& meet dozens of singles today!

User blogs

Video collaboration startup Frame.io unveiled a new technology today that it calls Frame.io Camera to Cloud.

Michael Cioni, the startup’s global senior vice president of innovation, explained that while consumers expect to instantly upload video footage to the cloud, professional film and TV productions still rely on hard drives.

There’s a good reason for that: Those productions use much higher-quality footage, which means that the files are enormous. But Frame.io gets around that by uploading “proxy” footage that’s not nearly so bandwidth intensive.

It can, in fact, be uploaded on an LTE connection, as the Frame.io team demonstrated for me by shooting brief footage that was accessible a few seconds later from a computer on the other side of the country.

Cioni said this means the editing process no longer has to wait on the movement of hard drives: “We take this linear process and make it parallel.”

Image Credits: Frame.io

Footage uploaded through Camera to Cloud can then be edited in Frame.io, but the technology is also integrated with popular editing software like Final Cut Pro and Adobe Premiere. And because the proxy footage has the same timecodes and metadata as the original, any edits can be synchronized once you receive the drives.

In addition, Camera to Cloud allows production members on and off the set to view footage from their computer, iPhone or iPad, as soon as it’s shot.

“The moment that you hit stop [on the camera], wouldn’t it just be great to pull the footage up on your phone, because you want to see what you shot?” said Frame.io CEO Emery Wells. “You can’t do that right now on a professional set. There’s person whose job it is to do that, there are playback monitors all over the set and everybody watches playback at the same time.”

And while the company started to develop this technology before the pandemic, Wells said, “It turns out there’s even more of a need for this now, when fewer people can be on sets.”

In fact, the technology was already used during the production of the pandemic movie “Songbird,” The movie was filmed last summer, and by using Camera to Cloud, producers who were not allowed on the set (due to new safety protocols) could still keep up with the footage.

Camera to Cloud works on existing devices like the Teradek CUBE 655, Sound Devices 888 and Scorpio recorders, which can be attached to compatible cameras from Arri, RED and Sony. It’s available at no additional charge to paying Frame.io subscribers.

“It’s our prediction that by the end of the decade, everybody shooting audio, video and whatever, they’re going to shoot into the cloud,” Cioni said.

Source: https://techcrunch.com/2021/02/11/frame-io-camera-to-cloud/

In general, ESG stands for “environment-social-governance” and comprises a set of principles that touches on issues from diversity and board structures to labor relations, supply chain, data ethics, environmental impact and legal requirements.

Unlike impact investing, which is squarely focused on the (external) effects of a business, ESG concerns mostly internal practices and processes that could support both a fund and its portfolio companies to make them more sustainable.

While other asset classes from buyout funds to public equities have seen a big push toward ESG ratings and initiatives, venture capital has been lagging behind. What has changed recently?

Over the last several months, quite a few mostly European funds have stepped forward with initiatives to tackle ESG. Balderton, for instance, announced its Sustainable Future Goals with a bang at the startup event Slush in early December 2020. Their efforts are focused both internally on the fund and externally on investment decisions and portfolio support. I asked Colin Hanna, one of the leaders of the development internally and a principal at the firm, how this initiative came about:

While our efforts on this front preceded COVID, this year we saw that a real impact was possible on climate-change-related goals […] we have become accustomed to doing virtual board meetings, cutting down on travel; the challenge will be to continue those efforts going forward and rolling them out to our portfolio companies even as the world returns to normal. Having a framework helps us do that.

This rationale also recently brought a group of about 25 VCs to form a community around ESG for VC for the first time. The initiative is led by GMG Ventures and Houghton Street Venture, a new firm affiliated with the London School of Economics that met for the first time in December with representatives from LocalGlobe and Latitude, Kindred Capital, Balderton, the Westly Group and Blisce. The group’s stated goal is to share expertise from the bottom up and fill the gap where existing frameworks don’t quite work.

This is direly needed right now, says Sophia Bendz, partner at Berlin-based firm Cherry Ventures:

Beginning with topics around DEI and climate issues, we are really keen on upping our ESG game. ESG involves such important issues and we have to dedicate the time to learn more to ultimately do more on these fronts now. Yet, I also believe that true impact doesn’t result from knowledge silos. It’s great that we are learning from and supporting each other to have more societal impacts in our day-to-day roles. I am really passionate about this.

What are the main drivers for this push?

I asked Susan Winterberg, an ESG consultant who recently finished a two-year fellowship at Harvard producing a groundbreaking report on the subject of ESG for VCs specifically about the “why now”:

There are broadly two sets of reasons why investors and company leaders adopt ESG. The first set relates to increased awareness of how their activities impact external events happening in the world such as climate change and social justice. The second relates to increased awareness of how adopting ESG can advance specific business goals they have such as increasing sales, attracting top talent, and reducing operating risks.”

