& meet dozens of singles today!

User blogs

As indoor farming expands, a number of new companies are cropping up to provide better data and monitoring tools for the businesses aimed at improving efficiencies and quality of indoor crops.

One of these companies, the Copenhagen-based Nordetect, is entering the U.S. market with around $1.5 million in funding from government investment firms and traditional accelerators like SOS V, with a tech that the company claims can give vertical farms a better way to monitor and manage nutrients and water quality.

Controlled agriculture, whether in greenhouses or warehouses, benefits from its ability to administer every aspect of the inputs to ensure that plants have the optimal growing conditions. It is, however, far more expensive than just seeding the ground.

Proponents say that these farms can overcome the additional expense by improving efficiency around water use, reducing the application of pesticides and fertilizer, and cultivating for better, tastier produce.

That’s where Keenan Pinto and Palak Sehgal’s Nordetect comes in. The two co-founders have known each other since they were undergraduates in India eight years ago. They went on to do their masters work together and after working in bioengineering plants — Sehgal focused on flowering systems in plants and Pinto focused on roots — they both went into more digital fields — but maintained their fascination with plants and kept in touch with each other.

Professional work in medical diagnostics for Sehgal and lab instrumentation for Pinto kept both busy, but they continued their discussions around plant science and soil health.

Roughly three years ago, the two hit on the idea for a combined toolkit for water quality monitoring and soil health. Sehgal left the India Institutes of Technology, where she had been working, and joined Pinto in Copenhagen to begin developing the tech that would form the core of Nordetect’s business proposition full time.

The company’s technology consists of an analyzer and a cartridge, a microfluidic chip that users can insert into their water tank to take a sample. From the data that the device collects, farmers can control the nutrients they put into the water to optimize for traits like color and flavor, Pinto said.

Image Credit: Shutterstock/Francesco83

The company was accepted into SOSV’s Hax accelerator in 2017 and the two first time founders moved from Denmark to Shenzhen to begin developing the business. In late 2018 the company moved back to Denmark and raised a small amount of additional capital from SOSV and Rockstart.

By 2020, watching the expansion of vertical farming, the company took what had initially been a soil monitoring tool and added water quality monitoring features to support indoor farming. That’s when the business started taking off, according to Pinto.

“One of the interesting things is when i consider the outdoor vs. the indoor markets. The outdoor felt a bit conservative… the indoor seems much more forthcoming… and that traction allowed us to pull together this funding round $1.5 million,” Pinto said.

The new round came from Rockstart, Preseed Ventures, SOSV, the government of Denmark’s growth fund, and Luminate, a Rochester, NY-based accelerator that focuses on optical electronics technology.

Luminate’s participation is one reason why Nordetect is coming to the U.S., but it’s hardly the only reason. There’s also the capital that has come in to finance indoor ag companies. The two largest vertical farming companies in the U.S., Plenty and Bowery Farming have raised $541 million and $167 million between them.

“The vertical movement has put people into the position where they are what I call data farmers,” said Pinto. “Each batch of produce is being used to learn and the data is more important than the output. We used this market as a beachhead.”

Ideally, it is expected of every business to reach its customers effectively. However, that’s not the case as limiting factors that hinder proper digital communication come into play at different growth stages. Termii, a Nigerian communications platform-as-a-service startup that solves this problem for African businesses, announced today that it has closed a $1.4 million seed round.

The round was co-led by African early-stage VC firm Future Africa and Japanese but Africa-focused VC Kepple Africa Ventures. Other investors include Acuity Ventures, Aidi Ventures, Assembly Capital, Kairos Angels, Nama Ventures, RallyCap Ventures, and Remapped Ventures.

Angel investors like Ham Serunjogi, co-founder and CEO of Chipper Cash; Josh Jones, former co-founder and CTO, Dreamhost; and Tayo Oviosu, co-founder and CEO of Paga also participated.

Gbolade Emmanuel and Ayomide Awe launched Termii after Emmanuel’s experience as a digital marketer helped him recognize the need for businesses to have exceptional communication channels. The CEO consulted for these companies and leveraged emails to retain customers, but as he found out that this process was lethargic, he sought other channels as a replacement.

“That got me to start thinking about multichannel messaging. What it meant was that we needed to find how to allow companies to use WhatsApp, voice, SMS effectively,” he said to TechCrunch. “And we had to make the process simple because in the African market, you can’t do complex stuff. You have to be as simple as possible.”

In 2017, the company officially launched and subsequently secured investment from Lagos-based VC Microtraction. Emmanuel says the company found product-market fit two years later after collating enough data from companies in different industries to understand what they really wanted.

Termii found out that in addition to assisting businesses to retain customers, there was a clear need to verify, authenticate and engage them.

“Many of these businesses we started engaging said they required tools to effectively communicate and verify customers because they were losing money at those points. For us, we saw it was a bigger problem,” Emmanuel added.

After making some tweaks, the team began to see an increase in customers numbers, especially amongst fintech startups. Positioning itself in the fast-moving space, Termii created an API-based communication infrastructure that caters to over 500 fintech startups across the continent. That’s not all. More than 1,000 businesses and developers are also using Termii’s API.

Some of these businesses include uLesson, Yassir, Helium Health, Piggyvest, Bankly, Paga, and TeamApt.

