& meet dozens of singles today!

User blogs

Eniac Ventures, a seed firm with a focus on New York startups, is announcing its fifth fund totaling $125 million.

Eniac’s four general partners — Hadley Harris, Nihal Mehta, Vic Singh and Tim Young — have been making seed investments together for more than a decade, and they’ve known each other for even longer, having first met at the University of Pennsylvania. Singh described the firm as “one of the OGs” in seed investing, while Mehta said, “Consistency has been our superpower.”

The size of Eniac’s funds has grown dramatically over the past decade, from its $1.6 million first fund in 2010 to its $100 million fourth fund in 2017. However, Mehta said the team approached the latest fund with $125 million as both a goal and a “hard cap.”

The larger funds allow Eniac to make more investments, and to lead rounds as the definition of a seed deal has expanded. (The firm says it can invest anywhere from $350,000 to $3 million in a single round.) At the same time, GP Hadley Harris emphasized that Eniac will remain focused on seed deals rather than Series As, and that it wants to remain “really collaborative, so that we never need to take more than half the round.”

Eniac’s general partners usually only two or three investments each per year, which Harris said is “quite a bit less than average seed fund.”

“We always want to be the investor of record in the companies that we invest in, leading or co-leading these rounds,” he continued. “And we want to have the bandwidth to be partners with them in the early stages of their journey. We think the only way to do that is concentration.”

Eniac’s portfolio now includes more than 120 companies, with 50-plus exits. Recent successes include mobile messaging company Attentive (which raised a $230 million Series D last fall), podcasting startup Anchor (acquired by Spotify) and online retailer Boxed (which recently partnered with one of Asia’s largest brick-and-mortar companies, Aeon).

While Eniac initially billed itself as a mobile-focused firm, it now invests across software-as-a-service, developer platforms, consumer and deeptech. Harris said they’re not pointing to any specific industries or trends that they’re focused on because, “We want to be balanced between thesis-driven and opportunistic … The theses that we tend to focus on tend to be on a per-partner basis and change pretty quickly.”

The firm is headquartered in New York, with an office in San Francisco. Hadley said New York-based startups remain a priority, while at the same time, “We also believe that great founders can be anywhere and we’re more and more interested in distributed teams.”

Singh added that despite the hype around other emerging startup hubs, “A lot of the founders we partner with in New York are staying in New York. They have not left.”

They might hire team members elsewhere, he said, but there’s a high bar for remote employees. And if a startup wants to be fully distributed, “You have to be fully remote and distributed first. You can’t go distributed later; you have to very intentionally build the organization in that way from the start.”

As for the team’s longevity, I noted that it also has a potential downside from a diversity perspective, especially since all four of the founding GPs are men. However, the firm has recently promoted two other team members — Vice President of Finance and Operations Anna Nitschke and Investor Kristin McDonald — who Singh noted “votes on deals with us” and “feels as if she has an equal say in how the firm is run.” And the firm plans to hire six new team members this year.

If you want to hear more from the firm’s partners, I’ll be interviewing them on Superpeer (another recent Eniac investment) tomorrow, February 10, at 2:30pm Eastern.

Just over a year ago in our coverage of the 2019 venture capital market, we noted that “United States-demarcated angel and seed deals dipped in 2019.” Our reporting concerning the Q1 2020 venture capital market had a similar tone, noting that “domestic seed rounds, in slow decline since peaks in 2017, have sharply fallen since Q3 2019.”

The same theme continued in the second quarter. Widening our lens to global seed data, own we wrote that “global seed and angel deals […] were down from 4,256 rounds in Q2 2019 worth $3.7 billion to 1,791 rounds worth just $2.3 billion in Q2 2020.”

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Of course, the second quarter of 2020 was the middle of the storm when it came to the temporary decline in venture capital confidence. So, what about Q3? One source noted, as we wrote at the time, that the “percentage of U.S. VC deals that were for rounds of $5 million or less was the lowest since at least 2010.” Another data source showed a slight rebound in domestic seed rounds, but it was a rare positive data point.

Then came Q4 2020 data and a full-year look at the market. We wrote that in “the U.S., seed deal count was high in 2020, around 5,227,” per that day’s data source.

Weird, right?

The Exchange leans on PitchBook, CB Insights, the NVCA, Silicon Valley Bank and Crunchbase along with other more focused data sources for its raw inputs. I’m not citing individual sources in the above (you can find them at the links) to avoid appearing to be cross with any particular entity; that’s not my goal.

The Exchange leans on PitchBook, CB Insights, the NVCA, Silicon Valley Bank and Crunchbase along with other more focused data sources for its raw inputs. I’m not citing individual sources in the above (you can find them at the links) to avoid appearing to be cross with any particular entity; that’s not my goal.

