& meet dozens of singles today!

User blogs

Many companies have turned to self-serve sales, which may encourage people to try freemium or open source versions of a product. Some percentage of these users may turn into paying customers, and in the best case will act as leaders to bring a product into their organization.

Calixa, an early stage startup believes that this type of sale, known as a bottom up sales motion, requires a new kind of tool to manage the process, and today it announced a $4.25 million seed round.

Kleiner Perkins led the round with help from Operator Collective, Liquid 2 Ventures and a bunch of individual investors. The round closed in February 2020, but is only being announced today.

Calixa co-founder and CEO Thomas Schiavone says the roots of the company began when he was working at Twilio in 2010, and saw how powerful it was for developers to purchase tooling themselves. And an idea began to form that CRM tools like Salesforce weren’t built to deal with this kind of sales motion.

“What I realized [at Twilio] was that developers were just signing up more and more every day, and that if you really wanted to stay on top of what was going on and try to effectively grow and retain those accounts, you weren’t looking in Salesforce,” Schiavone told me.

He said that he decided to start Calixa in 2019 to solve this problem once and for all. While this kind of user-driven, bottom up sale has been in place at software companies for years, he still saw a dearth of tools for dealing with its unique qualities in one place.

“We saw a great opportunity to build something that democratizes […] running a bottom up company by not only giving all customer facing teams the ability to see what’s going on with customers, but also take action,” he said.

This ability to manage the process and maybe extend a trial, issue a credit or even reset a password while letting these teams see and understand the underlying customer data was what set it apart from traditional CRMs.

“The central thesis here is that Salesforce and other CRMs, don’t have that data. They’re too divorced or too much in this rigid world of the typical sales model, and you need something different to be an effective company,” he said.

To use the product, you simply sign up and then link the various accounts the product needs to compile the data it needs. It uses various API connectors to make this happen, and all it requires is that you enter your user name and password to access the accounts and begins pulling together the data.

Bucky Moore, a partner at lead investor Kleiner Perkins says that the pandemic has accelerated the move to a bottom up approach as in person sales models have been impossible. “Core to the success of this strategy is a data-driven understanding of each customer and user. By democratizing this capability to companies of all sizes, Calixa’s opportunity is to become the de-facto customer operations platform for the modern software business,” Moore said.

Schiavone reports the company has 7 employees spread across the U.S., Canada and Columbia. He says that as he hires, he will have offices in cities close to his clusters of employees, but he sees a hybrid approach where employees can decide just how much they want to be in the office.

The company spent last year building the product and working with 21 beta customers. The product will be generally available starting today.

