& meet dozens of singles today!

User blogs

The All-22 tape is perhaps one of the most valued tools for professional football coaches because it allows the viewer to see all 22 players on the field at the same time. It improves a coach’s line of sight and, most importantly, helps avoid missing a critical motion or player.

The upshot: It removes the blind spot. The concept of this tool can — and should — be applied in the startup world as well. Successful founders and investors understand the playbook on both sides of the ball. For founders, that means being able to zoom out and see each of their employees’ points of view and being inclusive. Without an All-22 tape, founders can mistakenly spend too much on engineering while ignoring the product rollout strategy, or forget to communicate with employees outside of their bubble of interest. A company can become fragmented as more blind spots emerge, which can ultimately lead to oversights that damage its reputation, operations or even its ability to raise money from investors.

It’s a skillset that is developed through practice. Luckily, Eghosa Omoigui, the founder and managing general partner of EchoVC Partners, a seed and early-stage technology venture capital firm serving underrepresented founders and underserved markets, is coming to Early Stage 2021 to give early-stage founders the tools they need to develop their own All-22 tape.

TC Early Stage – Operations & Fundraising is a virtual event focused on early-stage founders happening on April 1 & 2. The event will include breakout sessions led by investors and experts that break down the most difficult parts of building a business.

Here’s a look of Omoigui’s talk:

The All-22 View

Improving line of sight and dynamic field of play aperture is rarely discussed but hugely important. Great founders, operators and investors have an understanding of playbooks on both sides of the ball. We’ll talk through learnings and some ideas on how to build muscle memory and skillsets.

Omoigui, who was previously director of consumer internet and semantic technologies at Intel Capital, will share his experiences and tips to help founders see every aspect of their company. Register for TC Early Stage 2021 today and catch his All-22 Tape talk.

Five years ago I landed the Solar Impulse 2 in Abu Dhabi after flying around the globe powered solely by solar energy, a first in aviation history.

It was also a milestone in energy and technology history. Solar Impulse was an experimental plane, weighing as little as a family car and using 17,248 solar cells. It was a flying laboratory, full of groundbreaking technologies that made it possible to produce renewable energy, store it and use it when necessary in the most efficient manner.

The time has come to use technology again to address the climate crisis affecting us all. As we enter the most crucial decade of climate action — and most likely our last chance to limit global warming to 1.5°C — we need to ensure that clean technologies become the only acceptable norm. These technologies exist now and they can be profitably implemented at this crucial moment.

Hundreds of clean tech solutions exist that protect the environment in a profitable way,

Here are just four innovations from our solar-powered plane that the market can start using now before it’s too late.

From insulating the cabin to insulating our homes

The building sector is one of the largest energy consumers in the world. Next to a reliance on carbon-heavy fuels for heating and cooling, poor insulation and associated energy loss are among the main reasons.

Inside Solar Impulse’s cockpit, insulation was crucial for the plane to fly at very high altitudes. Covestro, one of our official partners, developed an ultra-lightweight and insulating material. The cockpit insulation performance was 10% higher than the standards at the time because the pores in the insulating foam were 40% smaller, reaching a micrometer scale. Thanks to its very low density of fewer than 40 kilograms per cubic meter, the cockpit was ultra-lightweight.

This technology and many others exist. We now need to ensure that all market players are motivated to make hyperefficient building insulation their standard operating procedure.

From propelling an electric aircraft to propelling clean mobility

Solar Impulse was first and foremost an electric airplane when it flew 43,000 km without a single drop of fuel. Its four electric motors had a record-beating efficiency of 97%, far ahead of the miserable 27% of standard thermal engines. This means that they only lost 3% of the energy they used versus 73% for combustion propulsion. Today, electric vehicle sales are soaring. According to the International Energy Agency, when Solar Impulse landed in 2016, there were approximately 1.2 million electric cars on the road; the figure has now risen to over 5 million.

Nevertheless, this acceleration is far from enough. Power sockets are still far from replacing petrol pumps. The transport sector still accounts for one-quarter of global energy-related CO2 emissions. Electrification must happen much more quickly to reduce CO2 emissions from our tailpipes. To do so, governments need to boost the adoption of electric vehicles through clear tax incentives, diesel and petrol engine bans, and major infrastructure investments. 2021 should be the year that puts us on a one-way road to zero-emission vehicles and puts thermal engines in a dead end.

An aircraft microgrid can work for off-grid communities

To fly for several days and nights, reaching a theoretically endless flight potential, Solar Impulse relied on batteries that stored the energy collected during the day and used it to power its engines during the night.

What was made possible with Si2 on a small scale should guide the way to future-proofing power-generation systems that are made up entirely of renewable energy. In the meantime, microgrids, like those used in Si2, could benefit off-grid systems in remote communities or energy islands, allowing them to abolish diesel or other carbon-heavy fuels already today.

