& meet dozens of singles today!

User blogs

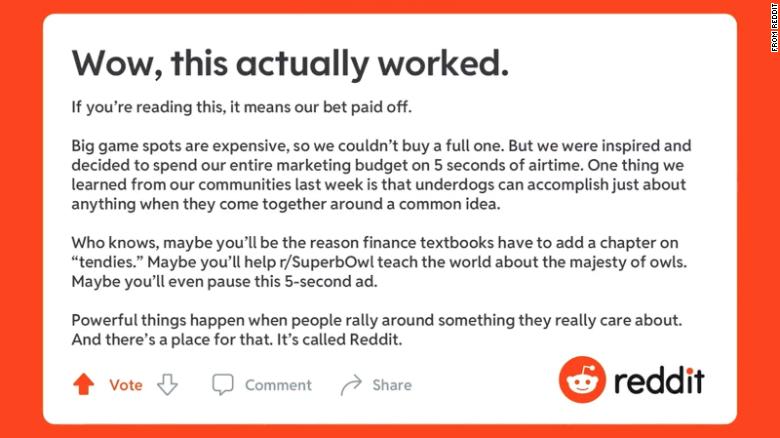

Reddit has raised a new funding round, totalling $250 million. This is the company’s Series E round of financing, and it comes hot on the heels of renewed public attention on the site that has dubbed itself ‘the front page of the Internet,’ owing to the role the subreddit r/WallStreetBets played in the recent meteoric rise (and subsequent steep fall) of the value of GameStop stock. Reddit also ran a 5-second Super Bowl ad on Sunday, consisting of. a single static image that looked like a standard post on the network itself.

This is Reddit’s 16th year of operation, and the company has raised around $800 million to date, including a Tencent-led $300 million Series D in February, 2019. Today’s round including financing from “existing and new investors,” Reddit noted in a blog post in which it announced the funding. In the post, Reddit notes that the company felt “now was the right opportunity to make strategic investments in Reddit including video, advertising, consumer products and expanding into international markets.”

Reddit’s 5-second Super Bowl ad.

It’s unclear how the round came together exactly, but given the network’s time in the spotlight over the past few weeks, culminating in yesterday’s very brief, but also very memorable and high-profile ad, it seems likely it was at least finalized fast in order to help the company make the most of its time in the spotlight. In terms of what kind of specific moves Reddit could make with its new cash on hand, the blog post also namecheck its acquisition late last year of short video sharing platform Dubsmash, and announced plans to double its team over the course of this year with new hires.

Reddit’s long history has also included some significant tumult, and efforts to clean up its act in order to present a better face to advertisers, and to potential new community members. The network still struggles with balancing its commitments to fostering a home for a range of communities with the potential for hate speech and discrimination to take root within some of these, and it was also in the news earlier this year for finally banning controversial subreddit r/donaldtrump following “repeat´d policy violations” surrounding the attempted insurrection a the U.S. Capitol by a mob of domestic terrorists.

Source: https://techcrunch.com/2021/02/08/reddit-raises-250-million-in-series-e-funding/

In hindsight, Dayna Grayson and Rachel Holt seemingly didn’t have the best timing. It was late in 2019 when the two, who met six years ago in Washington through a mutual acquaintance, decided to act on earlier conversations and start a fund together.

At the time, Grayson spied an opportunity to create a new venture brand that focused largely on the types of manufacturing-related deals that she was funding inside of the investing giant, NEA, which she joined in 2012.

Holt, who’d joined Uber in 2011, rising from a city general manager in Washington to the eventual head of the company’s mobility unit in 2018, was also ready for a change and excited about the prospect of investing full time, having been brought into NEA by Grayson to scout out nascent deals on the side.

“Of course, we didn’t expect COVID,” Holt says now. Still, it didn’t stop them from moving forward with fundraising and, in the process, securing $140 million in capital commitments from what Holt describes as “the typical kind of institutional LP base, including endowments, foundations,” and also some peers, including Aileen Lee of Cowboy Ventures, Josh Kopelman of First Round, and Grayson’s former NEA colleague, Scott Sandell.

