& meet dozens of singles today!

User blogs

In 2019, St. Louis Metro Transit was struggling to keep customers. Uber and Lyft, along with dockless shared bikes and scooters, had flooded streets, causing ridership to fall more than 7% in a single year.

The agency didn’t try to fight for attention. Instead, it embraced its competitors.

Metro Transit dropped its internal trip-planning app, which had been developed with the Trapeze Group and directed riders to Transit, a private third-party app that offers mapping and real-time transit data in more than 200 cities. That app also included micromobility and ride-hailing information, allowing customers to not just look up bus schedules, but see how they might get to and from stops — or ignore the bus altogether.

The following year, Metro Transit partnered with mobile ticketing company Masabi and added a payment option on some bus routes. Now, the agency is planning an all-in-one app — via third-party providers Transit and Masabi — where customers could plan and book end-to-end trips across trains, buses, bikes, scooters and taxis.

“What we do best is transporting large volumes of people on vehicles and managing mass transit,” said Metro Transit executive director Jessica Mefford-Miller. “On the software side, there are a lot of players out there doing great stuff that can help us meet our customers where they are and make trip planning as easy as possible.”

St. Louis Metro Transit isn’t an outlier. As transit agencies seek to win back riders, a flurry of platforms — some backed by giants like Uber, Intel and BMW — are offering new technology partnerships. Whether it’s bundling bookings, payments or just trip planning, startups are selling these mobility-as-a-service (MaaS) offerings as a lifeline to make transit agencies the backbone of urban mobility.

Whether it’s bundling bookings, payments or just trip planning, startups are selling mobility-as-a-service (MaaS) offerings as a lifeline to make transit agencies the backbone of urban mobility.

Third-party platforms have become more appealing to transit agencies as they scramble to keep buses, trains and rail full of customers. According to the American Public Transportation Association (APTA), ridership and total miles traveled has declined since 2014, including a 2.5% drop from 2017 to 2018. The COVID-19 pandemic could accelerate this trend as more people continue working from home or shy away from crowding into buses and trains.

“This is like Expedia, the idea of seeing multiple airlines in one place to comparison shop,” said Regina Clewlow, CEO of transportation management firm Populus. “A lot of operators are looking at the question of whether that would give them more rides.”

But that the private growth could come at a cost, potentially injecting private concerns into what should be a public good, Metro Transit’s Mefford-Miller cautioned.

“If we let the market handle this planning on its own, a company might only do it for someone with a digital device or a bank account or only help people who don’t need special accommodation,” Mefford-Miller said. “That’s why we have as an underpinning an equitable and accessible system. It’s the underpinning before we choose any tools we use.”

The players

Amid the swarm of new startups there are a few giants. One of the biggest established players is Cubic Corp., a San Diego-based defense and public transportation company. The firm already controls payments and back-end software for hundreds of transit agencies, including in Chicago, New York and San Francisco, and in January launched a suite of new products under the brand name Umo to expand their offerings.

The package includes a customer-facing multimodal app, a fare collection platform, a contactless payment system, a rewards program, a behind-the-scenes management platform and a MaaS marketplace for public and private offerings. Mick Spiers, general manager of Umo, said the goal is to offer a “connected, integrated journey.”

“We’re uniquely placed as an independent, trusted third party that can be the data broker for a journey focused around the needs of the user,” Spiers added. “The journey we create has no commercial interest for us.”

Gartner predicts low/no-code will represent 65% of all app development by 2024. Clearly, it’s the future, but what is it, and how can you turn your organization into a no-code company to get ahead of the trend?

No-code is changing how organizations build and maintain applications. It democratizes application development by creating “citizen developers” who can quickly build out applications that meet their business-facing needs in real time, realigning IT and business objectives by bringing them closer together than ever.

Anyone can now create and modify their own tools without complex coding skills using no-code’s easy-to-use visual interfaces and drag-and-drop functionality.

