& meet dozens of singles today!

User blogs

Rimac Automobili, the Croatian company known for its electric hypercars and battery and powertrain development, has gained yet another investment from Porsche AG.

Porsche said Monday it has invested 70 million euros ($83.3 miilion) into Rimac, a move that increases its stake from 15% to 24%.

This is the third time Porsche has invested into Rimac. The German automaker made its first investment into Rimac in 2018. Porsche increased its equity stake into Rimac in September 2019. A few months earlier, Hyundai Motor Company and Kia Motors jointly invested €80 million ($90 million at the time) into Rimac.

Rimac was founded by Mate Rimac in 2009 and is perhaps best known for its electric hypercars, such as the two-seater C Two that it debuted in 2018 at the Geneva International Motor Show. The vehicle produces an eye-popping 1,914 horsepower, has a top speed of 256 miles per hour and can accelerate from 0 to 60 mph in 1.85 seconds. Rimac plans to unveil C Two in its final form in 2021.

However, Rimac does more than produce hypercars. The company, which employs 1,000 people, also focuses on battery technology within the high-voltage segment, engineers and manufactures electric powertrains and develops digital interfaces between humans and machines.

Porsche is most interested in Rimac’s development of components, according to comments made by Lutz Meschke, the deputy chairman of Porsche AG’s executive board. Meschke noted that Rimac is “excellently positioned in prototype solutions and small series” and “is well on its way to becoming a Tier 1 supplier for Porsche and other manufacturers in the high-tech segment.”

Porsche has already placed its first orders with Rimac for the development of highly innovative series components, according to Meschke.

Despite its continued investments, Porsche said it doesn’t have a controlling stake in Rimac.

One of the few industries that have benefited from the COVID-19 crisis is online finance. Around the world, the pandemic has forced consumers to adopt digital banking. Hong Kong’s WeLab, a fintech company founded in 2013, saw users soar by 20% year-over-year in 2020, bringing its accumulative user base to 50 million.

Facing innovative players like WeLab, which aims to bring more convenience, transparency, and affordability to consumers, financial incumbents feel compelled to reinvent themselves. That’s in part why Allianz X, a venture capital arm of the 131-year-old European financial conglomerate Allianz, led WeLab’s latest funding round of $75 million. The Series C1, which involved other investors, followed WeLab’s $156 million Series C round in late 2019.

“Obviously, Allianz is one of the largest asset managers and insurers in the world with a strong presence and solid footprint,” co-founder and CEO Simon Loong told TechCrunch during an interview.

Loong declined to disclose WeLab’s latest valuation but said the number has gone up since the firm last reached the $1 billion unicorn status.

When WeLab set out to build a digital bank, which launched in Hong Kong last year, one of the products it had in mind was “a new generation of wealth advisory on digital banks.”

“Allianz saw what we did over the last couple of years and identified this very interesting opportunity to co-develop a wealth technology for digital banks, so they came to us and said, why don’t they lead the round?” Loong explained.

Through the strategic investment, the partners will jointly develop and distribute investment and insurance solutions across Asia. Those products will diversify Welab’s current offerings, including a virtual bank and a lending product in Hong Kong, as well as several types of lending services in mainland China and Indonesia. Around 47 million of its total users are in mainland China, 2.5 million in Indonesia, and less than one million in Hong Kong, a city with a 7.5 million population.

“It’s an interesting four-way cooperation,” said Loong, referring to the roles of Allianz as an asset management and insurance firm, and WeLab as a bank and fintech solution provider. “I think it will really be an interesting inflection point for the company to scale.”

Working with titans

The WeLab team

Equally important to WeLab’s revenue is enterprise services, according to Loong, which are helping conventional banks and financial institutions build up a digital presence. The strategy is not unlike Ant Group’s effort to be an “enabler” for traditional financial players.

In spite of the massive combined market share of Ant and Tencent in China’s fintech market, there remains room for smaller and more specialized players like WeLab. To date, WeLab has attracted about 600 enterprise customers, most of whom are in mainland China.

“[We have] an interesting dynamics with Ant,” said Loong, when asked how WeLab wrestles with a goliath like Ant, whose e-commerce affiliate Alibaba is an investor in WeLab through the Alibaba Hong Kong Entrepreneurs Fund.

“There are businesses where we compete, and there are also areas where we work well together,” he added. For example, WeLab introduced one of the first smartphone leasing services on Alipay, Ant’s flagship app that works as a marketplace for third-party financial products and end consumers. But Ant also has its own in-house financial products, which could clash with outside suppliers peddling on its marketplace.

“In short, I would say that because we are a rather independent company, we work with everyone,” Loong asserted.

