& meet dozens of singles today!

User blogs

In 2017, Ironclad founder and CEO Jason Boehmig was looking to raise a Series A. As a former lawyer, Boehmig had a specific process for fundraising and an ultimate goal of finding the right investors for his company.

Part of Boehmig’s process was to ask people in the San Francisco Bay Area about their favorite place to work. Many praised RelateIQ, a company founded by Steve Loughlin who had sold it to Salesforce for $390 million and was brand new to venture at the time.

“I wanted to meet Steve and had kind of put two and two together,” said Boehmig. “I was like, ‘There’s this founder I’ve been meaning to connect with anyways, just to pick his brain, about how to build a great company, and he also just became an investor.'”

On this week’s Extra Crunch Live, the duo discussed how the Ironclad pitch excited Loughlin about leading the round. (So excited, in fact, he signed paperwork in the hospital on the same day his child was born.) They also discussed how they’ve managed to build trust by working through disagreements and the challenges of pricing and packaging enterprise products.

As with every episode of Extra Crunch Live, they also gave feedback on pitch decks submitted by the audience. (If you’d like to see your deck featured on a future episode, send it to us using this form.)

We record Extra Crunch Live every Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. You can see our past episodes here and check out the March slate right here.

Episode breakdown:

- The pitch — 2:30

- How they operate — 23:00

- The problem of pricing — 29:00

- Pitch deck teardown — 35:00

The pitch

When Boehmig came in to pitch Accel, Loughlin remembers feeling ambivalent. He had heard about the company and knew a former lawyer was coming in to pitch a legal tech company. He also trusted the reference who had introduced him to Boehmig, and thought, “I’ll take the meeting.”

Then, Boehmig dove into the pitch. The company had about a dozen customers that were excited about the product, and a few who were expanding use of the product across the organization, but it wasn’t until the ultimate vision of Ironclad was teased that Loughlin perked up.

Loughlin realized that the contract can be seen as a core object that could be used to collaborate horizontally across the enterprise.

“That was when the lightbulb went off and I realized this is actually much bigger,” said Loughlin. “This is not a legal tech company. This is core horizontal enterprise collaboration in one of the areas that has not been solved yet, where there is no great software yet for legal departments to collaborate with their counterparts.”

He listed all the software that those same counterparts had to let them collaborate: Salesforce, Marketo, Zendesk. Any investor would be excited to hear that a potential portfolio company could match the likes of those behemoths. Loughlin was hooked.

“There was a slide that I’m guessing Jason didn’t think much of, as it was just the data around the business, but I got pretty excited about it,” said Loughlin. “It said, for every legal user Ironclad added, they added nine other users from departments like sales, marketing, customer service, etc. It was evidence that this theory of collaboration could be true at scale.”

WhatsApp said earlier this week that it will allow users to review its planned privacy update at “their own pace” and will display a banner to better explain them the changes in its terms. But what happens to its users who do not accept the terms by the May 15 deadline?

In an email to one of its merchant partners, reviewed by TechCrunch, Facebook-owned WhatsApp said it will “slowly ask” such users to comply with the new terms “in order to have full functionality of WhatsApp” starting May 15.

If they still don’t accept the terms, “for a short time, these users will be able to receive calls and notifications, but will not be able to read or send messages from the app,” the company added in the note. The company confirmed to TechCrunch that the note accurately characterizes its plan.

The “short time” will span a few weeks. In the note, WhatsApp linked to a newly created FAQ page that says its policy related to inactive users will apply after May 15.

WhatsApp’s policy for inactive users states that accounts are “generally deleted after 120 days of inactivity.”

The instant messaging service received backlash from some of its users — including those in India, its biggest market — last month after an in-app alert said they had until February 8 to agree to the planned privacy terms, which are being made to reflect its recent push into e-commerce, if they wished to continue using the service.

Following backlash, WhatsApp said its planned privacy update had created confusion among some of its users. “We’ve heard from so many people how much confusion there is around our recent update. There’s been a lot of misinformation causing concern and we want to help everyone understand our principles and the facts,” it wrote in a blog post last month.

Since 2016, WhatsApp’s privacy policies have granted the service permission to share certain metadata such as user phone numbers and device information with Facebook. The new terms will allow Facebook and WhatsApp to share payments and transactions data in order to help them better target ads as the social juggernaut broadens its e-commerce offerings and looks to merge its messaging platforms.

