& meet dozens of singles today!

User blogs

There’s a popular misconception that the cryptocurrency industry is a realm of rogue tech-bro cowboys. But the reality is many of the most ambitious entrepreneurs in fintech are betting big on institutional bitcoin adoption.

Such is the case with Lebanese-American venture capitalist Soona Amhaz of Volt Capital, whom Forbes recently listed as one of the most influential people in Silicon Valley. She discovered bitcoin through Reddit, back when she was an engineering student at the University of Michigan. Now her firm has invested in 11 crypto startups and is working alongside institutional players like TD Ameritrade, Cumberland and CMT Digital as part of the Chicago DeFi Alliance (CDA).

“Where institutions are at now is they’re looking to back quality founders in the space early on. They’re looking to be market makers for a lot of these [crypto] projects, and they’re looking to help with integrations and partnerships between decentralized finance [DeFi] projects and more established financial firms,” Amhaz said. “They see where the puck is going and the smart ones are getting ahead of the curve.”

When it comes to “DeFi,” Amhaz said the term includes bitcoin and the variety of blockchain-based systems gaining popularity among day traders during the pandemic.

“Specific DeFi projects that are gaining more traction now include automated market makers (AMMs), stablecoins and platforms for decentralized exchange (DEX) aggregation, lending and derivatives,” Amhaz said. “Recent DeFi projects simply offer more avenues to use bitcoin as a productive asset, not just a reserve asset.”

Until now, most institutions have preferred indirect exposure to cryptocurrency. Goldman Sachs alum Juthica Chou, who co-founded the derivatives exchange LedgerX back in 2013, pioneered the physically settled bitcoin futures that are now mainstay offerings among firms like Bakkt and CME Group. Futures contracts and bitcoin options offer a way for institutions to bet on the price of bitcoin without actually owning bitcoin directly. A cash-settled product means the buyer is paid in dollars, such as getting $10,000 when the option to buy at $10,000 expires, instead of getting paid in bitcoin. Rumor has it the asset management giant BlackRock will soon become the next player offering bitcoin futures products.

So far, many institutions are willing to forgo some profits in exchange for lower risk. One of the most popular institutional product providers, Grayscale’s Bitcoin Trust (GBTC), reportedly saw $1.2 billion in fresh investor funds in January 2021.

“I’m still bullish on options and derivatives,” Chou said, adding there’s enough demand from institutions for trust shares like GBTC, bitcoin options and even prospective exchange-traded funds (ETFs) to all generate substantial wealth in 2021.

“The environment has way more infrastructure than we had back in 2013,” Chou said. “There’s security infrastructure and best practices for custodians, auditing infrastructure … banking is another great example. Compared to 2013, the difference between where we were and where we are today is night and day.”

With regards to GBTC, in particular, insatiable demand for shares with lower risks than custodying bitcoin leads to sky-high premiums, sometimes up to 100% more expensive than buying cryptocurrency directly. That’s why Valkyrie CEO Leah Wald launched her own Texas-based asset management firm in 2020. According to Crunchbase, she was one of roughly 800 women founders who raised capital last year.

“It was really difficult to raise during a pandemic… not being able to organically expand my network,” Wald said. “I couldn’t have a meeting with someone even if I wanted to. And so much of seed investing is trusting in the team; trust built through high-quality, in-person conversations.”

Yet by January 2021, her startup had raised an undisclosed seed round from angel investors like Coinbase alum Charlie Lee, then applied to the Securities and Exchange Commission for permission to launch a bitcoin ETF. Chou said such a bitcoin ETF would boost the whole ecosystem because it would “open access for people who are already users brokers or securities services.”

Several ETF proposals have been rejected over the years, starting with a proposal by Tyler and Cameron Winklevoss in 2013. However, Wald says now she believes there’s never been better timing for an ETF to get approved. Among futures and options, trust shares and ETFs, all these products have different regulatory shapes that allow them to be redeemed faster, or traded in different ways, than the underlying asset, bitcoin, could be at-scale. Generally speaking, institutions seek indirect ways to gain exposure to these nascent, and often lucrative, crypto markets.

