& meet dozens of singles today!

User blogs

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Hi friends and new readers, welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

I changed things up this week to make room for an interview we had with Mike Lelli, senior manager of advanced battery cell technology over at GM. That means I don’t have the typical roundup at the bottom of EVERYTHING, or most things, that happened this week. But don’t worry, I’ll bring that back next issue.

You might recall, or maybe not, that GM president Mark Reuss announced last week a partnership with SolidEnergy Systems, an MIT spinoff. GM and SES plan to work together to improve the energy density of lithium-ion batteries. The companies are going to build a prototyping facility in Woburn, Massachusetts and aim to have a high-capacity, pre-production battery by 2023.

As one reader pointed out to me, the partnership is an interesting next step in GM’s interest in SES. Five years ago, GM Ventures, the VC arm of the automaker, invested in SES. Rohit Makharia, a longtime engineer turned investment manager at GM Ventures, is now the COO at SES. In other words, this isn’t some casual relationship.

Scroll below for a Q&A with Lelli.

Email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Q&A: GM’s battery plans

After the partnership between GM and SolidEnergy Systems was announced, we (meaning me and TC reporter Rebecca Bellan) jumped on the phone with Mike Lelli, senior manager of advanced battery cell technology at GM, to try and learn about about the automaker’s battery plans.

Specifically, we wanted to find out if SES was going to be providing the tech for the next generation of Ultium batteries. I’m not talking about the first generation of Ultium batteries that are going in the upcoming GMC Hummer. We’re talking next generation. We also wanted to learn more about GM’s approach to battery development.

The interview with Lelli was edited for clarity and brevity.

TECHCRUNCH: You’ve said that GM is trying to increase energy twofold and reduce the cost of batteries by 60%. So are you aiming to work directly with SolidEnergy Systems on building the next generation of Ultium batteries?

LELLI: The SolidEnergy Systems arrangement includes building a prototype line in Massachusetts. So, this new technology will be built on that line.

TECHCRUNCH: Are you looking at any other battery tech startups to help speed R&D along?

LELLI: I would just say, stay tuned on that; we have a lot more to announce in the future. In the meantime, work is continuing on lithium-metal batteries and other related technologies at our R&D lab. We’re working on many different technologies at this point, including high voltage cathode, electrolytes, dry processing, battery raw materials etc.

TECHCRUNCH: GM already has a lot of critical IP in the space of lithium metal batteries. How is SES filling in the gaps?

LELLI: Well they have strengths and we have strengths and that’s the beauty of this arrangement. SolidEnergy Systems is a very innovative technology company and they offer many novel ideas around lithium metal anode technology, and manufacturing and, of course, we do as well. That’s where their strength is.

They also have a strength in electrolytes, but we have a strength in electrolytes as well and we have IP around electrolytes that we think could be an enabler to this technology. We have 49 patents and over 45 pending in this lithium metal space, so we’ve been working on it for a while. This isn’t something that we’ve thought about, you know, a year ago and saying, ‘hey what are we going to do next?’ This is stuff we’ve been working on for quite some time.

TECHCRUNCH: How is GM thinking about pushing for reductions in nickel and cobalt? Is that a priority?

LELLI: When we came out with the event last year on the Ultium battery, we were very focused on the precious metals. And you may remember that we commented that our cathode would be NCMA — nickel, cobalt, manganese, aluminum. We said that technology we were taking on because it was able to reduce cobalt by over 70%, and we’re able to do that by building a cathode with aluminum.

We’re always focused on these raw materials and reducing high-cost materials and materials that are hard to get. That’s part of my group’s job; my group is responsible for the technology roadmap relative to all these different spaces within the cell: the cathode active material, separator, electrolyte, anode material, the different ways to process the cathode in manufacturing — right now we have a wet process and if we can get dry to work, it’ll be less expensive. We work in all of these spaces simultaneously to reduce costs.

The beauty with the SolidEnergy arrangement is that we can put any of those cathodes that we develop and we can tie that to the lithium metal anode. The key work we’re doing with SolidEnergy is getting the lithium anode technology to work, and then we can, at some point in time, continue to change the cathode part of that cell for further cost reduction and less reliance on some of these critical battery materials out there.

