& meet dozens of singles today!

User blogs

Rep. Barbara Lee, who has represented the East Bay of California since 1998, is one of Congress’s staunchest proponents of diversity in tech. Representing Oakland, Emeryville and other cities nestled around the hills of the East Bay, she knows all too well about the benefits reaped by those in Silicon Valley, San Francisco and beyond.

We are happy to announce that Rep. Lee will be joining us for a fireside chat at TechCrunch Sessions: Justice in just a few days.

By focusing on racial injustice, among the many other issues facing her constituency, Lee has highlighted the ways in which access to tech remains out of reach for people from underserved communities. And this doesn’t just refer to the so-called ‘pipeline problem,’ which is, arguably, a myth. It is also about the lack of tech education in early grades through high school, as well as a lack of access to computers and reliable broadband, which most of us take for granted.

We will speak with Lee about the opportunities that the tech industry has to create an equal playing field in tech so that underrepresented investors, founders, designers, coders and the like can take part in everything it has to offer. We will also discuss her membership in the Congressional Black Caucus, which is celebrating its 50th anniversary this year, as well as her role as co-chair of the Congressional Cannabis Caucus — the burgeoning cannabis industry will be a good place to start.

Head here to secure your seat to TechCrunch Sessions: Justice. In addition to Rep. Lee, you’ll hear from Backstage Capital’s Arlan Hamilton on finding the next big opportunities in tech, learn how to creatively navigate remote fundraising from top investors, examine the importance of accessible product design and learn how to battle algorithmic bias. Register now.

Jeff Bezos’ space company Blue Origin published an updated timeline for the first flight of New Glenn, the orbital rocket it’s building to complement its existing New Shepard suborbital space launch vehicle. The company is now targeting Q4 2022 – a slippage of roughly a year from the prior stated timeline of sometime towards the end of 2021. The main cause, per Blue Origin? Space Force passing on using New Glenn to launch national security payloads during a recent contract bid process.

Blue Origin said in a blog post that the “schedule has been refined to match the demand of Blue Origin’s commercial customers,” and specifically says it “follows the recent Space Force decision to not select New Glenn for the National Security Space Launch (NSSL) Phase 2 Launch Services Procurement (LSP).” Those awards were announced last August, and the two winners were the United Launch Alliance (ULA) and SpaceX, who prevailed over Blue Origin, and also Northrop Grumman. The launch service contracts that make up the awards begin in 2022, so it makes sense why Blue Origin had been pushing for a first launch of New Glenn by the end of this year in order to meet the needs of Space Force.

While it may not be under the same time pressure without access to those contracts, it’s still making “major progress” towards New Glenn and the facilities at Cape Canaveral in Florida from which it’ll launch, according to the company. Blue Origin shared tweets showing off some of its progress, including work on the New Glenn rocket factory, testing facility and Launch Complex 36. It also said it’s put more than $2.5 billion into the facilities and infrastructure that will support its eventual launches.

Check out the recent progress at our #NewGlenn rocket factory at Cape Canaveral. We are testing flight operations with the giant stage 1 simulator, producing flight hardware, and growing the integration and test facilities around the campus. pic.twitter.com/egH29IpQ7O

