& meet dozens of singles today!

User blogs

IROKO, a Nigerian-based media company, could file to go public in the next 12 months on the London Stock Exchange (LSE) Alternative Investment Market.

Founded by Jason Njoku and Bastian Gotter in 2011, IROKO boasts the largest online catalog of Nollywood film content globally.

According to this report, the media company will raise between $20 million and $30 million valuing the company at $80 million to $100 million.

In October 2019, Njoku hinted that the company was going public either on the London Stock Exchange or a local exchange on the continent. However, the CEO kept mute about the whole process the following year due to how tumultuous it was for the company.

In 2020, the company had plans to increase its average revenue per user (ARPU) in Africa for its video-on-demand service, iROKOtv, from $7-8 to $20-25. Through the first four months of the year, it seemed IROKO was set to achieve that. But amid pandemic-induced lockdown fears, consumer discretionary spending reduced in Nigeria and other African markets. What followed was a 70% drop in subscription numbers, and in May, 28% of the company’s staff went on unpaid leave. But unlike the numbers iROKOtv local markets put up, its international subscribers grew 200% during the lockdown, hitting a $25-30 ARPU range.

However, more bad news came in August when the CEO announced that the company was laying off 150 people. Njoku cited the naira devaluation, regulatory onslaught by the country’s broadcast regulator, and a reduced outbound marketing team as reasons behind this decision.

With the company spending $300,000 or more every month on growth, it decided to halt any scaling efforts on the continent. IROKO instead focused on its international market, primarily the U.S and the U.K where it has been able to execute a 150% price increase from $25 per year to $60 per year. Njoku said to this decision set the company straight leaving it in a stronger cash position than it had been for years.

“The costs of pursuing Africa growth is what was really resized dramatically. We were so focused on defending Africa and basically ended up doing nothing. Zero marketing or anything to drive that,” he told TechCrunch. “We pulled back to focus on where our economics actually makes sense. Our international business organically grew double-digit in 2020 and we expect it to continue this way for the foreseeable future.”

IROKO isn’t entirely giving up on the African market, instead, think of it in stealth mode. Due to its dominance over the past eight years as one of the strongest independent SVOD companies in Africa, it is hard not to see the company in pole position to benefit from any improvements made on the continent.

That said, IROKO makes 80% of its revenue outside Africa and listing on a foreign exchange will help consolidate its efforts. For Njoku, the Nigerian Stock Exchange or other local exchanges do not have a history of listing early-stage tech companies; therefore, the London Stock Exchange makes more sense in the short term.

IROKO is also seeking a market cap of about $100 million, which is small for the primary market. This is why the media company is choosing to list on the Alternative Investment Market (AIM) of the LSE. A sub-market of the LSE, the AIM is built specifically for small-cap companies. Still, there are plans in the future for IROKO to progress to the main market as its valuation grows — something U.K sports betting company, GVC and online fashion retailer, ASOS have done in the past.

Most companies when going public, tend to raise more money than their private equity days. But it’s quite different with IROKO. The company which secured around $30 million in total with its last priced round (Series E) in January 2016, plans to raise less or a similar amount when going public in 2022. In what seems like a down round, I asked Njoku why the company isn’t planning to raise more?

“We don’t need more. To be honest, $10 million to $15 million will be for corporate development; the rest will be secondaries for shareholders. As a private company, IROKO’s valuation was never priced above $70 million so anything in our target range wouldn’t be a down round at all,” he said. “Especially if you consider in that time we exited ROK for close to the total amount of capital we raised for IROKO; we have returned $11 million to early investors and shareholders already. We still have material capital left from the ROK-Canal+ acquisition coming in every 6 months until 2023.”

When IROKO sold ROK Studios to Vivendi-owned Canal+ in July 2019, the terms of the deal remained undisclosed. But from the CEO’s statement, an estimate of the acquisition could be around $30 million. What’s particularly impressive is that the proceeds from the deal likely sustained the company through a rough patch in 2020 and might well do so after its IPO in 2022.