TECHCRUNCH: The work around the anode is really the key to unlocking that energy density, is my understanding. Are there any other benefits?

LELLI: Equally important is the electrolyte. Because the electrolyte is not just a commodity where you can buy it and put it in. It has the electrochemistry and the kinetic of electrochemistry in the cell are very dependent on the electrolyte.

And so the life of a cell will be very dependent on what electrolyte — and the electrochemistry behind that electrolyte — and how it reacts with the materials you’re using, like lithium.

Lithium gives us energy density, but then you also have to design a cell that lasts many cycles, and so to do that you have to understand all the other parts and pieces of the cell that enable that. An electrolyte is an extremely critical part of that.

TECHCRUNCH: Is SES only working with GM or is it working with other automakers or clients?

LELLI: SolidEnergy Systems can work with other OEMs and, of course, we can work with other technologies. We’re not restricting SolidEnergy Systems in any way.

TECHCRUNCH: What are you expecting the range to be for the next generation of Ultium batteries?

LELLI: It’s conceivable that the range of our production in lithium metal batteries could be as high as 500 to 600 miles, but that really depends on the car you’re putting it into. If you put the same battery in a truck, it’s not going to have the range that if we took that same battery and put it in a small car. It really depends on the product you’re putting the battery in to answer that question, but to give you a frame of reference, 500 to 600 miles is conceivable.

TECHCRUNCH: Has GM identified which vehicles will receive the first generation Ultium battery, besides the GMC Hummer?

The Cadillac Lyriq and the Cruise Origin will be among the first.

Deal of the week

Earlier this year, I predicted that Via was going to have a big year; I was right. The on-demand shuttle startup turned mobility-as-a-service provider has been expanding, snapping up contracts with cities globally. And now it’s expanding through acquisitions.

Via bought Remix, the startup that developed mapping software used by cities for transportation planning and street design, for $100 million in cash and equity. Remix will become a subsidiary of Via, an arrangement that will let the startup maintain its independent brand. Remix’s 65 employees and two of its co-founders — CEO Tiffany Chu and CTO Dan Getelman — will stay on.

Remix’s strength is in planning, while Via brings expertise in software and operations. The acquisition should nicely rounded out Via’s current business and help it capture more customers, which currently number more than 350 local governments in 22 countries.

I’m not so sure that Via is done. I expect more deal making — maybe even a bid to go public — by this company that last year hit a $2.25 billion valuation after raising $400 million in a Series E round.

Other deals that got my attention …

Damon Motors, the electric motorcycle company, raised more than $30M in funding, completing a bridge round led by Benevolent Capital, SOL Global Investments, Zirmania, and others.

FlexClub, the South African-based car subscription startup founded in 2019, raised $5 million in equity and debt. This is a seed extension round, bringing the total investment raised by FlexClub to over $6 million. The company recently expanded to Mexico.

Optibus, the transit-focused software-as-service company based in Israel, raised a $107 million in a Series C round co-led by Bessemer Venture Partners and Insight Partners.

Populus AI, a San Francisco-based startup founded in 2017, has raised $5 million from new investors Storm Ventures and contract manufacturing and supplier company Magna along with existing backers Precursor, Relay Ventures and Ulu Ventures. The company has raised nearly $9 million to date.

Zego, the insurtech that got its start by offering flexible motorbike insurance for gig economy workers, has raised $150 million. DST Global led the London-based company’s C round, which gave it a $1.1 billion valuation and a unicorn status. Other new backers include General Catalyst, whose founder and MD, Joel Cutler, joins Zego’s board. Zego has since expanded its business to offer a range of tech-enabled commercial motor insurance products.

A deep dive: the Volkswagen ID. 4

I recently brought on Abigail Bassett, a World Car Juror and longtime journalist who writes about cars and tech (among other topics) to review some of the most important vehicles of 2021. Last month, Tamara Warren (another longtime reporter in autos and tech) reviewed the Aston Martin DBX, a vehicle that is critical to the automaker’s survival.

This month, Bassett takes a deep dive into the Volkswagen ID. 4, a five-passenger, fully electric crossover with a starting price of $33,995 (before federal or state incentives).

The ID. 4 matters. A lot. Volkswagen, once a dabbler in electric vehicles, is now betting its future on the technology.