“Bitcoin’s market cap has grown large enough that it may have finally surpassed an important threshold in the minds of the regulators,” Wald said. “I believe the biggest reason the regulators were nervous about approving a bitcoin ETF in 2017 was concerns around custodial solutions and security. And I agree with that. We’re much closer to better security and custody now with institutional-grade options.”

Wald added that both Valkyrie’s bitcoin trust shares and prospective ETF are structured to reduce volatility and premiums.

“We wanted to create a more transparent product. I wanted our product to trade closer to the net asset value [NAV],” Wald said. “We’re the only bitcoin trust launching an ETF fund so everyday investors can buy exposure to bitcoin.”

This propensity among women entrepreneurs using cryptocurrency isn’t restricted to American tech bubbles. According to Toya Zhang, head of marketing at the Hong Kong-based crypto and futures exchange AAX, women make up 25% of her platform’s users and a third of the top users.

“Our biggest market is in Russia. Other than Russia, our biggest markets are Hong Kong, Korea, Indonesia and India,” Zhang said. “Asian women are more often the one to take care of finances. If you look at stock investment user groups in China and Hong Kong, women are more than half of them.”

The highly specialized crypto landscape is quickly gaining diversity, compared to other financial sectors. At India’s Coinswitch.co exchange, women reportedly make up 50% of around 25,000 users, depending on the specific region. Women also make up at least 40% of British cryptocurrency users, according to a survey by the crypto exchange Gemini.

Across borders, the clear gender disparity may be associated with net worth rather than any lack of interest. In 2018, the World Bank estimated women only held 38% of capital wealth. Plus, Crunchbase tallied just 15,379 companies, less than 20% of startups that raised capital, that had women founders from 2009-2019.

Beyond startups, there are also several companies like the New York Digital Investments Group (NYDIG), where women executives took the helm in order to innovate on established brokerage models.

In December 2020, the insurance company Massachusetts Mutual Life Insurance Co. purchased $100 million in bitcoin and acquired NYDIG equity, a move that signaled a bullish outlook on institutional demand for bitcoin exposure in 2021. Then, on February 8, 2021, Elon Musk’s publicly traded car company Tesla validated the institutional thesis by buying $1.5 billion worth of bitcoin.

“In 2021, the greater acceptance of bitcoin by traditional investors and allocators is really exciting,” said NYDIG president Yan Zhao. “We’ll give banks and wealth managers the ability to offer bitcoin products and exposure. We’ll handle the back end.”

Zhao said her bitcoin-focused firm has roughly $4 billion under management, including derivatives, and is currently courting prospective clients like private banks and various asset managers. Her firm is open to exploring ideas like a bitcoin ETF or trust shares, she said, but isn’t interested in Ethereum-based DeFi products.

“We’ve made a conscious decision to focus on bitcoin,” Zhao said.

Likewise, Chou was skeptical about many of the Ethereum-based DeFi options available today, while remaining cautiously optimistic about the future of DeFi derivative options.

“Crypto-native products are important because that’s how you can really harness the power of not having centralized authorities involved to facilitate the transaction,” Chou said.

In short, now traditional options offer indirect access to cryptocurrency gains. At the same time, cryptocurrency itself is experimentally being used to offer comparable, yet more accessible, financial products. These DeFi products are designed for new functionality, not just price exposure.

Meanwhile in California, from network scaling crusader Elizabeth Stark, CEO of Lightning Labs, to Amhaz at Volt Capital, the next generation of bitcoin whales may look remarkably different from Silicon Valley’s past unicorn-building bros.

“The face of our industry looks different than how the tech industry looked in the early 90s or how finance has looked since forever,” Amhaz said. “We’re starting at a higher, more informed baseline. So, although there’s still work to be done here, I’m optimistic.”

Disclosure: Together, Leah Wald and Leigh Cuen are volunteer co-founders of the Digital Salon Initiative.

Source: https://techcrunch.com/2021/02/09/meet-the-entrepreneurs-bringing-bitcoin-to-institutions/

Oldsmar is a small town in Florida that became the center of the cyber world this week when a hacker broke into its drinking water supply and tried to poison it.