On a larger scale, we are looking at smart grids. If all “stupid grids” were replaced by smart grids, it would allow cities, for example, to manage production, storage, distribution and consumption of energy and to cut peaks in energy demand that would reduce CO2 emissions dramatically.

Energy efficiency in the air and on the ground

Solar Impulse’s philosophy was to save energy instead of trying to produce more of it. This is why the relatively small amount of solar energy we collected became enough to fly day and night. All the airplane parameters, including wingspan, aerodynamics, speed, flight profile and energy systems, had therefore been designed to minimize energy loss.

Unfortunately, this approach still stands out against the inefficiency of most of our energy use today. Even though the IEA found energy efficiency improved by an estimated 13% between 2000 and 2017, it is not enough. We need bolder action by policymakers to encourage investors. One of the best ways to do so is to put strict energy efficiency standards in place.

For example, California has set efficiency standards on buildings and appliances, such as consumer electronics and household appliances, estimated to have saved consumers more than $100 billion in utility bills. These measures are as good for the environment as they are for the economy.

Si2 was the future; now, it should define the present

When we used all these different innovations to build Solar Impulse, they were groundbreaking and futuristic. Today, they should define the present; they should be the norm. Next to the technologies mentioned above, hundreds of clean tech solutions exist that protect the environment in a profitable way, many of which have received the Solar Impulse Efficient Solution Label.

Just as for the Si2 technologies, we must now ensure that they enter the mainstream market. The faster we scale them, the faster we will set our economy on track to achieve the Paris Agreement goals and attain sustainable economic growth.

Uber and Lyft lost a lot of money in 2020. That’s not a surprise, as COVID-19 caused many ride-hailing markets to freeze, limiting demand for folks moving around. To combat the declines in their traditional businesses, Uber continued its push into consumer delivery, while Lyft announced a push into business-to-business logistics.

But the decline in demand harmed both companies. We can see that in their full-year numbers. Uber’s revenue fell from $13.0 billion in 2019 to $11.1 billion in 2020. Lyft’s fell from $3.6 billion in 2019 to a far-smaller $2.4 billion in 2020.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But Uber and Lyft are excited that they will reach adjusted profitability, measured as earnings before interest, taxes, depreciation, amortization, and even more stuff stripped out, by the fourth quarter of this year.

Ride-hailing profits have long felt similar to self-driving revenues: just a bit over the horizon. But after the year from hell, Uber and Lyft are pretty damn certain that their highly-adjusted profit dreams are going to come through.

Ride-hailing profits have long felt similar to self-driving revenues: just a bit over the horizon. But after the year from hell, Uber and Lyft are pretty damn certain that their highly-adjusted profit dreams are going to come through.

This morning, let’s unpack their latest numbers to see if what the two companies are dangling in front of investors is worth desiring. Along the way we’ll talk BS metrics and how firing a lot of people can cut your cost base.

Uber

Using normal accounting rules, Uber lost $6.77 billion in 2020, an improvement from its 2019 loss of $8.51 billion. However, if you lean on Uber’s definition of adjusted EBITDA, its 2019 and 2020 losses fall to $2.73 billion and $2.53 billion, respectively.

So what is this magic wand Uber is waving to make billions of dollars worth of red ink go away? Let’s hear from the company itself:

We define Adjusted EBITDA as net income (loss), excluding (i) income (loss) from discontinued operations, net of income taxes, (ii) net income (loss) attributable to non-controlling interests, net of tax, (iii) provision for (benefit from) income taxes, (iv) income (loss) from equity method investments, (v) interest expense, (vi) other income (expense), net, (vii) depreciation and amortization, (viii) stock-based compensation expense, (ix) certain legal, tax, and regulatory reserve changes and settlements, (x) goodwill and asset impairments/loss on sale of assets, (xi) acquisition and financing related expenses, (xii) restructuring and related charges and (xiii) other items not indicative of our ongoing operating performance, including COVID-19 response initiative related payments for financial assistance to Drivers personally impacted by COVID-19, the cost of personal protective equipment distributed to Drivers, Driver reimbursement for their cost of purchasing personal protective equipment, the costs related to free rides and food deliveries to healthcare workers, seniors, and others in need as well as charitable donations.

Er, hot damn. I can’t recall ever seeing an adjusted EBITDA definition with twelve different categories of exclusion. But, it’s what Uber is focused on as reaching positive adjusted EBITDA is key to its current pitch to investors.

Indeed, here’s the company’s CFO in its most recent earnings call, discussing its recent performance:

We remain on track to turn the EBITDA profitable in 2021, and we are confident that Uber can deliver sustained strong top-line growth as we move past the pandemic.

So, if investors get what Uber promises, they will get an unprofitable company at the end of 2021, albeit one that, if you strip out a dozen categories of expense, is no longer running in the red. This, from a company worth north of $112 billion, feels like a very small promise.

And yet Uber shares have quadrupled from their pandemic lows, during which they fell under the $15 mark. Today Uber is worth more than $60 per share, despite shrinking last year and projecting years of losses (real), and possible some (fake) profits later in the year.