Did the ID.4 make the grade? Bassett tested it on three different occasions. I suggest you read the whole article, but for those busy folks here is the tl;dr: The VW ID.4 offers a balanced blend of technology, comfort and design for a more affordable price. It offers solid technology without being so out of this world that your average crossover buyer will balk … with one exception. The lack of seamless charging makes finding and then connecting to a third-party charging station a clunky, even complex experience.

Read more by clicking below.

Voyage, the autonomous vehicle startup that spun out of Udacity, has been acquired by Cruise, a deal that points to the continued consolidation within the nascent industry.

Financial terms of the deal were not disclosed; the majority of Voyage’s 60-person team will move over to Cruise and the company’s co-founder and CEO Oliver Cameron will take on a new role as vice president of product.

Voyage, which was founded in 2017, was a tiny startup compared to well-funded operations like Cruise, Argo AI, Waymo and Aurora. But despite its size and only raising $52 million, Cameron helped Voyage stand out. The company is best known for its operations in two senior living communities. Voyage tested and gave rides to people within a 4,000-resident retirement community in San Jose, Calif., as well as The Villages, a 40-square-mile, 125,000-resident retirement city in Florida.

“Voyage’s approach has always been to leverage our limited resources to deliver a product that restores mobility to those who need it most: senior citizens. We’ve made tremendous progress towards this goal, moving countless senior citizens (some as old as 92!) around their communities,” Cameron wrote in a blog post announcing the deal. “Now at Cruise, we are thrilled to have the substantial resources to eventually serve not just senior citizens, but every possible demographic who stands to benefit from self-driving services.”

Voyage won’t be shutting down operations at the two senior communities immediately. However, Cruise reiterated to TechCrunch that its focus is commercial operations in San Francisco. Inevitably, any testing or operations at the senior communities will come to end, although Cruise did not provide a timeline.

Cameron’s role as VP of product is another signal that Cruise is inching forward with plans to launch a commercial robotaxi service in San Francisco. Cruise has hired hundreds of engineers, both hardware and software, but it will need to win over customers if it hopes to build a loyal base of robotaxi users. In his new role, Cameron will be the one who will be thinking through every customer touchpoint for Cruise’s self-driving service.

Cameron described the union of Cruise and Voyage as a “wonderful marriage,” in a tweet Monday morning. He noted that Cruise has the “most advanced self-driving technology, unique auto partners and the first purpose-built self-driving vehicle.” “With Voyage and our customer-service obsessed team, we’ll together deliver a game-changing self-driving product.”

1️⃣ @cruise + @voyage is a wonderful marriage.@cruise has the most advanced self-driving technology, unique auto partners, and the first purpose-built self-driving vehicle.

With @voyage and our customer-obsessed team, we’ll together deliver a game-changing self-driving product.

— Oliver Cameron (@olivercameron) March 15, 2021

Cruise has the funds to put towards this component of the business. Earlier this year, Cruise said it raised $2 billion in a new equity round that has pushed its valuation up to $30 billion and delivered Microsoft as an investor and partner. GM, Honda and other institutional investors also put more capital into Cruise as the autonomous vehicle company inches closer to commercializing its technology.

Netflix’s original films received 35 Oscar nominations this year, once again putting the streaming service ahead of ahead of any other Hollywood studios.

“Mank” led the pack with 10 nominations, including Best Picture, Best Director (David Fincher), Best Actor in a Leading Role (Gary Oldman) and Best Actress in a Supporting Role (Amanda Seyfried). That doesn’t necessarily make it a shoo-in to be Netflix’s first Best Picture winner, however — it’s worth remembering that in 2019, the streamer’s film “Roma” received 10 nominations as well, ultimately winning three awards but not Best Picture. And last year, “The Irishman” went empty-handed despite its 10 noms.

Besides “Mank,” Netflix’s “The Trial of the Chicago 7” received six nominations, including Best Picture and Best Actor in a Supporting Role (Sacha Baron Cohen). And “Crip Camp,” a film from the Obamas’ production company Higher Ground, is nominated for Best Documentary Feature, as is “My Octopus Teacher.”