Anyone can now create and modify their own tools without complex coding skills using no-code’s easy-to-use visual interfaces and drag-and-drop functionality. This creates organizational flexibility and agility, addresses growing IT backlogs and budgets, and helps fill the IT gap caused by a shortage of skilled developers.

Despite the many benefits, adopting a no-code platform won’t suddenly turn you into a no-code company. It’s a process. Here are three steps to help your transition:

1. Future-proof your tech strategy

For a long time, the threat of digital disruption and the subsequent need for digital transformation has been driving IT strategy. The pandemic made this threat all the more acute. Most organizations were forced to rapidly rethink their tech strategy in the new digital normal.

This strategy has been effective for many organizations, but it’s also been largely reactive. Organizations have been fighting to keep up with the acceleration of digital trends. The opportunity with no-code, which is still in its early days, is to make that tech strategy more proactive.

We find that many organizations still think about tech strategy from a predominantly IT lens without considering organizational structural changes that could be around the corner. Think about it: Having a critical mass of citizen developers in five years could dramatically change how your organization allocates resources, organizes departments and even hires talent.

Don’t future-proof your tech strategy for a slightly evolved version of your current organization, future-proof it for a fundamentally more democratized environment where everyone can build their own applications for their own needs. That’s a profound change. Here are three things to consider:

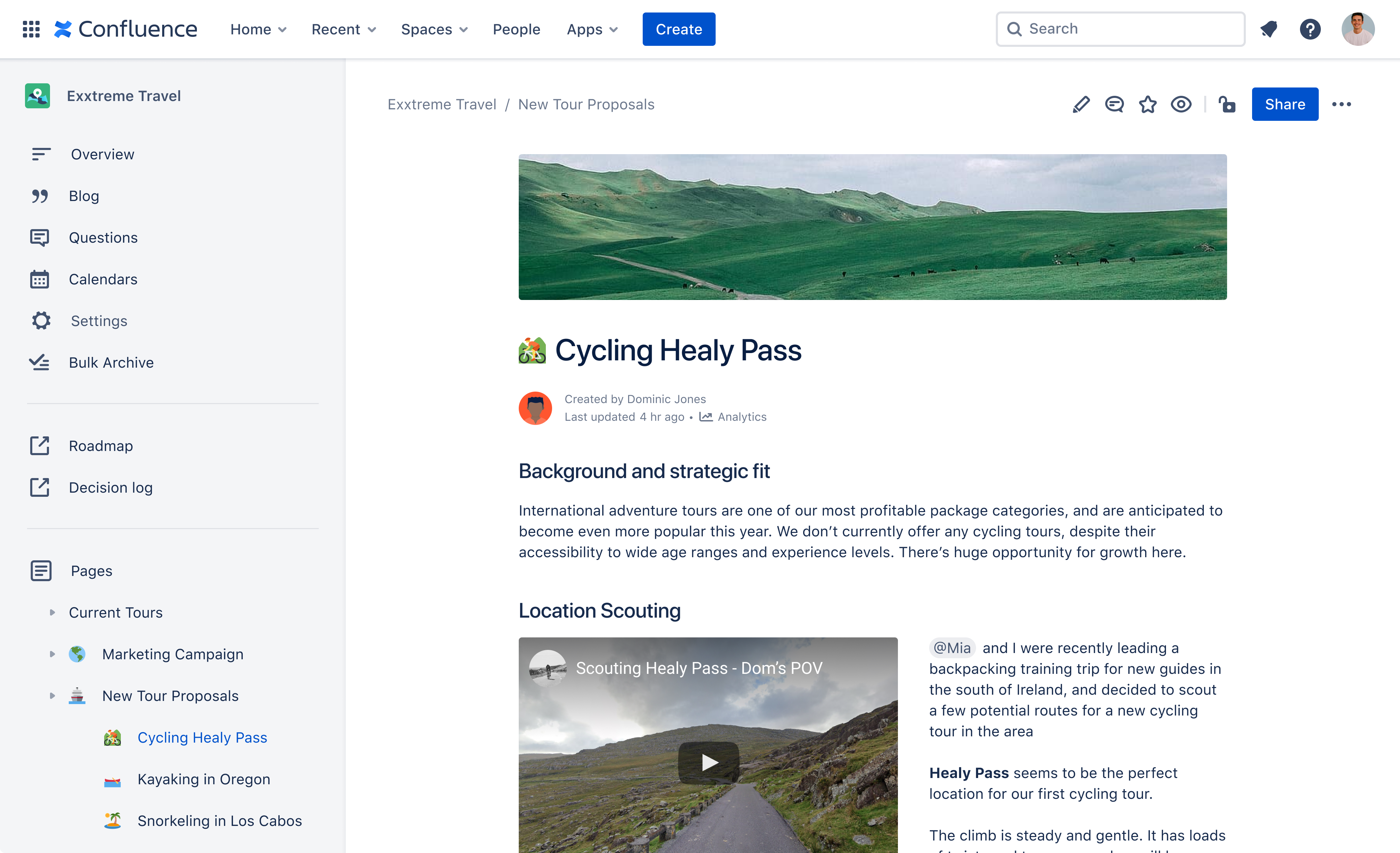

Confluence, Atlassian’s wiki-like collaborative workspace, has been around for over 15 years and is often a core knowledge-sharing tool for the companies that implement it. But for the most part, Confluence is a business tool and looks like it, with walls of text and the occasional graph, table or image. But user expectations have changed and so it’s maybe no major surprise that Atlassian is now bringing a stronger emphasis on design to the service.