Obviously, 2020 was a watershed year to drive change based on both of these sets of rationales. Social justice issues — from Black Lives Matter and racial equity, COVID-19 and healthcare to freedom of expression and democracy — were prevalent across the spectrum. Startup leaders and investors were influenced by these societal movements as much as by new research helping them understand how ESG can help advance business objectives in venture capital. The two reports published by CDC/FMO and the Belfer Center are only two examples of this evidence.

What do VCs say, how has change happened for them? Hana told me that at Balderton a combination of factors mentioned by Winterberg above, worked together to start the process:

It was both a push and a pull within Balderton. Our investors and the leaders at the top of our firm were proponents of this change but the efforts were also driven by the younger generation within the firm; they felt it was important. Overall, we were silent about climate change and sustainability for a long time, which was not really an option anymore.

For Martin Weber, founding partner at HV Capital that’s working with the St. Gallen-based ESG initiative ROSE, the conversation really started with Leaders for Climate Action. Weber admits: “We didn’t think about ESG enough […] beyond our own horizon really […] sometimes you really need a kick in the butt, that’s what Leaders for Climate Action did for us; a small change started our awareness and commitment to ESG.”

ESG concerns mostly internal practices and processes that could support both a fund and its portfolio companies to make them more sustainable.

For HV Capital but also some funds in the U.S. such as the Westly Group a specific ESG vector started the journey — that could be the E as in environment but also DEI as part of the S and G of ESG.

I also spoke to several LPs recently among others moderating a panel at the U.K.-based Allocate conference; the atmosphere seems to be shifting more drastically toward “doing business better” among the asset owners, too. Particularly family offices managing their own money are outspoken already, but big asset owners are becoming aware (and active) as well.

Michael Cappucci, managing director of Compliance and Sustainable Investing at the Harvard Management Company — Harvard’s endowment — thinks that “we are long past the time to ‘wait and see’ if ESG integration is a worthwhile undertaking for investors” (see the UNPRI report for more context).

The movement here seems to be coming even stronger from Europe again, however. As a result, the same group around Houghton Street Ventures and GMG Ventures pushing ESG for VCs is also in the process to get more LPs on board with a special workshop in February, as I learned. The tempo on the LP front is increasing as we speak.

What is still missing?

While lots of progress has been made on the level of individual funds, individual LPs and in baby steps toward a more general industry-wide push, there are still some core elements that are not in place. I believe the five key gaps concern a clear differentiation of ESG from impact, finding the right language, establishing a common framework, agreeing on metrics and real LP commitment.

- Know what ESG is: Many investors (and LPs) I speak with still don’t really know the difference between impact and ESG. In very simple terms, ESG principles are about the (internal) processes (of a fund, portfolio company, etc.) while impact investing is about outcomes (sometimes operationalized through the Sustainable Development Goals (SDGs)). While impact will likely remain a niche asset class for the foreseeable future, ESG principles should inform the practices of all investors in one way or the other.

- Find the right language: On a related note, finding the right language to talk about what ESG (versus impact) is, might help us to differentiate better. As Sarah Drinkwater of Omidyar Network made very clear in her post from September last year, we simply don’t have a good word to describe (and own) what ESG expresses in the world of venture capital and technology — principled, progressive, equitable? Possibly, “setting a standard” can help with this issue, too.

- Somebody, set a standard: ESG (and impact) frameworks developed and deployed slowly in the venture industry are still all over the place; they are influenced by all kinds of other frameworks (from other asset classes and related activities, such as impact) and mostly made up by individual funds themselves. There is certainly a risk of green washing if it stays that way; (self-proclaimed and reported) marketing is one thing but if we really want to change the industry, an authoritative body will have to step forward. What the biggest European anchor investor — the European Investment Fund — has done on that front so far with a very high-level questionnaire is not enough. How about, for instance, the UNPRI descends from the plane of high level down to individual industry principles?

- What isn’t measured: One part of what could really lead to an industry standard is a set of widely accepted and benchmarkable metrics; what are the most important measurements across early-stage and late-stage VC portfolio companies? The group of funds in London has for good reason announced that this particularly question will be one of the focus points they are working on next. But how will this again be adopted and spread industrywide? Another set of players might get involved in that again: LPs. If they make their GPs report on ESG on an annual basis, this will surely shift the industry as a whole and make the next generation of startups more equitable, responsible and stakeholder-focused.