Construct, which is focused primarily on five themes — decentralized manufacturing, supply chain visibility, automation, transportation and mobility — is already actively writing checks, in fact. Among the companies they have backed are Chef Robotics, a startup focused on assembling food at high throughput; Copia, a food waste management platform that connects businesses that have leftover food with organizations that feed the hungry; and ChargeLab, a maker of electric vehicle charging software that Holt likens to the “Android of the charging market.”

To get a better sense of the types of startups that might be ideal for the firm going forward, we talked earlier with the pair, who recently signed a lease in the nation’s capital for their team (Construct also has two junior investors), and who were working together today from Grayson’s home.

Parts of that conversation follow, edited lightly for length and clarity.

TC: Rachel, what startups did you identify for NEA and how do they fit into your point of view as an investor?

RH: I was always attracted to business solving real-world problems, so among the investments [I made as a scout for] NEA is an auto-refinancing company called MotoRefi because that was a problem I saw firsthand, talking with Uber drivers. I’m still on the board of that company.

But Dana and I have both been attracted to what we called foundational industries. I saw [opportunities] on the transportation side, on the supply chain side on the logistics side [at Uber]. When we were running Jump [as part of the mobility unit of Uber], we were building an e-bike, which is actually a pretty complicated piece of equipment to pull together, and you would see that something had left a factory in China, then you would lose track of it for five weeks, then you would see that it entered a port in the U.S., and then you would lose track of it again and I knew there had to be a better way . . . and I think COVID only highlights the urgency around some of the cracks in the system.

TC: Right. I think we’ve all been stunned by the supply chain issues as they related to the vaccines and PPE, certainly. Are you focused on global supply chain opportunities or just domestically?

DG: We’re primarily focused domestically. We will do investments in Canada and occasionally in Europe. We would [invest in] Asia without some more dedicated personnel there, and that’s not in the scope right now.

What we’ve seen in COVID is just a huge acceleration of consumer demand, so if you’re a brand or an e-tailor and you were planning all these upgrades to meet that demand two years from now, that’s happening today, so it’s really put a crunch on the system. Companies like [the e-commerce optimization startup] Tradeswell, brings data visibility across the supply chain, from where sales are happening online to how they’re being fulfilled in inventory. That’s something that analysts and agencies could help you do, but when you’re looking at just the crunch of having to have that real time urgency and information at your fingertips, you can’t wait for human intervention anymore. You have to you have to automate.

TC: You invested in Tradeswell’s seed round and its Series A. Will that be typical going forward? Relatedly, what size checks will you be writing and how much ownership will you be targeting when you invest in a company?

RH: Our typical size is $2 million to $6 million checks. We like to lead those those rounds, but they can be part of a round that goes up to, say, $12 million.

DG: As for ownership, something is reasonable is close to 15%. We’re not going to have a huge portfolio. Every company really matters to the fund I think something, you know, reasonable sort of is close to 15% as we can. I mean, we’d like to be. I think the point that we like to emphasize is that we’re not gonna have a huge portfolio. Every company really matters to the fund, every company receives dedicated time and attention from us, there isn’t a cookie cutter approach where if you work with Construct, you get X. It depends on the entrepreneur and what they need.

TC: How important are board seats to you both?

RH: What’s more important to us is meeting the company where they are and understanding what does the entrepreneur need and how can we add value.

TC: You’re in Washington. As investors who focus on what you do, is there any special advantage to being there?

DG: We’re investing nationally. If we find great projects here, we’d love to be involved with them, but of our first investments, two are in the Bay Area and two are on the East Coast.

RH: Dana [had been operating remotely at times before COVID] and I was running teams in the U.S and Canada [at Uber]. We don’t have a backyard bias.

TC: So you’re likely to do more remotely, even after the world returns to normal.

DG: I definitely think some things are here to stay, and that it’s great for founders. Their ability to engage investors over Zoom, whether they’re down the street or across the globe, is really in their interest and I’m glad to see a more efficient fundraise happen for a lot of them.

RH: I think for entrepreneurs, trying to find the best fit for what they are building, versus just who is the person they know because they run into them at the gym, is a big net positive [to come out of this whole thing]. It also enables them to build companies in the place where they’re best-suited to build the company, rather than indexing for where they’ll be seen from a funding perspective.