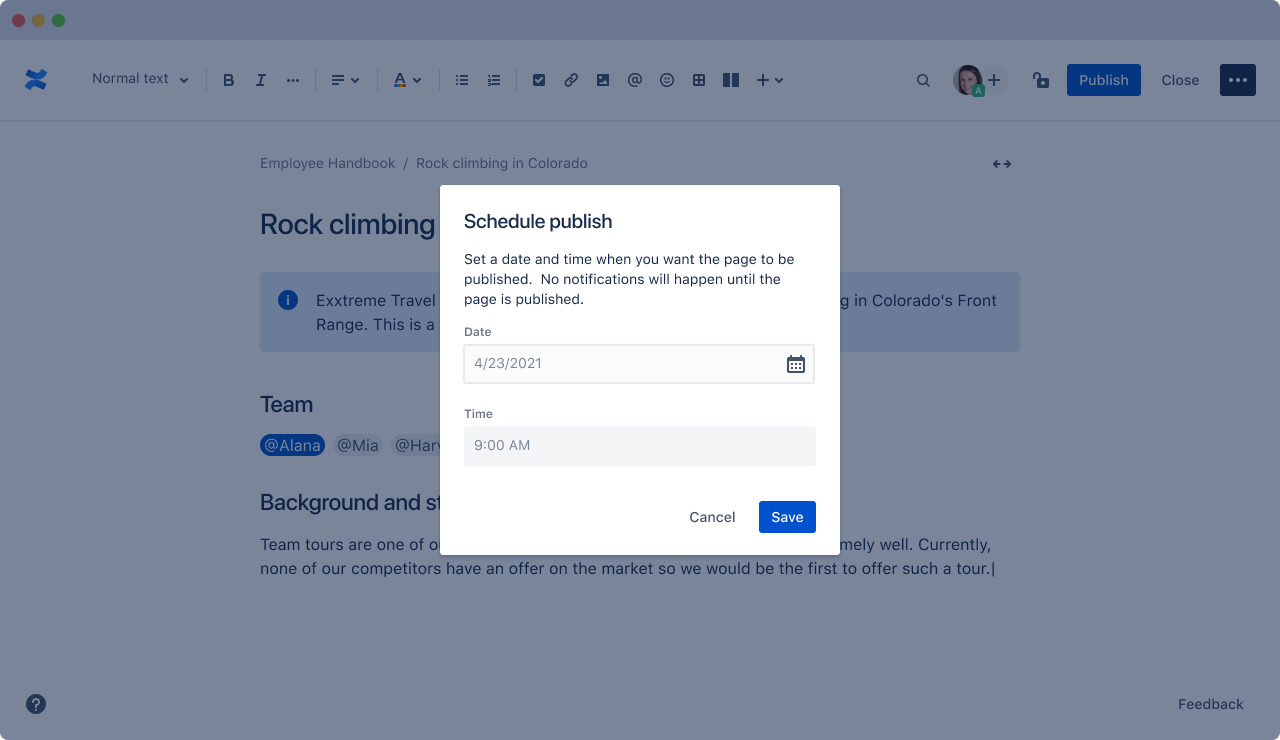

Today’s update, for example, brings features like cover images, title emojis and customizable space avatars (that is, “icons that denote a ‘space’ or section of Confluence”) to the service. The team also recently introduced smart links, which allow you to paste links from services like YouTube and Trello and have the service immediately recognize them and display them in their native format. Other new features include the ability to schedule when a new page is published and the ability to convert pages to blog posts (because, as it turns out, Atlassian has seen a bit of a resurgence in corporate blogging — mostly for internal audiences — during the pandemic).

“We ended up doing something that we called ‘love sprint,’ where we prioritize about 30 features for the enhancements, which are all — if you think about the themes — about how you design information in this world where you have to read more, where you have to write more,” Natalia Baryshnikova, the Head Of Product Management for Atlassian’s Confluence Experience Group, told me. “And there’s the attention span that’s kind of pushing its limits. So how do you design for that situation? How do you discover our content?”

Baryshnikova tells me that the team took a close look at how content production, management and delivery works in the social media world. But some of the new features are also purely a reaction to a changing work environment. Take the ability to schedule when pages are published, for example. Employees who work from home may work especially late or early right now, for example, in order to prioritize childcare. But they still want the content they produce to be seen inside the company and that can be hard when you would otherwise publish it at 11pm, for example.

And having your content get noticed is getting harder because Confluence usage has dramatically increased in the last twelve months. As Atlassian noted today, over 60,000 companies are now using the service. And inside those companies, those users are also far more active than ever before. The number of Confluence pages created from March 2020 to March 2021 increased by more than 33 percent. The average user now creates 11 percent more pages, but the product’s superusers have often doubled or tripled their output.

The use of Confluence has also helped many companies reduce their number of meetings, but as Baryshnikova noted, “not only are pages competing with meetings — but pages are competing with pages.” So using good graphics, for example, is a way for a user’s content to stand out in the noise of corporate content production. Which, I have to admit, strikes me as a somewhat strange dynamic. But I guess that just like on the web, in order to stand out in a corporate environment, you have to make the documents you produce stand out in order to get noticed. Maybe that — as well as the lack of watercooler conversations — is also the reason why corporate blogging is seeing an uptick right now.

Amazon is expanding customer deliveries via electric cargo vehicle to San Francisco, making the Bay Area the second of 16 total cities the company expects to bring its Rivian-sourced EVs to in 2021.

San Francisco’s unique terrain and climate were a couple of the reasons Amazon said it chose the city for its second round of testing. Its EVs, which were designed and built in partnership with Rivian, can last up to 150 miles on a single charge.

Amazon began testing its electric delivery van in Los Angeles in early February as part of its Climate Pledge, which involves the purchase of 100,000 custom electric delivery vehicles. The company first unveiled the vans last October, and has said it aims to have 10,000 of the vehicles operational by next year.

Bay Area deliveries will initially come out of Amazon’s station in Richmond, California, just one of the many delivery stations the e-commerce giant is redesigning to service its new fleet of EVs. A recent $200 million investment into a new delivery station in the heart of San Francisco signals Amazon’s push to significantly increase deliveries in the city.

