& meet dozens of singles today!

User blogs

The artist Beeple scores a huge NFT sale, Twitter Spaces are coming soon and Seth Rogen’s weed startup launches in the U.S. This is your Daily Crunch for March 11, 2021.

The big story: NFT artwork sells for $69M

For the first time, auction house Christie sold a digital-only artwork: “Everydays — The First 5000 Days,” a collage of several years of sketches from the artist Mike Winkelmann, who’s known online as Beeple.

Yes, it’s another one of those NFT (non-fungible token) sales you’ve been hearing so much about for the past few weeks. And this one came with the most eye-catching price tag so far, with bids in the final two hours escalating from $14 million to $69 million.

While crypto and NFT enthusiasts likely drove much of that bidding, this is certainly going to make the art world sit up and take notice — not just when it comes to selling digital art, but also potentially as a means to record and transfer proof of ownership for any art.

The tech giants

Twitter Spaces to launch publicly next month, may include Spaces-only tweets — The social network’s Clubhouse rival is working toward a public launch in April.

Facebook is bringing ads to shorter videos and Stories — Facebook is expanding its monetization options for video creators, which probably means more ads for viewers.

Google paves way to monetize Pay users’ data in India — Google says it will roll out an update to Google Pay next week asking users to choose whether they wish to share data with the company.

Startups, funding and venture capital

Seth Rogen and Evan Goldberg want to be your weed dealer — Seth Rogen and four friends-turned-co-founders have been building Houseplant for close to 10 years, and its products are now available in the United States.

Epidemic Sound raises $450M at a $1.4B valuation to ‘soundtrack the internet’ — Epidemic’s audio marketplace currently features around 32,000 music tracks and 60,000 sound effects.

Indy-based High Alpha Capital launches new $110M fund — The firm focuses on B2B SaaS startups.

Advice and analysis from Extra Crunch

Five takeaways from the Coursera IPO filing — The company is still unprofitable, despite the pandemic’s boost to its business and customer base.

Does your VC have an investment thesis or a hypothesis? — OpenVC has identified six common patterns of how VCs articulate their theses and some best practices in doing so.

Bessemer’s 2021 cloud report provides context for soaring software startup valuations — Growth rates among cloud companies should prove more durable than nearly anyone expected.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Everything you missed from TC Sessions: Justice — If you didn’t have a chance to join us last week, you can still catch up on all the conversations.

The 2021 Volkswagen ID. 4 ticks all the boxes, except one — The electric crossover offers plenty of range at an affordable price.

Eye, robot — Our latest robotics roundup covers the surgical, food delivery and ocean mapping robots, as well as the return of an adorable friend.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Another day brings another pubic debut of a multibillion dollar company that performed well out of the gate.

This time it’s Coupang, whose shares are currently up just over 46% to more than $51 after pricing at $35, $1 above the South Korean e-commerce giant’s IPO price range. Raising one’s range and then pricing above it only to see the public markets take the new equity higher is somewhat par for the course when it comes to the most successful recent debuts, to which we can add Coupang.

The company’s mix of rapid growth and slimming deficits appear to have found an audience among public money types, so let’s quickly explore the price they paid. What was the company worth at its IPO price, and what is worth now? And, of course, we’ll want to calculate revenue run rates for each figure.

Oh — we’ll also need to calculate how much money SoftBank made. Inverted J-Curve indeed!

Coupang’s IPO and current value

As Renaissance Capital notes, Coupang boosted its share allocation to 130 million shares from 120 million. This made the value of both primary and secondary shares in its public offering worth a total of $4.55 billion. That’s a lot of damn money.

At its IPO price of $35, the same source pegged the company’s fully diluted IPO valuation at $62.9 billion. By our accounting, the company’s simple valuation at its IPO price came to $60.4 billion. Those numbers are close enough that we’ll just stick with the diluted number out of kindness to the company’s fans.

Doing some quick math, Coupang is worth around $92 billion at the moment. That’s a huge number that nearly zero companies will ever reach. Some do, of course, but as a percentage of startups that start it’s an outlier figure.

Today, the auction of an NFT digital art collage from a relatively unrecognized digital artist ended with a purchase price above $69 million. The work, called Everydays – The First 5000 Days, chronicled several years-worth of daily sketches from the artist Mike Winkelmann — known online as Beeple. Unlike every other work the auction house Christie’s has listed in its 250+ year history, this was a purely digital work.