Joining IROKO in plans to go public within the next two years is Interswitch, a Nigerian-based payments company valued at $1 billion. But unlike Interswitch, which was founded in 2002, IROKO has been operating for just 10 years. Within that time, the only internet company to have gone public is Jumia, and it did so after seven years. IROKO is expected to achieve this feat in its 11th year of operation and Njoku, who holds an 18% stake in the company, believes it’s enough time to take the next step.

“What we can achieve in private, we can equally achieve as a public company. We will likely open up the IPO to our loyal members too so they can capture the value too, which I am super excited about. One thing about IROKO is that we have always been pioneers and we’re okay being super experimental. I plan to open-source the entire process so any other African company coming behind — if we’re successful — will benefit from our experience,” he said of the journey ahead.

Twitter said on Wednesday it has taken actions on more than 500 accounts and reduced visibility of some hashtags in India to comply with “several” orders from the Indian government after New Delhi threatened legal action against executives with American social network.

Twitter had suspended hundreds of Twitter accounts at the request of New Delhi early last week, but then reversed its decision within hours citing users’ freedom of speech. The company said on Wednesday that it was re-suspending most of those accounts, in some cases, permanently, and preventing certain terms from appearing in the Trends section.

The company said Twitter handles are only being blocked in India and will remain visible outside of the country as it believes orders by the Indian government are inconsistent with local law. It also said that no accounts belonging to news media entities, journalists, activists, and politicians were taken down. “To do so, we believe, would violate their fundamental right to free expression under Indian law. We informed MeitY [Ministry of Electronics and Information Technology] of our enforcement actions today,” it said.

“Over the course of the last 10 days, Twitter has been served with several separate blocking orders by the Ministry of Electronics and Information Technology, Government of India, under Section 69A of the Information Technology Act,” the company wrote in a blog post.

“Out of these, two were emergency blocking orders that we temporarily complied with but subsequently restored access to the content in a manner that we believe was consistent with Indian law. After we communicated this to MeitY, we were served with a non-compliance notice,” it added.

Millions of farmers have been protesting New Delhi’s new laws for more than two months. The Indian government maintains that the new laws are aimed at helping farmers and consumers by streamlining the agricultural supply chain — millions of farmers disagree. New Delhi also temporarily shut internet services near the protests in and around national capital last month.

Twitter, which reaches more than 75 million users through its apps in India, has emerged as the single-most important online forum for people seeking to voice their opinion on this subject. Singer Rihanna, who has more followers on Twitter than any Indian actor or politician, tweeted a CNN news story last week about the protests in India and asked “why aren’t we talking about this!?”

why aren’t we talking about this?! #FarmersProtest https://t.co/obmIlXhK9S

— Rihanna (@rihanna) February 2, 2021

Several users in India had also tweeted using the hashtag #modiplanningfarmersgenocide that were aimed at New Delhi’s agriculture reforms. The company said several accounts and hashtags violated the Twitter Rules, particularly inciting violence, abuse, wishes of harm, and threats that could trigger the risk of offline harm.

A Twitter spokesperson told TechCrunch that hashtags that were merely supporting farmers or their protests have not been restricted.

India demanded Twitter to block hundreds of accounts earlier this month over concerns that many users were sharing false and intimidatory statements and provocative messages late last months.

Twitter had initially complied with the order, which resulted in blocking accounts of several high-profile names such as The Caravan (a news outlet that conducts investigative journalism), political commentator Sanjukta Basu, activist Hansraj Meena, actor Sushant Singh, and Shashi Shekhar Vempati, chief executive of state-run broadcasting agency Prasar Bharti. Accounts of at least two politicians with Aam Aadmi Party — Preeti Sharma Menon and Jarnail Singh — that governs the National Capital Territory of Delhi were also blocked.