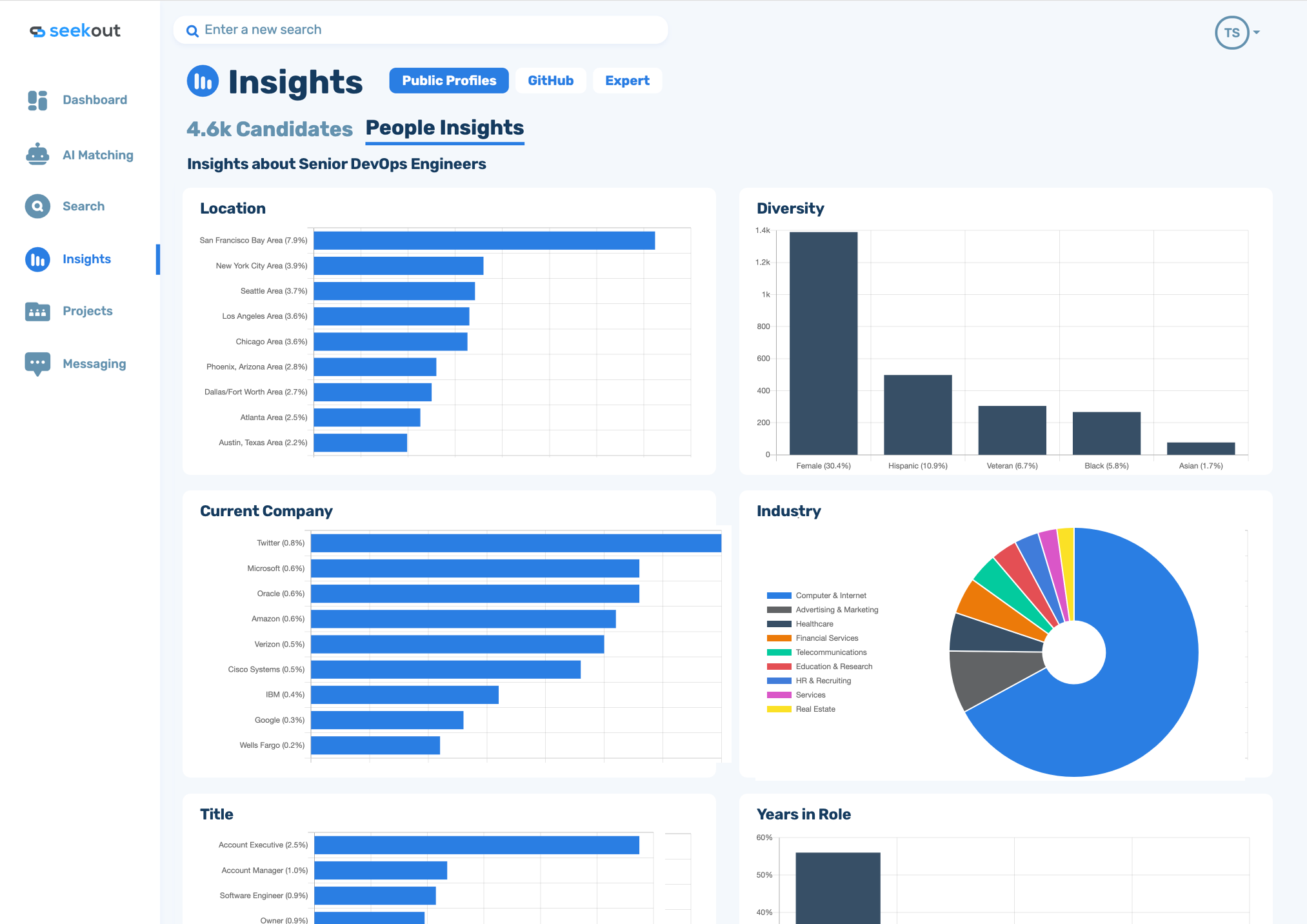

Most companies claim they want a diverse staff but at the same time, complain they don’t know how to go about recruiting more diverse candidates.

Enter SeekOut — a startup that is out to give companies no excuses with its AI-powered platform.

A group of former Microsoft executives and engineers — Anoop Gupta, Aravind Bala, John Tippett, Vikas Manocha — founded SeekOut in 2016. The team started out building a messaging platform that provided a deep level of information about people that others might be emailing. When they realized that what customers really were after was the information they were uncovering, and not so much the messaging capability, the company pivoted in 2017.

Today, SeekOut’s goal is to help talent acquisition teams to recruit “hard-to-find and diverse talent.” The startup wouldn’t name names but said it is working with 6 out of the 10 “most highly valued companies” by market cap in the U.S. Overall, it had about 500 customers as of January across a range of industries from technology to pharmaceutical to aerospace and defense to banking.

Over the years, SeekOut has built out a database with hundreds of millions of profiles using its AI-powered talent search engine and “deep interactive analytics.” It finds talent by scouring public data and using natural-language and machine-learning technologies to understand the expertise of each candidate and build a complete 360-degree view of each potential employee. Specifically, it blends info from public profiles, GitHub, papers and patents, employee referrals, company alumni, candidates in ATS systems.

