& meet dozens of singles today!

User blogs

The pitch deck is just one aspect of the broader fundraising process, but for founders aiming to entice investors, it’s the best way to communicate their startup’s progress and potential.

The decisions founders make regarding what to include on those few slides can be the difference between a quick pass or a first check. As the venture capital market continues to boil over and investors find themselves reviewing more deals remotely across different stages, there’s added need to drill down into the basics for their first look inside the company.

To get an insider’s look into the process, I chatted with Pilot CEO Waseem Daher. Last month, his bookkeeping and financial tools startup wrapped a $60 million Series C round led by Sequoia, bringing the company’s total funding to just north of $118 million. We discussed the different approaches he has taken to crafting the company’s pitch deck to showcase what he knew potential investors were most curious in, something that shifted over time as the company hit new milestones.

Daher took me on a tour of his company’s Series C pitch deck (embedded below) and described the decisions he and his team spent the most time considering as they crafted the deck. During the discussion, he broke down some of the key questions investors ask at each stage and touched on many of the proof points that VCs have started paying more attention to.

“If the Series A was about, ‘Do you have the right ingredients to make this work?’ then the Series B is about, ‘Is this actually working?'”

“If the Series A was about, ‘Do you have the right ingredients to make this work?’ then the Series B is about, ‘Is this actually working?'” Daher tells TechCrunch. “And then the Series C is more, ‘Well, show me that the core business is really working and that you have unlocked real drivers to allow the business to continue growing.'”

What are investors looking for?

Seed

- Key investor question: Is there significant potential?

- Proof points to consider: Total addressable market (TAM), team.

Series A

- Key investor question: Is there proof of product-market fit?

- Additional proof points to consider: Annual recurring revenues (ARR), cash burn.

Series B

- Key investor question: Is the flywheel working? Will you be the market winner?

- Additional proof points to consider: ARR growth, net retention, market share.

Series C/D

- Key investor question: Are the unit economics compelling?

- Additional proof points to consider: Gross margin, lifetime value (LTV), Customer acquisition costs (CAC).

IPO

- Key investor question: Will the business generate significant cash flow?

- Additional proof points to consider: Free cash flow (FCF), FCF margin, average selling price (ASP) growth, category expansion, earnings per share (EPS).

Check out the full pitch deck below from Pilot’s most recent raise (with illustrative data swapped for actual financial metrics).

A little over two years after ANGI Homeservices acquired his startup Handy, Oisin Hanrahan is becoming CEO of the combined organization and joining its board of directors.

ANGI is a publicly-traded subsidiary of IAC, formed from the merger of Angie’s List and HomeAdvisor. In addition to the Angie’s List, HomeAdvisor and Handy brands, the company also operates Fixd Repair, HomeStars, MyHammer, MyBuilder, Instapro, Travaux and Werkspot (most of those are outside the United States).

The company says that nearly 250,000 home service professionals are active across its platforms in a given year, with more than 30 million projects facilitated annually. For the fourth quarter of 2020, it reported revenue of $359 million (up 12% year-over-year) and a net loss of $14.5 million.

Hanrahan joined the company with the acquisition of Handy in October 2018, becoming ANGI’s chief product officer the next year.

“I’m really excited for the opportunity to lead ANGI at this inflection point,” Hanrahan said in a statement. “As we’ve all spent extra time at home over the last year it’s clearer than ever how important our physical space is in our daily lives, and ANGI’s mission to help people love where they live is more relevant than ever. I’m grateful to the Board and energized to work with our talented team to help ANGI become the home for everything home.”

ANGI’s previous CEO, Brandon Ridenour, is stepping down from the role. In the announcement, IAC CEO Joey Levin thanked Ridenour “for his instrumental role in building ANGI Homeservices over the last decade” while praising Hanrahan as “an exceptional product visionary.”

In addition, the company announced appointments to two new positions, with Bryan Ellis, becoming Chief Revenue Officer – Marketplace (he’ll oversee the company’s leads and advertising products) and Handy co-founder Umang Dua becoming Chief Revenue Officer — ANGI Services (where he’ll be in charge of ANGI’s pre-priced product).

Source: https://techcrunch.com/2021/02/24/oisin-hanrahan-angi-homeservices-ceo/

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This is our first-ever Wednesday episode. If you want to learn more about the latest edition of the podcast, head here for more. This week we talked about space, an increasingly active part of the global economy, and a place where we’re seeing more and more young tech companies place their focus.

We were lucky to have TechCrunch’s Darrell Etherington join us for the show. He’s our resident expert, so we had to have him on to chat about the space startup ecosystem. Here’s the rundown:

- SpaceX has raised a bunch more money, at a far higher valuation. We chat about why it didn’t raise more, and how much capital there is available for the famous rocket company.