It’s a crazy dollar amount sure, but it’s also a tacit endorsement from the stratospherically wealthy patrons of the fine art world that blockchain-minted digital art is an acceptable medium. Beeple may have attracted a higher premium than other artists of his class thanks to crypto-enthusiasts aiming to use this wave of enthusiasm to prop up a new market for crypto assets and a new medium for blockchain, but it’s still a historic moment for the art world.

Christie’s auction notes that the sale makes Beeple one of the world’s three most valuable living artists. Christie’s detailed that the bids exploded in the artwork’s final two hours at auction, moving from nearly $14 million to over $69 million as the bids poured in.

.@beeple 's 'The First 5000 Days', the 1st purely digital NFT based artwork offered by a major auction house has sold for $69,346,250, positioning him among the top three most valuable living artists. Major Thanks to @beeple + @makersplaceco. More details to be released shortly

— Christie's (@ChristiesInc) March 11, 2021

Beeple had embraced NFT artwork for months, making several million dollars off the artwork late last year before a slightly more mainstream embrace of the tech by the art world drove his works’ valuations to the moon. NFTs — or non-fungible tokens — are essentially minted assets with mathematically defined contracts that can indicate true ownership of a digital good. For digital artists who had struggled to define a sense of scarcity for digital files that could be downloaded, uploaded and shared freely, NFTs seem to be a coup of the medium that feel custom-built for the art world.

Internet-embracing meme art has been fusing with street art and eating the fine art world over the past decade, much to the chagrin of many of the existing tastemakers and stakeholders in that world who have struggled to find a shared definition of what these works mean in terms of artistic value. Christie’s embrace of the NFT for this singular sale is perhaps the most impactful evolution here. The FOMO for other auction houses may push them to quickly embrace a technology they otherwise would have been more reticent to.

The impact of the blockchain may have long-term effects on art auction houses beyond pure NFTs sales, namely it’s highly possible that these entities embrace NFTs as a trusted solution for indicating and transferring proof of ownership. The future of NFTs in the art world is certainly far from certain, but this is an explosive start.

Volkswagen, once a dabbler in electric vehicles, is now betting its future on the technology. And the new Volkswagen ID.4 — a five-passenger, fully-electric crossover with a starting price of $33,995 (before federal or state incentives) — is its first global effort to make EVs a mainstream product and part of its larger goal to become carbon neutral by 2050.

The upshot: The VW ID.4 offers a balanced blend of technology, comfort and design for a more affordable price and seeks to capture some of the market left vacant by the lack of an affordable Tesla Model Y. The VW ID.4 offers solid technology without being so out-of-this-world that your average crossover buyer will balk with one exception. The lack of seamless charging makes finding and then connecting to a third-party charging station a clunky, even complex experience.

As Mark Gillies, Senior Manager of Product at VW said during our interview, “We want to be the company that builds electric cars for the millions, not just for the millionaires.”

While that may be true, there are a few niggling concerns like a somewhat laggy infotainment system that should improve with updates coming soon, and the previously mentioned miss of seamless charging. If Volkswagen can address those problems, the VW ID.4 could take a solid bite out of the booming crossover market. But will the masses flock to a fully-electric future that delivers a near-to-gasoline driving experience and become the “car for the millions?”

The 2021 Volkswagen ID.4 crossover might be the first global, dedicated all-electric vehicle from the VW brand, but it’s not the first consumer-available electric vehicle from the VW Group as a whole. It launched the California-only Volkswagen e-Golf back in 2013 (discontinued last year), and the company’s luxury performance brand Porsche began sales of its all-electric Taycan in 2019.

When it launched, e-Golf represented more of a fringe case for the company. It was targeted specifically at the California market, where incentives for electric vehicles and charging infrastructure, as well as environmental regulations, are more robust. The ID.4, in contrast, represents one of the “most important Volkswagen debuts since the Beetle,” and it will be available across the country.

The tech that stands out

Rather than try to fit a gasoline-shaped peg into an electric-shaped hole, Volkswagen appears to have taken a page from Tesla’s book in its approach to the dash layout and cabin feel in the ID.4.

The interior design of the ID.4 feels like a glimpse of a self-driving future as you could visualize a day when both the steering column and even the infotainment system could simply be deleted. Even the center console, complete with modular cupholders, cubbies and NFC charging pad could eventually be modified to create more passenger space, making the interior of the ID.4. feel even more open and airy than it already does.

