& meet dozens of singles today!

User blogs

A new VC fund, “2150“, is launching with the first close of a €200m ($240m) fund which will back technologies aimed largely at reducing the carbon footprint of cities. For example, startups that inject carbon into concrete, or monitor the energy of buildings. The final close is anticipated by mid-2021.

The advisory board for 2150 comprises the former chief sustainability officer in the Obama administration and renowned urbanist and academic, Richard Florida. 2150 is based around the idea that half of the world’s population lives in cities, and this will increase to two-thirds by 2050, creating a growing environmental impact that the world can ill-afford, given the climate crisis.

Based across London, Copenhagen and Berlin, the fund’s Limited Partners include a mix of institutional capital and family offices including Chr. Augustinus Fabrikker, Denmark’s Green Future Fund and Novo Holdings. 2150 says it has other LP partners who are building or managing “over 16 million square meters of real estate”, who will come in handy, kicking the tires on the efficacy of 2150 investments. The anchor funding has come from NREP, a sustainable real estate fund manager with a large Northern European footprint and platform.

The founding partners include Mikkel Bülow-Lehnsby, Chairman and co-founder of large real estate logistics company NREP; Jacob Bro, former Chief Product Officer at Rocket Internet; Christian Jølck, the founder and former Chairman of industry climate advocacy group SYNERGI; Christian Hernandez, former Facebook executive and VC; Nicole LeBlanc, formerly with Alphabet’s urban product incubator Sidewalk Labs; Rahul Parekh, founder of VC-backed foodtech startup EatFirst and former executive director at Goldman Sachs; and Alexandra Perez, who incubated and launched urban tech startups at Tech City Ventures.

2150 will focus on startups that can make cities more resilient, efficient and sustainable, investing in tech associated with the urban environment, materials, automation, and sensor-based monitoring to improve the health, safety, and productivity of building occupants. It says it will only invest where sustainability impact can be measured, aiming for a first portfolio of around 20 companies. Ticket sizes will be €4-5m series A for startups, but it will also invest in existing companies that want to expand.

Its first investment is in CarbonCure Technologies – a Canadian company lowering the CO2 footprint of concrete – in which 2150 participated in a funding round for last year, investing alongside Amazon’s Climate Pledge Fund, Bill Gates-backed Breakthrough Energy Ventures, and Microsoft’s Climate Innovation Fund. At present, concrete accounts for 8% of all global CO2 emissions

Speaking to TechCrunch, Hernandez said 2150 was particularly interested in what’s coming to be known as “ESG Analytics” or “Carbon Accounting”. In other words, platforms that can analyze the impact of developments for an ESG and CO2 perspective.

The other background data which inspired the creation of the fund includes the fact that two billion new homes will need to be built over the next 80 years ; cities consume over two-thirds of the world’s energy and account for more than 70% of global CO2 emissions; 13% of global GDP is spent on construction, but the industry is slow to adopt new technology; and the UN has said ground-breaking innovation is needed in cities, where the battle for sustainable development will be “won or lost”.

Mikkel Bülow-Lehnsby, Partner at 2150 and Chairman and co-founder of NREP, said: “With NREP we have been on a 15-year mission of making real estate and cities more efficient, customer-centric and sustainable. With 2150 we are leveraging all of NREP’s learnings and ambitions and partnering with our industry peers to identify and accelerate technology that can help us support our purpose of making real estate better. I am convinced that 2150’s mission-aligned team will play an important role in designing a future in which the convergence of entrepreneurship, technology and sustainability will reverse the built environment’s negative impact on the planet.”

Christian Hernandez, Partner at 2150, said: “Cities are complex living systems that are constantly expanding, evolving and adapting, with half the world’s population now living in urban environments and rising. Cities, while vehicles for the betterment of humanity, currently emit 70% of the world’s greenhouse gases and generate the vast majority of the planet’s waste. We see a huge opportunity to make a serious impact on the way cities are developed and the way our citizens live, work and are cared for by completely reimagining and reshaping the urban environment for good.”