WhatsApp, used by over 2 billion users, last month delayed enforcing the new policy by three months and has been explaining its terms to users ever since — though its explanations hadn’t explicitly addressed what it planned to do with users who didn’t accept the terms.

Brex is the latest fintech to apply for a bank charter.

The fast-growing company, which sells a credit card tailored for startups with Emigrant Bank currently acting as the issuer, announced Friday that it has submitted an application with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI) to establish Brex Bank.

The industrial bank will be located in Draper, Utah, and be a wholly owned subsidiary of Brex.

The company has tapped former Silicon Valley Bank (SVB) exec Bruce Wallace to serve as the subsidiary’s CEO. He served in several roles at SVB, including COO, chief digital officer and head of global services. It also has named Jean Perschon, the former CFO for UBS Bank USA, to be the Brex Bank CFO.

Last May, Brex announced that it had raised $150 million in a Series C extension from a group of existing investors, including DST Global and Lone Pine Capital.

With that raise, Brex, which was co-founded by Henrique Dubugras and Pedro Franceschi, had amassed $465 million in venture capital funding to date.

The company said in a statement today that “Brex Bank will expand upon its existing suite of financial products and business software, offering credit solutions and FDIC insured deposit products to small and medium-sized businesses (SMBs).”

Offering credit products to small businesses has become a popular product offering and source of revenue for tech companies serving entrepreneurs, including Shopify and Square in the commerce arena. Likewise, offering business-focused bank accounts, like Shopify Balance, which is currently in development with a plan to launch sometime this year in the U.S.

These financial products can provide additional opportunities for revenue on interest and cost of borrowing for these companies, which might have better insight into the risk profiles of the types of businesses they serve than traditional lenders and FIs.

“Brex and Brex Bank will work in tandem to help SMBs grow to realize their full potential,” said Wallace.

Brex is based in San Francisco and counts Kleiner Perkins Growth, YC Continuity Fund, Greenoaks Capital, Ribbit Capital, IVP and DST Global, as well as Peter Thiel and Affirm CEO Max Levchin, among its investors. It currently has over 400 employees, and though it had significant layoffs mid-year in 2020, it cited restructuring rather than financial difficulty as the cause of that downsize.

Other fintechs that have made moves toward bank charters include Varo Bank, which this week raised another $63 million, and SoFi, which last October was granted preliminary approval for a national bank charter.

Austin is known for its usually mild winters. But on February 12, a winter storm hit the state — leading to over a week of freezing temperatures. This has resulted in a statewide disaster with millions of Texas residents losing power or water, or both.

It’s too early to tell the exact toll this has all taken in loss of life, property damage and economic activity. But it’s clear that this disaster is, and will continue to be, devastating on many levels. Austin-area hospitals even lost water this week, as an indication of how bad things have been.

Since last Thursday, my own household lost power and got it back multiple times. On February 17, we lost water, with no idea of when it will be restored. I realize there are many worse off than me, so I’ll spare you the pity party, but it’s definitely been a humbling experience. Boiling snow/ice for toilet water and rationing the little bottled water we had left with fear of frozen/bursting pipes. At least we have been warm the past couple of days, as many still don’t have power.

Meanwhile, over the past few months (and years, really), Austin has been making headlines for other news — namely the fact that so many tech companies, founders (ahem, Elon) and investors are either moving their headquarters here (Oracle), building significant factories (Tesla) or offices (Apple, Google, Facebook) here, or are thinking about relocating entirely.

The lack of state income taxes has been a big draw, as well as the housing/land/office prices that are affordable when compared to those in the Bay Area. This is nothing new, but only accelerated as the pandemic has encouraged/forced more remote work.

Ironically, some of the very things that have led to the state being more attractive to companies have also contributed to the crisis: Fewer taxes means less money for infrastructure, for one.

But it goes beyond that. Many other states have had freezing cold temperatures without the loss of power and water that Texas is currently experiencing. As The Washington Post reported earlier this week, the state’s choice to deregulate electricity led to “a financial structure for power generation that offers no incentives to power plant operators to prepare for winter. In the name of deregulation and free markets, critics say, Texas has created an electric grid that puts an emphasis on cheap prices over reliable service.”

