& meet dozens of singles today!

User blogs

Splice, the New York-based, AI-infused, beat-making software service for music producers created by the founder of GroupMe, has managed to sample another $55 million in financing from investors for its wildly popular service.

The github for music producers ranging from Hook N Sling, Mr Hudson, SLY, and Steve Solomon to TechCrunch’s own Megan Rose Dickey, Splice gained a following for its ability to help electronic dance music creators save, share, collaborate and remix music.

The company’s popularity has made it from bedroom djs to the Goldman Sachs boardroom as the financial services giant joined MUSIC, a joint venture between the music executive Matt Pincus and boutique financial services firm, Liontree, in leading the company’s latest $55 million round. The company’s previous investors include USV, True Ventures, DFJ Growth, and Flybridge.

“The music creation process is going through a digital transformation. Artists are flocking to solutions that offer a user-friendly, collaborative, and affordable platform for music creation,” said Stephen Kerns, a VP with Goldman Sachs’ GS Growth, in a statement. “With 4 million users, Splice is at the forefront of this transformation and is beloved by the creator community. We’re thrilled to be partnering with Steve Martocci and his team at Splice.”

Splice’s financing follows an incredibly acquisitive 2020 for the company, which saw it acquiring music technology companies Audiaire and Superpowered.

In addition to the financing, Splice also nabbed Kakul Srivastava, the vice president of Adobe Creative Cloud Experience and Engagement as a director for its board.

The funding news comes on the heels of Splice’s recent acquisitions of music-tech companies Audiaire and Superpowered, creating more ways to improve and inspire the audio and music-making process. Splice is also pleased to announce that Kakul Srivastava has joined the company’s board.

Steve Martocci at TechCrunch Disrupt in 2016. Image Credits: Getty Images

Splice’s beefed up balance sheet comes as new entrants have started vying for a slice of Splice’s music-making market. These are companies like hardware maker Native Instruments, which launched the Sounds.com marketplace last year, and there’s also Arcade by Output that’s pitching a similar service.

Meanwhile Splice continues to invest in new technology to make producers’ lives easier. In November 2019 it unveiled its artificial intelligence product that lets producers match samples from different genres using machine learning techniques to find the matches.

“My job is to keep as many people inspired to create as possible” Splice founder and chief executive, Steve Martocci told TechCrunch.

It’s another win for the serial entrepreneur who famously sold his TechCrunch Disrupt Hackathon chat app Group.Me to Skype for $85 million just a year after launching.

Mere days after we discussed Coinbase at $77 billion and Stripe at $115 billion in the private markets, those same semi-liquid exchanges have provided a new valuation for the cryptocurrency company. It’s now $100 billion, per Axios’ reporting.

Good thing we argued last week that there could be some merit to Coinbase’s $77 billion secondary market valuation from a particular perspective. We’d look silly today if we’d mocked the $77 billion figure only for it to go up by about a third in just a few days.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Luckily for us, Axios also got its hands on a few numbers regarding Coinbase’s 2019 and 2020 financial performance, so we can get into all sorts of trouble this morning. We’ll look at the data, which stretches to the end of Q3 2020, and then do some creative extrapolating into Q1 2021 to decide whether Coinbase at $100 billion makes no sense, a little sense or perfect sense.

As always, we’re riffing, not giving investment advice. So read on if you want to noodle on Coinbase with me; its impending direct listing will be one of the year’s most-watched financial events.

We’ll drag Stripe back in at the end. Given that the companies now nearly share private-market valuations, we’d be remiss to not unfairly stack them against one another. Into the breach!

Coinbase @ $100B

Axios’ Dan Primack, a good egg in my experience, got the goods on Coinbase’s historical performance. Summarizing the bits we need, here’s what the crypto exchange got up to recently:

- Coinbase 2019: $530 million in revenues, $30 million in net losses

- Coinbase 2020 Q1-Q3: $691 million in revenues, $141 million in net income

It’s simple to take the 2020 data that we have and extrapolate it into full-year data. Indeed, you get revenues of $921.33 million and net income of $188 million. Compared to its 2019 data, Coinbase would have managed around 74% growth while swinging steeply into the profitable domain.