It’s the nightmare scenario that the security community has warned for years, one that could kill thousands by targeting the critical infrastructure that we all rely on. The hacker gained access to a computer at the water facility used for running remote control software TeamViewer, according to Reuters, and jacked up the levels of sodium hydroxide, aka lye, which would have made the water highly toxic to drink.

It’s not known what security was in place to prevent unauthorized users from gaining access to the critical system. Sheriff Bob Gualtieri said in a press conference that there were fail-safes and alarms in place to prevent tainted water from reaching residents, and as a result there was little risk to the population of some 15,000 residents.

But suffice to say, running remote control software in a facility that controls the local water supply is a disaster waiting to happen. These networks are supposed to be isolated from the internet to prevent this exact scenario. But you can look for clues in this Reuters report: The water facility is a public utility owned by the town and has its own internal IT staff.

Gualtieri, in his remarks, said: “The important thing is to put everyone on notice.” He’s not kidding; it’s a similar picture to a lot of small-town America, where much of these facilities are under-resourced and underfunded. Robert Lee, founder and chief executive at industrial security startup Dragos, set the context:

Hiring, workforce development, culture shifts, working within national priorities and regulations, state and local regulations, resourcing other areas that are organizational challenges, modernizing infrastructure beyond "cyber", etc. There's not 1 easy answer tech or not

— Robert M. Lee (@RobertMLee) February 8, 2021

The FBI confirmed it has been called in to investigate. But what’s unlikely to change any time soon is that small towns are underfunded and don’t get the resources that other critical infrastructure gets. In the end, a TeamViewer subscription will be cheaper than a person’s salary, and there is no greater incentive to cut costs than during a pandemic.

On with the rest of Decrypted.

THE BIG PICTURE

Hackers post stolen health data after hospital ransomware attacks

As COVID-19 vaccines begin to roll out, ransomware actors are hitting back. NBC News this week revealed two hospitals that were hit by data-stealing ransomware. After the hospitals refused to pay the ransom, the hackers started to publish highly sensitive health and medical data stolen from the hospital networks.

Source: https://techcrunch.com/2021/02/09/decrypted-hackers-attempt-to-poison-florida-towns-water-supply/

“We intend to build the Standard Oil of renewable energy,” said James McGinniss, the co-founder and chief executive of David Energy, in a statement announcing the company’s new $19 million seed round of debt and equity funding.

McGinniss’ company is aiming to boost renewable energy adoption and slash energy usage in the built environment by creating a service that operates on both sides of the energy marketplace.

The company combines energy management services for commercial buildings through the software it has developed with the ability to sell energy directly to customers in an effort to reduce the energy consumption and the attendant carbon footprint of the built environment.

The company’s software, Mycor, leverages building demand data and the assets that the building has at its disposal to shift user energy consumption to the times when renewable power is most available, and cheapest.

It’s a novel approach to an old idea of creating environmental benefits by reducing energy consumption. Using its technology, David Energy tracks both the market price of energy and the energy usage by the buildings it manages. The company sells energy to customers at a fixed price and then uses its windows into energy markets and energy demand to make money off of the difference in power pricing.

That’s why the company needed to raise $15 million in a monthly revolving credit facility from Hartree Partners. So it could pay for the power its customers have bought upfront.

Image Credit: Getty Images

There are a number of tailwinds supporting the growth of a business like David Energy right now. Given the massive amounts of money that are being earmarked for energy conservation and energy efficiency upgrades, companies like David, which promise to manage energy consumption to reduce demand, are going to be huge beneficiaries.

“Looking at the macro shift and the attention being paid to things like battery storage and micro grids we do feel like we’re launching this at the perfect time,” said McGinniss. “We’re offering [customers] market rates and then rebating the savings back to them. They’re getting the software with a market energy supply contract and they are getting the savings back. It’s is bringing that whole bundled package together really brings it all together.”

In addition to the credit facility, the company also raised $4.1 million in venture financing from investors led by Equal Ventures and including Operator Partners, Box Group, Greycroft, Sandeep Jain and Xuan Yong of RigUp, returning angel investor Kiran Bhatraju of Arcadia, and Jason Jacobs’ recently launched My Climate Journey Collective, an early-stage climate tech fund.

