& meet dozens of singles today!

User blogs

Meet Resilience, a new startup that wants to help cancer treatment institutes as well as cancer patients at every step of the treatment journey. It’s an ambitious project founded by two well-known French entrepreneurs. They want to leverage their tech skills for this new healthcare startup.

Behind the scenes, there are two co-CEOs — Céline Lazorthes and Jonathan Benhamou. Nicolas Helleringer and Matthieu Pozza are the two remaining co-founders acting as CTO and CPO respectively. Lazorthes previously co-founded Leetchi, the leading money pot company in France. She also started MangoPay, a marketplace payment solution, as a spinout company. Crédit Mutuel Arkéa acquired both companies.

Benhamou co-founded PeopleDoc, a cloud-based HR service. In 2018, his company was acquired by Ultimate Software. Following the acquisition, he served as an executive in the publicly quoted company. Shortly after, private equity firm Hellman & Friedman Capital Partners acquired Ultimate Software.

Last year, they both spent a lot of time working together on a nonprofit called ProtegeTonSoignant. Along with 140 people, they raised €7.4 million ($8.8 million) in donations to buy personal protective equipment and deliver it to hospitals in need. It was a fundraising and logistics challenge.

After spending a lot of time talking with healthcare professionals, they decided to “dedicate at least the next ten years to those who save lives,” Lazorthes said.

It seems like an ambitious bet, and they’re aware of that. “We don’t know anything about healthcare just like we didn’t know anything about HR and finance. We’re entering a market that is highly regulated,” Benhamou told me.

That’s why they chose to focus on one area in particular — cancer care. While research institutes have made some tremendous progress over the past few years, it has become increasingly more complicated to treat cancer. For instance, Benhamou says he expects to see 300 new treatments over the next three years. Treatment is slowly evolving from broad spectrum treatments to targeted treatments.

Cancer treatment facilities face three issues. First, “a human brain can’t assimilate all this data,” Benhamou said. Second, as life expectancy increases, there are more cancer cases every year. A tumor board is going to spend a minute and a half or two minutes on a specific case to make a therapeutic decision.

Third, as a result of the first two problems, patients are left on their own. For instance, they suffer from side effects because there’s no dosage adjustment in their treatment.

Image Credits: Resilience

Starting from there, Resilience wants to become a full-stack software solution for cancer treatment for both the medical team and patients. When it comes to practitioners, Resilience will be a software-as-a-service solution that can augment therapeutic decisions. The company will categorize scientific literature, use machine learning to find some similarities with past cases and surface clinical trials based on various criteria.

When it comes to patients, there will be a web and mobile app to access content and information about their cancer. In particular, Resilience could help you understand side effects and treat them.

“Our goal is to prove that the app can improve the quality of life of the patients,” Lazorthes said. Resilience also wants to leverage its app to ask questions and collect data to improve treatments.

The startup is already putting together a data science team. It will use natural language processing to parse scientific literature. It will also work with a medical team to double-check everything.

When it comes to finding similarities between patients, the company is signing partnerships with various hospitals to get data from past cases.

Resilience has raised a $6 million funding round (€5 million) led by Singular, the VC firm founded by former Alven partners Raffi Kamber and Jérémy Uzan. Tech business angels Nathalie Balla (La Redoute), Xavier Niel (Free), Jean-Charles Samuelian (Alan), Roxanne Varza (Station F) and more are also participating.

There are also some healthcare investors in today’s funding round, such as Charles Ferté (AstraZeneca), Philippe Dabi (Bioclinic) and Thomas Clozel (Owkin).

Resilience is a mission-driven company — the company is partnering with a scientific board and a patient board. Gustave Roussy, one of the leading cancer research institutes in the world, is also acting as a co-founder in Resilience.

That’s a lot of stakeholders, but it’s the right thing to do when you’re building a healthcare company. Resilience now has the right system of checks and balance to iterate on its product and roll out a product that has a chance of actually improving cancer treatment.

Ikigai, a London fintech founded by former McKinsey partners, thinks there’s room in the crowded challenger market for a new premium offering that combines digital banking with wealth management.

Targeting future and present high-net-worth individuals, Ikigai is iOS-only for now and consists of a current account and savings account, with adjacent wealth management features, all combined in a single app and card. The thesis, says the founding team, is that currently there is very little on the market that provides a modern digital-first banking experience and the kind of premium banking services typically offered by legacy banks to their more affluent customers.