That’s a killer year. But it’s actually a bit better than we are giving Coinbase credit for. Poking around volume data compiled by Bitcoinity.org, Coinbase had its biggest period of 2020 in terms of bitcoin trading volume in the fourth quarter. Thinking about Coinbase’s 2020 from a trading perspective using the same dataset, it had a great Q1, more staid Qs 2 and 3, and a blockbuster Q4 that ramped to record highs at the end.

A new market forecast predicts app spending will reach $270 billion by the year 2025, including paid downloads, in-app purchases, and subscriptions. According to data from Sensor Tower, in-app spending will return to pre-pandemic levels of stable growth over the next few years, downloads will continue to grow, and, perhaps most notably, it’s predicting app store spending in non-game apps will overtake mobile game spending by 2024.

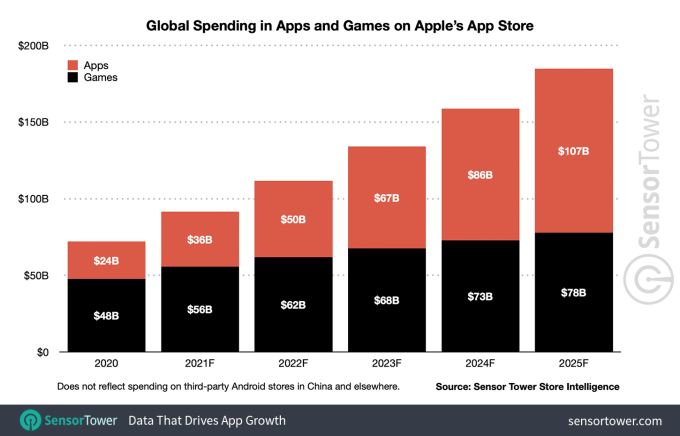

This is a big bet, given that, today, consumers spend twice as much on mobile games than on non-games. The firm, however, believes the subscription model now being adopted by a range of mobile apps will cause a shift in the market. By 2024, it expects non-game spending to reach $86 billion compared with $73 billion in game spending. And by 2025, that gap will widen, with non-games reaching $107 billion while mobile games reach $78 billion.

Image Credits: Sensor Tower

Last year, global consumer spending in the top 100 subscription apps was up by 34%, year-over-year, to give you an idea of the current state of the market. But there were already some indications that subscription growth was being impacted by larger apps, like Netflix and Tinder, which found workarounds to in-app purchases.

What Sensor Tower also can’t predict is how the regulatory environment of the next several years will play out across the app stores. Today, companies like Apple and Google require apps to charge customers for subscriptions via Google and Apple’s own payment mechanisms. But new anti-competition laws could be enacted that would allow publishers to market their own subscriptions inside their apps, which then redirect users to their own channels to make those purchases. Such a change would have an outsized impact on app store subscription growth trends, and, therefore, this forecast.

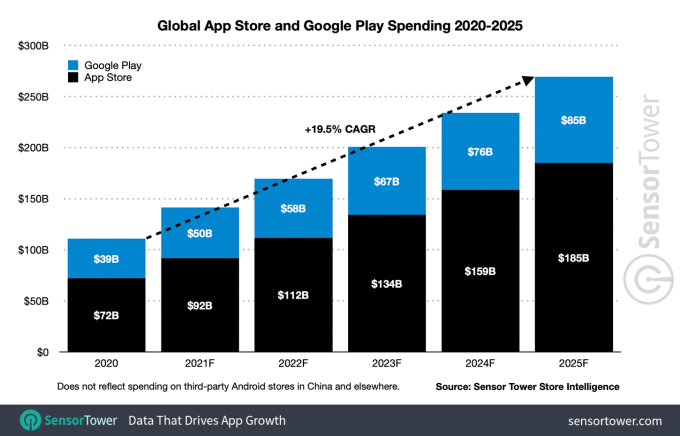

Though the pandemic pushed in-app spending up by 30% year-over-year to a record $111 billion in 2020, the new forecast predicts general in-app spending will return to pre-COVID levels over the next five years. It says gross revenue across both app stores will climb each year with a 19.5% compound annual growth rate (CAGR) to reach $270 billion by 2025. Of that figure, $185 billion will be App Store spending, versus $85 billion on Google Play.