“Renewable energy generators are fundamentally different in their variable, distributed, and digitally-native nature compared to their fossil fuel predecessors while customer loads like heating and driving are shifting to electricity consumption from gas. The sands of market power are shifting and incumbents are poorly-positioned to adapt to evolving customer needs, so there’s a massive opportunity for us to capitalize.”

Founded by McGinniss, Brian Maxwell and Ahmed Salman, David Energy raised $1.5 million in pre-seed financing back in March 2020.

As the company expands, its relationship with Hartree, an energy and commodities trading desk, will become even more important. As the startup noted, Hartree is the gateway that David needs to transact with energy markets. The trader provides a balance sheet for working capital to purchase energy on behalf of David’s customers.

“Renewables are causing fundamental shifts in energy markets, and new models and tools need to emerge,” said Dinkar Bhatia, Co-Head of North American Power at Hartree Partners. “James and the team have identified a significant opportunity in the market and have the right strategy to execute. Hartree is excited to be a commodity partner with David Energy on the launch of the new smart retail platform and is looking forward to helping make DE Supply the premier retailer in the market.”

David now has retail electricity licenses in New York, New Jersey, and Massachusetts and is looking to expand around the country.

“David energy stands to reinvent the way that hundreds of billions of dollars a year in energy are consumed,” said Equal Ventures investor Rick Zullo. “Business model creativity and finding ways to change user behavior with new models is just as important if not more important than the technology innovation itself.”

Zullo said his firm pitched David Energy on leading the round after years of looking for a commercial renewable energy startup. The core insight was finding a service that could appeal not to the new construction that already is working with top-of-the-line energy management systems, but with the millions of square feet that aren’t adopting the latest and greatest energy management systems.

“Finding something that will go and bring this to the mass market was something we had been on the hunt for really since the inception of Equal Ventures,” said Zullo.

The innovation that made David attractive was the business model. “There is a landscape of hundreds of dead companies,” Zullo said. “What they did was find a way to subsidize the service. They give away at low or no cost and move that in with line items. The partnership with Partree gives them the opportunity to be the cheapest and also the best for you and the highest margin regional energy provider in the market.”

TC Sessions: Justice, our second-ever dedicated event to diversity, equity, inclusion and labor in tech, is coming up on March 3, 2021. This is a virtual one-day conference featuring the brightest innovators, leaders and worker-activists in the industry.

We’re pumped to be able to host Backstage Capital founder and Managing Partner Arlan Hamilton, Gig Workers Collective’s Vanessa Bain, Alphabet Workers Union Executive Chair Parul Koul, Color of Change President Rashad Robinson, Anti-Defamation League CEO Jonathan Greenblatt and others.

In addition to the firesides and panel discussions of the virtual stage, the event will also include networking, startup presentations and the chance to connect with attendees from around the world.

Below, you’ll find the official agenda for TC Sessions: Justice. It’s a packed day already, but we’ve got some extra surprises in store, so keep an eye on the agenda over the coming weeks for more great speakers we’re adding.

If you want to be a part of this event, you can grab a ticket here for just $5.

If you’re interested in a sponsored speaking opportunity to join the stage with these fantastic speakers, contact us here to speak with someone from our sales team!

AGENDA

Wednesday, March 3

State of the Union with Parul Koul (Google), Grace Reckers (Office and Professional Employees International Union), and Clarissa Redwine (NYU)

Labor unions have been fairly uncommon in tech. That’s finally starting to change in recent years, as workers have pushed to organize at some the industry’s biggest companies, from Alphabet to Kickstarter. Parul Koul (Google), Grace Reckers (Office and Professional Employees International Union) and Clarissa Redwine (NYU) will join us to discuss the growing movement.

Finding the Next Unicorn with Arlan Hamilton (Backstage Capital)

Arlan Hamilton, the founder and managing partner of Backstage Capital, has raised more than $12 million to back 150 companies led by underrepresented founders. In this session, Hamilton will discuss how she vets the biggest opportunities in investment, and how to disrupt in a positive way.