The advisory board for 2150 includes technologists, scientists and designers including well-known architect, Bjarke Ingels, the Director of Princeton’s Andlinger Center for Energy and the Environment; Dr. Lynn Loo, Unity’s head of AI; Danny Lange, the former Chief Sustainability Officer in the Obama Administration; Christine Harada, the founder of sustainable developer EDGE Technologies; and Coen van Oostrom.

Based in Singapore, ErudiFi wants to help more students in Southeast Asia stay in school by giving them affordable financing options. The startup announced today it has raised a $5 million Series A, co-led by Monk’s Hill Ventures and Qualgro.

ErudiFi currently works with more than 50 universities and vocational schools in Indonesia and the Philippines. Co-founder and chief executive officer Naga Tan told TechCrunch that students in those countries have limited financing options, and often rely on friends or family, or informal payday lenders that charge high interest rates.

To provide more accessible financing options, ErudiFi partners with accredited universities and schools to offer subsidized installment plans, using tech to scale up while keeping costs down. Interest rates and repayment terms vary between institutions, but can be as low as 0%, with loans payable in 12 to 24 months.

By providing their students with affordable financing plans, ErudiFi can increase retention rates at schools, helping them keep students who would otherwise be forced to drop out because of financial issues.

Tan said ErudiFi’s value proposition for educational institutions is “being able to offer a data-driven financing solution that helps with student recruitment and retention. Students also greatly benefit because our product is one of the few, if not the only, affordable financing option they have access to.”

In a press statement, Peng T. Ong, co-founder and managing partner of Monk’s Hill Ventures, said, “Access to affordable tertiary education remains a huge pain point in Southeast Asia where the cost is nearly double then the average GDP per capita. ErudiFi is tackling an underserved market that is plagued with high-interest rates by traditional financial institutions and limited reach from peer-to-peer lending companies.”

ErudiFi’s Series A will be used on hiring for its product and engineering teams and to expand in Indonesia and the Philippines.

A new VC fund, “2150“, is launching with the first close of a €200m ($281m) fund which will back technologies aimed largely at reducing the carbon footprint of cities. For example, startups that inject carbon into concrete, or monitor the energy of buildings. The final close is anticipated by mid-2021.

The advisory board for 2150 comprises the former chief sustainability officer in the Obama administration and renowned urbanist and academic, Richard Florida. 2150 is based around the idea that half of the world’s population lives in cities, and this will increase to two-thirds by 2050, creating a growing environmental impact that the world can ill-afford, given the climate crisis.

Based across London, Copenhagen and Berlin, the fund’s Limited Partners include a mix of institutional capital and family offices including Chr. Augustinus Fabrikker, Denmark’s Green Future Fund and Novo Holdings. 2150 says it has other LP partners who are building or managing “over 16 million square meters of real estate”, who will come in handy, kicking the tires on the efficacy of 2150 investments. The anchor funding has come from NREP, a sustainable real estate fund manager with a large Northern European footprint and platform.

The founding partners include Mikkel Bülow-Lehnsby, Chairman and co-founder of large real estate logistics company NREP; Jacob Bro, former Chief Product Officer at Rocket Internet; Christian Jølck, the founder and former Chairman of industry climate advocacy group SYNERGI; Christian Hernandez, former Facebook executive and VC; Nicole LeBlanc, formerly with Alphabet’s urban product incubator Sidewalk Labs; Rahul Parekh, founder of VC-backed foodtech startup EatFirst and former executive director at Goldman Sachs; and Alexandra Perez, who incubated and launched urban tech startups at Tech City Ventures.

2150 will focus on startups that can make cities more resilient, efficient and sustainable, investing in tech associated with the urban environment, materials, automation, and sensor-based monitoring to improve the health, safety, and productivity of building occupants. It says it will only invest where sustainability impact can be measured, aiming for a first portfolio of around 20 companies. Ticket sizes will be €4-5m series A for startups, but it will also invest in existing companies that want to expand.

Its first investment is in CarbonCure Technologies – a Canadian company lowering the CO2 footprint of concrete – in which 2150 participated in a funding round for last year, investing alongside Amazon’s Climate Pledge Fund, Bill Gates-backed Breakthrough Energy Ventures, and Microsoft’s Climate Innovation Fund. At present, concrete accounts for 8% of all global CO2 emissions

Speaking to TechCrunch, Hernandez said 2150 was particularly interested in what’s coming to be known as “ESG Analytics” or “Carbon Accounting”. In other words, platforms that can analyze the impact of developments for an ESG and CO2 perspective.