For a fuller look at what the team is building, you can check out their blog post here.

Tesla’s $1.5 billion investment in Bitcoin may be good for Elon Musk, but it’s definitely risky for the company that made him the world’s richest man, according to investors, analysts and money managers at some of the country’s largest banks.

As a standard bearer for the consumer electric vehicle industry and the broader climate tech movement rallying around it, Tesla’s bet to go all in on crypto could damage its climate bonafides and its reputation with customers even as other automakers pour in to the EV market.

Given Bitcoin’s current environmental footprint, the deal flies in the face of Tesla’s purported interest in moving the world to cleaner sources of energy and commerce.

Until the energy grid decarbonizes in places like Russia and China, mining bitcoin remains a pretty dirty business (from an energy perspective), according to some energy investors who declined to be identified because they were not authorized to speak about Musk’s plans.

“We were talking about people doing this in Russia back in 2018 and how they were tapping coal power to run their mining operations,” one investor said. “The cost per transaction from an energy intensity standpoint has only gotten more intense. I don’t see how those things coalesce, climate and crypto.”

The stake makes Tesla one of the largest corporate hodlers of Bitcoin but represents a massive portion of the company’s $19 billion in cash and cash equivalents on hand.

“Given the size of their treasury it feels irresponsible, IMO,” wrote one investor whose firm backed Tesla from its earliest days. The company’s move could be seen as another example of the absurdity of U.S. capital markets in today’s investment climate — and the underlying cynicism of some of its biggest beneficiaries.

Industry observers on Wall Street also criticized the company’s big bet on Bitcoin.

“Tesla buying $1.5 billion in BTC is interesting. Am assuming they haven’t hedged it, so they will either be cash rich in the future or have a hole in the balance sheet. Elon Musk stays wild,” wrote one capital planning executive at a major Wall Street bank who declined to be identified because they were not authorized to speak to the press. “[It’s] not dissimilar from a large company throwing cash into a wildly volatile emerging market currency.”

Still, in the short term, the deal is showing dividends. The price of Bitcoin has risen nearly $8,000, or 18.73%, over the course of the day since Tesla made its announcement. The question is whether any regulator will step in to punish Musk and Tesla.

Musk has been tweeting his support for Bitcoin and other, more arcane (or useless) cryptocurrencies like Dogecoin for the past several weeks, in what seems to be a violation of his agreement with the Securities and Exchange Commission.

The world’s richest man has previously been fined by regulatory agencies for his tweeting habits. Back in 2018, the SEC charged Musk with fraud for tweets about privatizing the electric vehicle company at $420 per share.

Musk eventually settled with the SEC, at the price of his role as chairman of Tesla’s board and a $20 million personal fine — with Tesla paying out another $20 million to the SEC.

The volatility of the cryptocurrency could impact more than just Tesla’s bottom line, but also hit its customers should they use the currency to buy cars.

“Bitcoin jumped over 15% to a new high of $44,000 on Monday. This sort of hype-based price power should be worrying to investors and consumers alike – especially if this is to be used as medium of exchange,” wrote GlobalData analyst Danyaal Rashid, Head of Thematic Research at GlobalData.

“If Elon Musk can help dictate the price of this asset with a tweet or large order, the same could happen to send the price back down. The task of purchasing a vehicle should not be speculative. Consumers who may have thought of buying bitcoin to use as a substitute for fiat – could very easily end up with more or less than they bargained for.”

Cynthia Perry, a former design research senior manager at Salesforce who left earlier this month, posted her resignation letter on LinkedIn that detailed her negative treatment at the company, Protocol first reported. In it, Perry, a Black woman, alleges she experienced “countless microaggressions and inequity” during her time there.

Ultimately, Perry said she left her job because she had been “Gaslit, manipulated, bullied, neglected, and mostly unsupported” by folks she chose not to name.

“Salesforce, for me, is not a safe place to come to work,” she wrote. “It’s not a place where I can be my full self. It’s not a place where I have been invested in. It’s not a place full of opportunity. It’s not a place of Equality for All. It’s not a place where well-being matters.”