Image Credits: Sensor Tower

The U.S. will grow slightly slower than the rest of the global market, with a CAGR of 17.7% to reach $74 billion by 2025.

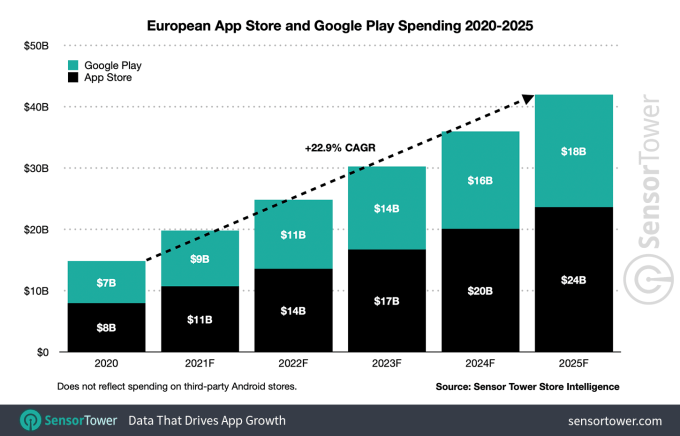

European markets will drive growth in app store spending from 2020 through 2025, led by the U.K. This not the equivalent to which markets see the most spending in total, but rather is about where growth is taking place — in other words, opportunity for app makers. By 2025, 11 European countries will pass the $1 billion in consumer spending milestone, to collectively reach $42 billion in consumer spend.

Image Credits: Sensor Tower

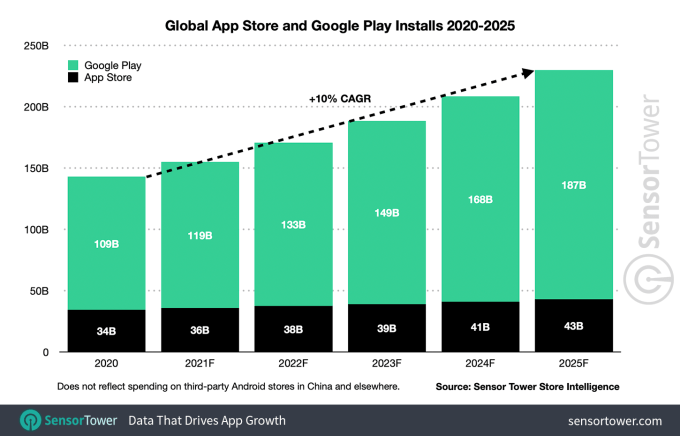

Downloads, meanwhile, will continue to grow over the next several years, to reach 230 billion by 2025, the forecast predicts, with Google Play accounting for a majority of that figure, with 187 billion global downloads. In the U.S., however, App Store downloads in 2025 (10.6B) will top those from Google Play (6.3B), the report concludes.

Image Credits: Sensor Tower

Source: https://techcrunch.com/2021/02/22/app-spending-to-reach-270b-by-2025-new-forecast-predicts/

TechCrunch is embarking on a major project to survey the venture capital investors of Europe, and their cities.

Our survey of VCs in Oslo and Norway will capture how the country is faring, and what changes are being wrought amongst investors by the coronavirus pandemic.

We’d like to know how Norway’s startup scene is evolving, how the tech sector is being impacted by COVID-19, and, generally, how your thinking will evolve from here.

Our survey will only be about investors, and only the contributions of VC investors will be included. More than one partner is welcome to fill out the survey. (Please note, if you have filled the survey out already, there is no need to do it again).

The shortlist of questions will require only brief responses, but the more you can add, the better.

You can fill out the survey here.

Obviously, investors who contribute will be featured in the final surveys, with links to their companies and profiles.

What kinds of things do we want to know? Questions include: Which trends are you most excited by? What startup do you wish someone would create? Where are the overlooked opportunities? What are you looking for in your next investment, in general? How is your local ecosystem going? And how has COVID-19 impacted your investment strategy?