— Blue Origin (@blueorigin) February 25, 2021

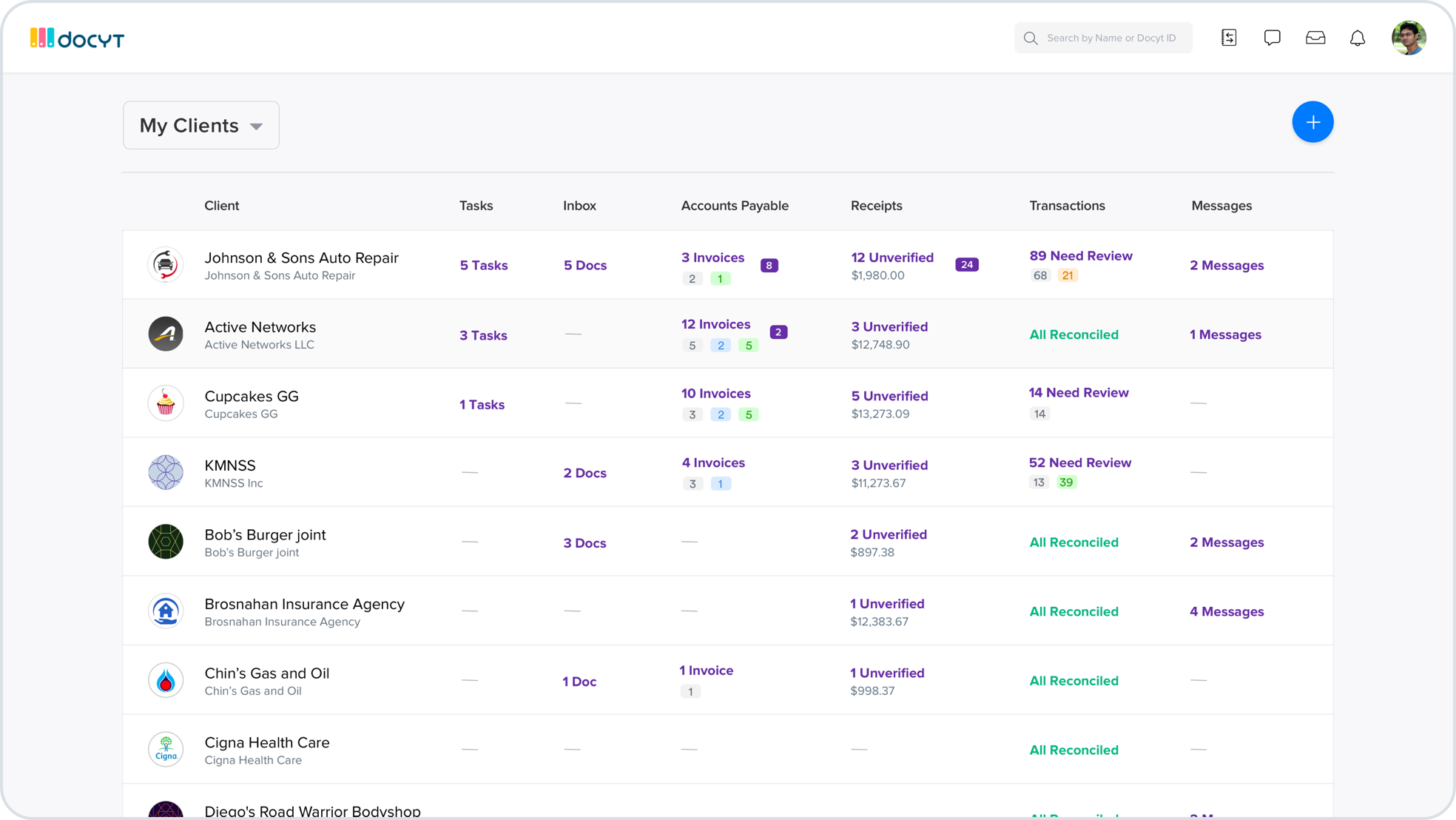

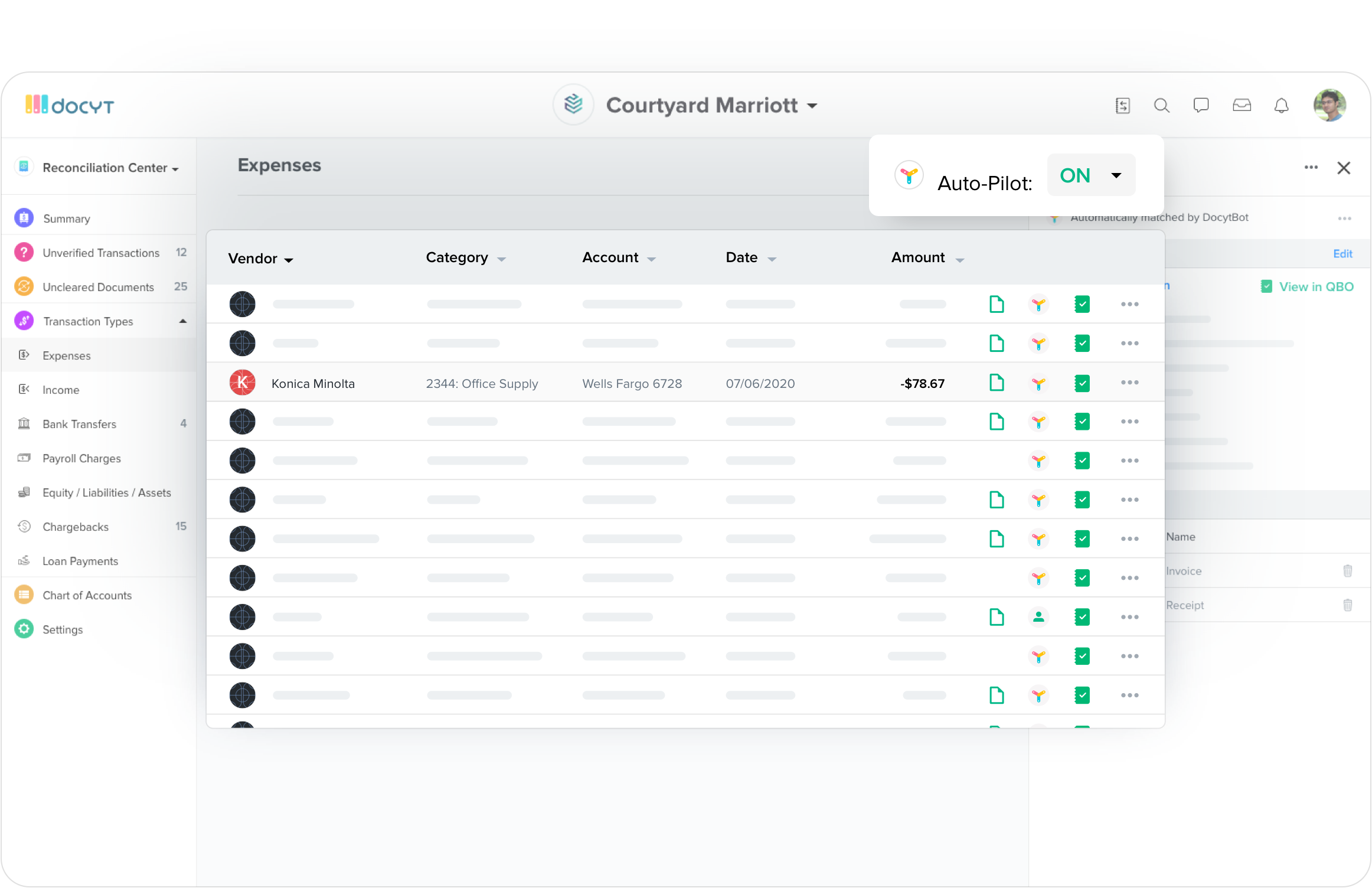

Accounting isn’t a topic that most people can get excited about — probably not even most accountants. But if you’re running any kind of business, there’s just no way around it. Santa Clara-based Docyt wants to make the life of small and medium business owners (and their accounting firms) a bit easier by using machine learning to handle a lot of the routine tasks around collecting financial data, digitizing receipts, categorization and — maybe most importantly — reconciliation.

The company today announced that it has raised a $1.5 million seed-extension round led by First Rays Venture Partners with participation from Morado Ventures and a group of angel investors. Docyt (pronounced ‘docket’) had previously raised a $2.2 million seed round from Morado Ventures, AME Cloud Ventures, Westwave Capital, Xplorer Capital, Tuesday and angel investors. The company plans to use the new investment to accelerate its customer growth.

At first glance, it may seem like Docyt competes with the likes of QuickBooks, which is pretty much the de facto standard for small business accounting. But Docyt co-founder and CTO Sugam Pandey tells me that he thinks of the service as a partner to the likes of QuickBooks.

“Docyt is a product for the small business owners who finds accounting very complex, who are very experienced on howto run and grow their business, but not really an expert in accounting. At the same time, businesses who are graduating out of QuickBooks — small business owners sometimes become mid-sized enterprises as well — […] they start growing out of their accounting systems like QuickBooks and looking for more sophisticated systems like NetSuite and Sage. And Docyt fits in in that space as well, extending the life of QuickBooks for such business owners so they don’t have to change their systems.”

In its earliest days, Docyt was a secure document sharing platform with a focus on mobile. Some of this is still in the company’s DNA, with its focus on being able to pull in financial documents and then reconciling that with a business’ bank transactions. While other systems may put the emphasis on transaction data, Docyt’s emphasis is on documents. That means you can forward an emailed receipt to the service, for example, and it can automatically attach this to a financial transaction from your credit card or bank statement (the service uses Plaid to pull in this data).

For new transactions, you sometimes have to train the system by entering some of this information by hand, but over time, Docyt should be able to do most of this automatically and then sync your data with QuickBooks.