The other background data which inspired the creation of the fund includes the fact that two billion new homes will need to be built over the next 80 years ; cities consume over two-thirds of the world’s energy and account for more than 70% of global CO2 emissions; 13% of global GDP is spent on construction, but the industry is slow to adopt new technology; and the UN has said ground-breaking innovation is needed in cities, where the battle for sustainable development will be “won or lost”.

Mikkel Bülow-Lehnsby, Partner at 2150 and Chairman and co-founder of NREP, said: “With NREP we have been on a 15-year mission of making real estate and cities more efficient, customer-centric and sustainable. With 2150 we are leveraging all of NREP’s learnings and ambitions and partnering with our industry peers to identify and accelerate technology that can help us support our purpose of making real estate better. I am convinced that 2150’s mission-aligned team will play an important role in designing a future in which the convergence of entrepreneurship, technology and sustainability will reverse the built environment’s negative impact on the planet.”

Christian Hernandez, Partner at 2150, said: “Cities are complex living systems that are constantly expanding, evolving and adapting, with half the world’s population now living in urban environments and rising. Cities, while vehicles for the betterment of humanity, currently emit 70% of the world’s greenhouse gases and generate the vast majority of the planet’s waste. We see a huge opportunity to make a serious impact on the way cities are developed and the way our citizens live, work and are cared for by completely reimagining and reshaping the urban environment for good.”

The advisory board for 2150 includes technologists, scientists and designers including well-known architect, Bjarke Ingels, the Director of Princeton’s Andlinger Center for Energy and the Environment; Dr. Lynn Loo, Unity’s head of AI; Danny Lange, the former Chief Sustainability Officer in the Obama Administration; Christine Harada, the founder of sustainable developer EDGE Technologies; and Coen van Oostrom.

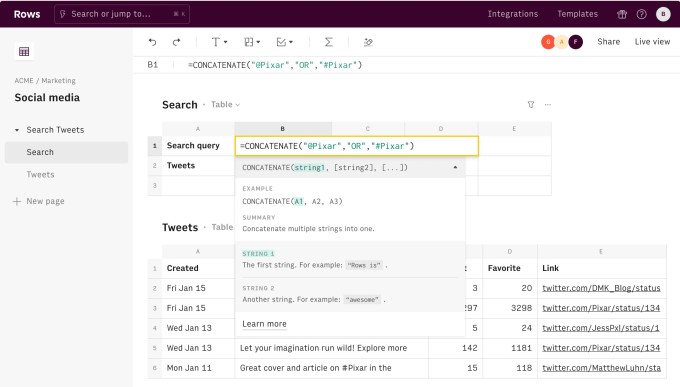

Spreadsheet software — led by products like Microsoft’s Excel, Google’s Sheets and Apple’s Numbers — continues to be one of the most-used categories of business apps, with Excel alone clocking up more than a billion users just on its Android version. Now, a startup called Rows that’s built on that ubiquity, with a low-code platform that lets people populate and analyze web apps using just spreadsheet interfaces, is announcing funding and launching a freemium open beta of its expanded service.

The Berlin-based startup — which rebranded from dashdash at the end of last year — closed a Series B round of $16 million, money that it is using to continue investing in its platform as well as in sales and marketing.

The round was led by Lakestar, with past investors Accel (which led its $8 million Series A in 2018) and Cherry Ventures also participating. Christian Reber has also invested in this round. Reber knows a thing or two about software disrupting legacy products — he is the co-founder and CEO of presentation software startup Pitch and the former CEO and founder of Microsoft-acquired Wunderlist — and notably he is joining Rows’ Advisory Board along with the investment.

A little detail about this Series B: CEO Humberto Ayres Pereira tells us that the round actually was quietly closed over a year ago, in January 2020 — just ahead of the world shutting down amid the Covid-19 pandemic. The startup chose to announce that round today to coincide with adding more features to its product and moving it into an open beta, he said.