This survey is part of a broader series of surveys we’re doing to help founders find the right investors.

https://techcrunch.com/extra-crunch/investor-surveys/

For example, here is the recent survey of London.

You are not in Norway, but would like to take part? That’s fine! Any European VC investor can STILL fill out the survey, as we probably will be putting a call out to your country next anyway! And we will use the data for future surveys on vertical topics.

The survey is covering almost every country on in the Union for the Mediterranean, so just look for your country and city on the survey and please participate (if you’re a venture capital investor).

Thank you for participating. If you have questions you can email mike@techcrunch.com

(Please note: Filling out the survey is not a guarantee of inclusion in the final published piece).

I’ve piloted Spot a number of ways in a number of different settings. I had the chance to control the robot for the first time at one of our Robotics events a number of years back, and drove one around an obstacle course at Boston Dynamics’ headquarters. More recently, I navigated it via web browser as a test of the robot’s new remote interface.

But a recent test drive was different. For one thing, it wasn’t officially sanctioned by Boston Dynamics. Of course, the highly sophisticated quadrupedal robot has been out in the world for a while, and a few enterprising souls have begun to offer a remote Spot walking experience through the streets of San Francisco.

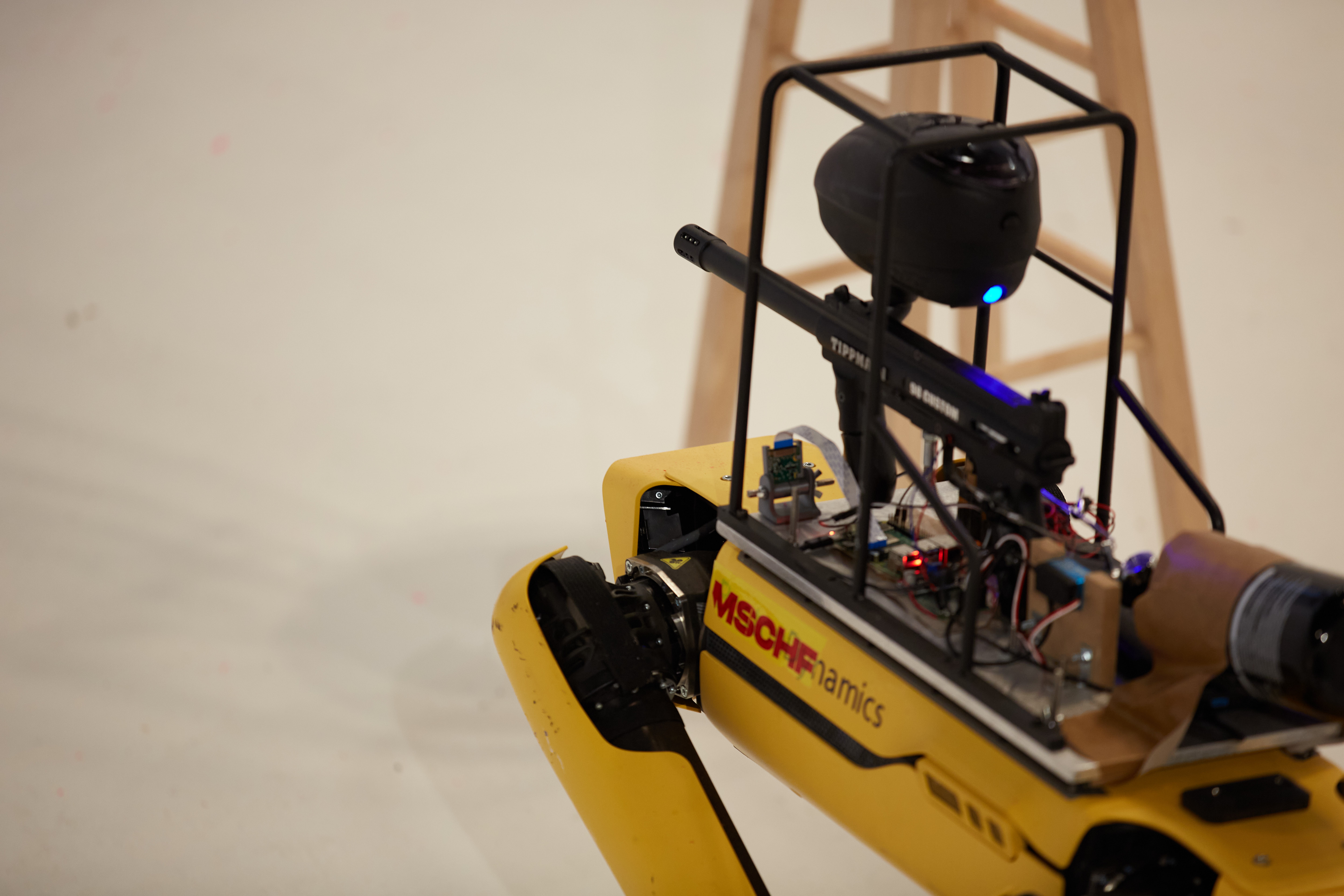

The latest project form MSCHF isn’t that. That should come as no surprise, of course. The Brooklyn-based company is never that straightforward. It’s the same organization that gave us the “pirate radio” streaming service All The Streams.FM and that wild Amazon Echo ultrasonic jammer. More than anything, their events are comments — on privacy, on consumerism or this case, a kind of dystopian foreshadowing of what robotics might become.

Like the rest of the world, the company was fascinated when Boston Dynamics put Spot up for sale — but unlike most of us, MSCHF actually managed to cobble together $75,000 to buy one.

And then it mounted a paintball gun to its back.

Image Credits: MSCHF

Starting Wednesday, users will be able to pilot a Spot unit through MSCHF’s site, and fire off a paintball gun in a closed setting. The company calls it “Spot’s Rampage.”

