& meet dozens of singles today!

User blogs

Northmill Bank, the Sweden-based challenger that has around 200,000 customers across three European countries, has raised around $30 million in new funding.

Leading the round is M2 Asset Management, the Swedish investment company controlled by Rutger Arnhult, and asset management firm Coeli. The injection of cash will be used for continued geographical expansion and to accelerate the development of new products. Notably, this will include plans to launch in 10 new markets as Northmill aims to step on the gas. Next stop, Norway.

As it stands, 2006-founded Northmill is available in Sweden, Norway and Finland, where it competes with incumbent banks with physical branches and the likes of Lunar, Revolut and Klarna (which operates as a bank in its home country of Sweden, and Germany).

More adjacent, another competitor is Anyfin, which is similar to Northmill’s “Reduce” product, which promises to help customers consolidate their existing loans/credit and lower their interest payments. “Our fastest-growing product and main driver today is Reduce, which lowers people’s interest on existing credits, part-payments and credit cards,” explains a Northmill spokesperson.

Founded nearly 15 years ago and originally operating as a credit provider, in 2019 Northmill secured a full banking license, regulated by the Swedish Financial Supervisory Authority. The bank employs 150 people and offers savings, credits, payments and insurances. More generally, it has taken a different and slower path than most of the newer crop of challengers in Europe, relying less on investment to fuel its growth and claims to have been profitable from nearly the get-go.

Cue statement from Rutger Arnhult, chairman of the board of M2 Assets Management: “Northmill Bank is already a profitable company with a proven and sustainable business model, which stands out among today’s tech investments. We have been following their journey for a while and have been impressed by the founders, as well as the company. The banking market is well on its way to change and the winners will be those who best can adapt to the new digital reality. For me, this is an investment in a tech company with long-term owners, who are just at the beginning of their journey. I see great growth potential in the bank.”

Source: https://techcrunch.com/2021/02/10/sweden-based-digital-bank-northmill-raises-30m/

India may soon have another fintech unicorn. BharatPe said on Thursday it has raised $108 million in a financing round that valued the New Delhi-based financial services startup at $900 million.

Coatue Management led the three-year-old startup’s Series D round. Other six existing institutional investors — Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo and Sequoia Capital — also participated in the round, which brings BharatPe’s total to-date raise to $233 million in equity and $35 million in debt.

The startup said as part of the new financing round it returned $17.17 million to its angel investors and employees with stock option.

“With the balance sheet well capitalized (more than US$ 200M in bank), we are now going to keep our heads down and deliver US$30B TPV and build a loan book of US$ 700mn with small merchants by March 2023,” said Ashneer Grover, co-founder and chief executive of BharatPe.

BharatPe operates an eponymous service to help offline merchants accept digital payments and secure working capital. Even as India has already emerged as the second largest internet market, with more than 600 million users, much of the country remains offline.

Among those outside of the reach of the internet are merchants running small businesses, such as roadside tea stalls and neighborhood stores. To make these merchants comfortable with accepting digital payments, BharatPe relies on QR codes and point of sale machines that support government-backed UPI payments infrastructure.