- LPs really need to bite: So far, we are still missing real LP commitments when it comes to ESG. On the one hand, many GPs I spoke with that have recently been fundraising reported that LPs in general still don’t ask about ESG. In fact, some LPs particularly in the U.S. believe ESG might be a distraction from generating returns. In any case, ESG still has not become a must-have but is merely regarded a nice-to-do. The ESG questionnaires that do exist — like the EIF framework — are so far really high level and unspecific. When big anchor LPs like the EIF and BBB in Europe or big foundations and university endowments ask about it in their due diligence meetings, GPs will have to comply — all of them. Their influence as agenda setters might in the medium term be the biggest driving factor toward making ESG for VC the normal way of doing business. Given that there is state-money, all of our money, involved here, it seems an absolute no-brainer to take that step.

Source: https://techcrunch.com/2021/02/11/european-vc-funds-are-building-community-around-esg-initiatives/

Just three years after its founding, biotech startup Immunai has raised $60 million in Series A funding, bringing its total raised to over $80 million. Despite its youth, Immunai has already established the largest database in the world for single cell immunity characteristics, and it has already used its machine learning-powered immunity analysts platform to enhance the performance of existing immunotherapies, but aided by this new funding, it’s now ready to expand into the development of entirely new therapies based on the strength and breadth of its data and ML.

Immunai’s approach to developing new insights around the human immune system uses a ‘multi-omic’ approach – essentially layering analysis of different types of biological data, including a cell’s genome, microbiome, epigenome (a genome’s chemical instruction set) and more. The startup’s unique edge is in combining the largest and richest data set of its type available, formed in partnership with world-leading immunological research organizations, with its own machine learning technology to deliver analytics at unprecedented scale.

“I hope it doesn’t sound corny, but we don’t have the luxury to move more slowly,” explained Immunai co-founder and CEO Noam Solomon in an interview. “Because I think that we are in kind of a perfect storm, where a lot of advances in machine learning and compute computations have led us to the point where we can actually leverage those methods to mine important insights. You have a limit or ceiling to how fast you can go by the number of people that you have – so I think with the vision that we have, and thanks to our very think large network between MIT, and Cambridge to Stanford in the Bay Area, and Tel Aviv, we just moved very quickly to harness people to say, let’s solve this problem together.”

Solomon and his co-founder and CTO Luis Voloch both have extensive computer science and machine learning backgrounds, and they initially connected and identified a need for the application of this kind of technology in immunology. Scientific co-founder and SVP of Strategic Research Danny Wells then helped them refine their approach to focus on improving efficacy of immunotherapies designed to treat cancerous tumors.

Immunai has already demonstrated that its platform can help identify optimal targets for existing therapies, including in a partnership with the Baylor College of Medicine where it assisted with a cell therapy product for use in treating neuroblastoma (a type of cancer that develops from immune cells, often in the adrenal glands). The company is now also moving into new territory with therapies, using its machine learning platform and industry-leading cell database to new therapy discovery – not only identifying and validating targets for existing therapies, but helping to create entirely new ones.

“We’re moving from just observing cells, but actually to going and perturbing them, and seeing what the outcome is,” explained Voloch. This, from the computational side, later allows us to move from correlative assessments to actually causal assessments, which makes our models a lot more powerful. Both on the computational side and on the on the lab side, this is really bleeding edge technologies that I think we will be the first to really put together at any kind of real scale.”

“The next step is to say ‘Okay, now that we understand the human immune profile, can we develop new drugs?’,” said Solomon. “You can think about it like we’ve been building a Google Maps for the immune system of a few years – so we are mapping different roads and paths in the in the immune system. But at some point, we figured out that there are certain roads or bridges that haven’t been built yet. And we will be able to support building new roads and new and new bridges, and hopefully leading from current states of disease or cities of disease, to building cities of health.”

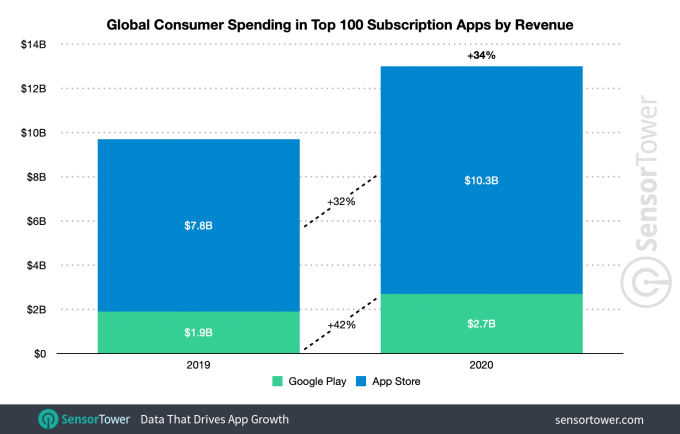

Apps saw record downloads and consumer spending in 2020, globally reaching somewhere around $111 billion to $112 billion, according to various estimates. But a growing part of that spend was subscription payments, a new report from Sensor Tower indicates. Last year, global subscription app revenue from the top 100 subscription apps (excluding games), climbed 34% year-over-year to $13 billion, up from $9.7 billion in 2019.