Amazon, meanwhile, received 12 nominations, with six for “Sound of Metal” (including Best Picture). “Borat Subsequent Moviefilm: Delivery of Prodigious Bribe to American Regime for Make Benefit Once Glorious Nation of Kazakhstan,” “One Night in Miami” and “Time” were nominated as well. And Apple received its first two nominations ever, for “Wolfwalkers” (Best Animated Feature) and “Greyhound” (Best Sound).

Of course, this is a streaming-centric year for movies overall. With the COVID-19 pandemic forcing theaters to close across the world, the Oscars temporarily abandoned their requirement that films screen commercially in theaters in order to qualify for wards.

And it’s probably safe to assume that most viewers (Academy members and otherwise) watched these movies via streaming. For example, Best Picture nominee and Golden Globe winner for Best Drama Film winner “Nomadland” was released by Fox Searchlight simultaneously in theaters and on Hulu.

The Academy Awards will air on April 25 at 5pm Pacific on ABC.

Sprinklr, a New York-based customer experience company, announced today it has filed a confidential S-1 ahead of a possible IPO.

“Sprinklr today announced that it has confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) relating to the proposed initial public offering of its common stock,” the company said in a statement.

It also indicated that it will determine the exact number of shares and the price range at a later point after it receives approval from the SEC to go public.

The company most recently raised $200 million on a $2.7 billion valuation last year. It was its first fundraise in 4 years. At the time, founder and CEO Ragy Thomas said his company expected to end 2020 with $400 million in ARR, certainly a healthy number on which to embark as a public company.

He also said that Sprinklr’s next fundraise would be an IPO, making him true to his word. “I’ve been public about the pathway around this, and the path is that the next financial milestone will be an IPO,” he told me at the time of the $200 million round. He said that with COVID, it probably was a year or so away, but the timing appears to have sped up.

Sprinklr sees customer experience management as a natural extension of CRM, and as such a huge market potentially worth a $100 billion, according to Thomas. But he also admitted that he was up against some big competitors like Salesforce and Adobe, helping explain why he fundraised last year.

Sprinklr was founded in 2009 with a focus on social media listening, but it announced a hard push into customer experience in 2017 when it added marketing, advertising, research, customer and e-commerce to its social efforts.

The company has raised $585 million to-date, and has also been highly acquisitive buying 11 companies along the way as it added functionality to the base platform, according to Crunchbase data.

Bangalore’s fintech startup ecosystem is inching closer to delivering a new unicorn: CRED.

Two-year-old CRED is in advanced stages of talks to raise about $200 million at about $2 billion valuation, three sources familiar with the matter told TechCrunch. The new funding round, like this January’s Series C, will be largely financed by existing investors, the sources said, requesting anonymity as talks are private. The round is expected to close within a month, one of them said.

CRED, founded by Kunal Shah, has become one of the most talked-about startups in India, in part because of the pace at which its valuation has soared.

Backed by high-profile investors including DST Global, Sequoia Capital India, Tiger Global, Ribbit Capital, and General Catalyst, CRED was valued at $806 million when it closed its Series C round in January this year and $450 million in August 2019. (TechCrunch also scooped the Series C round of CRED.)

I think @CRED_club has probably scaled faster than any Indian startup I know. In two years they have created a category so strong that everyone has an opinion on it.

— Harshil Mathur (@harshilmathur) February 27, 2021

If the new deal goes through, CRED will be the fastest startup in the world’s second largest internet market to attain a $2 billion valuation. Prior to the upcoming Series D round, CRED had raised about $228 million.

Reached by TechCrunch early last week, CRED declined to comment. Sequoia Capital India didn’t immediately respond to a request for comment.

The Indian startup operates an eponymous app that rewards customers for paying their credit card bills on time and offers deals from online brands such as Starbucks, Nykaa, and Vahdam Teas. It had over 5.9 million customers as of January — or about 20% of the credit card holder population in the country.

The startup, unlike most others in India, doesn’t focus on the usual TAM of India — hundreds of millions of users of the world’s second most populated nation — and instead caters to some of the most premium audiences.