“From what we’ve seen, this is one of the fastest modern commercial electrification programs, and we’re incredibly proud of that,” said Ross Rachey, director of Amazon’s global fleet and products in a statement.

Amazon isn’t the only company to recognize the logic behind electrifying delivery fleets for short trips within cities: DHL says zero-emission vehicles already make up 20% of its fleet, UPS has placed an order for 10,000 EVs and FedEx has pledged to replace 100% of its fleet with electric vehicles by 2040.

The B2B payments space has been on fire for a while, and the COVID-19 pandemic has only fueled mass adoption of digitizing finances.

In regions like Latin America, the need for innovation in the sector is even more paramount than in the United States with so many people still relying on outdated processes.

One Mexico City-based startup, Higo.io, is out to transform B2B payments for SMBs (small and medium-sized businesses) in Latin America, starting with its home country.

Rodolfo Corcuera, Juan José Fernández and Daniel Tamayo founded the company in January 2020, recognizing that the process of paying vendors for business owners is largely “manual and cumbersome.”

“In Mexico, small businesses mostly handle payables with nothing more than spreadsheets and email and legacy bank accounts,” CEO Corcuera said.

The trio formed Higo to automate processes and provide visibility into cash flow, particularly for small businesses. “Informal” businesses make up about 23% of Mexico’s GDP, according to data from INEGI, the government’s National Institute of Statistics and Geography. Higo launched its SaaS platform last November.

And now the startup has raised $3.3 million from a group of U.S.-based investors including Homebrew (which led the round), Susa Ventures, Haystack and J Ventures. The financing is the latest in a string of fintech-related fundings in Mexico that TechCrunch has covered as of late.

Higo wants shake up the payments scene in the region by creating an alternative to traditional banking for businesses to pay each other.

“We want to build the Venmo for B2B payments in Latin America,” Corcuera told TechCrunch.

Ultimately, the goal is to help SMB owners deal less with tedious tasks and more on generating revenues and profits for their businesses. Customers so far include hundreds of small business owners and the company aims to have “thousands” of customers by year’s end.

“E-invoicing is ubiquitous in the States and in the U.S., receiving a PDF invoice is enough,” Corcuera told TechCrunch. “But in Mexico, it has to be electronic to be [tax] deductible by law. With our platform, invoices are automatically populated so businesses can have visibility into what has to be paid, what vendors they owe and when they owe.”

Corcuera is no stranger to running companies, having launched a housecleaning marketplace at the age of 23 in 2013. He also founded Tandem, an office management platform, in 2018, to help office managers streamline their procurement needs. As is often the case for founders, it was during the process of growing that company that Corcuera realized how painful and time consuming it was for businesses to manage their payables and receivables. That led him to come up with the concept behind Higo.io.

Gallardo was previously COO at Swap, a Mexican challenger bank, and also was one of the founding members of Uber’s Mexican operations.

Looking ahead, Higo plans to use its new capital in part to boost its six-person staff, particularly beefing up its engineering team so that it can “scale as fast as possible,” according to Corcuera.

For now, the company’s efforts are focused exclusively on the Mexican market, which in of itself is huge.

“Later we will expand in Latin America. We see a very clear opportunity in similar markets across the region,” Corcuera said.

Homebrew Partner Satya Patel said his San Francisco-based VC firm believes there’s a massive opportunity in Latin America given the move to digital payments. The investment in Higo marks Homebrew’s third in the region in the past 18 months.

“This is an exceptional team focused on a problem that is visceral for businesses in Mexico in particular,” Patel told TechCrunch. “They are able to provide businesses with a real-time view of their cash flow and working capital. Without it, they are at risk. So the opportunity is to tackle this acute pain point being felt by a lot of businesses.”

The region’s payments ecosystem, he said, is still very nascent.

“Being the intermediary for B2B tax information gives Higo an opportunity to provide a real alternative to the traditional way Mexicans are used to doing banking and business,” Patel added.