While SeekOut initially focused strictly on technical talent, it has since broadened its base to helping recruiters and sources find more diverse candidates in general as well as people with simply “hard-to-find” skill sets. And it claims to do it with “unprecedented speed and precision” via a blind hiring method designed to reduce bias. SeekOut then gives recruiters a way to engage with candidates instantly by getting access to the right contact information in a “single click.”

SeekOut co-founders (left-to-right) Anoop Gupta, Aravind Bala, Vikas Manocha and John Tippett. Image courtesy of SeekOut

The startup is hitting such a sweet spot that it attracted the attention of Tiger Global Management, the global investment firm that just led a $65 million Series B that values SeekOut at around $500 million.

Existing backers Madrona Venture Group and Mayfield also participated in the financing, which brings SeekOut’s total funding since inception to $73 million.

In a world where so many startups have yet to turn a profit, SeekOut is a refreshing exception. Since its $6 million Series A raise in May 2019, the SaaS company says it has grown its subscription revenue (ARR) by “more than 10-fold” (although it declined to reveal hard revenue figures). And it’s been profitable, or cash-flow positive, each of the last two years.

Gupta, who serves as the company’s CEO, said its platform (dubbed Talent-360) helps companies not only find diverse talent, but helps them improve retention by finding the “right” candidate to begin with.

While there was a pause almost across the board in hiring when the COVID-19 pandemic began, the emergence of remote work as a new normal has forced companies to think more creatively about hiring — especially since they are not constricted by geography as in the past — according to Gupta.

“This freedom also means their need for tools like SeekOut increased and we have seen our business take off as a result,” he told TechCrunch. “The focus on diversity hiring and our unique approach to finding the talent and offering blind hiring features has super charged the adoption.”

Mario Linares, head of talent acquisition at Aviatrix, acknowledges that competition for talent among software companies is fiercer than ever

“SeekOut’s innovative AI-powered search, global power filters, diversity filters, and talent pool insight have been critical components of Aviatrix’s global growth plan,” he said in a written statement.

For Tiger Global Partner John Curtius, SeekOut’s platform has the potential “to transform the world of HR.”

“We are impressed by the customer love and traction SeekOut is experiencing,” he said in a written statement.

Looking ahead, SeekOut plans to use its new capital to speed up the development and expansion of its platform and build customer success, engineering, sales and marketing teams in Seattle. And it plans to use its own platform to do it.

The company also plans to double its headcount of 50 over the next year.

Rep. Barbara Lee (D-13 California) took time out of her busy schedule this week to join us for TechCrunch Sessions: Justice. During our our wide-ranging discussion, she talked about the issues in tech that unfortunately do not get enough attention: a lack of diversity in tech, the so-called pipeline problem, the digital divide and access for all to the legal cannabis marketplace.

Rep. Lee has represented the 13th District of California — Oakland and the surrounding East Bay cities — since 1998. Since then she has been an active member of the Congressional Black Caucus, which formed 50 years ago this month with 13 members and continues to have an enduring impact on the nation.

“They were truly the conscience of the Congress,” Lee says, “because these 13 members of Congress on each and every issue, they pushed the envelope for justice — for racial justice. Yes, for the African American community, but in their initial founding statement, they said for all marginalized communities in this country. And so if you fight for justice for African Americans, you’re fighting for justice and equality for everyone who has been left out of this country’s promise of the American dream.”

On a lack of diversity in tech

Rep. Lee, along with Rep. Maxine Waters and other Congressional Black Caucus members have visited companies in Silicon Valley and New York to address the issue of diversity in tech. In 2015, as a part of TECH2020 [PDF], the members met with CEOs of some of the biggest companies in the world to get their take on diversity in tech and the struggles the wider industry seems to have when it comes to increasing representation on their teams.