Even Elon shared his disappointment on Twitter:

.@ERCOT_ISO is not earning that R

— Elon Musk (@elonmusk) February 17, 2021

It’s fair to say Texas has attracted widespread criticism of its handling of this new crisis — both in terms of its lack of preparation and mismanagement (Sen. Cruz, we’re looking at you). But are the events of the past week going to take away some of the shine on Austin as a potential relocation destination for tech and investors? Will this deter people from wanting to move here? Isn’t it also ironic that some folks who didn’t want to move here due to the scorching summer temperatures are now also slamming the city/state for the impacts of a major winter storm?

So I did what many other enterprising tech reporters might do in this situation, and took to Twitter. The results were pretty much as expected — varied and passionate on either side.

There were many tweets from Austinites who defended their city and praised how its residents have come together during crises:

If I've learned one thing in my years and different places, it's that three types of people:

1. Those who live there and don't like change

2. Those who love there and support what it might be

3. Those who just are thereAnd now some don't want to move to Texas because weather?

— Paul O'Brien (@seobrien) February 19, 2021

There's lots of shit on Twitter, and most of it is just that: shit.

Anecdotes from Twitter profiles of dubious authenticity are worth about as much as an endorsement today from the junior U.S. senator from Texas.

Trust stat-sig data.

Like it or not, Austin, TX is a boom town.

— Dan Driscoll (@dbdriscoll) February 19, 2021

This was a once every 100 years event. I grew up here and hae never seen anything like it.

Anybody who refuses to move somewhere because of a single event probably wouldn't stick around anyways.

— Ⓐ®Ⓛ⓪ (@arlogilbert) February 18, 2021

What I saw here in Austin was community coming together

Neighbors helping each other. Taking in friends and strangers. Local restaurants stepping up, even after a year of a pandemic crisis.

I’ve lived here my entire life, it’s the community that makes it great, always will

— Mark Magnuson (@MarkMagnuson) February 19, 2021

Then there were some tweets from people who lived here but are disgusted and disappointed:

I live here and am 100% considering leaving

— shelby (@shelbymichellle) February 18, 2021

I hope businesses put pressure on politicians to ensure that the infrastructure of TX is sound. The lost productivity over the last several days and potentially into the future is huge, not to mention the lost of life and trauma. (Oh & our offices flooded due to a main break.)

— Kate Moon

(@Katemooooon) February 19, 2021

I was wondering how existing infrastructure & water resources would be able to sustain more people in the best of times. Now we're seeing how fragile the system is after years of underinvestment, new residents are right to question the sustainability, but new voices will help.

— Ruth Glendinning (@GuRuth) February 19, 2021

There were also some tweets from others who said they were so turned off they’d never contemplate moving to Texas or that they were dismayed by the lack of preparation:

Startups & Tech don’t want to have to build out their own utilities in addition to the rest of their infrastructure. Until Texas solves this energy incompetence they will take a pass.

— Clayton Slaughter (@schmubba) February 19, 2021

I’m not a founder, but I chose to move from SF to Portland, OR rather than Austin precisely BECAUSE Austin (the great city that it is) is located in the state of Texas.

— Debra J. Farber (@privacyguru) February 18, 2021

I grew up in Texas (Houston) and I’d never move back.

Too hot, too many disasters, too much driving everywhere. I can make my own damn brisket.

— Andrew Kemendo (@AndrewKemendo) February 19, 2021

I’m kind of out of that now but the failure to weathering, which is pretty cheap, doesn’t say either of “vision “ or “disciplined management.” Partners need at least one of those traits usually

— tim mullaney (@timmullaney) February 19, 2021

Good luck getting me to move to any startup city in a state run by people who deny climate change and see oversight of vital infrastructure as a burden.

— Charlie O'Donnell (@ceonyc) February 17, 2021

And there were those who don’t live here but scoffed at the notion that this was enough to keep people away, while others pointed out that natural disasters happen all over:

Seems silly. The Midwest has cold and tornados. The south east is hot-humid and has hurricanes. California has earthquakes and is always on fire.

— Joseph Bella (@jbella) February 19, 2021

I’m from outside Texas but we experienced rolling outages due to power share agreements (and I used to live in ATX)— it’s really just such a rare event that it makes sense to me that the state wouldn’t be prepared for it.