- Starlink came up as well, as the satellite array just put another 60 units into orbit. What is it good for? We have a few ideas.

- The second crew member of first all-civilian SpaceX mission revealed, and of course there is an IPO and startup angle involved.

- Which brought us to a side conversation on which one of us are most interested in going to space commercially. It’s the raised hands feature no one asked for, but take your guesses on who wants to go first and see if you’re right.

- Regardless, Axiom Space raises $130 million for its commercial space station ambitions

- And then there was the Astra SPAC. You can read its deck here. What matters is that we get a look into how fast it plans to ramp future launches. And the answer is fast.

As we get more comfortable in our Wednesday episodes, we’ll tinker with the format and the like. As we do, we’re always taking feedback at equitypod@techcrunch.com, or over on Twitter. Hit us up, we’re having a lot of fun but are always looking for ways to sharpen the show!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Source: https://techcrunch.com/2021/02/24/spacex-is-really-just-spac-and-an-ex/

Equity is celebrating its fourth birthday in a few weeks and closed 2020 with its biggest quarter to date. To celebrate and say thank you to our wonderful listeners who tune into us each and every single week, we’re growing upward and outward!

First, as many of you have noticed, we’ve expanded the Equity team. Grace Mendenhall joined the production crew this year, initially helping cover for Chris Gates while he was out on paternity leave. But now Chris is back and so we’ve doubled our producer team.

In classic startup fashion, a bigger team means we can make more swings at R&D, or in this case, add on a new show to our semiweekly cadence.

Today, the whole Equity team — Chris, Grace, Danny, Natasha and Alex — are super proud to announce that we’re expanding the podcast’s show lineup. We’re going to add a new show each week, which will rotate around a particular theme, geography or supermassive news event. It’s your midweek chance to listen to a show about one trend, whether that’s space tech or the growth of community as a competitive advantage. Sometimes it will be an exact topic you’ve cared about for so long (insert Alex and SaaS joke here) and sometimes it will be about a topic you know nothing about. We’re here to convince you to care anyway. Regardless, you can depend on the Equity trio to give you a trifecta of shows that helps you stay up to date on startup and venture capital news in a consumable way.

Starting, well, now, here’s what Equity looks like:

- Equity on Monday: Our weekly kickoff show is not changing. Except Alex has promised to learn how to speak with better diction.

- Equity on Wednesday: Our midweek show focused on a single topic or theme. Expect to hear from other TechCrunch reporters about their beats, investors on what they are seeing in the market and reporting on countries and cities where startup activity is blowing up.

- Equity, now on Friday: The main Equity episode is not changing, other than that we’re going to tighten it up a little bit and release it Friday mornings like we used to. While it was a blast to get out the door Thursday afternoon, we’re going to give Equity Wednesday a little more time to breathe. And since so many of you listen to this episode on Friday anyway, most folks won’t notice a change.

As COVID-19 fades thanks to the rollout of vaccines around the globe, we’ll eventually get back into our studio. That could mean more video down the pike. And we’ll still do the odd Equity Shot for big events that we can’t help but chat about.

Our goal was to double-down on what we think is the best part of Equity: A group of friends hammering through the news as a group, learning, joking and having fun with the world of startups and venture capital.

So, we’ll see you one more time each week. Cool? Cool. Hugs from here and chat soon. — The Equity Team

Source: https://techcrunch.com/2021/02/24/the-equity-podcast-is-getting-bigger-and-better/

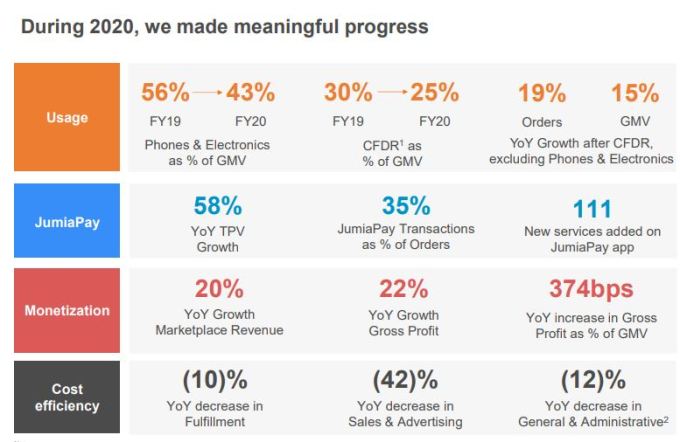

After years of losses, African e-commerce giant Jumia claimed significant progress towards profitability in its Q4 2020. Backing that claim, Jumia reported record gross profit and some improvements to its cost structure.

The company wrote in its earnings release that while “2020 has been a challenging year operationally with COVID-19 related supply and logistics disruption,” it had also proven “transformative” for its business model.

