from employees last week, said it will deploy the fresh capital to organize more esports tournaments in the country and accelerate its international expansion this year. The startup recently organized College Premier League, which saw participation of more than 13,000 gamers from over 100 colleges.

“We are excited to partner with the MPL team and support their continued growth. As an industry leader in the gaming market, we believe the company will continue to innovate and drive the evolution of eSports, both in India and internationally,” said Kanush Chaudhary, Managing Director, Composite Capital, in a statement.

GajiGesa, a fintech company that offers Earned Wage Access (EWA) and other services for workers in Indonesia, has raised $2.5 million in seed funding. The round was co-led by Defy.vc and Quest Ventures. Other participants included GK Plug and Play, Next Billion Ventures, Alto Partners Multi-Family Office, Kanmo Group and strategic angel investors.

The company was founded last year by husband-and-wife team Vidit Agrawal and Martyna Malinowska. Agrawal was Uber’s first employee in Asia and has also served in leadership positions at Carro and Stripe. Malinowska led product development at Standard Chartered’s SC Ventures and alternative credit-scoring platform LenddoEFL.

About 66% of Indonesia’s 260 million population is “unbanked,” which means they don’t have a bank account and limited access to financial services like loans. Agrawal and Malinowska decided to launch GajiGesa in Indonesia because Malinowska worked with many unbanked workers while at LenddoEFL. While at Uber, Agrawal also worked with drivers across Southeast Asia whose average earnings were $250 USD a month (excluding Singapore), and he said the top issue they face was harassment by money lenders.

“These hardworking Indonesians had no fair or formal sources for easy access to capital. Further, the most common reason for borrowing was short-term liquidity issues,” Agrawal told TechCrunch. “But workers were forced to borrow either long-term, high ticket size loans or short-term loans with exorbitantly high-interest rates.”

Having immediate access to earned wages, instead of waiting for a semi-monthly or monthly paycheck, can help alleviate financial stress and make it easier for workers to manage their income and handle emergencies. Companies that have started instant payment services for workers in other countries include Square, London-based startup Wagestream and Gusto.