Greater Bay links

As a Hong Kong-founded firm, WeLab has actively taken part in the Chinese government’s push to integrate what’s dubbed the Greater Bay Area, which spans the two special administrative regions of China, Hong Kong and Macau, and nine cities in the southern province of Guangdong, including Shenzhen.

An objective of the GBA blueprint is to encourage cross-border talent flow. In a way, the area has all the right conditions to run a fintech startup, which would gain access to technological and banking talents respectively in Shenzhen and Hong Kong, two adjoining cities. WeLab has done exactly that, with a larger base of tech staff in Shenzhen compared to its Hong Kong office which has more finance professionals. It’s planning to add around 100 hires this year to its 800-person headcount.

Aside from shared talent pools, Beijing also wants to encourage more financial integration in the GBA. WeLab has taken notice and plans to roll out its forthcoming wealth management products first in Hong Kong and later into other parts of the GBA through the government-supported scheme called the Wealth Management Connect, which allows residents of Hong Kong and Macau to invest in wealth management products distributed by mainland banks in the GBA. Vice versa, residents in the mainland GBA cities will be able to buy wealth management products in Hong Kong and Macau.

“Hong Kong is a great testbed, but for online business, you need to subject your successful business model to a large population,” said Loong, explaining the company’s expansion plan. “The Greater Bay Area gives us the opportunity to do so. There is a 72 million population with a GDP of $1.7 trillion, which is larger than South Korea… Naturally, it is a good area to scale.”

WeLab was looking to go public back in 2018 but halted the plan because “we didn’t feel that it was the right market window to do this,” Loong recalled. The company was also in the process of securing a banking license, so it decided to work on the critical permit before going public.

“Obviously if you look now, it’s very hot in terms of the equity market,” said Loong. “So we are talking to a lot of people. We keep a close eye on this and we are always open-minded to explore the next right market window for us.”

Imaging has long been the primary battlefield on which the smartphone battles are waged. It makes sense. The thing about smartphones in 2021 is that they’re mostly very good. Sure, there are differentiators, but if you spend a decent amount on a device from any major manufacturer, you’re probably going to get a pretty good device.

But there’s still plenty of opportunity to continually bridge the gap between smartphone imaging and devoted camera systems. And today OnePlus takes a potentially key step in that direction by announcing a partnership with Hasselblad. The DJI-owned Swedish camera maker has signed onto a three-year partnership with OnePlus.

According to a release tied to the news, the pair plan to spend $150 million over the course of the deal, in an attempt to vault OnePlus to the front of the pack. Hasselblad has dipped its toes in the mobile market, including a Moto Z attachment, and has created cameras for DJI drones, but this represents a pretty big move for the 180-year-old camera company.

The first fruits of the partnership will arrive on the OnePlus 9, a new handset set to launch on March 23. The companies promise a “revamped camera system.” The phone will feature a Sony IMX789 sensor, coupled with HDR video and the ability capture 4K at 120FPS and 8K at 30FPS.

Per the release:

The partnership will continuously develop over the next three years, starting with software improvements including color tuning and sensor calibration, and extending to more dimensions in the future. The two parties will jointly define the technology standards of the mobile camera experience and develop innovative imaging technologies, continuing to improve the Hasselblad Camera for Mobile. Both companies are committed to delivering immediate benefit for OnePlus users, while continuously collaborating to further improve the user experience and quality for the long-term.

The deal includes the development of four global labs, including U.S. and Japan locations and:

Pioneering new areas of smartphone imaging technology for future OnePlus camera systems, such as a panoramic camera with a 140-degree field of view, T-lens technology for lightning-fast focus in the front-facing camera, and a freeform lens – to be first introduced on the OnePlus 9 Series – that practically eliminates edge distortion in ultrawide photos.

It will be interesting to see how a company like Hasselblad will take to mobile imaging, though such a deal could be a secret weapon as OnePlus looks to keep on the flagship end of the mobile spectrum against the likes of Apple and Samsung.

Following in the footsteps of Tesla, Chinese app maker Meitu has joined the ranks of cryptocurrency investment.

In the early 2010s, Meitu reached such dominance in the portrait touch-up space that its eponymous flagship app became a verb for “photo beautifying” in China. But in recent years, as smartphones became to offer built-in filters, photo editors like Meitu are struggling to hold their lead. Meitu’s stock shrank from HK$18 apiece in 2017 to less than HK$3 today.

As the company turns 13 years old and seeks alternative growth, it sets its eyes on cryptocurrency.

Meitu purchased 15,000 units of Ether and 379.1214267 units of Bitcoin worth around $22.1 million and $17.9 million respectively on March 5 in open market transactions, the company disclosed Sunday. The purchase is the first tranche of the firm’s investment plan to buy up to $100 million worth of cryptocurrency, which is financed by its cash reserves.