Instead, I’m curious how we can have so many different seed data signals in the same year. This is a question I’ve had for some time, as whenever I’d report that seed deal volume in any particular part of the world was looking light — Europe, for example — investors would tell me, in polite tones or with sheer incredulity, that the seed data in question did not match their lived realities.

Investors were seeing a hot seed market, while data often showed a flat-to-down seed market. So, what’s going on?

SAFEs could be to blame

Thanks to angel investor and Twitter bon vivant Trace Cohen, I think we have a good idea of what’s to blame for discrepant data and reality when it comes to seed and earlier dealmaking. Per Cohen, could SAFEs be to blame?

SAFEs, or Simple Agreements for Future Equity, are a method of raising capital that is quick and cheap. Y Combinator invented them back in 2013, and they’ve become rather popular amongst seed deals over time.

Source: https://techcrunch.com/2021/02/09/are-safes-obscuring-todays-seed-volume/

During a small gathering of journalists in China, Ren Zhengfei made his first public remarks since Joe Biden was inaugurated at the 46th President of the United States. The Huawei CEO struck a hopeful tone for those gathered around the table, in comments reported by CNBC among others.

“I would welcome such phone calls and the message is around joint development and shared success,” the executive said, noting a readiness to speak with the new administration in translated remarks. “The U.S. wants to have economic growth and China wants to have economic growth as well.”

Huawei’s future in the U.S. has been a major question mark hanging over the new administration. Under Trump, a number of high profile Chinese companies were added to the Commerce Department’s so-called “entity list” to various effects. Huawei has been among the hardest hit by the moves.

In addition to blocking sales in the world’s third-largest smartphone market, the company has been unable to work with key U.S. companies, including Google. That, in turn, has blocked access to key technologies, including the Android ecosystem and left Huawei scrambling. The company’s support among consumers has increased within China, but the move has been a big blow to the smartphone maker’s bottom line.

The incoming Biden administration has mostly been quiet on the matter. Though, facing mounting criticism from Republican lawmaker, Commerce Secretary nominee Gina Raimondo has since added that, “I currently have no reason to believe that entities on those lists should not be there. If confirmed, I look forward to a briefing on these entities and others of concern.”

While there haven’t been many positive signs for Huawei thus far, the company’s Chief understandably would prefer to make nice with the new administration.

“If Huawei’s production capacity can be expanded, that would mean more opportunities for U.S. companies to supply too,” Ren said in the translated comments. “I believe that’s going to be mutually beneficially. I believe that (the) new administration would bear in mind such business interests as they are about to decide their new policy.”

Source: https://techcrunch.com/2021/02/09/huaweis-ceo-wants-to-talk-to-joe-biden/

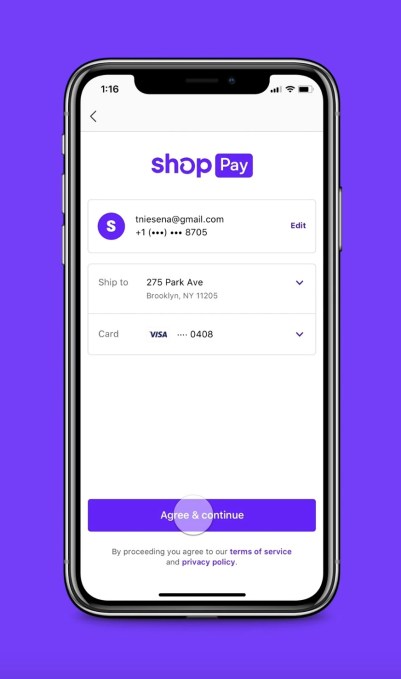

Shopify announced this morning it’s partnered with Facebook to expand its payment option, Shop Pay, to all Shopify merchants selling across both Facebook and Instagram. This is the first time Shop Pay will be made available outside of Shopify’s own platform, and represents a significant expansion for the e-commerce platform’s payments technology.

The company tells TechCrunch Shop Pay will first become available to all Shopify merchants using checkout on Instagram in the U.S., and will then be rolled out to Facebook in the weeks that follow.

Prior to this launch, Facebook’s platform has been one of Shopify’s most popular sales and marketing channels for merchants, Shopify says. At the beginning of the pandemic last year (March through April 2020), marketing on Facebook and Instagram via Shopify’s channel integration saw 36% growth in monthly active users, and that trend continues to rise.

Today, Shop Pay’s payment option is used by a number of top direct-to-consumer and newer brands, including Allbirds, Kith, Beyond Yoga, Kylie Cosmetics, Jonathan Adler, Loeffler Randall, Blueland and others. Over 40 million buyers now regularly use Shop Pay at these merchants and others on Shopify’s platform to complete their purchases.