However, hours later, Twitter lifted the block, citing users’ freedom of speech. The move prompted New Delhi to issue a more serious warning to Twitter and executives under the nation’s Section 69A, which allows “punishment with an imprisonment for a term which may extend to seven years and shall also be liable to fines.” New Delhi said that Twitter cannot “assume the role of a court and justify non-compliance” in India.

“We will continue to advocate for the right of free expression on behalf of the people we serve and are actively exploring options under Indian law — both for Twitter and for the accounts that have been impacted. We remain committed to safeguarding the health of the conversation occurring on Twitter, and strongly believe that the Tweets should flow,” the company said today.

In a large win for the Korean startup ecosystem, dating powerhouse Match Group announced this afternoon that it would buy social networking company Hyperconnect for a combined cash and stock deal valued at $1.73 billion.

Hyperconnect, which is projected to have $200 million in revenue in 2020 (up 50% from 2019) according to the company, offers two apps — Azar and Hakuna Live — which allow users to connect to each other across language barriers. The two are complementary, with Azar focused on one-to-one video chats and Hakuna Live focused on the online live broadcast market. In their press statement, the companies noted that 75% of Hyperconnect’s revenue originates in Asia.

It’s the largest acquisition to date by Match Group, which also owns the popular dating apps Tinder and Hinge along with many other assorted properties.

One theme of the acquisition and Hyperconnect’s story is technology. The company built what it describes as “the first mobile version” of WebRTC, a now well-developed standard that is designed to offer resilient peer-to-peer connections between users without relying on a company to serve as a middleman server.

For instance, a video chat between two participants would be transmitted directly between the two of them using WebRTC, without the video being broadcast through Hyperconnect’s servers. That’s designed to improve reliability by removing latency while also reducing the cost of bandwidth for the service to Hyperconnect. WebRTC is now a well-deployed open-source standard, with companies such as Google using it in products like Google Meet.

In addition to its innovative work on WebRTC, Hyperconnect built infrastructure to support two users who speak and text in different languages to interact with each other directly through its apps using real-time translation. In a marketing post on Google Cloud, Hyperconnect is a marquee customer of the cloud service’s speech, real-time translation and messaging APIs.

In the companies’ joint press statement, both sides emphasized R&D and engineering as key wins for the deal. That begs the question then what Match Group is looking to build with its massive new purchase? While the group has largely confined itself to dating, live broadcast and other media verticals may well be in its sights once it acquires the technology from Hyperconnect.

The deal is expected to close in 2021Q2.

Source: https://techcrunch.com/2021/02/09/match-hyperconnect-acquisition/

OpenOcean, a European VC which has tended to specialise in big data-oriented startups and deep tech, has reach the €92 million ($111.5 million) mark for its third main venture fund, and is aiming for a final close of €130 million by mid-way this year. LPs in the new fund include the European Investment Fund (EIF), Tesi, pension funds, major family offices and Oxford University’s Corpus Christi College.

Ekaterina Almasque — who has already led investments in IQM (superconducting quantum machines) and Sunrise.io (multi-cloud hyper-converged infrastructure) and is leading the London team and operations for the firm — has been appointed as general partner. Before joining, Almasque was a managing director at Samsung Catalyst Fund in Europe, led investments in Graphcore’s processor for Artificial Intelligence, Mapillary’s layer for rapid mapping and AIMotive’s autonomous driving stack.

The enormous wealth of data in the modern world means the next generation of software is being built at the infrastructure. Thus, the fund said it would invest primarily at the Series A level with initial investments of €3 million to €5 million, across OpenOcean’s principle areas of artificial intelligence, application-driven data infrastructure, intelligent automation and open source.

OpenOcean’s team includes Michael “Monty” Widenius, the “spiritual father” of MariaDB, and one of the original developers of MySQL, the predecessor to MariaDB; Tom Henriksson, who invested in MySQL and MariaDB; as well as Ralf Wahlsten and Patrik Backman.