The Path Forward For Essential Tech Workers with Vanessa Bain (Gig Workers’ Collective), Jessica E. Martinez (National Council for Occupational Safety and Health), and Christian Smalls (The Congress of Essential Workers)

Gig workers and warehouse workers have become essential in a pandemic-ravaged economy. In California, a law went into effect earlier this year that makes gig workers independent contractors. Meanwhile, Amazon warehouse workers in Alabama are actively seeking to form a union to ensure better protections at the workplace. You’ll hear from workers and organizers about what’s next for gig workers and tech’s contractor workforce, and what battles lie ahead for these essential workers.

Identifying and Dismantling Tech’s Deep Systems of Bias with Haben Girma (Disability Justice Lawyer), Mutale Nkonde (AI for the People), and Safiya Umoja Noble (UCLA)

Nearly every popular technology or service has within it systems of bias or exclusion, ignored by the privileged but obvious to the groups affected. How should these systems be exposed and documented, and how can we set about eliminating them and preventing more from appearing in the future? AI for the People’s Mutale Nkonde, disability rights lawyer Haben Girma, and author of Algorithms of Oppression Safiya Umoja Noble discuss a more inclusive future.

Founders in Focus with Tracy Chou (Block Party)

We sit down with the founders poised to be the next big disruptors in this industry. Here we chat with Tracy Chou of Block Party, which works to protect people from abuse and harassment online.

The Role of Online Hate and Where Social Media Goes From Here with Naj Austin (Somewhere Good and Ethel’s Club), Jesse Lehrich (Accountable Tech), and Rashad Robinson (Color of Change)

Toxic culture, deadly conspiracies and organized hate have exploded online in recent years. We’ll discuss how much responsibility social networks have in the rise of these phenomena and how to build healthy online communities that make society better, not worse.

Networking Break

With our virtual platform, attendees can network via video chat, giving folks the chance to make meaningful connections. CrunchMatch, our algorithmic matching product, will be available to ensure you’re meeting the right people at the show, as well as random matching for attendees who are feeling more adventurous.

Demystifying First-Check Fundraising with First-Check Investors with Brian Brackeen (Lightship Capital), Astrid Scholz (Zebras Unite), and Sydney Thomas (Precursor Ventures)

There are so many ways to finance your startup that don’t include Y combinator or a traditional fund. In this stacked panel, founders will hear from a trio of decision-makers about how to leverage unconventional communities and resources to get the first dollars they need to execute.

Meeting of the Minds with Wade Davis (Netflix) and Bo Young Lee (Uber)

Diversity and inclusion as an idea has been on the agenda of tech companies for years now. But the industry still lacks true inclusion, despite best efforts put forth by heads of diversity, equity and inclusion at these companies. We’ll seek to better understand what’s standing in the way of progress and what it’s going to take to achieve real change.

Access All Areas: Designing Accessibility From Day One with Cynthia Bennett (Carnegie Mellon University), Srin Madipalli (former Accomable and Airbnb), and Mara Mills (NYU)

The session will examine the importance of ensuring accessible product design from the beginning. We’ll ask how the social and medical models of disability influence technological evolution. Integrating the expertise of disabled technologists, makers, investors, scientists, software engineers into the DNA of your company from the very beginning is vital to the pursuit of a functioning and equitable society. And could mean you don’t leave money on the table.

Creating New Opportunities For Formerly Incarcerated People with Jason Jones (The Last Mile), Deepti Rohatgi (Slack), and Aly Tamboura (Chan Zuckerberg Initiative)

Reentering society after having been incarcerated presents challenges few of us can understand. In this panel, we will examine the role tech can play in ensuring pathways to employment for returned citizens.