“The stream will start Wednesday at 1 PM EST,” MSCHF’s Daniel Greenberg told TechCrunch. “We will have a four-camera livestream going and as long as you’re on the site on your phone, you will have an equal chance of being able to control Spot, and every two minutes the driver will change. It should go for a few hours.”

Ahead of the launch of Spot’s web portal, the company built an API to remotely control both Spot’s SDK and the paintball gun mounted to the robot’s back. It’s a setup Boston Dynamics isn’t particularly thrilled with. Understandably so. For a company that has long been dealing with the blowback of cautionary science fiction like Black Mirror, the optics of a third-party mounting a gun — even one that shoots paint — are less than ideal.

Boston Dynamics tells TechCrunch that it was interested in working with the company early on.

“They came to us with the idea that they were going to do a creative project with Spot,” a rep told TechCrunch. “They’re a creative group of guys, who have done a bunch of creative things. In our conversations, we said that if you want to cooperate with us, we want to make it clear that the robots will not be used in any way that hurts people.”

Boston Dynamics balked when paintball gun entered the conversation. On Friday, it issued the following statement through Twitter:

Today we learned that an art group is planning a spectacle to draw attention to a provocative use of our industrial robot, Spot. To be clear, we condemn the portrayal of our technology in any way that promotes violence, harm, or intimidation. Our mission is to create and deliver surprisingly capable robots that inspire, delight & positively impact society. We take great care to make sure our customers intend to use our robots for legal uses. We cross-check every purchase request against the U.S. Government’s denied persons and entities lists, prior to authorizing a sale.

In addition, all buyers must agree to our Terms and Conditions of Sale, which state that our products must be used in compliance with the law, and cannot be used to harm or intimidate people or animals. Any violation of our Terms of Sale will automatically void the product’s warranty and prevent the robot from being updated, serviced, repaired or replaced. Provocative art can help push useful dialogue about the role of technology in our daily lives. This art, however, fundamentally misrepresents Spot and how it is being used to benefit our daily lives.

The statement is in line with the language in Spot’s contract, which prohibits using the robot to do anything illegal, or to intimidate or harm people. The company says it does additional “due diligence” with potential customers, including background checks.