That open beta is free in its most basic form — free is limited to 10 users or less and a minimal amount of integration usage. Paid tiers, which cover more team members and up to 100,000 integration tasks (which are measured by how many times a spreadsheet queries another service), start at $59 per month.

One strong sign of interest in this latest iteration of the software will be in the lasting popularity of spreadsheets. Another is Rows’ traction to date: in invite-only mode, it picked up 10,000 users, and hundreds of companies, as customers.

No-code and low-code software, which let people create and work with apps and other digital content without delving deep into the lines of code that underpin them, have continued to pick up traction in the market in the last several years.

The reason for this is straightforward: non-technical employees may not code, but they are getting increasingly adept at understanding how services function and what can be achieved within an app.

No-code and low-code platforms let them get more hands-on when it comes to customizing and creating the services that they need to use everyday to get their work done, without the time and effort it might take to get an engineer involved.

“People want to create their own tools,” said Ayres Pereira. “They want to understand and test and iterate.” He said that the majority of Rows’ users so far are based out of North America, and typical use cases include marketing and sales teams, as well as companies using Rows spreadsheets as a dynamic interface to manage logistics and other operations.

Stephen Nundy, the partner at Lakestar who led its investment, describes the army of users taking up no-code tools as “citizen developers.”

Rows is precisely the kind of platform that plays into the low-code trend. For people who are already au fait with the kinds of tools that you find in spreadsheets — and something like Excel has hundreds of functions in it — it presents a way of leaning on those familiar functions to trigger integrations with other apps, and to subsequently use a spreadsheet created in Rows to both analyse data from other apps, as well as update them.

You might ask, why is it more useful, for example, to look at content from Twitter in Rows rather than Twitter itself? A Rows document might let a person search for a set of Tweets using a certain chain of keywords, and then organise those results based on parameters such as how many “likes” those Tweets received.

Or users responding to a call to action for a promotion on Instagram might then be cross referenced with a company’s existing database of customers, to analyze how those respondents overlap or present new leads.

There have been a number of other startups building tools that are providing similar no- and low-code approaches. Gyana is focusing more on data science, Tray.io provides a graphical interface to integrate how apps work together, Zapier and Notion also provide simple interfaces to integrate apps and APIs together, and Airtable has its own take on reinventing the spreadsheet interface. For now, Ayres Pereira sees these more as compatriots than competitors.

“Yes, we overlap with services like Zapier and Notion,” he said. “But I’d say we are friends. We’re all raising awareness about people being able to do more and not having to be stuck using old tools. It’s not a zero sum game for us.”

When we covered Rows’s Series A two years ago, the startup had built a platform to let people who are comfortable working with data in spreadsheets to use that interface to create and populate content in web apps. It had a lot of extensibility, but mainly geared at people still willing to do the work to create those links.

Two years on, while the spreadsheet has remained the anchor, the platform has grown. Ayres Pereira, who co-founded the company with Torben Schulz (both pictured above), said that there are some 50 new integrations now, including ways to analyse and update content on social media platforms like Instagram, YouTube, CrunchBase, Salesforce, Slack, LinkedIn and Twitter, as well as some 200 new features in the platform itself.

It also has a number of templates available for people to guide them through simple tasks, such as looking up LinkedIn profiles or emails for a list of people; tracking social media counts and so on.

One of the most common details of spreadsheets, however, has yet to be built. The interface is still banked around rows and columns, with no graphical tools to visualize data in different ways such as pie charts or graphs as you might have in a typical spreadsheet program.

It’s for this reason that Rows has yet to exit beta. The feature is one requested a lot, Pereira said, describing it as “the final frontier.” When Rows is ready to ship with that functionality, likely by Q3 of this year, it will tick over to general “1.0” release, he added.

“Humberto and Torben have really impressed us with their ambition to disrupt the market with a new spreadsheet paradigm that tackles the significant shortcomings of today’s solutions,” said Nundy at Lakestar. “Data integrations are native, the collaboration experience is first class and the ability to share and publish your work as an application is unique and will create more ‘Citizen developers’ to emerge. This is essential to the growing needs of today’s technology literate workforce. The level of interest they’ve received in their private beta is proof of the desirability of platforms like Rows, and we’re excited to be supporting them through their public beta launch and beyond with this investment.” Nundy is also joining Rows’ board with this round.