Salesforce has long been vocal about the importance of equality. In 2016, Salesforce named Tony Prophet as its first-ever chief equality officer. That came about a year after Salesforce CEO Marc Benioff said its major diversity focus was “the women’s issue.”

Salesforce was one of the many companies that came out in support of the Black people in the wake of the killing of George Floyd.

“Now more than ever we must support one another as allies and speak up for justice and equality,” the company said in a tweet.

But companywide, Salesforce is just 3.4% Black in the U.S. while its leadership team is only 2.3% Black, according to its November 2020 diversity report.

“For privacy reasons, we can’t comment on individual employee matters but Equality is one of our highest values and we have been dedicated to its advancement both inside and outside of our company since we were founded almost 22 years ago,” a Salesforce spokesperson said in a statement to TechCrunch.

Perry is the latest Black female tech worker to speak out about her negative experience at a tech company. Last year, Ifeoma Ozoma and Aerica Shimizu Banks came forward with allegations of racial and gender discrimination at Pinterest. Then, Dr. Timnit Gebru said she was fired for speaking out about diversity issues in artificial intelligence at Google. That was shortly before Google former diversity recruiter April Curley alleged Google fired her for calling the company out “on their racist bullshit.”

Source: https://techcrunch.com/2021/02/08/ex-salesforce-manager-alleges-microaggressions-and-inequity/

DoorDash acquires a salad-making robotics startup, Twitter confirms subscription plans and Tesla makes a big bet on bitcoin. This is your Daily Crunch for February 8, 2021.

The big story: DoorDash acquires Chowbotics

DoorDash has acquired the Bay Area startup behind Sally, a salad-making, vending machine-style robot that added contactless ordering last fall.

DoorDash says the acquisition will “improve consumer access to fresh and safe meals, and enhance our robust merchant offerings and logistics platform,” though it isn’t getting specific about how it plans to use Chowbotics’ tech in its delivery platform.

This continues exploratory work that DoorDash has done with robotics, for example with Starship Technologies to test delivery robots.

The tech giants

Twitter confirms plans to experiment with new models, like subscriptions, in 2021— The company confirmed that it’s researching and experimenting with new models, but declined to provide details.

Tesla buys $1.5B in bitcoin, may accept the cryptocurrency as payment in the future — As the news broke, the price of bitcoin instantly rose by around 7% to more than $40,000 per coin.

Amazon warehouse workers to begin historic vote to unionize — On Friday, the National Labor Relations Board rejected Amazon’s attempt to delay a union vote set to begin today.

Startups, funding and venture capital

Clubhouse is now blocked in China after a brief uncensored period — Thousands of Chinese users suddenly found themselves unable to access Clubhouse on early Monday evening.

WeWork is apparently doing better, not that SoftBank wants you to talk about that — Buried in the footnotes of SoftBank’s earnings report today is some good news related to WeWork.

Automattic acquires analytics company Parse.ly — Parse.ly is now part of WPVIP, the organization within Automattic that offers enterprise hosting and support to publishers and marketers, including TechCrunch.

Advice and analysis from Extra Crunch

Oscar Health’s IPO filing will test the venture-backed insurance model — While Oscar has shown a strong ability to raise private funds and scale revenues, it’s a deeply unprofitable enterprise.

Container security acquisitions increase as companies accelerate shift to cloud — Why is there so much M&A action now?

Two $50M-ish ARR companies talk growth and plans for the coming quarters — In this installment of Alex Wilhelm’s series, we look at SimpleNexus and PicsArt.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Silenced No More Act seeks to ban use of NDAs in situations involving harassment or discrimination — This proposed bill would expand the protections workers currently have through the Stand Together Against Non-Disclosures Act, which went into effect in 2019.

MIT is building a ‘one-stop shop’ for 3D-printing robots — The university’s CSAIL department showcased “LaserFactory,” a new project that attempts to develop robotics, drones and other machines than can be fabricated as part of a one-stop shop.

Hasselblad X1D II 50C: out of the studio and into the streets — We took the $10,000 camera kit out for a socially distanced spin.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/02/08/daily-crunch-doordash-acquires-chowbotics/