In recent times, Meitu chairman Cai Wensheng has been an outspoken advocate of blockchain technologies. Though China has banned initial coin offerings and crypto trading exchanges, Cai said in 2018 that he personally bought about 10,000 bitcoins.

His support for cryptocurrencies is manifested in Meitu’s latest investment move. In the disclosure, the company states:

“The Board takes the view that blockchain technology has the potential to disrupt both existing financial and technology industries, similar to the manner in which mobile internet has disrupted the PC internet and many other offline industries. The Board believes that the blockchain industry is still in its early stage, analogous to the mobile internet industry in circa 2005.”

It continues: “Against this backdrop, the Board believes cryptocurrencies have ample room for appreciation in value and by allocating part of its treasury in cryptocurrencies can also serve as a diversification to holding cash treasury management.”

Meitu further explains that the Bitcoin investment is part of its “asset allocation” plan while its bet on Ether will aid its general blockchain endeavor, wherein it’s considering baking blockchain into its various overseas businesses, including Ethereum-based dApps. It’s also looking to invest in overseas blockchain projects “that can be synergistic to its large user base.”

As of June 2020, Meitu claimed nearly 300 million monthly active users on its suite of apps released across the globe.

Praava Health founder and chief executive officer Sylvana Sinha (third from left) at one of the company’s healthcare centers

Before launching Praava Health, a company that combines telemedicine with physical clinics, Sylvana Sinha had a successful career in international law, including serving as a foreign policy advisor to Barack Obama’s 2008 presidential campaign and working for the World Bank in Afghanistan. While visiting Bangladesh in 2014 for a family wedding, however, Sinha had a “lightbulb moment” after her mother nearly died after an operation at a top private hospital.

“When I had this experience with my mom, I observed that there was really no amount of money that could afford you access to quality healthcare in Bangladesh,” she told TechCrunch.

“It really struck me that despite all the progress the country had made, and the fact that there is now a middle class of 40 million people, that there are still not really great options for excellent healthcare,” she added. “You have thousands of people traveling abroad every year and billions of dollars a year going outside the country to access better healthcare.”