—

Craig Inzana (@craiginzana) February 19, 2021

Then there were those who joked that the disaster was engineered as a ploy to “keep California people away,” or at least might have that effect:

It was all a ploy to stop everyone from California moving here. Trying to #Texas a no-income tax state.

— Lance Roberts (@LanceRoberts) February 19, 2021

A lot of folks in Austin hope this will stop the flood of California people.

— dcornish (@dcornish) February 19, 2021

I have lived on all three coasts — East, West and Gulf. There are pluses and minuses to each. This likely is enough of a deterrent to keep people away. But I will say that the state could — and should — have been more prepared when it decided to deregulate electricity. I am heartbroken at all the suffering people in the city and state are dealing with and for now, just want to see things get back to “normal” as soon as possible so the only crisis we’re dealing with is the COVID-19 pandemic. Never thought we’d look back fondly on those days.

Here’s to hoping that migration of techies can build solutions that could maybe help prevent similar disasters in the future.

Source: https://techcrunch.com/2021/02/19/will-the-texas-winter-disaster-deter-further-tech-migration/

The last year has been one of financial hardship for billions, and among the specific hardships is the elementary one of paying for utilities, taxes and other government fees — the systems for which are rarely set up for easy or flexible payment. Promise aims to change that by integrating with official payment systems and offering more forgiving terms for fees and debts people can’t handle all at once, and has raised $20 million to do so.

When every penny is going toward rent and food, it can be hard to muster the cash to pay an irregular bill like water or electricity. They’re less likely to be shut off on short notice than a mobile plan, so it’s safer to kick the can down the road… until a few bills add up and suddenly a family is looking at hundreds of dollars of unpaid bills and no way to split them up or pay over time. Same with tickets and other fees and fines.

The CEO and co-founder of Promise, Phaedra Ellis-Lamkins, explained that this (among other places) is where current systems fall down. Unlike buying a TV or piece of furniture, where payment plans may be offered in a single click during online checkout, there frequently is no such option for municipal ticket payment sites or utilities.

“We have found that people struggling to pay their bills want to pay and will pay at extremely high rates if you offer them reminders, accessible payment options and flexibility. The systems are the problem — they are not designed for people who don’t always have a surplus of money in their bank accounts,” she told TechCrunch.

“They assume for example that if someone makes their first payment at 10 PM on the 15th, they will have the same amount of money the next month on the 15th at 10 PM,” she continued. “These systems do not recognize that most people are struggling with their basic needs. Payments may need to be weekly or split up into multiple payment types.”

Even those that do offer plans still see many failures to pay, due at least partly to a lack of flexibility on their part, said Ellis-Lamkins — failure to make a payment can lead to the whole plan being cancelled. Furthermore, it may be difficult to get enrolled in the first place.

“Some cities offer payment plans but you have to go in person to sign up, complete a multiple-page form, show proof of income and meet restrictive criteria,” she said. “We have been able to work with our partners to use self-certification to ease the process as opposed to providing tax returns or other documentation. Currently, we have over a 90% repayment rate.”

