& meet dozens of singles today!

User blogs

TechCrunch is excited to announce that Zoom chief revenue officer (CRO) Ryan Azus is joining us at TechCrunch Early Stage on April 1.

Azus has worked at Cisco, RingCentral and most recently Zoom. In his previous roles he held a number of sales titles, including his final role at RingCentral where he was its executive vice president of global sales and services.

Zoom needs little introduction, having crossed over from enterprise software success story to consumer phenomenon during the COVID-19 pandemic, during which time companies, groups, individuals and families leaned on the video chat provider to stay in touch.

Azus has been at the helm of Zoom’s money engine since mid-2019, which means that he has sat atop it during one of the most impressive periods of sales growth at any software company — ever.

So we’re glad that he’ll be at TC Early Stage this year, where we’ll pepper him with questions. Bring your own, of course, as we’ll be reserving around half our time for audience Q&A.

But the TechCrunch crew has a plethora of things we want to chat about too, including the importance of bottom-up sales during the pandemic, especially in contrast to the more traditional sales bullpen model that many startups have historically used; how to balance self-service sales and human-powered sales at a tech company that presents both options to customers, and their relative strength in 2021; changes to sales incentive metrics at Zoom over time from which startups might be able to learn; and how to maintain order and culture in a quickly scaling, remote sales organization.

We’re also curious how Zoom managed to adapt to the pandemic itself, like how long it took the company to reach full-strength from a sales perspective as it moved to remote work and customers that were also out of the office. The simple answer is that his company simply used more of its own product, but there’s more to the story that we want to hear.

Often at TechCrunch events we round up a cadre of executives from well-known technology companies and then hammer them for news. Early Stage is a bit different, focusing instead on extracting knowledge, tips and what-pitfalls-to-avoid from tech folks interested in helping startups do more, more quickly.

Azus won’t be coming alone. Bucky Moore from Kleiner will be in the house, along with Neal Sales-Griffin (a managing director at Techstars) and Eghosa Omoigui (a managing general partner at EchoVC Partners). The list goes on, as you can see here. (We’re also having a big pitch-off, so make sure to come to both days of the event.)

TC Early Stage continues TechCrunch’s recent spate of virtual events, so no matter where you are, you can tune in and learn. Register today to take advantage of early bird pricing, don’t forget to bring your best questions, and we’ll see you in early April!

If we are not careful, every entry of this column could consist of SPAC news.

Special purpose acquisition companies, or blank-check companies, whatever you prefer to call them, are enormous business today. But they aren’t the only thing going on, and we’ll get to other things shortly. Consider this an apology for having written about SPACs twice in two days.

Yesterday, we considered the rise of the VC-led SPAC and whether venture capital groups that offer seed-through-SPAC money will wind up with advantage in the market over firms that specialize on any particular startup stage. Sticking to the blank-check theme, this morning we’re looking into two SPAC-led deals, namely those involving Rover and MoneyLion.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We’re doubling up to prevent more SPAC-related posts. And we’ve selected Rover because Chewy, another pet-themed entity, is an already-public company. As both were venture-backed, we may be able to contrast their trading performance post-debut. Sadly, Chewy is focused on pet e-commerce while Rover is more centered around pet services, but they may prove close enough for some loose comparisons.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

So this is a SPAC post, but as we’ll largely be looking at the financial health of two companies that we’ve heard about for ages and never got to see inside of, I hope you join me all the same.

We’re starting with the Rover investor presentation, before zipping over to MoneyLion’s own.

Rover

Rover is merging with Nebula Caravel Acquisition Corp., which is affiliated with True Wind Capital. The deal gives Rover an anticipated market cap of around $1.6 billion, with around $300 million in cash on its books.

So, how attractive is this new unicorn? You can find its investor deck here, if you want to read along as we peek.

First up, the company stresses rising use of digital services in the last year thanks to the pandemic and the fact that pet ownership is growing. Both of which are true. We’ve seen the accelerating digital transformation for both companies and consumers. And if you’ve tried to adopt a pet lately, you’ve seen how few are left waiting for forever homes.

With those things behind it, you might be wondering why Rover is pursuing a SPAC-led debut as well. If its market is hot and it has previously raised venture capital, why not just go public via an IPO? Because 2020 was tough on the company.