“Our typical client is young — usually in their late twenties or thirties,” explains Ikigai co-founder Edgar de Picciotto. “They’re entering their prime spending and earning years, and are looking to secure their financial future. Although they’re not high-net-worths yet, they have aspirations and goals — and they want to do more with their money”.

Rather than a freemium model, Ikigai charges a flat subscription fee from the get-go, and new users gain access to a relationship manager, which differentiates it from most digital-first banking. Features include an “everyday” spending account, and a saving section of the app, dubbed “nest”. The latter is separate from the spending account, including having its own account number, but can be easily topped up from the everyday account.

So far, quite me-too, you might conclude. However, where some more differentiation arguably comes into play is that Ikigai also offers “fully managed, globally diversified investment portfolios” under the wealth section of the app. Portfolios are built and managed by Ikigai in collaboration with asset manager BlackRock, and take into account both risk appetite and the nature of what users want to achieve.

“We say it a lot but Ikigai was very much born from personal frustration,” says de Picciotto. “Everything on the market seemed to be slow, impersonal, full of attempts to sell lending and debt products. It felt like either the tech was there or the humanity, never both. That was the first thing we knew we wanted to solve”.

“Banking can also be way too time-consuming, investing even more so,” adds Maurizio Kaiser, Ikigai’s other co-founder. “There is so much for people to do when they have to do it themselves. It can basically become a second job if you’re constantly looking at different stocks and shares working out if the value is under this or over that. No one really has time for that — I certainly didn’t”.

Once the pair dug deeper, as management consultants are wont to do, they say they also discovered “interesting behavioural trends,” particularly when it comes to young and affluent people.

“This group are entering their prime earning and spending years, and they expect so much more from their banks than previous generations,” says de Picciotto. “Not only do they expect faster, fairer and better experiences, they have specific expectations and demands that current financial providers just don’t meet. This includes things like approaching personal finance as an act of self-care, like lifestyle banking over lifestage banking, and aligning their money with their goals and sense of purpose”.

Notably, unlike many of the first wave of challenger banks that made a virtue out of claims to be building their own core banking technology, Ikigai is primarily partnering with technology providers, including Railsbank and WealthKernel.

“Going with banking-as-a-service providers actually makes it easier to execute on our vision,” claims de Picciotto. “It allows us to focus on what we are good at and really matters to our customers: the user experience”.

On banking competitors, Ikigai’s founders argue that existing incumbents and challengers both have “significant” failings.

Incumbents are too dependent on branches or telephone services, and are premised on cross-selling and up-selling services, particularly lending products, in order to make money on loss-making current accounts.

Challengers, on the other hand, are “faster and more accessible”. However, in a bid to keep their cost-base low, they are increasingly automating their chat support and, in some cases, hiding live chat features.

“Delivering a high-quality service is obviously at odds with their aim of offering banking for free,” concludes Kaiser.

It is nearly impossible for businesses in some African countries to receive money from PayPal. While the payments giant has not given reasons why this is so, speculation hints at factors like insufficient regulation and poor banking security in said countries.

That might be a thing of the past for some businesses as African payments company Flutterwave today is announcing a collaboration with PayPal to allow PayPal customers globally to pay African merchants through its ‘Pay with PayPal’ feature.

Via this partnership, African businesses can connect with the more than 377 million PayPal accounts globally and overcome the challenges presented by the highly fragmented and complex payment and banking infrastructure on the continent.

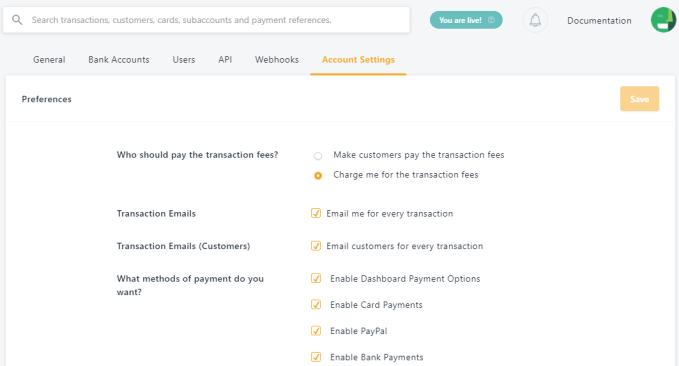

According to CEO Olugbenga ‘GB’ Agboola, this will happen via a Flutterwave integration with PayPal so merchants can add PayPal as a payment option when receiving money outside the continent. The service, which is already available for merchants with registered business accounts on Flutterwave, will be operational across 50 African countries and worldwide, the company claims. Flutterwave hopes to roll out this service to individual merchants on the platform as well.