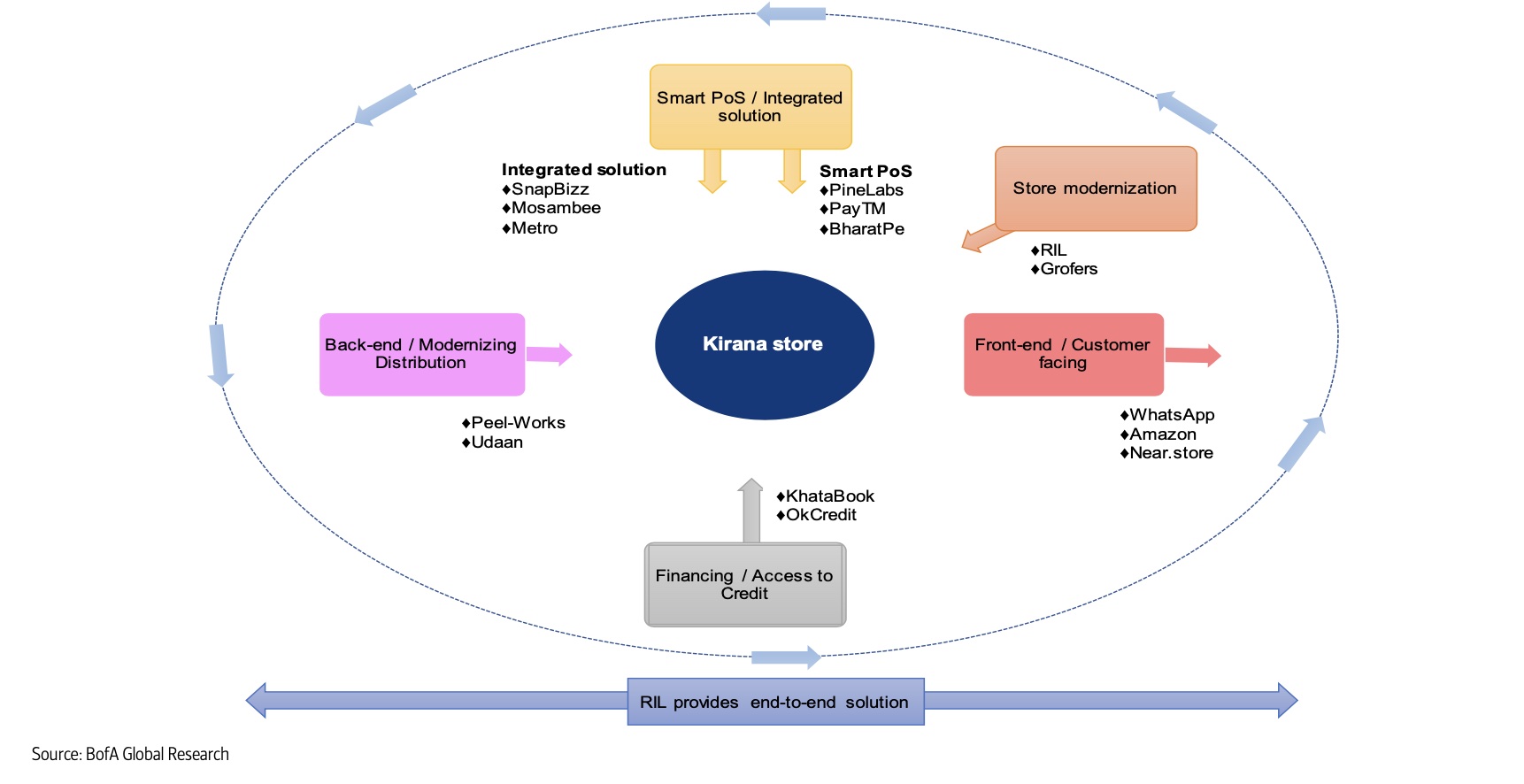

Scores of giants and startups are attempting to serve neighborhood stores in India.

The startup said it had deployed over 50,000 PoS machines by November of last year, and enables monthly transactions worth more than $123 million. It does not charge merchants for universal QR code access, but is looking to make money by lending. Grover said the startup’s lending business grew by 10x in 2020.

“This growth reiterates the trust that the small merchants and kirana store owners have showed in us. This is just the beginning of our journey and we are committed to build India’s largest B2B financial services company that can serve as one-stop destination for small merchants. For BharatPe, merchants will always be at the core of everything we build,” he said.

BharatPe’s growth is impressive especially because it was not the first startup to help merchants. In a recent report to clients, analysts at Bank of America said BharatPe has proven that fintech is not the winner takes all market.

“BharatPe perhaps has the late mover advantages in the space. It was one of the first companies to act as a universal consolidator of QR codes on UPI, giving the merchant the advantage to have one QR code (eventually others like Paytm followed). Unlike its Fintech peers, BharatPe is not educating the merchants but instead following its larger peers who have already educated the merchants,” they wrote in the report, reviewed by TechCrunch.

The startup, which has presence in 75 cities today, plans to further expand its network in the nation with the new fund.

This afternoon Bumble priced its IPO at $43 per share, ahead its raised IPO range of $37 to $39 per share.

After filing to go public in mid-January, and offered up its first price range on February 2nd. That range, $28 to $30 per share wound up coming up short. Bumble raised its price range to $37 to $39 per share earlier this week.

Before counting a possible underwriters’ option, Bumble raised $2.15 by selling 50,000,000 million shares in its public offering. The company will begin to trade tomorrow morning.

Bumble’s debut comes amidst a number of other 2021 offerings, including MetroMile’s SPAC-led public combination earlier this week. Other well-known companies are anticipated to list this year, including Coinbase and, perhaps, Robinhood.

The public offering of Bumble shares comes after a sustained period when one company, Match, was presumed to be the only possible public dating company. However, the smaller Bumble has proven that there is room for at least one more.