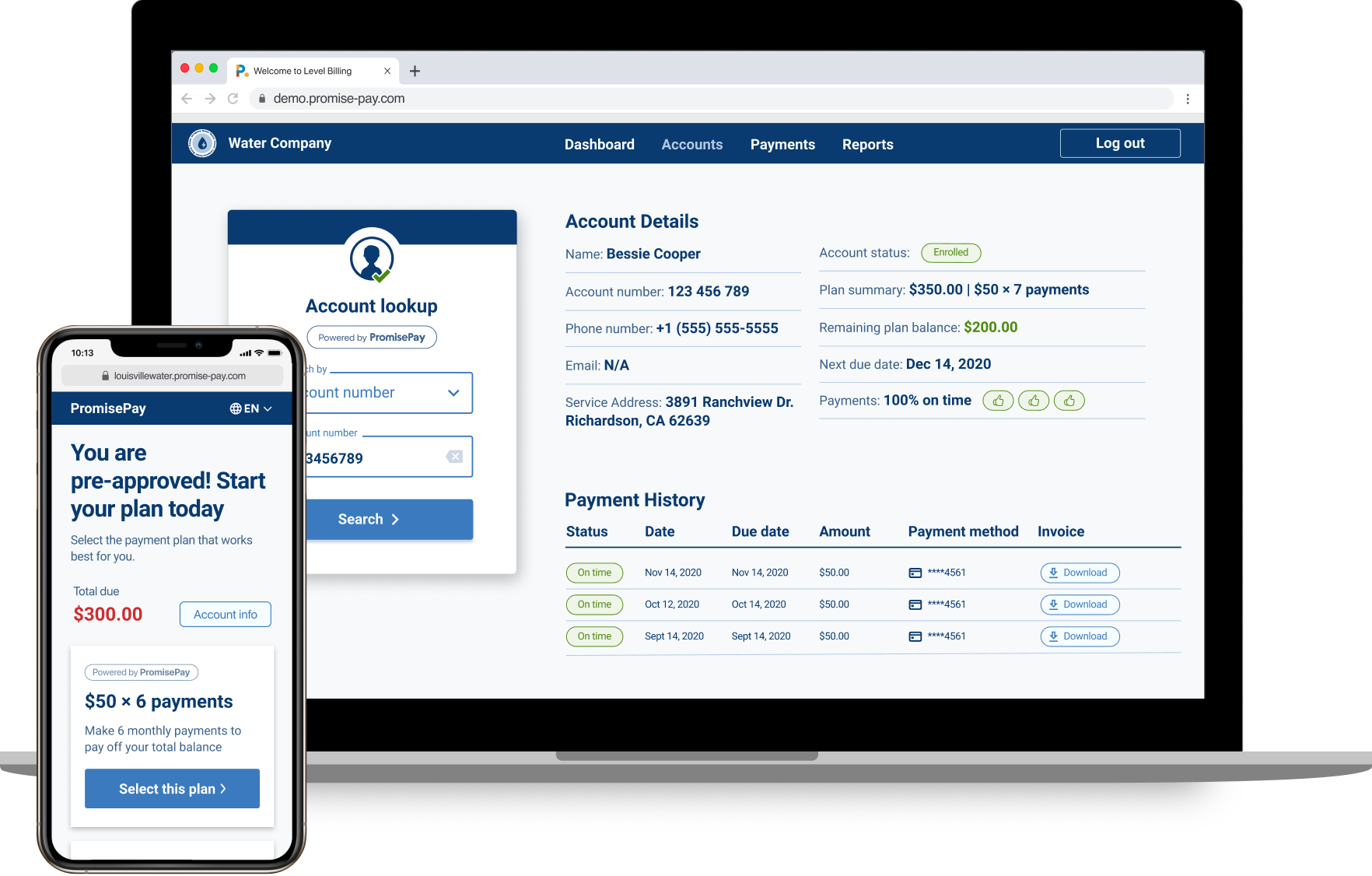

Promise acts as a sort of middleman, integrating lightly with the agency or utility, which in turn makes anyone owing money aware of the possibility of the different payment system. It’s similar to how you might see various payment options, including installments, when making a purchase at an online shop.

The user enrolls in a payment plan (the service is mobile-friendly because that’s the only form of internet many people have) and Promise handles that end of it, with reminders, receipts and processing, passing on the money to the agency as it comes in — the company doesn’t cover the cost up front and collect on its own terms. Essentially it’s a bolt-on flexible payment mechanism that specializes in government agencies and other public-facing fee collectors.

Promise makes money by subscription fees (i.e. SaaS) and/or through transaction fees, whichever makes more sense for the given customer. As you might imagine, it makes more sense for a utility to pay a couple bucks to be more sure of collecting $500, than to take its chance on getting none of that $500, or having to resort to more heavy-handed and expensive debt collection methods.

Lest you think this is not a big problem (and consequently not a big market), Ellis-Lamkins noted a recent study from the California Water Boards showing there are 1.6 million people with a total of $1 billion in water debt in the state — one in eight households is in arrears to an average of $500.

Those numbers are likely worse than normal, given the immense financial pressure that the pandemic has placed on nearly all households — but like payment plans in other circumstances, households of many incomes and types find their own reason to take advantage of such systems. And pretty much anyone who’s had to deal with an obtusely designed utility payment site would welcome an alternative.

The new round brings the company’s total raised to over $30 million, counting $10 million it raised immediately after leaving Y Combinator in 2018. The funding comes from existing investors Kapor Capital, XYZ, Bronze, First Round, YC, Village, and others.