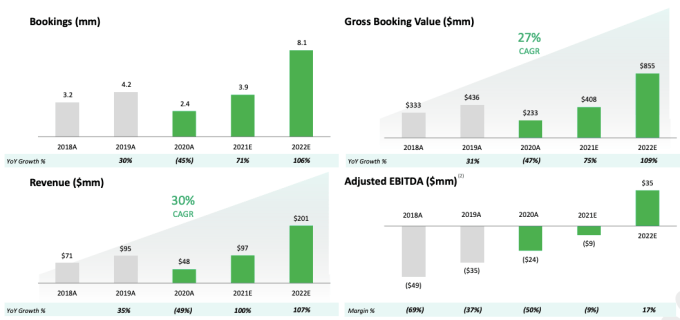

Revenue dipped from $95 million in 2019 to just $48 million last year. Bookings fell from 4.2 million to 2.4 million over the same time frame, leading to gross booking value falling from $436 million in 2019 to $233 million in 2020. Why? Because everyone was stuck at home. With their pets. A situation that limited demand for Rover-delivered pet services.

Source: https://techcrunch.com/2021/02/16/inside-rover-and-moneylions-spac-led-public-debuts/

Efficient and cost-effective vaccine distribution remains one of the biggest challenges of 2021, so it’s no surprise that startup Notable Health wants to use their automation platform to help. Initially started to help address the nearly $250 billion annual administrative costs in healthcare, Notable Health launched in 2017 to use automation to replace time-consuming and repetitive simple tasks in health industry admin. In early January of this year, they announced plans to use that technology as a way to help manage vaccine distribution.

“As a physician, I saw firsthand that with any patient encounter, there are 90 steps or touchpoints that need to occur,” said Notable Health medical director Muthu Alagappan in an interview. “It’s our hypothesis that the vast majority of those points can be automated.”

Notable Health’s core technology is a platform that uses robotic process automation (RPA), natural language processing (NLP), and machine learning to find eligible patients for the COVID-19 vaccine. Combined with data provided by hospital systems’ electronic health records, the platform helps those qualified to receive the vaccine set up appointments and guides them to other relevant educational resources.

“By leveraging intelligent automation to identify, outreach, educate and triage patients, health systems can develop efficient and equitable vaccine distribution workflows,” said Notable Health strategic advisor and Biden Transition COVID-19 Advisory Board Member Dr. Ezekiel Emanuel, in a press release.

Making vaccine appointments has been especially difficult for older Americans, many of whom have reportedly struggled with navigating scheduling websites. Alagappan sees that as a design problem. “Technology often gets a bad reputation, because it’s hampered by the many bad technology experiences that are out there,” he said.

Instead, he thinks Notable Health has kept the user in mind through a more simplified approach, asking users only for basic and easy-to-remember information through a text message link. “It’s that emphasis on user-centric design that I think has allowed us to still have really good engagement rates even with older populations,” he said.

While the startup’s platform will likely help hospitals and health systems develop a more efficient approach to vaccinations, its use of RPA and NLP holds promise for future optimization in healthcare. Leaders of similar technology in other industries have already gone on to have multi-billion dollar valuations, and continue to attract investors’ interest.

Artificial intelligence is expected to grow in healthcare over the next several years, but Alagappan argues that combining that with other, more readily available intelligent technologies is also an important step towards improved care. “When we say intelligent automation, we’re really referring to the marriage of two concepts: artificial intelligence—which is knowing what to do—and robotic process automation—which is knowing how to do it,” he said. That dual approach is what he says allows Notable Health to bypass administrative bottlenecks in healthcare, instructing bots to carry out those tasks in an efficient and adaptable way.

So far, Notable Health has worked with several hospital systems across multiple states in using their platform for vaccine distribution and scheduling, and are now using the platform to reach out to tens of thousands of patients per day.

Tackling the learning curve that comes with building a startup is not for the faint of heart. So many questions, so little time to search out reliable, actionable advice. Enter TechCrunch Early Stage 2021 — two distinct, virtual bootcamps designed specifically for early-stage founders and open to entrepreneurs and startup enthusiasts.

Budget-friendly tips: TC Early Stage part one takes place April 1-2, and you have two weeks left to score the early bird price and save up to $250. Founder passes cost $199 and Innovator passes (for investors and other startup fans) cost $299. The early-bird deadline ends at 11:59 p.m. (PT) on February 27. Buy a dual-event pass to learn and save even more (TC Early Stage – Marketing and Fundraising runs July 8-9). The TC Early Stage April and July bootcamps feature different speakers, topics and content.

At TC Early Stage, you’ll take part in interactive sessions and learn from the leading experts and investors who span the range of the startup ecosystem — operations, product lifecycle, fundraising and recruiting for starters. Here are just two examples of the people ready to help you move your startup dreams forward.