The ID.4 launches with three trims: the Pro, Pro S and 1st Edition. The Pro comes with a 10-inch touchscreen. The Pro S and 1st Edition trims come with a 12-inch infotainment touchscreen mounted at the center of the dashboard.

As you reach towards the center screen, the icons respond thanks to an in-cabin camera that tracks hand motion towards the system. There are very few hard-touch buttons inside the ID.4, and those that do exist are more like medical-grade haptic buttons used to control everything from climate and audio to the opening and closing of the shade on the optional panoramic fixed-glass roof and even driving modes and driver assistance features. They take a little getting used to, but once familiar they tend to work like slider buttons, allowing you to adjust volume or temperature with slight pressure changes and small slides from left to right.

Hello I.D.

Instead of buttons, Volkswagen has decided to leverage hands-free voice control in the new ID.4, but during our time with the vehicle, the system felt like it was still in beta.

Both driver and passenger use the touchscreen or specific voice commands to many of the common features and infotainment of the ID.4. Say “Hello I.D.” and a light strip along the base of the windshield lights up based on which side of the vehicle the voice came from (passenger or driver), indicating that it’s ready to receive the command you say next.

Commands are rather limited at this time and must be initiated by either saying the key phrase (“Hello I.D.”) or pushing the voice control button located on the steering wheel. You can say basic things like navigation commands but you can also say things like “I’m cold,” or “tell me a joke,” and the ID.4 system will respond by raising the temperature on that side of the car, or telling a seatbelt joke.

During the test drive, the response time from the system was very slow compared to other voice systems on the market, and it struggled to find connectivity to do things like change a Sirius XM channel, (repeatedly saying that it couldn’t find a specific channel number or name) even though my test drive didn’t stray beyond the bounds of Los Angeles and Long Beach. It also failed more often than naught, taking around ten seconds or more to finally cancel out of the voice control systems when it either couldn’t understand the command or it couldn’t get connectivity.

Laggy nav

The navigation system in the ID.4 was also a bit laggy and imprecise, which meant I reverted to using Google maps and the wireless Android Auto system (included along with Apple CarPlay throughout the ID.4 lineup) to get directions. One neat feature of the ID.4’s on-board navigation system, however, is that the light strip along the windshield illuminates on either side of the vehicle as you approach a turn to indicate which direction you should go.

The infotainment screen looks just like your phone or tablet screen: Swipe through the pages of apps or various windows to get to the page you want. Unfortunately, the combination of a laggy connection to the network (despite having three to five bars of 4G connectivity according to the infotainment system), and a laggy load time, the screens would occasionally freeze while swiping between pages, showing half of one page while still loading the next.

As a caveat: I was lucky enough to get three separate opportunities to spend extended time in different ID.4s in the Los Angeles press fleet and only experienced the lag/freeze with one of the vehicles, however. Volkswagen PR says that the software in the test vehicles is not the final version that customers will receive and it will be updated before getting to owners, which should solve for the strange stuttering and voice command issues that I experienced.

The ID.4 will also get Alexa capability later this year through their Car-Net service which includes an app that can help you monitor your vehicle from afar. The app is simple enough to use: Owners login and can see the location, charge level, and status of their ID.4.

VW made a multitude of interesting design choices inside the ID.4 including the placement of the main instrument panel and the transmission selector. Rather than attaching these items to the dash or center console like you’d find in a typical vehicle, they’re attached directly to the steering column. When you move the steering wheel, the instrument panel and transmission rocker move with it. Volkswagen uses a 5.3-inch screen attached to the steering wheel to provide information about everything from speed and direction of travel to range, trip, and basic navigation information. You use a rhombus-shaped rocker at the right side of the steering wheel to toggle through driving modes rather than a standard button or shift lever.

There’s a start/stop button located in a rather hidden spot on the right side of the column to start the ID.4, but it’s largely superfluous. When you unlock the vehicle and sit in the driver’s seat, the ID.4 powers on and is ready to drive. When you unlatch your seatbelt and climb out, the ID.4 powers down. That makes things a bit complicated if you have friends or family in the vehicle while you dash into a place to run an errand, but the ID.4 allows passengers to keep things like the AC and heat going for a short period of time by using controls that appear on the infotainment screen, even if the driver isn’t in the vehicle.