“In a nutshell, we’re bringing more than 300 million PayPal users to African businesses so they can accept payments across the continent,” he said to TechCrunch. “Our mission at the company has always been to simplify payments for endless possibilities, and from when we started, it has always been about global payments. So despite having the largest payment infrastructure in Africa, we want to have arguably all the important payments systems in the world on our platform.”

A PayPal spokesperson confirmed the Flutterwave collaboration with TechCrunch.

Since the company’s expansion to Africa, it has maintained a one-sided relationship with most countries on the continent, allowing them only to send money. And according to its website, only 12 African countries can send and receive money on the platform, but to varying degrees. They include Algeria, Botswana, Egypt, Kenya, Lesotho, Malawi, Mauritius, Morocco, Mozambique, Senegal, Seychelles and South Africa.

Users in countries who are not afforded the luxury to do so have to rely on using the PayPal account of a friend or family, based in countries where payments can be received. Next, they request the funds via bank transfer, leading to more incurred costs or use other cross-border money platforms like WorldRemit.

This is a pain point for these businesses, particularly in Nigeria. PayPal finally arrived Africa’s most populous country in 2014 and a year later, it became the company’s second-biggest market on the continent.

But despite its fast adoption rate and large fintech appetite, merchants cannot still receive payments from other countries on the platform with various sources alluding PayPal’s decision to the country’s history with internet fraud.

Fraud or not, Nigeria’s e-commerce and that of the continent at large continues to grow at a breathtaking pace. In 2017, Africa generated $16.5 billion in revenue, and by 2022, it is expected to reach $29 billion. With numbers like this, it isn’t hard to see why PayPal wants to get in on the action, albeit not completely. Hence, the partnership with Flutterwave.

The company, via its APIs, offer payment services to individuals and businesses across the continent. Since launching in 2019, the African payments company has partnered with Visa to launch Barter; Alipay to offer digital payments between Africa and China; and Worldpay FIS for payments in Africa.

But this one with PayPal is arguably its biggest collaboration yet. Now, African businesses have more access to sell to global customers using PayPal to receive and send payments online.

In a way, Flutterwave absorbs most of the risk PayPal thinks it will incur if it makes its platform more open to merchants in these countries. But at the same time, it solidifies Flutterwave’s position in the eyes of multinationals looking to enter the African market.

Like when its partnership with Worldpay FIS coincided with its Series B funding, this announcement is also coming on the back of a raise. Last week, the payments company closed a $170 million Series C led by Avenir Growth Capital and Tiger Global, becoming a billion-dollar company in the process.

In hindsight, the mammoth raise suggests that there are a couple of projects in the company’s pipeline. Going by this partnership, we can expect the majority of them to be global plays.

Yet, these questions remain top of mind — What happens when PayPal automatically allows businesses from these neglected African countries to start receiving payments? Will both services continue to coexist if that happens? We’ve reached out to PayPal for comment.

However that plays out, this is a step forward in the right direction for Flutterwave, which has shown time and time again the length it is willing to go for its 290,000 merchants and the ongoing quest to become a global payments company.

“By working with PayPal, we can further strengthen our commitment to our customers and service users as we will be enabling them to transact and expand their business operations to reach new markets. PayPal’s global reach is unrivalled, and collaborating with them allows our customers to explore new markets where PayPal is embedded,” the CEO said.

One of the bigger startups in Europe operating a trading platform for cryptocurrency has closed a big round of funding on the heels of very rapid growth and plans to open its platform to a wider stream of assets.

Bitpanda, a “neobroker” that wants to make it easier for ordinary people to invest not just in bitcoin and other digital assets, but also gold, and any established stock that takes their interest, has picked up $170 million, a Series B that catapults the company’s valuation to $1.2 billion. Bitpanda is based in Vienna, Austria and says that this equity round makes it the country’s first “unicorn” — the first startup to pass the $1 billion valuation mark.

“We are shifting to become a pan-investment platform, not just a crypto broker,” said Eric Demuth, the CEO of Bitpanda who co-founded it with Paul Klanschek and Christain Trummer. Bitpanda’s focus up to now has been primarily on building a platform to target investors in Europe, a largely untapped market, as it happens. “In the EU, we probably have less than 10% of the population owning stocks. Our growth goes hand in hand with that.”