Image Credits: Shopify

Through the course of 2020, Shop Pay helped buyers complete 137 million orders. And by the end of the year, Shop Pay had facilitated nearly $20 billion in cumulative GMV since its launch in 2017. Through its carbon offsetting feature, this also represented 75,000 tons of carbon emissions.

In addition to the carbon offsets, Shopify claims Shop Pay on its own platform is 70% faster with a conversion rate that’s 1.72x higher than a typical checkout. It also includes order tracking and management, which, to date, have tracked over 430 million orders across over 450 million miles.

Once available on Instagram, consumers will be able to find tagged products from Shopify merchants in the app, then add them to their in-app cart. At checkout, they can then select Shop Pay as their preferred payment option from among credit card, debit card, and PayPal. The consumer will receive a confirmation code to their phone, then enter the code to complete the order without leaving Instagram. A similar experience will be available on Facebook.

These orders can also be tracked via Shopify’s Shop app, the same as those processed on Shopify itself.

Image Credits: Shopify

“People are embracing social platforms not only for connection, but for commerce,” said Carl Rivera, General Manager of Shop, in a statement. “Making Shop Pay available outside of Shopify for the first time means even more shoppers can use the fastest and best checkout on the Internet. And there’s more to come; we’ll continue to work with Facebook to bring a number of Shopify services and products to these platforms to make social selling so much better.”

This is not the first third-party payment option integrated into Facebook’s shopping platforms, as PayPal is also accepted. But it is a notable addition, given how heavily Facebook has pushed its own “shops” platform, which encourages merchants to sell and transact within its own apps — an even more critical source of revenue now that Apple’s privacy changes will impact Facebook’s ads business to the tune of billions of dollars. But likely, working with a third-party like Shopify is allowing the company to spin up a new revenue stream.

Shopify, however, declined to discuss its financial arrangement with Facebook.

Shopify isn’t limiting itself to Facebook in an effort to expand its e-commerce business. Last fall, it also partnered with TikTok on social commerce, allowing merchants to publish their marketing ads directly to the video platform.

This morning Monte Carlo, a startup focused on helping other companies better monitor their data inflows, announced that it has closed a $25 million Series B.

The round, which was co-led by GGV and Redpoint, comes mere months after its September Series A that was worth $15 million. Accel led the company’s Series A and Seed deals, participating in its Series B as well.

The round caught our attention not only for the speed at which it was raised following Monte Carlo’s preceding investment, but also because your humble servant had no idea what data observability, the startup’s niche, really was.

So we got Monte Carlo co-founder and CEO Barr Moses on a call to explain both her company’s space, and how it managed to attract so much more capital so quickly.

Data inflows

Big data was the jam a while back, but it turned out to be merely one piece in the broader data puzzle. We can see evidence of that in recent revenue growth at Databricks, which reached $425 million ARR in 2020 by building an analytics and AI service that sits on top of companies’ data.

Monte Carlo is another bet on the data space, sitting a bit earlier in the data lifecycle. Think of it this way: Snowflake can hold all your data, and Databricks can help you analyze it. But what’s checking to make sure that data flowing into your repositories is, you know, not bullshit?

Figuring out if data inflows are healthy and not bunk is what Monte Carlo does.

According to Moses, companies now have myriad data sources. That’s great in theory as more data is usually a good thing. But if one or two of those sources goes haywire, figuring that out before you collect, store, and analyze the bad information is pretty important.

So Monte Carlo sits upstream from the other data companies that are hot these days, keeping tabs on inbound data sources across a number of parameters to make sure that what’s actually arriving in your data lake is legit.

The startup does that, Moses said, by checking data freshness (how recent, or tardy the data in question is), volume (is there too little, too much?), schema (the data’s structure itself, to see if things have changed that could matter, or break downstream services), distribution (if data points suddenly jump from say, the single digits to the millions), and lineage, which can help find breakpoints in data inflows.

Hearing that Monte Carlo learns from a company’s particular data pipes to figure out what could be non-standard data inflow made me curious how long it takes to get the startup’s software set up and running; not long, per Barr, an hour to fire it up in many cases, and a week to learn.

A growing sector

Monte Carlo’s product is neat enough to warrant our attention by itself. But, fitting neatly inside the growth of the broader data space, and especially data tooling that isn’t directly concerning storage, makes it all the more worth considering.

And now with $25 million more, Monte Carlo can expand its current staff of 25, and keep attacking its mid-market and enterprise customer target. Let’s see how quickly it can scale, and how soon we can start squeezing the startup for growth numbers.

Source: https://techcrunch.com/2021/02/09/monte-carlo-raises-25m-for-its-data-observability-service/