Source: https://techcrunch.com/2021/02/09/announcing-the-agenda-for-techcrunch-sessions-justice/

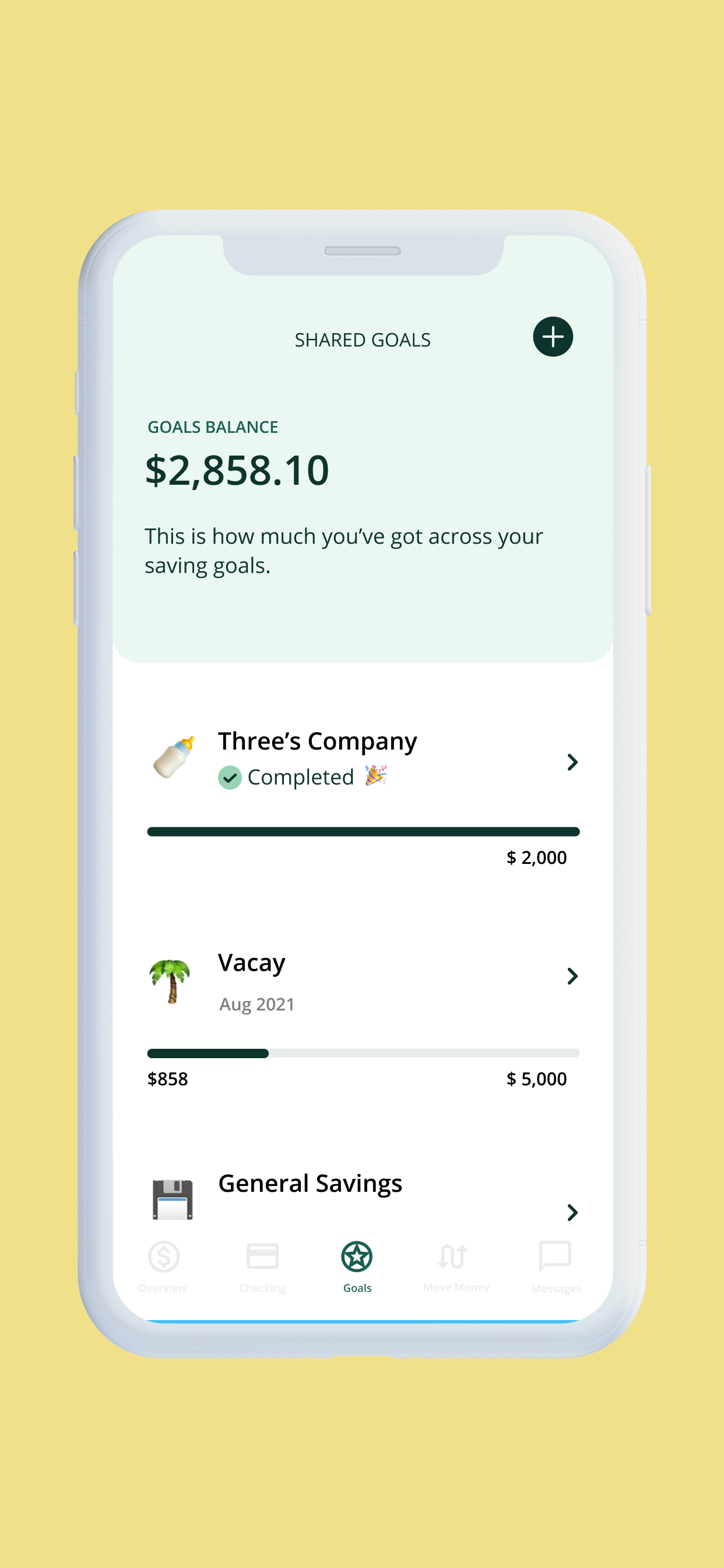

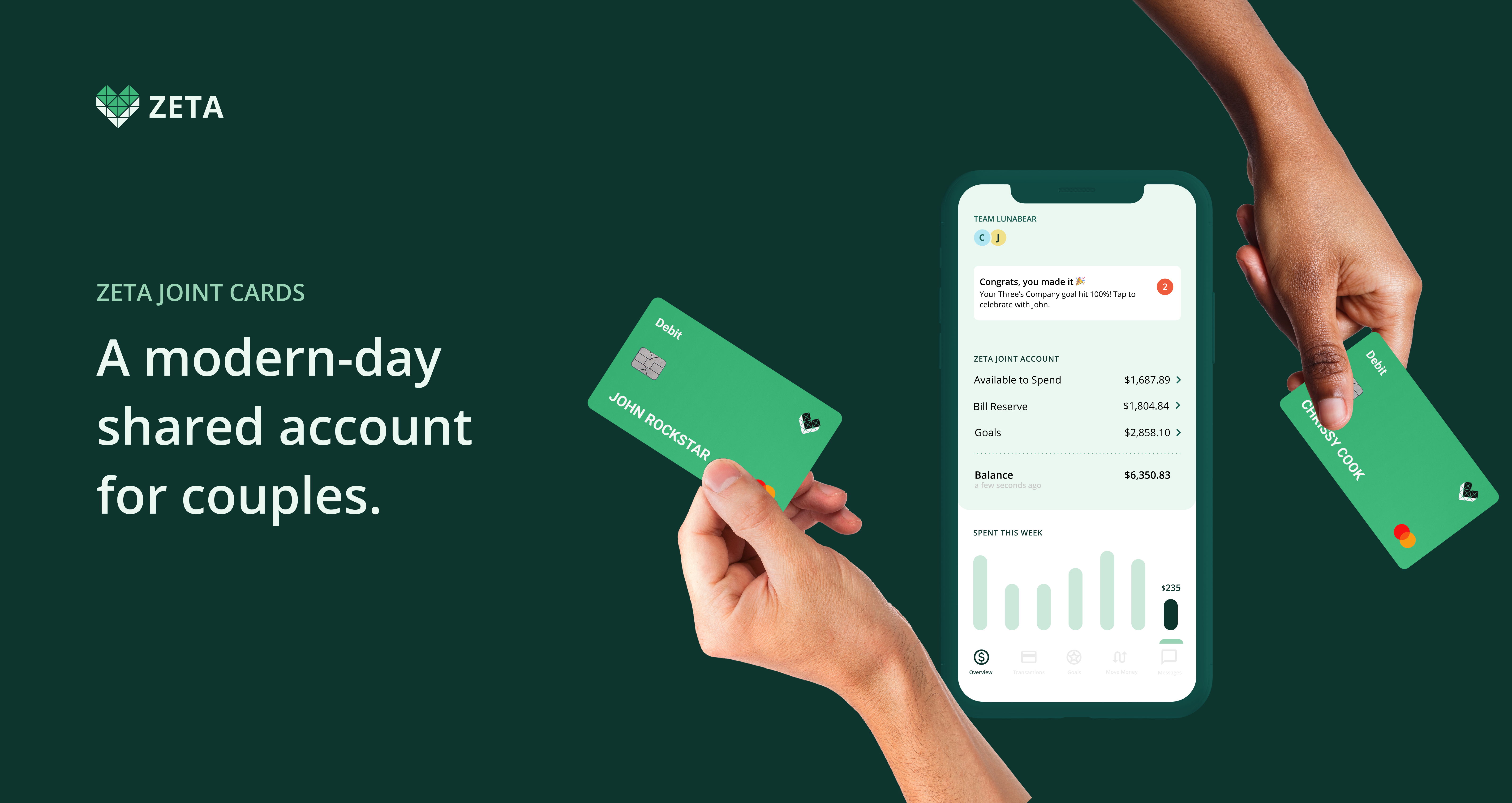

Zeta co-founder Aditi Shekar has spent the past three years tracking the ways couples share and manage their finances, from each card swipe to every split bill. Her effort led to tens of thousands of couples signing up for a free budgeting app experiment. Today, those learnings have been formed into a venture-backed startup.

Zeta is a new fintech platform that helps couples join their finances. Zeta isn’t creating the concept of joint accounts; it’s simply trying to rebuild them for the modern family. Currently, joint accounts lack transparency or the option to add multiple users that come from different relationships in your life. Many standard joint accounts just give every user entire access to other users’ finances, versus tiered ways to spend.

Shekar, who started the company after experiencing the stress of dividing and dealing with money in her own relationship, says the goal of Zeta is to take the “cognitive load” of dealing with money off of people in a relationship.