We’ve made many trips to Silicon Valley and to New York and have met with the tech sector over and over and over again. We see a glimmer of hope, but not much. When you look at the numbers of the workforce in terms of employees, I think we’re looking from maybe — as it relates to African Americans — but maybe from 2 to about 7%. If that. When you look at the retention numbers, cultural hostility in many respects that tech sector employees tell me they were faced once they’re in, they don’t stay a long time, because the culture has not been a culture friendly for African Americans and Latinx individuals. And it’s a problem. And we’re gonna keep pushing. I co-chair TECH2020, which we started five years ago. And we’ve heard so many excuses from tech sector.… We’ve got to crack that culture. And I’m telling you, we’ve got to do before we exercise our regulatory reform, and I’ll stick because there’s no way in America, any tech sector, any company should have only — and especially in California, only 2 to 7% of African Americans in the in the workforce. (Timestamp: 2:48)

The conversation around diversity in tech is one that began years ago. Public diversity reports illustrate the struggle that companies still find themselves engaged in. And potential unwillingness to address the issue. Rep. Lee says she and other members of the Congressional Black Caucus have their eyes on the industry as a whole. And she talked a bit more about what tools the federal government has in its arsenal to help encourage companies to engage in equitable hiring.

We have Black members everywhere on key committees that are conducting oversight and making sure that the tech sector, especially those — many received federal contracts, and they’re required to comply with executive order 11924. And they just don’t. They get away with it. And so no, I’m not satisfied. I think we made some progress, we see more diversity officers and more human resources officers who are African American, and I work closely with them. And I know the challenges that they’re faced with it. So I try to help them from the outside to make those companies respond in a more adequate and in a fair and equitable manner. (Timestamp: 5:26)

- Apple announces new projects related to its $100M pledge for racial equity and justice

- Facebook hires a VP of civil rights

- Airbnb sets new diversity goals

On the so-called ‘pipeline problem’

The “pipeline.” It’s what company heads point to when they’re asked why their rosters lack diversity. The thing is, it’s not real.

It’s a total myth. First of all, we have — I know African American engineers, African American professionals who, quote qualify for these jobs. But I do know there’s unconscious bias, i.e. racism in the companies. And so a lot of the companies have developed these anti-racist policies and programs where they tried to do the deep dive and try to help people understand unconscious bias and what have you, but they don’t take the results and implement them. And so it’s just really, you know, it’s not good. When you look at the tech sector jobs, I believe it’s about 40% are non-tech-related. And so you can’t tell me that we don’t have African American accountants, and, you know, auditors, African American communications firms, all of the services that they buy, they don’t contract with, and the non-tech jobs they don’t hire black people for. And so it’s a shame and disgrace, but we’re gonna keep pushing. (Timestamp: 6:08)

- Examining the ‘pipeline problem’

- Black Tech Pipeline proves the ‘pipeline problem’ isn’t real

- The other pipeline

On investing in diversity

Oakland, Calif.-based Kapor Capital, the investment arm of the Kapor Center for Social Impact, raised $125 million for its third fund. The firm’s investing thesis promotes startups that are committed to building diverse teams and a culture of inclusion.

Thank god for Kapor… They’re committed to racial equity and racial justice. And in terms of their venture capital strategies in terms of how they seed firms to begin to enter into this space. What they do all over the state and in the country is remarkable. And I’m so proud that they are in Oakland, because Oakland, I think, is a microcosm of all of the possibilities, but all the challenges that we as African Americans and people of color have in America. (Timestamp: 10:55)

- Kapor Capital is raising a $125 million fund

- If you’re not investing in diverse founders, you’re a bad investor

- Venture firms rush to find ways to support Black founders and investors

On cannabis

There remains a disproportionate number of Blacks incarcerated due to drug offenses. And as states continue to legalize marijuana, most recently in New Jersey just last week, the industry is seeing incredible growth. But Black Americans are being excluded from the economic benefits of that. As the co-chair of the Cannabis Caucus, Rep. Lee has plans to ensure the capital in the burgeoning legal cannabis market is available to all.