In addition to Austria, Bitpanda is live in France, Spain, Turkey, Italy and Poland with plans to expand to more markets this year, building hubs in Madrid, Barcelona, London, Paris and Berlin. New investment options to back ETFs and “fractional” trades, which will let people invest small amounts of money in whichever stocks they would like to back, are due to be added in April, the company says.

The round is being led by Valar Ventures — the fund backed by Peter Thiel — with participation also from unnamed partners from DST Global (Yuri Milner’s fund). Both have been building name for themselves as significant backers of crypto startups. Valar is also an investor in Robinhood, and most recently, earlier this month the pair co-invested in a $350 million round for BlockFi, which provides financial services like loans to crypto traders.

While DST is a new investor in Bitpanda, Valar also led a round for Bitpanda just six months ago — a $52 million Series A. Since then, Demuth and Klanschek say that the company has seen growth skyrocket (not unlike the price of bitcoin itself).

KPIs like revenue and customer numbers “have been roughly 10x,” Klanschek said. “Very soon we will cross the €100 million revenue mark for the first few months of this year.” Annualized it will work out to around €300-400 million, he added. While the bulk of its trading is for individuals, it’s not only focused on single investors, September, the company’s trading volume for its “Pro” tier for companies, daily trading on the platform was $2 million. Now, it is over $25 million.

Bitpanda’s growth and enthusiasm taps into a much bigger trend in the world of trading. One of the byproducts of the Covid-19 pandemic has been consumers becoming more engaged in their own personal finance.

With interest rates down, professional futures less certain for some, a plethora of apps out there to do more with your money, a whole new set of investing classes thanks to cryptocurrency, and (last but not least) the juggernaut that is social media to help concepts go viral, people are dabbling in a wider range of activities, some having never done more than simply keep their money in a bank account before, and shuffling off a bit of money to their 401k’s or other pension funds.

Bitpanda made a decision last year to start to get more aggressive in its own fundraising to ride that wave.

“We are profitable, and we have been for four years, but in September we changed strategy and wanted to become ‘the’ investment platform for all of Europe,” Demuth said. “We needed more partners and more capital to get more top talent and this is why we did the Series A last year. Then over the past two months, we talked to our investors and said what do you think, it seems like there is some momentum. They said ‘we are in.” No roadshow needed, we will help you. We will call our contacts and they’ll join, too.”

There has been a huge wave of hype around crypto, although in the wider sense it’s still primarily an adopter phenomenon, far from being a mainstream investment, with most people having no idea how it works. Ironically, this is not that dissimilar to much of the stock market for most people although the difference these days is that apps like Robinhood, Square Cash and Bitpanda are making it easier to engage with crypto and other trading by lowering the barrier to entry, both in terms of actually putting money into the system, and also by making it possible to get engaged with only a small amount of money.

Whether cryptocurrency bears out in the longer term, it’s likely that the democratization will stay and become a part of the bigger process of how people manage their own money, if not by gambling all-in, then at least by creating a little diversification for themselves.

That doesn’t excuse the ridiculous hype merchants on social media that potentially exploit these new traders, nor the fact that there is still a very long way to go in regulators getting better oversight of how these new exchanges work, but it does point to an interesting future and more opportunities longer term for organizations and individuals to do more with their money and their assets (NFTs being an example on the other side, of how to build assets and value for investing in the first place).

“In today’s financial world everything is connected,” said Klanschek. “We saw huge growth on Bitpanda after the Covid stock crash in March 2020.” Crypto dropped then too, with “interest high but price very low.” Yet with saving accounts and other traditional, low-key ways for people to growth their money yielding nothing, “it eventually led to huge interest in financial markets, with crypto being established as its own financial asset, its own category.”

While there are a number of platforms emerging for people to engage of that, the pace of adoption for Bitpanda in Europe is what attracted investors here.

“Since we joined the board last September, we have continued to be impressed with the work that Eric, Paul and the team are doing. One of the positive changes caused by the pandemic was an increased interest in personal finance, and Bitpanda’s broad offer and commitment to demystifying investing for a new breed of retail investors means it is perfectly positioned to take advantage of the trend,” said James Fitzgerald, Founding Partner of Valar Ventures, in a statement. “With over 700,000 new users in just 6 months, we know that people want access to the platform, and we’re excited to bring Bitpanda to every investor in Europe.”

Chinese users of the instant messenger Signal knew that good time wouldn’t last long. The app, which is used for encrypted chats, is unavailable in mainland China as of Tuesday morning, a test by TechCrunch shows. The website of the app has been banned in China since Monday, according to censorship tracking website Greatfire.org.

More to come…