Learn from folks like Alexa von Tobel as she leads a discussion on Finance for Founders. Got questions about raising Series A funding? Don’t miss Bucky Moore of Kleiner Perkins as he breaks down that complicated topic.

Ready for an awesome plot twist? We’re adding an exciting opportunity on day two of both TC Early Stage bootcamps — the TC Early Stage Pitch-Off. Ten early-stage startups will get to pitch live to a global audience of investors, press and tech industry leaders. That kind of exposure can change a startup’s trajectory in the best possible way.

You’ll find all the Pitch-off details here — how it works, who qualifies to compete, what competitors receive and the prizes in store for the ultimate winner. Or cut to the chase and apply for the April 2 pitch-off here before the clock hits 11:59 p.m. (PT) on February 21.

Whether you’re competing or watching, Katia Paramonova, founder and CEO of Centrly (who attended Early Stage 2020), says a pitch critique shows you ways to strengthen your pitch deck.

“The pitch deck teardown session was great. VCs reviewed my deck and gave specific, actionable advice. Watching them provide comments on other decks was helpful, too. We’re incorporating the feedback and when we start fundraising, the improved slides will make it easier for VCs to understand our value proposition.”

TC Early Stage Operations & Fundraising takes place on April 1-2. Don’t miss this opportunity to learn the essentials of building a stronger startup. And don’t miss out on early bird savings. Buy your pass (remember, you’ll save more and learn twice as much with a dual-event pass) before 11:59 p.m. (PT) on February 27.

Is your company interested in sponsoring or exhibiting at Early Stage 2021 — Operations & Fundraising? Contact our sponsorship sales team by filling out this form.

Source: https://techcrunch.com/2021/02/16/just-two-weeks-left-to-score-early-bird-passes-for-tc-early-stage/

While companies have embraced the offerings of software-as-a-service companies with growing vigor, getting those new offerings to work in a seamless way from the outset isn’t so easy, with some business customers feeling forgotten as soon as the digital ink dries.

Enter Onboard, a 10-month-old, startup that aims to help SaaS businesses delight those new customers instead of turning them off.

The company was cofounded by CEO Jeff Epstein, who previously launched the referral marketing and affiliate marketing software company Ambassador, which sold in 2018, eight years after it was founded.

Terms of the sale to West Corporation — now Intrado — were never disclosed, but Epstein says it was a “good outcome” for shareholders. (Ambassador was sold again last month to a small Seattle company.)