Converting drivers to EVs

Volkswagen says that its research has shown that roughly 30% of crossover owners would consider an electric crossover. There’s no denying that the ID.4 enters a crowded crossover market complete with extremely popular gasoline and hybrid competitors like the Toyota RAV4 and Honda CR-V. Volkswagen says that, based on its research, consumers shouldn’t feel any range anxiety since most crossover owners drive around 60 miles per day and the battery system offers an EPA-estimated 250 miles of range. You can charge the ID.4 from 5% to 80% in 38 minutes at a 125 kW.

A full charge at home is estimated to take around 7.5 hours but, if you’re out and about, Volkswagen is offering free, unlimited charging at DC fast chargers by Electrify America at no additional cost for the first three years of ID.4 ownership, which sounds great, but comes with some caveats. VW says that it expects most people to charge overnight on typical residential power, and it’s clear that the company doesn’t expect owners to use public chargers all that frequently because the process of locating an available charger is not seamless, at least not at the ID.4’s launch.

Electrify America is a subsidiary of VW, yet they operate completely separately from Volkswagen. The company operates 550 charging stations and more than 2,400 DC fast chargers, across the country. You can search for “charging stations,” through the on-board nav but the system brings up all charging stations in the vicinity and doesn’t show which are online and available and which ones are not. In order to find specific Electrify America chargers, owners have to pull out their phones and open the Electrify America app to see which stations are online and available. You can then send the location of a specific charger to AndroidAuto or Apple CarPlay to navigate. Unfortunately, at this point, the Electrify America app does not show up in Android Auto.

This process is rather clunky and would require owners to pull over and park to safely complete it before heading to the charging station–at least at this point in time. Volkswagen says that an over-the-air update coming later this year will further integrate Electrify America stations into the on-board nav in a more seamless way.

The good news is that the EPA-estimated fuel economy equivalent for the Pro S and 1st Edition models is 104 MPGe for city driving, while highway driving is rated at 89 MPGe, for a combined city/highway rating of 97 MPGe.

One of the striking features of the ID.4 is how it drives. Transmission modes on the ID.4 include a B or brake mode–a common and exceedingly convenient setting that allows for one-pedal driving on electric vehicles. Take your foot off the brake and the ID.4 slows slightly, regenerating electricity and sending it back into the battery. It’s a great feature in stop-and-go traffic and Volkswagen intentionally tuned the one-pedal driving to be less aggressive than those in other electric vehicles, with the aim of making the feel more familiar for first-time electric vehicle owners.

On the road, the ID.4 feels well planted and not nearly as large as it looks. It’s nimble but not exactly quick off the line (VW has not released 0-60 mph times) though it doesn’t leave you sweating to make a short merge. It’s certainly no tire-smoker or rocketship, however.

Since it’s a rather bulbous shape, there is some very minor wind noise at speed on the road, but the ride is comfortable and confident. At speeds below 20 miles an hour (and when you put it into reverse), it does make that characteristic electric car sound to alert pedestrians. It’s not noticeable inside the cabin when the windows are raised, but pass a neighbor who is working on a car in his garage, and you’ll be sure to arrive home to a text asking if that was you driving around in the car that sounds like a spaceship.

ADAS form & function

VW’s Travel Assist is the branded name for the company’s Level 2 autonomous driving system, which works at speeds that range from 0-95 mph. Travel Assist uses both the adaptive cruise control and the lane-keeping systems to follow the road and other vehicles ahead. When a motorcycle suddenly hops into your lane, the instrument screen shows an image of a motorcycle directly in front of the vehicle. If said motorcycle decides to randomly slam on the brakes, the ID.4 responds and brakes automatically. If traffic comes to a stop ahead, the ID.4 Travel Assist waits until traffic moves again. It approximates a human response to traffic motion very well–neither waiting inordinately long and leaving huge gaps (which causes rubberbanding in traffic) nor accelerating aggressively.

The system makes long stints in heinous traffic bearable. I spent an hour commuting on the dreaded 405 freeway in Los Angeles during rush hour and only had to keep my hands lightly on the capacitive steering wheel to keep the system engaged.