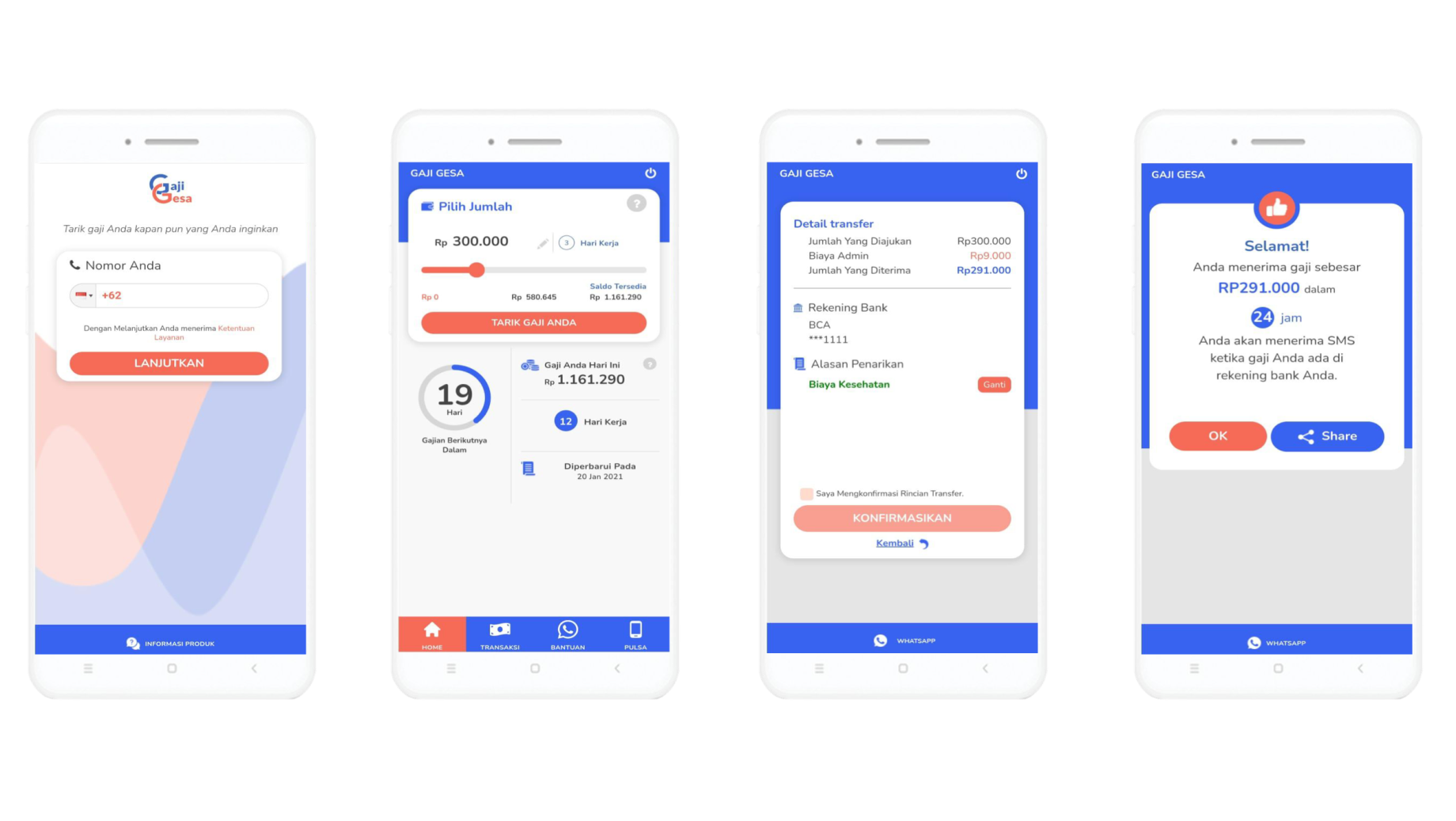

Since launching in October 2020, GajiGesa has added over 30 employers on its platform, serving tens of thousand of workers in total. It integrates into a company’s existing human resources management and payroll systems. Workers can get earned wages immediately, track earnings, pay bills, buy prepaid cards and access financial education resources through an app.

GajiGesa does not charge interest rates or require collateral, since all its users are pre-approved by their employers. Companies decide to charge fees or offer GajiGesa as part of their benefits packages, and also get access to analytics that can help them create targeted incentives or new benefits for their workforce.

During COVID-19, Agrawal said the startup has “seen insatiable demand and support for GajiGesa’s EWA solution from employers. This is partly attributed to the various challenges employers are facing due to the effects of COVID-19, but our platform is designed to support employers and employees in the long-term. The value of EWA and the other services we offer is not limited to the pandemic.”

Grab, the Southeast Asian ride-hailing and on-demand delivery giant, announced a program to increase access to COVID-19 vaccinations today. Its goal is to have all of its employees, as well as driver and delivery partners, vaccinated by 2022 (excluding people who are medically unable to receive shots). Grab also said it will work with governments to provide information about vaccines through its app, and is in discussions to provide last-mile vaccine distribution, and transportation to and from vaccination centers.

The company currently has operations in eight Southeast Asian countries: Singapore, Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Thailand and Vietnam. Grab joins a growing roster of private companies around the world that have offered to help governments with their vaccination programs. In the United States, these include tech companies like Microsoft, Oracle, Salesforce and Epic. Meanwhile, China’s largest ride-hailing company, Didi Chuxing, is pledging $10 million to support vaccination programs in 13 countries.

In a statement, Russell Cohen, Grab’s group managing director of operations, said, “The quicker we can achieve herd immunity, the sooner our communities and economies can start to rebuild. Public-private partnership has been critical in taking on some of the pandemic’s biggest battles, and this collaboration should continue.”

For drivers and delivery partners, Grab said it will subsidize COVID-19 vaccine costs not covered by national vaccination programs. The company will also extend its Group Prolonged Medical Leave insurance policy to cover income lost by drivers as a result of potential side effects from getting vaccinated. Employees and immediate family members will have any costs not covered by national programs paid for by Grab.

In terms of vaccine education, the Grab app will prominently display information from governments and health authorities, and run user surveys to help them understand public sentiment about COVID-19 vaccines. The company says its app has been downloaded more than 214 million times.