Tom Henriksson, general partner at OpenOcean, commented: “Ekaterina… brings an immense amount of expertise to the team and exemplifies the way we want to support our founders. Fund 2020 is an important step for OpenOcean, with prestigious LPs trusting our approach and our knowledge, and believing in our ability to identify the very best data solutions and infrastructure technologies in Europe.”

Almasque said: “The next five years will be critical for digital infrastructure, as breakthrough technologies are currently being constrained by the capabilities of the stack. Enabling this next level of infrastructure innovation is crucial to realising digitisation projects across the economy and will determine what the internet of the future looks like. We’re excited by the potential of world-leading businesses being built across Europe and are looking forward to supporting the next generation of software leaders.”

Speaking to TechCrunch she added: “It’s very rare to find such a VC so deep in the stack which also invested in one of the first unicorns in Europe and really built the open source ecosystem globally. So for me, this was absolutely an interesting team to join. And what OpenOcean was doing since inception in 2011 was very unique among pioneering ecosystems, such as big data analytics… and it remains very pioneering, pushing the frontiers in artificial intelligence and now quantum computing. This is what really attracts me, and I think there is a very, very big future.”

In an interview Henriksson told me: “What we are seeing is that our economy is shifting more and more towards the digital, data-driven economy. It started with few industries, but now we see a larger shift, including new industries like healthcare, like manufacturing.”

Asked about the effects of the pandemic on the sector, he said: “Obviously we see a lot of startups who are plugging into things like the UiPath platform. This is very relevant for the pandemic. Because the companies that had started automating strongly before the pandemic hit… they’ve actually accelerated and they find benefits for their teams and organisations and actually the people are happier because they have better automation technologies in place. The ones that didn’t start before [the pandemic hit] they’re a little behind now.”