The App Store, not surprisingly, accounted for a sizable chunk of this subscription revenue, given it has historically outpaced the Play Store on consumer spending. In 2020, the top 100 subscription apps worldwide generated $10.3 billion on the App Store, up 32% over 2019, compared with $2.7 billion on Google Play, which grew 42% from $1.9 billion in 2019.

Image Credits: Sensor Tower

There are some signs that subscription revenue growth may be hitting a peak. Some of the slowdown and otherwise flat growth can be attributed to larger apps, like Netflix and Tinder, which have found ways to workaround the app stores’ in-app purchases requirements.

Globally, subscription app revenue from the top 100 apps was around 11.7% of the total ~$111 billion consumers spent on in-app purchases in 2020 — which is roughly the same share it saw in 2019.

And in the fourth quarter of 2020, 86 of the top 100 earning apps worldwide offered subscriptions, which was down from the 89 that did so in the fourth quarter of 2019.

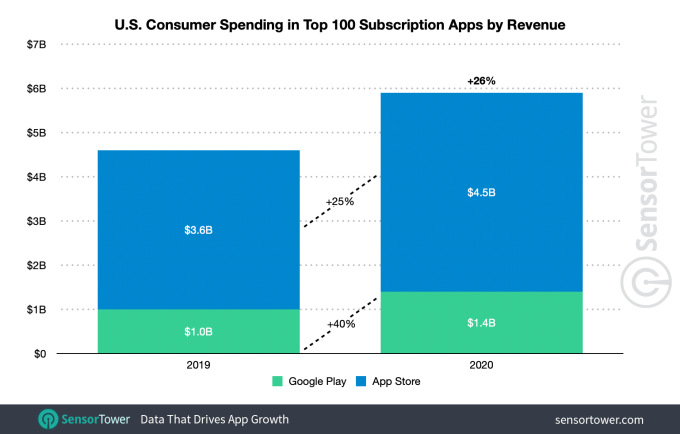

In addition, subscription app revenue growth in the U.S. is now trailing the global trends.

Although subscription app revenue was still up 26% on a year-over-year basis to reach nearly $5.9 billion in 2020, that was slower growth than the 34% seen worldwide.

Image Credits: Sensor Tower

What’s more, subscription app spending in the U.S. last year represented a smaller percentage of the total consumer spend than in 2019, the report found. In 2020, subscription payments from the top 100 subscription apps were 17.6% of the $33 billion U.S. consumers spent on in-app purchases, down from the 21% share they accounted for in 2019.

And out of the 100 top grossing apps in the U.S. in the fourth quarter 2020, 91 were subscription-based, down from 93 in the year ago quarter.

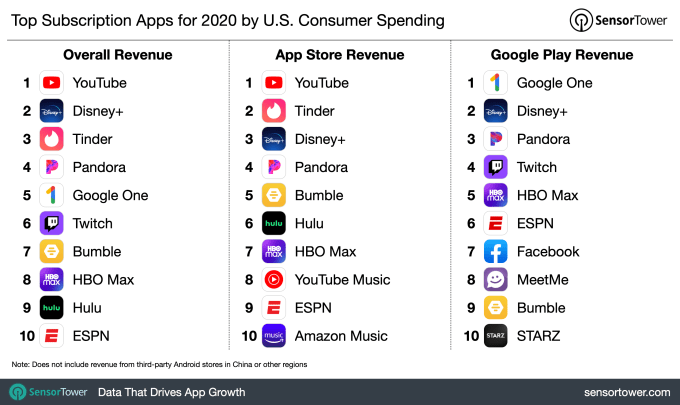

The top subscription apps in the U.S. looked different between the App Store and Google Play. On the former, YouTube was the top grosser in this category, while Google Pay users spent on Google One (Google’s cloud storage product). Tinder, meanwhile, was No. 2 on the App Store, while Disney+ took the second spot on Google Play.

Image Credits: Sensor Tower

Overall, the top 10 across both stores were YouTube, Disney+, Tinder, Pandora, Google One, Twitch, Bumble, HBO Max, Hulu, and ESPN. These top earners indicate that consumers are willing to pay for their entertainment — like streaming services — on subscription, but it’s more difficult for other categories to break into the top charts. Dating apps. however, remain an exception.