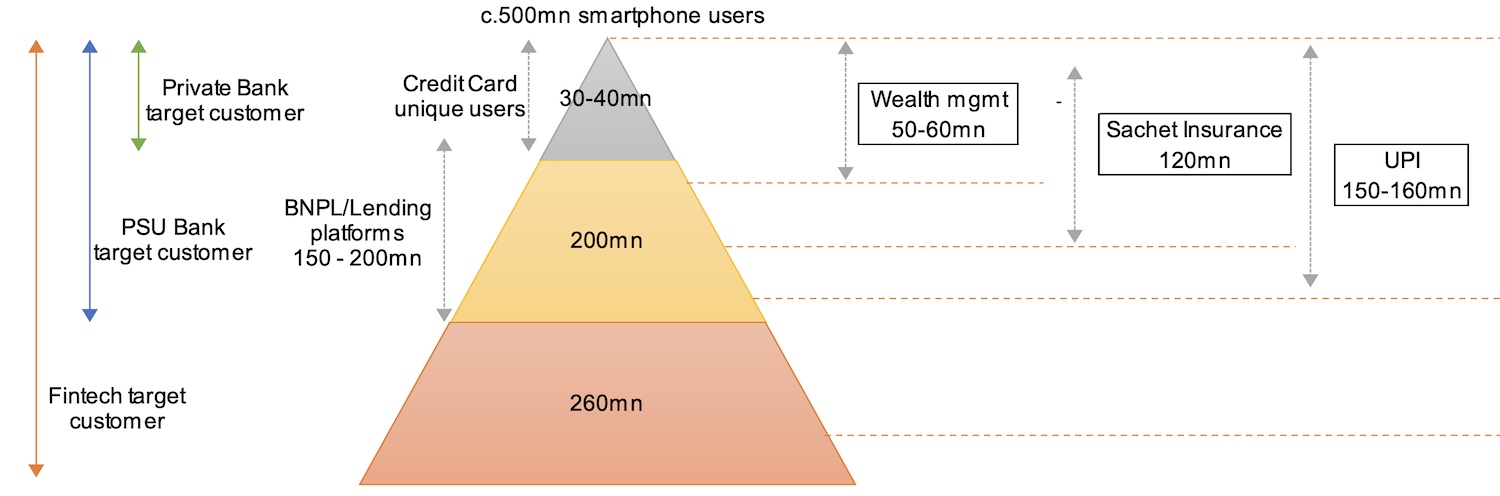

“India has 57 million credit cards (vs 830 million debit cards) [that] largely serves the high-end market. The credit card industry is largely concentrated with the top 4 banks (HDFC, SBI, ICICI and Axis) controlling about 70% of the total market. This space is extremely profitable for these banks – as evident from the SBI Cards IPO,” analysts at Bank of America wrote in a recent report to clients.

“Very few starts-ups like CRED are focusing on this high-end base and [have] taken a platform-based approach (acquire customers now and look for monetization later). Credit card in India remains an aspirational product. The under penetration would likely ensure continued strong growth in coming years. Overtime, the form-factor may evolve (i.e. move from plastic card to virtual card), but the inherent demand for credit is expected to grow,” they added.

Consumer segmentation and addressable market for fintech firms in India (BofA Research)

CRED says it is trying to help customers improve their financial behavior. An individual needs a credit score of at least 750 to join CRED. In a recent newsletter to customers, CRED said the median credit score of its customers was 830 and at “any given point in time” more than 375,000 individuals are on the app’s waiting list, many of whom have demonstrably improved their score to join CRED.

“It’s easy to be responsible when you’re empowered. 80% CRED Protect members got visibility on extra interest charges and avoided late payment fees by tracking their dues on CRED. Ignorance is not always bliss. CRED members detected additional charges worth over ₹145 Crores [$20.1 million] on their statements. CRED members avoided over ₹43.5 Crores [$6 million] worth of late payment fees,” it wrote in the newsletter.

“With the help of regular bill payment reminders, and a seamless credit card management experience; 160,000 CRED members improved their credit scores last month. CRED members know it pays to be good as they earned cash-back worth ₹12 Crores [$1.65 million] by paying their bills on time. There’s always something to look forward to on CRED. Our members got access to over 750 new rewards and products.”

The startup makes money by cross-selling financing products — for which it has a revenue-sharing arrangement with banks and other financial institutions — and levies a similar cut from merchants who are on the platform, Shah, who is also one of the most prolific angel investors in India, told TechCrunch in an interview in January this year.