I also have legislation is called the RESPECT Act, which is about equity in the industry. The licenses — as of last year only maybe 1% or less were granted to African Americans. This is a trillion-dollar industry. And I don’t want to see what’s happening in the tech sector happening in the cannabis sector now, so we’re at the beginning of this. So we have in the MORE Act and in my bills, requirements to set up offices of equity and how you bring companies and help companies — I know in my own district we have an Office of Equity — to help them weed through the bureaucracy to get their licenses. But also access to capital. Sometimes it’s [$300K] to $500K just for a license… But I am determined — I am determined that we’re going to see those who have been most affected by these, this horrific draconian war on drugs get access to the industry and to the benefits. This industry creates jobs – good-paying jobs. They create economic opportunities, and they create community reinvestment opportunities, and so why not? And we’ve got to move forward. And we’re making a lot of progress. (Timestamp: 13:03)

Read the full transcript here.

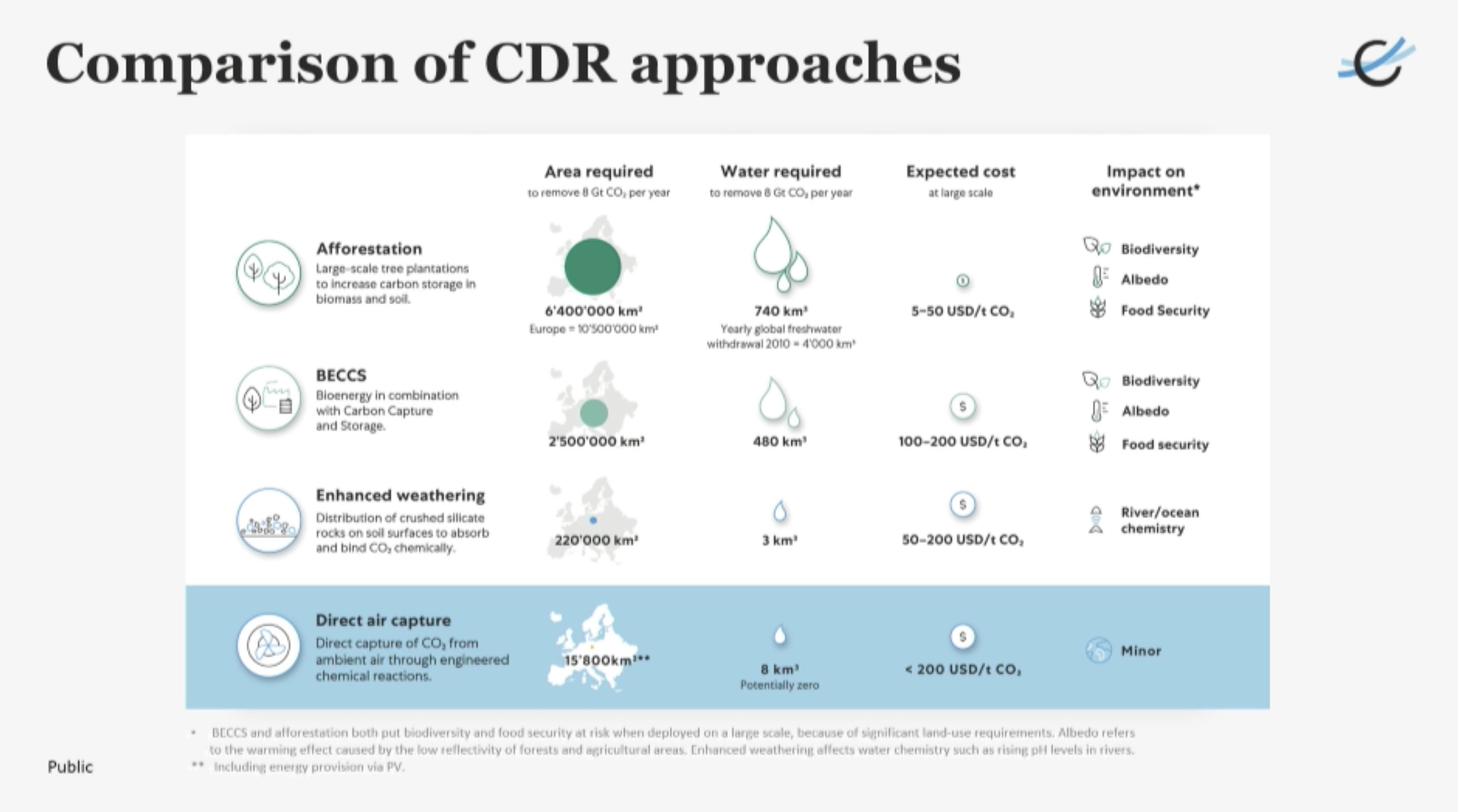

The Swiss-based, venture capital-backed, direct air capture technology developer Climeworks is partnering with a joint venture between the government of Norway and massive European energy companies to map the pathway for a business that could provide not only the direct capture of carbon dioxide emissions from air, but the underground sequestration and storage of those emissions.

The deal could pave the way for a new business that would offer carbon capture and sequestration services to commercial enterprises around the world, if the joint venture between the Climeworks and the newly formed Northern Lights company is successful. It would mean the realization of a full-chain carbon dioxide removal service that the two companies called a necessary component of the efforts to reverse global climate change.

Northern Lights was incorporated in March as a joint venture between Equinor, Shell and Total to provide processing, transportation and underground sequestration services for captured carbon dioxide emissions. The business is one of the lynchpins in the Norwegian government’s efforts to capture and store carbon emissions safely underground under a plan called The Longship Project.

“There is growing awareness of the need to build capacity to remove CO2 from the atmosphere to achieve net zero by 2050. We are enthusiastic about this collaboration with Climeworks. Combined with safe and permanent storage, direct air capture has the potential to get the carbon cycle back in balance,” said Børre Jacobsen, the Managing Director of Northern Lights, in a statement.