Let’s examine its financial results to see how Jumia fared during the pandemic year and see if we can see the same path to profitability discussed in its written remarks.

The results

Jumia’s core metrics were uneven in 2020. The company saw its user base grow by 12% in 2020, from 6.1 million customers in 2019 to 6.8 million customers. That means the company added 700,000 customers in 2020 compared to the 2 million customers it acquired the year before.

Other metrics were negative. The company’s gross merchandise value (GMV), the total worth of goods sold over a period of time, grew 23% from the previous quarter to €231.1 million. The company said this was a result of the Black Fridays sales in the quarter. However, when compared year-over-year, Q4 GMV was down 21% “as the effects of the business mix rebalancing initiated late 2019 continued playing out during the fourth quarter of 2020,” Jumia wrote.

Image Credits: Jumia

In terms of orders made on the platform, Jumia saw a 3% year-over-year drop from 8.3 million in Q4 2019 to 8.1 million in Q4 2020. But while the company’s metrics were mixed during Q4 and the full-year 2020 period, there were encouraging signs to be found.

Last year, Jumia’s Q4 gross profit after fulfillment expense was €1.0 million. We reported at the time that the number’s positivity was commendable if merely another mile of the company’s path to profitability.

The company built on that result in 2020, allowing it to report a record gross profit after fulfillment expense result of €8.4 million in the final quarter of last year. From a full-year perspective, the numbers are even starker, with Jumia managing just €1.5 million in 2019 gross profit after fulfillment expense; in 2020, that number grew to €23.5 million.

That Jumia managed those improvements while seeing its 2019 revenues of €160.4 million slip 12.9% in 2020 to €139.6 million is notable.

JumiaPay and improvement in losses and expenses

There are other metrics that are encouraging for Jumia.

Its gross profit reached €27.9 million in 2020, representing a year-over-year gain of 12%. Sales and Advertising expense decreased year-over-year by 34% to €10.2 million, while General and Administrative costs, excluding share-based compensation, came to €21.8 million in the year, falling 36% year-over-year.

In 2019, Jumia incurred a massive €227.9 million in losses, a 34% increase from 2018 figures of €169.7 million. But that changed last year as Jumia reported a smaller €149.2 million in operating losses, representing a 34.5% decrease from 2019.

Turning from GAAP numbers to more kind metrics, Jumia’s Q4 2020 adjusted EBITDA loss also decreased. The company recorded an adjusted EBITDA of -€28.3 million in the final quarter of 2020, falling 47% year-over-year from 2019’s €53.4 million Q4 result. For the full 2020 period, Jumia reported €119.5 million in adjusted EBITDA losses, down 34.6% from FY19’s -€182.7 million result.

Jumia lost less money on an adjusted EBITDA basis in 2020 of any of its full-year periods we have the data for. Still, the company remains deeply unprofitable today and for the foreseeable future.

Fintech

Jumia’s fintech product, JumiaPay, has been a factor behind its improving metrics.

In Q1 2020, it processed 2.3 million transactions worth €35.5 million. That number grew to €53.6 million from 2.4 million transactions in Q2 2020. In the third quarter of last year, it recorded 2.3 million transactions with a payment volume of €48.0 million. For Q4, JumiaPay performed 2.7 million transactions worth €59.3 million.

In total, JumiaPay processed 9.6 million transactions with a total payment volume (TPV) of €196.4 million throughout 2020. TPV increased by 30% in Q4 2020 from its 2019 result and 58% in 2020 as a whole.

JumiaPay is a critical part of Jumia’s business, as 33.1% of its orders in Q4 2020 were paid for with the service, up from 29.5% in Q4 2019.

Share price and optimism around profitability

Jumia went public in April 2019. Since opening as Africa’s first tech company on the NYSE at $14.50 per share, the company’s stock has been on a rollercoaster ride.

It traded at $49 per share at one point before battling with scepticism about its business model, fraud allegations, and shorting by Andrew Left, a well-known short-seller and founder of Citron Research. What followed was the company’s share price crashing to $26 before reaching an all-time low of $2.15 on the 18th of March 2020.

Later, Left made a reversal after claiming Jumia had handled its fraud problems. He took long positions at the company and later proposed it would hit $100 per share. That change in market sentiment, coupled with the fact that Jumia changed its business model and halted operations in Cameroon, Rwanda, and Tanzania, enabled its share price to climb back, reaching an all-time high of $69.89 this February 10th.

Before today’s earnings call, Jumia was trading at $48.81. Since dropping its latest data, the company’s share price has expanded by around 10% to just over $54 per share as of the time of writing, indicating investor bullishness despite its continued operating and adjusted EBITDA losses.