Source: https://techcrunch.com/2021/02/12/will-ride-hailing-profits-ever-come/

Cloud monitoring platform Datadog has announced that it plans to acquire Sqreen, a software-as-a-service security platform. Originally founded in France, Sqreen participated in TechCrunch’s Startup Battlefield in 2016.

Sqreen is a cloud-based security product to protect your application directly. Once you install the sandboxed Sqreen agent, it analyzes your application in real time to find vulnerabilities in your code or your configuration. There’s a small CPU overhead with Sqreen enabled, but there are some upsides.

It can surface threats and you can set up your own threat detection rules. You can see the status of your application from the Sqreen dashboard, receive notifications when there’s an incident and get information about incidents.

For instance, you can see blocked SQL injections, see where the injection attempts came from and act to prevent further attempts. Sqreen also detects common attacks, such as credential stuffing attacks, cross-site scripting, etc. As your product evolves, you can enable different modules from the plugin marketplace.

Combining Datadog and Sqreen makes a lot of sense as many companies already rely on Datadog to monitor their apps. Sqreen has a good product, Datadog has a good customer base. So you can expect some improvements on the security front for Datadog.

The company raised a $2.3 million round from Alven Capital, Point Nine Capital, Kima Ventures, 50 Partners and business angels. It then participated in TechCrunch’s Startup Battlefield — it made it to the finals but didn’t win the competition. The startup attended Y Combinator a bit later.

In 2019, Sqreen raised a $14 million Series A round led by Greylock Partners with existing investors Y Combinator, Alven and Point Nine participating once again.

Datadog and Sqreen have signed a definitive acquisition agreement. Terms of the deal remain undisclosed and the acquisition should close in Q2 2021.

Notion, the online workspace startup that was last year valued at over $2 billion, was knocked offline after a DNS outage.

The collaborative online office and document service was not loading as of around 9am ET on Friday, preventing anyone who relies on the service from accessing their cloud-stored data.

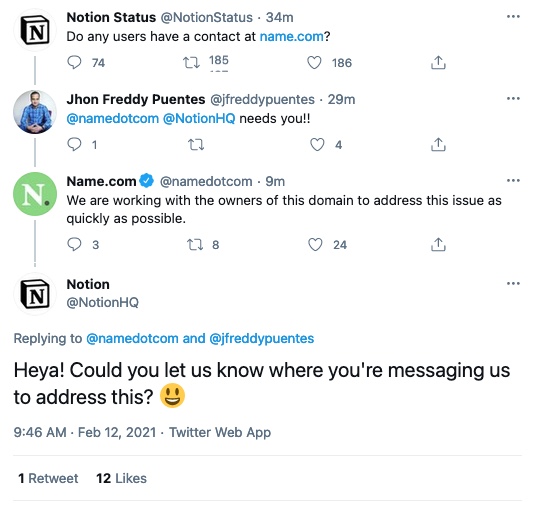

In a since-deleted tweet, Notion asked if “any users have a contact at Name.com,” the web host that Notion relies on for its domain name. In a reply, Name.com said it was “working with the owners of this domain to address this issue as quickly as possible.” Notion replied: “Could you let us know where you’re messaging us to address this?”

The now-partially deleted tweet thread noting the apparent Notion outage. (Image: TechCrunch)

In a statement shortly after its first tweet went out, Notion told TechCrunch: “We’re experiencing a DNS issue, causing the site to not resolve for many users. We are actively looking into this issue, and will update you with more information as we receive it via our status page on Twitter.”

Notion didn’t say specifically what the DNS issue is. Domain name servers, or DNS, is an important part of how the internet works. Every time you go to visit a website, your browser uses a DNS server to convert web addresses to machine-readable IP addresses to locate where a web page is located on the internet. But if a website or its DNS server is not configured correctly, it can cause the website not to load.

It appears a misconfiguration on @NotionHQ’s domain is causing a site-wide outage

The https://t.co/JfK06CSXK0 domain currently resolves to nothing pic.twitter.com/VLn8GBHe52

— Jane Manchun Wong (@wongmjane) February 12, 2021

It’s not clear exactly who is responsible for this particular DNS issue. When reached, a spokesperson for Name.com did not immediately comment, and Sonic.so, the Somali-based registrar that oversees the .so country-code top level domain which Notion relies on, did not return a request for comment.

We’ll update once we know more.

Read more on TechCrunch:

- TikTok emerges as a political battleground in Navalny-stirred Russia

- Facebook Oversight Board says other social networks ‘welcome to join’ if project succeeds

- A security researcher commandeered a country’s expired top-level domain to save it from hackers

- Sweden’s data watchdog slaps police for unlawful use of Clearview AI

- TechCrunch’s favorites from Techstars’ Boston, Chicago and workforce accelerators

Source: https://techcrunch.com/2021/02/12/notion-outage-dns-domain-issues/