The two companies are hoping to prove that Northern Lights facilities combined with Climeworks direct air capture technologies can prove to be a part of a push towards negative emissions technologies that allow companies in non-industrial sectors to become either carbon neutral or carbon negative.

There are a number of caveats to the project, which reveal both the potential promise and pitfalls of direct air capture initiatives and sequestration and monitoring projects.

The first issue is the need to set a global price for carbon dioxide emissions that would take to make the projects economically viable.

“There is one legislation worldwide that is paying for direct air capture of CO2 and that is the Low Carbon Fuel Standard in California,” said Christoph Gelbad, the co-chief executive and co-founder of Climeworks. “It’s paying up to $200 per ton… this price range is the price range that will be needed to make this full chain, really going from the atmosphere to direct air capture to underground storage and monitoring. That will be the price range needed to build up the infrastructure and finance it.”

A breakdown of the costs associated with different carbon capture technologies.Image Credit: Climeworks

That price is on the highest end of any that world leaders have discusses as a potential cost for carbon emitting industries (and it’s well below the price that China has set for carbon emissions, which is important to note given the scale of China’s contribution to the production of greenhouse gases that cause global warming).

Beyond any pricing concerns associated with making these direct air carbon capture and storage solutions viable, there’s the scale at which these projects would need to be developed to make a real dent in global emissions.

Here again, Gelbad offers a clear-eyed assessment of his company’s capabilities and the size of the problem.

“The numbers given by science 10 to 20 billion tons of CO2 for removal,” Gelbad said. “Direct Air Capture will need to grow at a gigaton scale. This [potential] site will be in the megaton scale. [But] this is the range where our journey together with Northern Lights definitely could go. We see it going into the megaton ranges.”

Climeworks uses renewable energy and waste heat to power modular collectors that can be stacked into machines at any size. The only limit to the company’s ability to capture carbon dioxide is the availability of power, according to Gelbad.

The company already has a collaboration with an Icelandic company called Carbfix, where the Climeworks technology is used to capture carbon dioxide and store it in mineralized basalt. The company said in a statement that it’s looking globally for other opportunities for permanent carbon dioxide storage and that the Northern Lights solution of deep geological sequestration in an offshore saline aquifer under the North Sea represents an ideal alternative site.