TechCrunch explored Bumble’s financial results here, if you’d like more.

Source: https://techcrunch.com/2021/02/10/bumble-prices-ipo-at-43-per-share/

Facebook tries to get less political, Oracle’s TikTok acquisition may not be happening and Twitter says Donald Trump is banned forever. This is your Daily Crunch for February 10, 2021.

The big story: Facebook tests a News Feed with less politics

Facebook announced today that it’s testing changes to the News Feed that would downrank political content. The company says the results will help determine how it treats such content in the future; content from health organizations and official government agencies will not be affected.

Two years ago, Facebook said it would be downranking publisher content in favor of content from family and friends, but this time it’s targeting politics specifically. For now, this test is only being conducted with a small group of users in select markets, including the United States, Canada, Brazil and Indonesia.

The tech giants

TikTok’s forced sale to Oracle is put on hold — The insane saga of a potential forced sale of TikTok’s U.S. operations is reportedly ending.

Twitter says Trump is banned forever, even if he runs for president again — “When you’re removed from the platform, you’re removed from the platform,” said Twitter CFO Ned Segal.

Apple Maps to gain Waze-like features for reporting accidents, hazards and speed traps — The new features are live in the iOS 14.5 beta.

Startups, funding and venture capital

Israeli startup CYE raises $100M to help companies shore up their cyber-defenses — CYE conducts offensive operations against their customers (with their permission) to find weaknesses before malicious hackers do.

SecuriThings snares $14M Series A to keep edge devices under control — This could include devices like security cameras, access control systems and building management systems.

Podz turns podcasts into a personalized audio newsfeed — A new company from an old Startup Battlefield winner, backed by Katie Couric and Paris Hilton.

Advice and analysis from Extra Crunch

Three adtech and martech VCs see major opportunities in privacy and compliance — We asked them to update us on whether deal flow has recovered, and to look ahead at the possibility of additional regulation.

Dear Sophie: How can I improve our startup’s international recruiting? — The latest edition of the advice column that answers immigration-related questions about working at technology companies.

How will investors value MetroMile and Oscar Health? — Last night, MetroMile and SPAC INSU Acquisition Corp. II completed their combination.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Ancestry says it fought two police requests to search its DNA database — Neither request resulted in the company turning over customer or DNA data.

NASA will use Fitbits to help prevent spread of COVID-19 to astronauts and employees — NASA will provide 1,000 of its employees, including 150 astronauts, with Fitbit devices in a pilot program.

EU’s top privacy regulator urges ban on surveillance-based ad targeting — The regulator is proposing that this ban be included in a major reform of digital services rules.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/02/10/daily-crunch-facebook-tests-a-news-feed-with-less-politics/

Scalarr, a startup that says it uses machine learning to combat ad fraud, is announcing that it has raised $7.5 million in Series A funding.

The company was founded by CEO Inna Ushakova and CPO Yuriy Yashunin, who previously led the mobile marketing agency Zenna. Ushakova told me that while at Zenna, they realized that ad fraud had grown to the point that it posed a real threat to their business.

At the same time, the team wasn’t impressed by any of the existing anti-fraud solutions, so it built its own technology. Eventually, they shut Zenna down completely and moved the entire team over to Scalarr.

The startup’s products include AutoBlock, which is supposed to detect fraud before the advertiser bids on an ad, and DeepView, which is used by adtech platforms (including ad exchanges, demand-side platforms and supply-side platforms).

Scalarr says it can detect 60% more fraud than existing products on the market and that it saved its clients $22 million in ad fraud refunds in 2020. Ushakova attributed this in large part to the startup’s extensive use of machine learning technology.

She added that while large ad attribution companies are adding anti-fraud products, they aren’t the focus. And historically, companies have tried to detect fraud through a “rules-based approach,” where there’s a list of behaviors that suggest fraudulent activity — but no matter how quickly they create those rules, it’s hard to keep up with the fraudsters.

“Fraud is ever evolving,” Ushakova said. “It’s like a Tom and Jerry game, so they are ahead of you and we are trying to catch them.”

As for why machine learning works is so much more effective, she said, “Only ML could help you predict the next step, and with ML, you should be able to detect abnormalities that are not classified. Right after that, our analytics should be able to take a look at those abnormalities and decide whether something significant statistically important.”

Scalarr’s Series A led by the European Bank of Reconstruction and Development, with participation from TMT Investments, OTB Ventures, and Speedinvest. Among other things, the company will use the money to expand its presence in Asia and to continue developing the product.