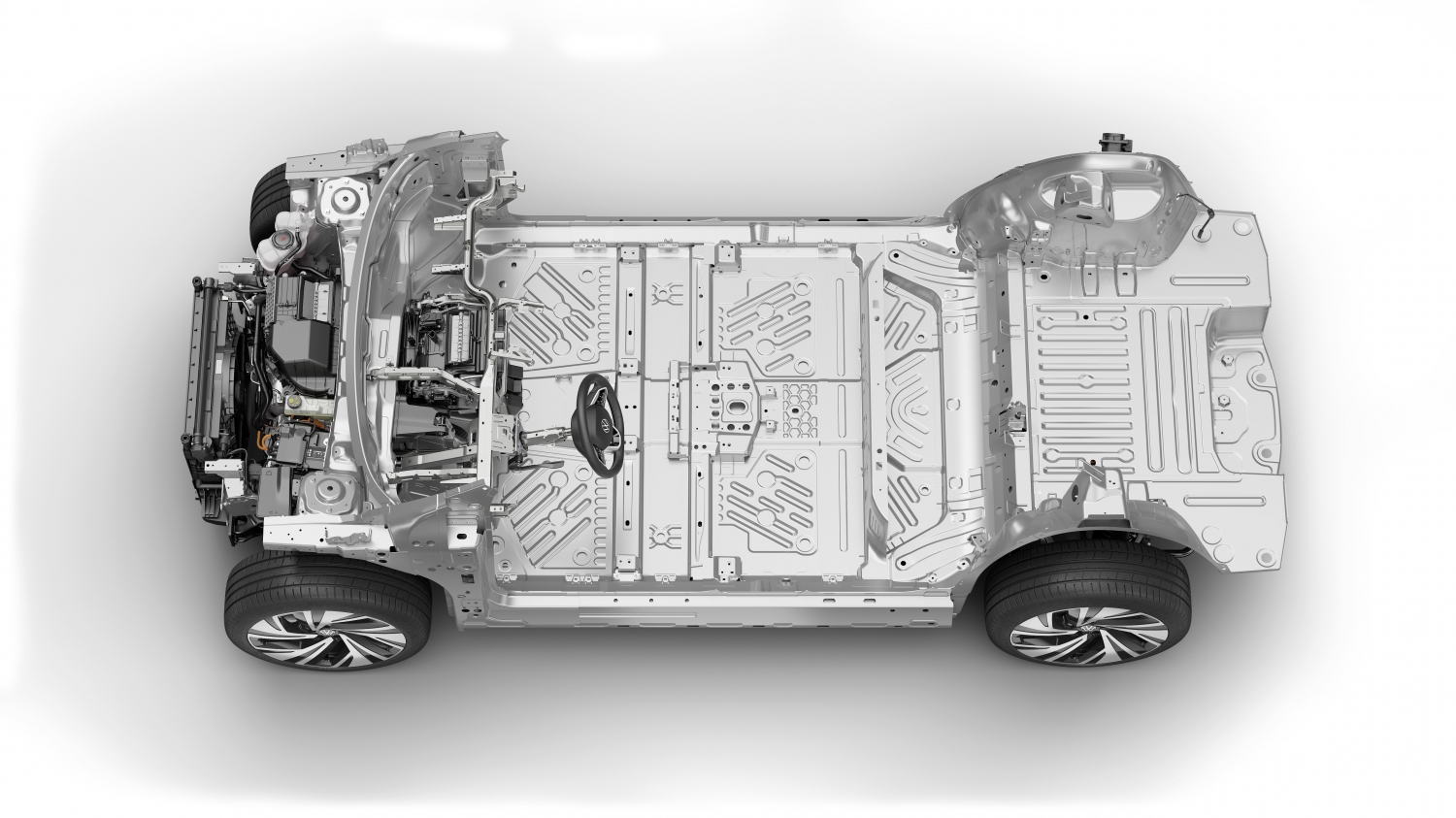

The skateboard powertrain

The VW ID.4 is built on a new skateboard architecture called MEB or modular electric drive matrix, with an AC permanent-magnet synchronous motor that makes 201 horsepower and 229 lb-ft of torque mounted at the back of the vehicle, above the rear axle–much like the old Beetle. At launch, VW is only offering a rear-wheel-drive version, but an all-wheel-drive version will be available by the end of the year, offering 302 horsepower.

Volkswagen is purchasing batteries from Panasonic for the ID.4 and assembling the 82-kWh, 12-module, 288-pouch-cell battery packs themselves at plants in China and Germany. There are plans to begin production in the U.S. soon. Volkswagen also builds its own electric motors.

All in, the VW ID.4 makes electric vehicles more attainable for the crossover buying public who can’t afford the high price tags for the other luxury all-electric crossovers like a Jaguar I-Pace, Tesla Model Y, Polestar or Audi E-tron.