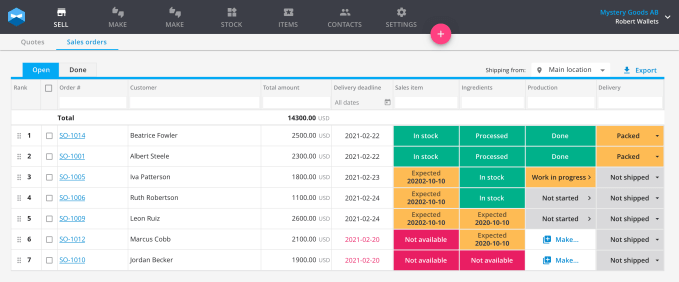

Katana, an Estonian startup that has built manufacturing-specific enterprise resource planning (ERP) software for SMBs, has raised $11 million in Series A funding.

Leading the round is European venture capital firm Atomico, with participation from angel investors Ott Kaukver (Checkout.com CTO), Sten Tamkivi (CPO Topia, formerly Skype), Sergei Anikin (CTO, Pipedrive) and Kairi Pauskar (former TransferWise HR Architect). Previous backer 42Cap also followed on, bringing the total investment raised by the company to date to $16 million.

Founded in 2017 by Kristjan Vilosius (CEO), Priit Kaasik (engineering lead) and Hannes Kert (CCO), Katana positions itself as the “entrepreneur manufacturer’s secret weapon” with a plug-and-play ERP for small to medium-sized manufacturers. The idea is to wean companies off existing antiquated tools such as spreadsheets and legacy software to manage inventory and production. The startup is also playing into macro trends, such as the advent of online marketplaces and D2C e-commerce, that are resulting in an explosion of independent makers, spanning cosmetics to home décor, electronics to apparel, and food and beverages.

“We are seeing a global renaissance of small manufacturing driven by the rise of e-commerce tools and consumer demand for bespoke products produced locally,” says Vilosius. “Just walk around any big city from London to San Francisco, and you’ll see workshops all around you. Someone’s making organic cosmetics here; over there, someone is making electric bikes. These companies are run by passionate entrepreneurs selling through traditional channels, but also selling through direct-to-consumer channels, e-commerce stores and marketplaces, etc. This is a massive boom of makers wanting to create products and sell them globally, and it is not a trend that will disappear tomorrow”.

The problem, however, is that small and medium-sized manufacturers don’t have the right software to support workflows necessary to sell through multiple channels — and this is where Katana comes in. The plug-and-play software claims a superior UX designed specifically to power boutique manufacturing, including functionality supporting the workflows of modern manufacturers, i.e. inventory control and optimization, and purchasing materials, managing bill-of-materials, tracking costs and more. It also offers an API and integrations with popular e-commerce sales channels and accounting tools such as Shopify, Amazon, WooCommerce, QuickBooks, Xero and others.

“We have built the world’s most self on-board-able manufacturing ERP, and that’s a very important differentiation between us and competitors,” explains Vilosius. “Implementation is so simple that more than half of Katana’s users self-onboard. It takes less than a week on average to get Katana up and running, compared to months for competitors”.

As an example of how a company might use Katana, imagine a boutique manufacturer using Shopify as their main sales channel. Once configured, Katana pulls in orders from Shopify and knows whether or not the product is available so it can be shipped immediately. If it’s unavailable, Katana displays if the necessary raw materials needed to manufacture are in stock and by when the product could be finished. “We handle the entire process from getting the raw materials in the warehouse to planning manufacturing activities, executing and shipping when the product is done,” says Vilosius.

Image Credits: Katana

Cue statement from Atomico partner Ben Blume, who joins the Katana board: “Atomico has always believed in the strength of Estonian-built engineering and product, and as we got to know the team at Katana, we saw a familiar pattern: a relentlessly product-focussed team with the incredible ability to build and think from their customer’s point of view, and an unwavering belief that a new generation of manufacturers with big ideas shouldn’t have to settle for less than world-class technology to support them.”