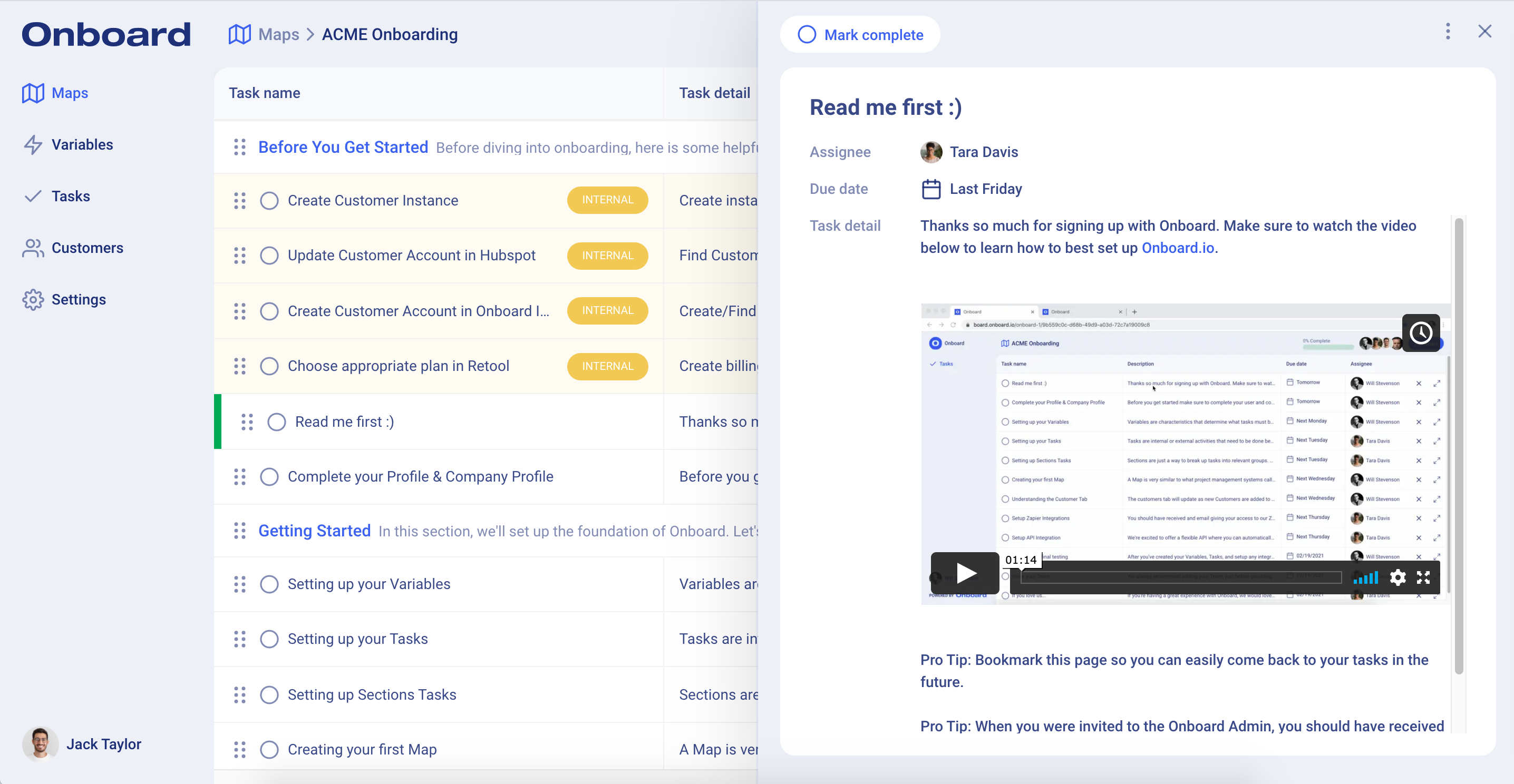

As for how Onboard works, Epstein makes the process sound straightforward. “You determine the variables of your customer segment, because different plan types might mean that companies need to do something different.” (They could use an API or some code snippet, for example.) After that, Onboard works with the SaaS company to create a global task list with requirements it has hopefully gleaned from the sales process, and helps it create a kind of dynamic, drop-down task list with assignees and due dates and alerts and notifications.

It’s largely a self-service product that makes accountability more transparent, ultimately, though Epstein describes the onboarding process as a “shared responsibility” between his company and its customers. He also says his nascent startup is already working on building out a more sophisticated notification layer with automated nudges that are helpful yet not obnoxious.

The five-person company is not charging its dozens of beta customers right now. It wants to get the product right before it shifts into revenue gear, says Epstein. The plan eventually is to charge the types of customers it is chasing — mid-size companies — hundreds of dollars of month, plus a per-person-per-month fee. (“We don’t plan on being enterprise-y in any way,” says Epstein of the company’s plan to eschew long contracts.)

Onboard is not without competitors. On the contrary, a lot of upstarts have sprung up around this problematic slice of the enterprise universe. That it’s an aggravating period for many new customers was brought to Epstein’s attention by one of his cofounders, William Stevenson, who spent four years as Ambassador’s VP of customer success, where like a lot of people in his position at other companies, he was trying to make do with a less-than-ideal patchwork of offerings, sometimes from Monday or Asana or Basecamp or Google Docs.

It was the same problem that Jonathon Triest of Ludlow Ventures — whose firm quietly led a $1.25 million seed round for Onboard in late summer, joined by Zelkova Ventures and Detroit Venture Partners — says he know well.

“Over and over again, throughout our portfolio, especially in B2B SaaS sales,” Ludlow says, he has heard about companies “forced to piece together solutions or use tools not made for them.”

The question is whether Onboard can gain a foothold faster than some of its other rivals, and unsurprisingly, Epstein believes his team has what it takes to get started. (A third founder, Matt Majewski, more recently left Ambassador to help the company gain momentum.)

Epstein’s resume is helping, too, he says. As a founder in Detroit who sold a company, he’s known to local investors and then some. (“We were able to be a big fish in a small pond,” he says.)

Epstein also says that investors realize there’s “an opportunity generally in the space,” adding that “partners [from venture firms] have been calling– not associates — and they are coming through third-party connections on LinkedIn in some cases.”

He has “obviously raised a bit of money” in the past, Epstein says, but he hasn’t seen anything quite like this before. “It’s weird,” he adds, “but cool.”