Yet it also competes well with popular gasoline-powered crossovers like the Honda CR-V and the Toyota RAV4, especially when you add in the potential for as much as $7500 in rebates. Where the VW ID.4 truly stands out is in its blending of advanced technology and affordability in a good-looking EV, that won’t give you range anxiety. Will it be the “car for the millions?” We’ll have to wait and find out.

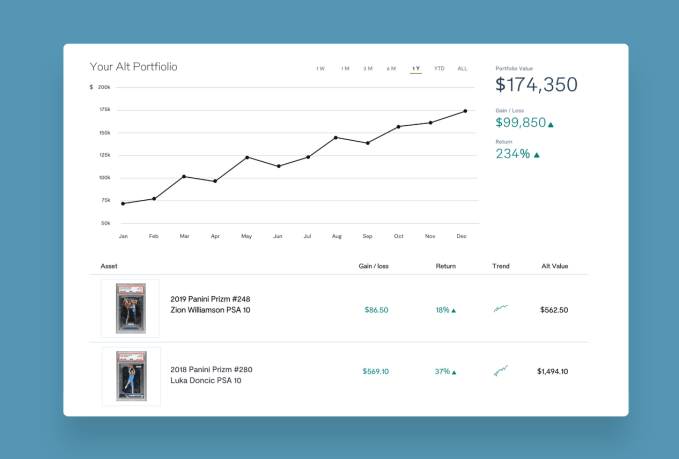

The alternative asset market showed promise pre-pandemic but amid a broader rally among traditional asset classes, the number of investors searching for and promoting value in the space has exploded. That has, in turn, promoted a pretty major influx of VC dollars into startups building platforms that wrangle these buyers into specific communities.

Enter, Alt. The young startup has received more than $31 million from top investors intrigued by the particularly hot space it has bulked up its expertise in — physical sports trading cards. The company provides a Goat-like marketplace for the cards, authenticating the transactions and providing buyers with the peace of mind that the slice of cardboard they’re dropping several thousands of dollars on is no fake. While entities like NBA Top Shot have rallied a new generation of buyers around blockchain era digital trading cards, its success has been enabled by the excitement that traditional collectibles markets have been garnering recently.

After years of stocking up on sports trading cards, Alt CEO Leore Avidar is just happy to have more people to talk about his obsession with. Like many in the sports card community, Avidar has spent years collecting cards and engaging with forums online, but it’s been an interest he hasn’t been able to share with friends and family given its somewhat fringe appeal. This isn’t the case today, Avidar says, with old collectors re-entering the market as they dust off aged collections and new collectors intrigued by skyrocketing prices and a more connected online community.

“I’ve talked with a lot of people in the community and one of the things I love is how intergenerational this is, I see a lot of like kids and their parents doing this together,” Avidar tells TechCrunch.

As the market has moved more mainstream, platforms like Alt have also begun seeing more investor interest. In the span of a few months, Alt wrapped a pair of funding rounds from investors hungry to embrace a play in the market — a seed round led by First Round and a Series A led by Reddit co-founder Alexis Ohanian’s new firm Seven Seven Six. Other Alt investors include John and Patrick Collison, Kevin Durant, SV Angel, BoxGroup, Sue Wagner, and Jeff Morris’s Chapter One.

Avidar wants Alt’s platform to increase transparency and liquidity in the alternative assets space and make acquiring assets here just as easy as platforms like Robinhood have made buying and selling stocks. Avidar’s central strategy to capturing this market and bringing it to his platform is by significantly undercutting the fees structure of other sites, with Alt charging 1.5% of the total sales price including processing fees.

In addition to authenticating its stock, Alt has had to build some infrastructure that’s somewhat custom to the trading cards market. Users that are less concerned with holding their physical cards and more worried about them being lost or damaged over time can opt to have Alt store their physical cards in a temperature and light-controlled vault (for a fee), ensuring that physical degradations of the card don’t affect its value. One of Alt’s key features that Avidar expects to be popular with collectors is their Zestimate-like Alt Value rating which will give card buyers and sellers a closer idea of what the market value of their card is based on historic transactions and the trending growth metrics.

The team is launching the Alt market with sports trading cards, but plans to expand its reach to other alternative assets as the marketplace matures further, with Avidar highlighting markets like watches, sneakers and art as potential growth areas.