Off that vision, Shekar and her co-founder Kevin Hopkins have raised $1.5 million in a round co-led by Deciens Capital and Precursor with participation from executives from Chime, Square, PayPal, Venmo, Google, Facebook and Weight Watchers. Shekar says that 57% of its cap table is women or people of color.

“In some ways, we see ourselves as part of a replacement for Venmo,” Shekar said. “We saw couples Venmoing back and forth to each other sometimes six times a day…we want to take over your money chores.” While Zeta is entering the market as a tool for couples, Shekar sees the startup’s moonshot as being the go-to operational account for any modern household.

A tool like Zeta is trying to give already existent transactions — begging for a rent check, splitting the grocery bill, going halfsies on dinner, giving allowance — an easier way to be completed.

In reality, the startup works as a First Republic or Chase replacement, providing a digital layer of banking services that can integrate with pre-existing bank accounts. Couples who download Zeta will each get a Zeta joint card and a joint account to layer atop their finances. The joint card will serve as the way that couples can spend from the same account.

So far, users use their Zeta account in two main ways: have it take over standing bills such as rent or mortgage, or have it serve as a savings account for mutual goals, such as a post-COVID trip or big shared purchase like a car or home. Users can direct-deposit as much money as they want from their main bank accounts into Zeta, and then use the Zeta debit card to swipe couple money instead of individual money.

“There are a lot of fintechs that will go after the direct deposit,” Shekar said. “But we really thought about Zeta as the layer on top of existing accounts so you don’t have to move everything over.”

Similar to Chime, Zeta makes money from interchange fees, the cost it takes for a merchant to process your payment, on card transactions. A portion of the interchange fee is paid to Zeta, and a portion goes to your bank.

“If you and your partner wanted to share rent and pay bills together we’d be the natural place to plug into,” she said.

“Frankly, institutions have treated people as single-player games,” Shekar said. “Fintech is way more social than we realize.”

The success of Zeta hinges on the idea that people want to share their finances in an ongoing and meaningful way, and that the world of finance is ready to shift from individualism to collectivism earlier and louder. It sounds daunting, but we already know that social finance is big, as shown by apps like Venmo and Splitwise, and phenomena like the GameStop saga from just a few weeks ago.

Other startups have taken notice too, entering the world of multiplayer fintech, a term that categorizes socially focused and consumer-friendly financial services. Braid, a group-financing platform, is trying to make transactions work for various entities, from shared households to side hustles to creative projects.

Braid founder Amanda Payton breaks down the concept of multi-player, social finance into two phases: if 1.0 was Venmo, then 2.0 will “enable sharing money at the account and transaction level,” she says.

“I think about it this way: The current set of mainstream financial products supports my money and your money. Social finance 2.0 will be all about our money,” Peyton said.

“Banks have historically prioritized growing their own customer base. They haven’t invested a lot in products that promote sharing money, regardless of where your primary checking account lives…Zelle is a noticeable exception here,” she said. “And it’s not hard to see why, there’s little tangible benefit for them to do so.”

Zeta differentiates from Braid in that it is solely focused on couples and families, which lets it do things like pay bills and save money to plan for the financial future. Shekar says that it plans to support families in broader ways over time, such as being part of taxes or prenuptial agreements. That said, Zeta currently only supports two people per account, while Braid already has the capability to add multiple parties to its joint account.

The biggest hurdle for Zeta is if people trust each other enough to get into operational accounts with each other to do it. Individualism isn’t just a lazy reaction to lack of tooling out there; for many people, keeping your money to yourself is a preference. Of course, the flip-side of shared finances is dealing with the repercussions of ending that relationship if life gets in the way.

Image Credits: Zeta

“Break-up was the first feature we ever built,” Shekar said. Right now, there are no clear ways that Zeta can define what happens to the money in the shared account if people break up (no, there’s no clause that requires you to split money down the middle).

The startup is thinking about adding a feature during on-boarding that asks users what they prefer happens “in the event of a closure.”

“The psychology you need to have to open an account together is that you really trust your partner,” she said. “If you don’t trust your partner you might not be ready for this.”

Image Credits: Zeta

Source: https://techcrunch.com/2021/02/09/zeta-joint-card-seed/