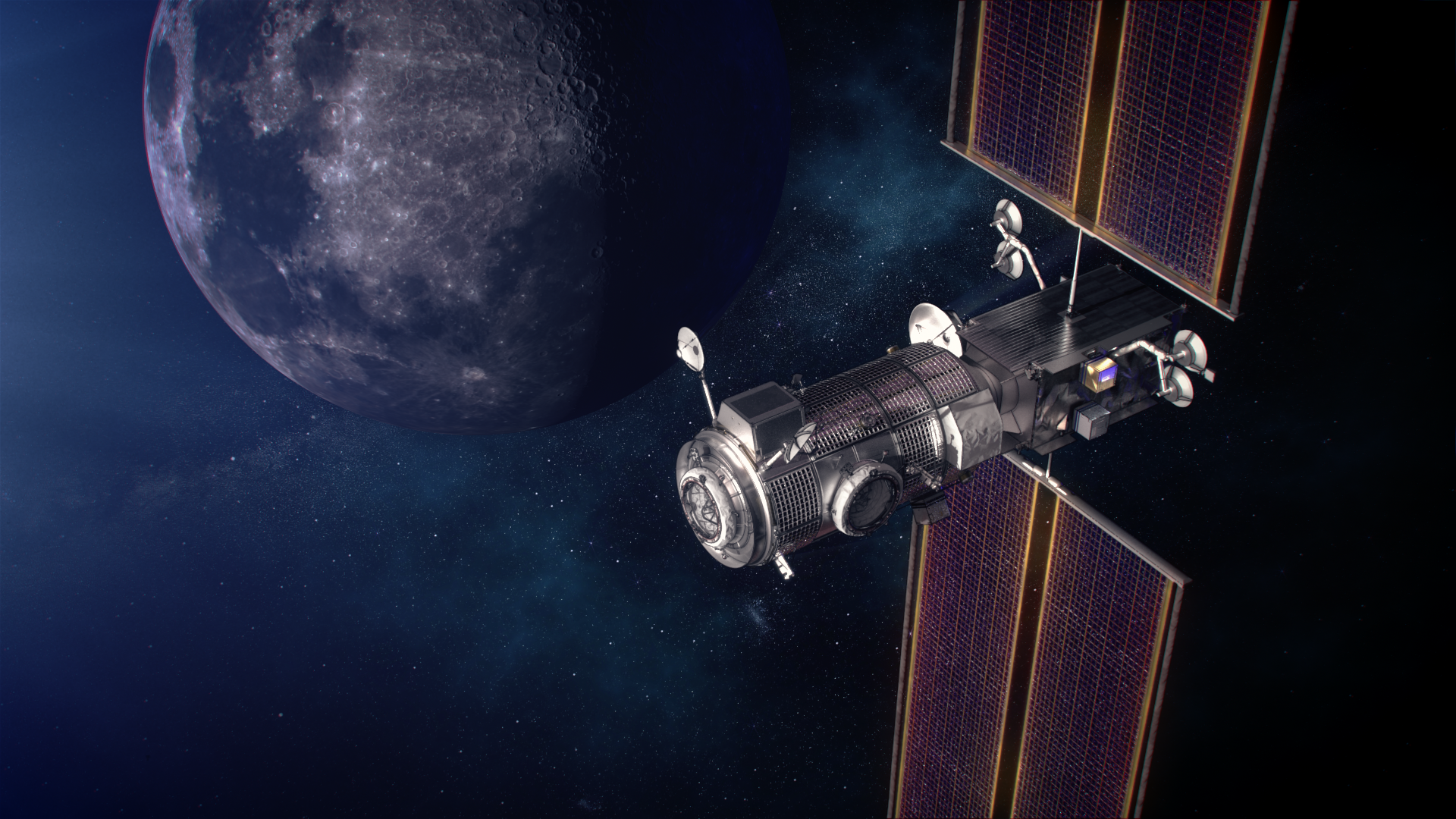

NASA has announced that SpaceX will take two major parts of the Gateway lunar orbiter that will function as a pit stop for future moon missions. The Power and Propulsion Element and Habitation and Logistics Outpost — which together will form the first usable lunar space station — will go up in 2024 on a Falcon Heavy, with an estimated price tag of $332 million.

The Falcon Heavy, which provides a far larger lift capacity than SpaceX’s now commonly used Falcon 9, has only had two commercial launches since its successful test launch in early 2018 (with Starman and a Tesla Roadster, you may remember). Arabsat-6A launched in April of 2019, and STP-2 a few months later, but since then the Heavy hasn’t seen any action. (Several missions are planned for the next year, however.)

NASA’s selection of the launch vehicle as the one that will bring these two crucial components to lunar orbit is a huge endorsement, however, and may actually snowball into more work down the line if the agency’s own Space Launch System continues to be delayed.

The PPE and HALO, as the two pieces are called, provide the essentials for a self-sustaining lunar orbital habitat: essentially the pressurized cabin and the power source that keeps it operational and allows maneuvering. So you could say they’re fundamental.

They’re also big, and can’t be sent up in 10 different pieces on smaller rockets. But there are precious few heavy launch vehicles available — and it looks like they decided that SpaceX’s was the best bet, having flown three successful missions already.

This mission is valued at $332 million in launch and related costs, so it’s a serious investment that will require a lot of collaboration between SpaceX, NASA, Northrop Grumman (which is building the HALO) and Maxar (making the PPE).

CG image of the lunar Gateway with the propulsion element and first habitable element attached. Not particularly roomy, but you can’t beat the view. Image: NASA

For now launch is set for no earlier than may of 2024, but that date may (and in fact is highly likely to) slip as various delays accrue. The whole Artemis program is experiencing a period of reality alignment, and while new target dates haven’t been given for all the ambitious plans made during the last four years, few of the old ones have been repeated the way they were as recently as last fall. Nevertheless even a five or six-year plan to return to the moon’s surface is still quite ambitious, considering — as has become the standard NASA refrain — “we’re going there to stay.”

We’ll likely hear more about the new timeline as the agency comes to grips with it itself over the next few months.