“Docyt is the first company to apply AI across the entire accounting stack,” said Amit Sridharan, Founding General Partner at First Rays Venture Partners. “Docyt software’s AI-powered data extraction, auto categorization and auto reconciliation is unparalleled. It’s an enterprise-level, powerful solution that’s affordable and accessible to small and medium businesses.”

Source: https://techcrunch.com/2021/02/25/docyt-raises-1-5m-for-its-ml-based-accounting-automation-platform/

The executive who built the financial services boutique for Paytm, India’s most valuable startup, from the ground is ready to do something similar all over again.

Pravin Jadhav, the former chief executive of Paytm Money, revealed on Thursday his own startup, Raise Financial Services.

This time, Jadhav — under whose leadership, Paytm had amassed over 6 million Money customers — is focusing on serving a different set of the population.

Hundreds of millions of users in India today don’t have access to financial services. They don’t have a credit card, banks don’t lend to them, and they have never purchased an insurance cover or invested in mutual funds or stocks.

Scores of large firms and startups in India today are attempting to reach these users by building an underwriting technology that can use alternative data to determine an applicant’s credit worthiness. It’s a tough and capital intensive business, built on pillars of uncertainties, assumptions and hopes.

In an interview with TechCrunch, Jadhav said Raise Financial Services is aimed at customers living in metro, tier 1 and tier 2 cities (so very much in and around urban cities). “They want financial products, they are literate about these products, but they are not being served the way they should be,” he said.

Pravin Jadhav, left, poses with Paytm founder and CEO Vijay Shekhar Sharma. Jadhav left Paytm last year.

He said his new startup will offer products across financial services including investing, financing, insurance, wealth, and payments. “Just not doing the banking part, as I believe that is more of an infrastructure play,” he said.

“The idea is to offer great exceptional products that are not being offered by anyone. Number 2: Focus a lot on tech-driven distribution. And third is that today the quality of customer service experience is bad across the market. So we are trying to solve that,” he said. “Over time, we will try to stitch all of this together.”

Jadhav also announced he has raised a Seed financing round. He did not disclose the amount, but revealed enough high-profile names, including: Kunal Shah (Cred), Kalyan Krishnamurthi (Flipkart), Amod Malviya and Sujeet Kumar (Udaan), Sameer Nigam and Rahul Chari (PhonePe), Amrish Rau (Pine Labs, Citrus Pay), Sandeep Tandon (Freecharge), Jitendra Gupta (Jupiter), Girish Mathrubootham (Freshworks), Nischal Shetty (WazirX), Kuldeep Dhankar (Clevertap), Sreevatsa Prabhakar (Servify), and Amit Bhor (Walnut).

Jadhav himself is also investing, and venture investor Mirae Asset Venture is leading the round, with participation from Multi-Act Private Equity, Blume Ventures (via its Founder’s Fund) and US based early-stage investor Social Leverage, for which it is the first investment in India.

Ashish Dave, CEO of Mirae Asset Venture’s India business, told TechCrunch that even though he had known Jadhav, it was listening to him at various Clubhouse sessions that prompted him to reach out to Jadhav.

Jadhav said users can expect the startup’s first product to be live by the end of the year. (TechCrunch understands it’s shipping much sooner. Raise Financial Services’ offerings will have some similarities with SoFi and Goldman Sachs’ Marcus.)

Source: https://techcrunch.com/2021/02/25/pravin-jadhav-raise-financial-services-startup/

Dawn Belt has been working with top tech companies for two decades, most recently helping commercial electric vehicle company Proterra go public as a SPAC in January.

Now she’ll be joining us at TC Early Stage in April to talk about building a company in 2021, from however you incorporate to however you decide to maybe go public one day.

As a partner at Fenwick & West, a top Silicon Valley law firm, Belt works with startups of all ages, sizes and industries (two of her past IPOs include Facebook and Bill.com). She has also written legal perspectives on a wide range of other topics that startups face, including implications of the CARES Act, board diversity legal requirements and how to manage acquired startups successfully. She also co-authored the firm’s Gender Diversity Survey, an in-depth report on women’s participation at senior levels of public tech companies.

She’ll be at Early Stage to share her experiences old and new, to help you make better decisions now for your company. The talk is part of the two days of events that explore seed and Series A fundraising, recruiting and more for early-stage startups at TC Early Stage – Operations and Fundraising on April 1 & 2. Grab your ticket now before prices increase tomorrow!