Image Credits: MSCHF

The application is something of a gray area where Boston Dynamics is concerned. MSCHF approached the robotics company with its idea and Boston Dynamics balked, believing it wasn’t in-line with the stated mission for the quadrupedal robots. The official Spot’s Rampage site notes:

We talked with Boston Dynamics and they HATED [emphasis theirs] this idea. They said they would give us another TWO Spots for FREE if we took the gun off. That just made us want to do this even more and if our Spot stops working just know they have a backdoor override built into each and every one of these little robots.

Boston Dynamics says the company’s “understanding of the interaction” is “inaccurate.”

“We get approached by marketing opportunities all the time to create a really fantastic and compelling experience,” the company adds. “Selling one robot is not that interesting. Creating an amazing interactive experience is really compelling for us. One of the things they pitched to us was an interactive idea. It’s an expensive robot and they wanted to create an interactive experience where anybody can control the robot. We thought that was super cool and compelling.”

Boston Dynamics says it pitched the idea of using Spot’s robot arm to paint the physical space with a brush, rather than using the paintball gun. The company also offered to send technicians to the site to help maintain the robot during the stream, along with a few models as back up.

MSCHF’s inclusion of the paintball gun is, ultimately, about more than simply painting the canvas. The image of the robot with a gun — even one that only shoots paint — is menacing. And that’s kind of the point.

“It’s easy to look at these robots dance and cavort and see them as cute semi-sentient little friends,” says Greenberg. “They’re endearing when they mess up and fall over. We’ve adopted the trappings of that scenario by creating a ‘bull-in-a-china-shop’ scenario. Still, it’s worth remembering the big versions of Spot [Big Dog] were explicitly military mules, and that their public deployments tend to be by city agencies and law enforcement. At the end of the day, Spot is a terrestrial UAV – when you get to drive this robot and experience the thrill of pulling the trigger your adrenaline spikes — but, we hope, a few minutes later you feel a distinct chill. Anyone in their right mind knows these little cuties will kill people sooner or later.”

While early Boston Dynamics robots were, indeed, funded by DARPA for use as transport vehicles, the company is quick to distance itself from even the remotest hint of ominous imagery. Boston Dynamics came under fire from the ACLU after showcasing footage of a Spot being used in Massachusetts State police drills onstage at a TechCrunch robotics event.

Image Credits: MSCHF

The company told TechCrunch at the time:

Right now we’re at a scale where we can pick and choose the partners we engage with and make sure that they have a similar deployment and a vision for how robots are used. For example, not using robots in a way that would physically harm or intimidate people. But also have a realistic expectation for what a robot can and cannot do.

As MSCHF prepares to launch its event, the company is echoing those sentiments.

“I turned down a customer that wanted to use Spot for a haunted house,” Boston Dynamics tells TechCrunch. “Even putting it in that context of using our technology to scare people was not within our terms of use and not how we imagined the product being beneficial for people, and so we declined that initial sale. Had this concept been brought to us while we were in the initial sales discussions, we probably would have said, ‘there’s Arduino quadruped that you could easily put this activation together. Go do that. This isn’t representative of how we view our technology being used.’ ”

Image Credits: MSCHF

But the question of whether the company can put the toothpaste back in the tube remains. In cases of violations of the Terms of Service, the company can opt not to renew the license, which effectively deactivates it the next time a firmware update is due. Other cases could essentially void the warranty, meaning the company won’t service it.

A paintball gun being fired in a closed space likely doesn’t fall under harm, intimidation or illegal activity, however. So it’s not entirely clear whether Boston Dynamics has a direct course of action in this case.

“This is something we’re evaluating now, around this particular use case,” Boston Dynamics says. “We do have other terms of service in there, regarding modification of the robot in a way that makes it unsafe. We’re trying to understand what the implications are.”

Boston Dynamics (whose sale to Hyundai is expected to close in June) has devoted a good deal of time to showcasing the various tasks the robot can perform, from routine inspections at hazard sites to the complex dance moves it’s performed in a recent viral video. MSCHF’s primary — and, really, only — use is an interactive art piece.

“To be honest, we don’t have any further plans [for the robot],” says Greenberg. “I know we won’t do another drop with it as we do not do repeats so we will just have to get really creative. Maybe a waking cup holder.”

Source: https://techcrunch.com/2021/02/22/mschf-mounted-a-remote-control-paintball-gun-to-spot/