To develop its technology, Climeworks has raised over $150 million from investors including the Swiss lender Zuercher Kantonalbank.

For its part, Northern Lights is already planning on capturing carbon dioxide from industrial point sources in the Oslo region, which will then be shipped to an onshore terminal on the Norwegian coast. A facility there will transport the liquefied carbon dioxide by pipeline to an offshore storage location 1.62 miles below the seabed in the North Sea.

“Northern Lights is offering carbon capture and sequestration as a service. From the idea of doing this project and from the early days of working with the ministry … my biggest surprise was the level of interest in [carbon capture and sequestration] among emitters in Europe,” said Jacobsen. “This awareness. This interest. And the need to find a solution is accelerating. We are talking about what are the possibilities and what are the solutions. Northern Lights offers a great part of the value chain.”

Some companies are already interested in becoming early customers for the project, Jacobsen said. “We have a number of MOUs and confidentiality agreements with customers and letters of support. Big interest in discussing with us. The key will be that we have to bring conversations into agreements so that we can bring this business forward.”

Each of the big three cloud vendors — Amazon, Microsoft and Google — has a marketplace where software vendors can sell their wares. It seems like an easy enough proposition to throw your software up there and be done with it, but it turns out that it’s not quite that simple, requiring a complex set of business and technical tasks.

Tackle, a startup that wants to help ease the process of getting a product onto one of these marketplaces, announced a $35 million Series B today. Andreessen Horowitz led the investment with help from existing investor Bessemer Venture Partners. The company reports it has now raised $48.5 million.

Company founder Dillon Woods says that at previous jobs, he found that it took several months with a couple of engineers dedicated to the task to get a product onto the AWS marketplace, and he noticed that it was a similar set of tasks each time.

“What I saw [in my previous jobs] was that we were kind of redoing the same work. And I thought everybody out there was probably reinventing the same wheel. And so when I started Tackle, my goal was to create a software platform that would take that time down to one or two days. So it’s really a no code solution, and it makes it much more of a business decision, rather than this big technical integration project,” Woods told me.

While you may think it’s a pretty simple task to put an app on one of these marketplaces, Woods points out that the AWS user guide explaining the ins and outs is a 700 page pdf. He says that it’s not just the technical complexity of setting up the various API calls to get it connected, there is also the business side of selling in the marketplace, and that requires additional APIs.

“There’s not just the initial sale. There could be things later like upgrades, refunds, cancellations — maybe you need to do overage charges against that same contract. And so there are all of these downstream things that happen that all require API integration, and Tackle takes care of all of that for you,” Woods explained.

CEO John Jahnke says that the company usually starts with one product in one marketplace, which acts as a kind of proof of concept for the customer, then builds up from there. Once customers see what Tackle can do, they can expand usage.

It seems to be working with the startup reporting that it tripled annual recurring revenue (ARR), although it didn’t want to share a specific number. It also doubled headcount and the number of customers and was responsible for over $200 million in transactions across the three cloud marketplaces.

Jahnke didn’t share the exact number of customers, but he said there were currently hundreds on the platform including companies like Snowflake, GitHub, New Relic and PagerDuty.

The company currently has 67 employees spread across 25 states with plans to almost double that by the end of 2021. He says that it’s essential to put systems in place to build a diverse company now.

“How we scale through this next 100% increase in headcount is going to define the mix of the company into the future. If we can get this right right now and continue to extend on the foundation for diversity and inclusion that we started and make it a real part of our conversation at some scale, we think we’ll be set up as we go from 100 employees to 1000 employees over the long period of time to continue to grow and create opportunities for people wherever they are,” Jahnke said.

Martin Casado, general partner at lead investor a16z, says this type of selling has become essential for businesses and that’s why he wanted to invest in the company. “Cloud marketplaces have become a primary channel for selling software quickly and conveniently. Tackle is the leading player for enabling companies to sell software through the cloud,” he said.