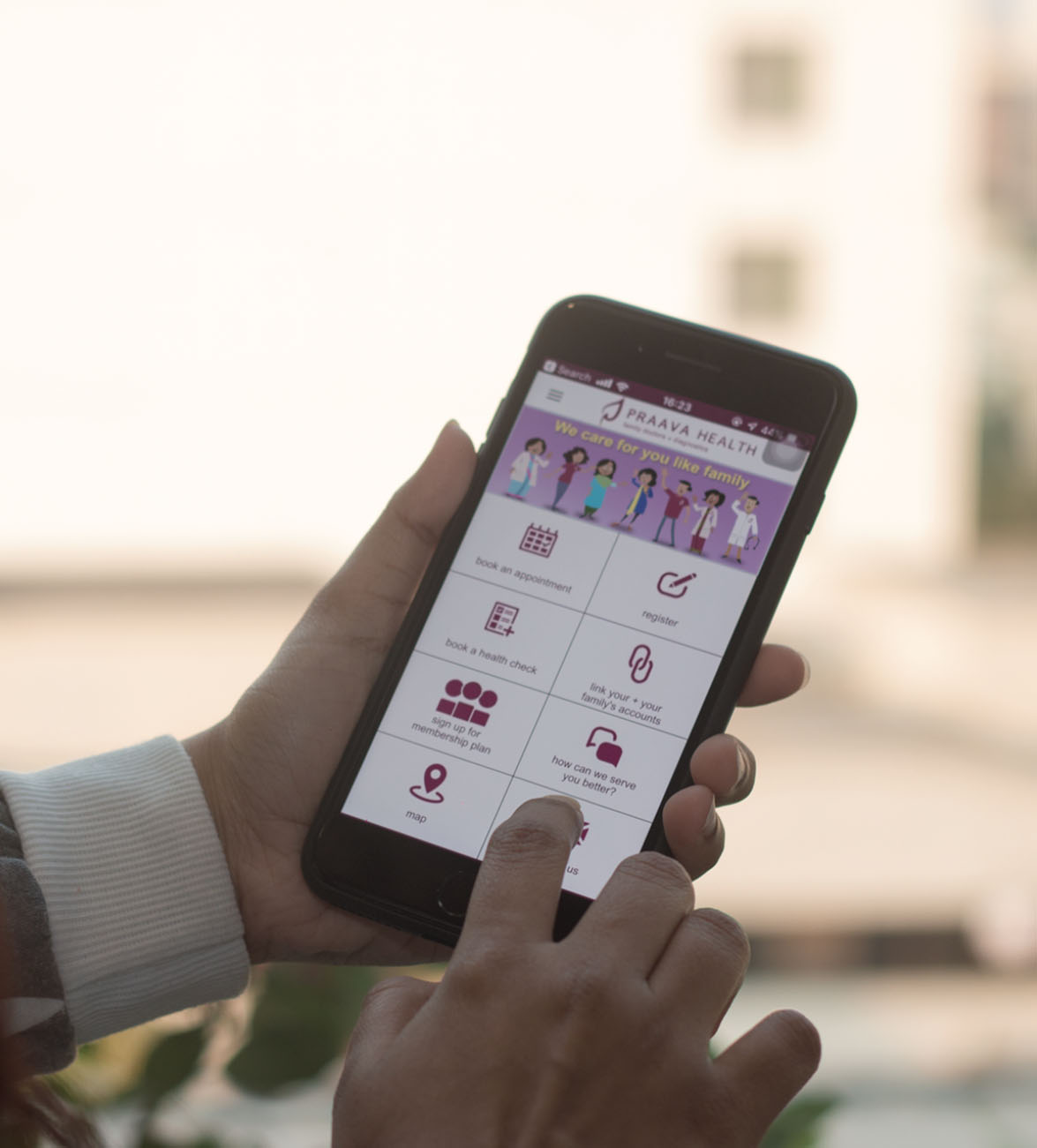

Born and raised in the United States, Sinha moved to Bangladesh in 2015 to start working on Praava. Today the company is announcing a Series A Prime round that brings its total raised to $10.6 million. Praava claims to have tripled its growth every year since launching services in 2018, and now serves 150,000 patients. In 2020, it also processed 75,000 COVID-19 tests in-house.

Praava’s backers include a list of prominent angel investors: former Central Intelligence Agency director and United States army general David Petraeus, who also invested in Praava’s seed round; Wellville executive founder Esther Dyson; SBK Tech Ventures; Dr. Jeremy Link, advisor of digital health to Singapore’s Agency for Science, Technology and Research; Dr. Rushika Fernandopoulle, co-founder and CEO of Iora Health; and Geoff Price, co-founder and chief operating officer of Oak Street Health.

The company has a flagship medical center in the Dhaka, Bangladesh’s capital, and a network of 40 smaller clinics throughout the city. Praava plans to open more clinics in Dhaka, before expanding into Chittagong, the country’s second-largest city.

Its “brick-and-click” model, including online consultations, also allows it to reach patients throughout the country. Virtual healthcare accounts for about 40% of Praava’s services including telemedicine and an online pharmacy.

Bangladesh is one of the fastest-growing economies in the world, but there is a critical shortage of healthcare workers for its 170 million people. The World Health Organization estimates that there are only about 3 physicians and 1 nurse for every 10,000 people, and most work in urban hospitals, even though 70% of Bangladesh’s population is in rural areas. This means people often travel long distances for consultations that may last less than a minute.

“One of the things that we see telemedicine really help with is patients outside of Dhaka to figure out if they even need to make that trip,” said Sinha.

The company found that in over 80% of cases, especially primary care, its providers are able to address patient needs online. In the remaining 20% of cases, they will ask them to come into one of Praava’s clinics, which provide a wide range of outpatient services, imaging and lab diagnostics and a pharmacy.

At the beginning of the COVID-19 pandemic, about 90% of Praava’s consultations were happening virtually, though clinic visits have picked up again. Most of Praava’s doctors are salaried full-time employees and one of its goals is to create deeper provider-patient relationships, with appointments typically lasting about 15 minutes.

“I think technology is the future of health, there’s absolutely no doubt about that,” Sinha said. “But when it come to seeing a doctor and the kind of healthcare needs that we all have over the course of our lifetime, technology is not going to be able to replace that entirely.”

Most of Praava’s patients currently pay per visit, and its pricing is at market rate, between Bangladesh’s public healthcare system and more expensive private hospitals. It has also introduced membership plans with a flat rate for unlimited access to services.

Sinha said this is a very new type of model in Bangladesh, where only 1% of people have health insurance, primarily to cover hospitalizations.

“It’s our experiment of introducing value-based care to the region, so we’re very excited about the product, but it’s a new product and we expect it to pick up more in the coming years,” she added. “It’s already picked up a lot in the last year, because I think people are more health conscious and corporations are more willing to invest in employees’ health.”

With its new funding, Praava will focus on building a “super app” for patients, to consolidate all of its digital services into one mobile app. It also plans to open 10 more healthcare centers in Dhaka, before expanding into Chittagong. Praava’s “brick-and-click” model can scale into other emerging markets, but it plans to concentrate on Bangladesh for the next few years.

“There are 170 million people to take care of first,” Sinha said. “So we’re really focused on this market on this market for now.”