Playing in a $3.6 billion B2C communications market estimated to grow 6% annually, Termii runs a B2B2C model. But how does it make money? While a subscription-based model would’ve made sense, the two years spent by the company trying to find PMF made them think otherwise.

So the company leverages a virtual wallet system tied to a bank account and customers can make payments to the platform using mobile money, bank transfer, and credit cards. The startup charges these wallets on a per-message basis. It also does the same on every successful customer verification made towards customers’ contacts.

The Termii team

In early 2020, Termii started seeing immense progress and this coincided with their acceptance into Y Combinator. The growth continued throughout the year, growing its messaging transactions by 1000% and experiencing a 400% increase in its ARR.

Spilling into this year, Emmanuel says the company’s revenue is growing 60% month-on-month as a result of the surge in online financial transactions which to date makes up for 68% of the company’s total messaging transactions.

The seed investment that is coming a year after Termii graduated from the YC will be used for expansion and launch more messaging offerings across Africa.

Emmanuel says the company has its sights on North Africa with a physical presence in Algeria for the expansion. The reason lies behind the fact that in this quarter, Nigeria has accounted for 76% of the company’s messaging transactions, while Algeria currently accounts for 15%.

With this new fundraising, the company plans to tap into the wealth of experience from some of its new investors like Oviosu and Serunjogi who have also taken local companies into expansion phases.

Termii’s round is also noteworthy because it strays away from the usual fintech, mobility, agritech and cleantech sectors that investors typically notice. In fact, there are only a handful of venture-backed communications platform-as-a-service companies on the continent. A notable example is Kenya’s Africa Talking. It might be a stretch to say we might see more funding activity from this segment but one thing is apparent — investors are willing to place bets on less popular sectors.

Another highlight of Termii’s investment is that while foreign investors continue to dominate rounds in African tech startups, local and Africa-focused firms are beginning to step up by leading some which is a good sign for the bubbling ecosystem.

This round is also a big step for Future Africa. According to publicly available information, the firm is leading a million-dollar round for the first time since officially launching last year. This achievement is a continuation of its work over the past three quarters having invested in more than 10 African startups in the last three quarters and 30 startups in general.

Kepple Africa Ventures, the co-lead, is also an active investor and can be argued to be the most early-stage VC firm on the continent — in terms of the number of deals made. So far, the firm has invested in 79 companies across 11 countries.

Speaking on the investment for Kepple Africa, Satoshi Shinada, a partner at the firm, said, “Fragmented and unstable communication channels are one of the biggest challenges for the digitization of businesses in Africa. Emmanuel has proven that with his visionary goals and solid implementation of iterations on the ground, his team is unparalleled to build an innovative solution in this space.”

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

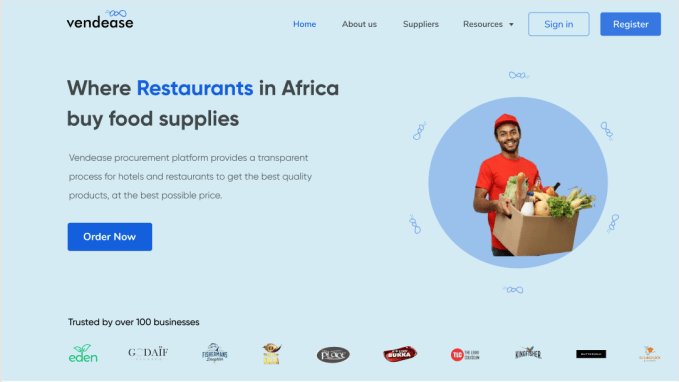

For small and mid-sized restaurants in Nigeria and most of Africa, food procurement can be a complex process to manage. The system is such that a business can easily run out of money or have considerable savings. Most restaurants don’t have access to deal directly with farms to get better deals because they lack the staffing to chase them. Besides, they also don’t have the aggregation pull as single entities to directly get good value from the farms.

Nigerian startup Vendease solves this problem by building a marketplace that allows restaurants to buy directly from farms and food manufacturers.

The company was founded by Tunde Kara, Olumide Fayankin, Gatumi Aliyu, and Wale Oyepeju. The idea for Vendease came when founders who have been friends for more than five years noticed their favorite restaurants in cities like Lagos and Accra shutting down. Inquisitive, they asked the owners who were acquaintances why, and the problems boiled down to the unreliable and expensive nature of food procurement in the cities.

Some months later they saw a hotel manager openly complain to a vendor about the unsteady supply of produce the hotel was getting. It sparked an idea in the founders’ minds.

The established processes involved staff or a contract employee going to the market or using third-party vendors. The founders saw that these processes were often unreliable from the two unrelated events, and restaurants lost a lot of money from price inflation and bad produce.

“We thought to ourselves that if restaurant owners and hotel managers have these problems, let us actually do some research and find out if it is a problem we can solve, scale and make money while doing it,” Kara said to TechCrunch.

At the time, Kara, the CEO, and Fayankin, the COO, held the respective positions at a Pan-African media consulting company called RED Media. Aliyu, the chief product officer (CPO), also held a similar role at another Lagos and San Francisco-based, YC-backed startup, 54gene. Oyepeju, the CTO, was working on a couple of technology projects for corporates.

Before Vendease, they had founded an adtech startup for ride-hailing companies, which didn’t survive for long. So this was another shot at another entrepreneurial journey, and after two and half months of iteration, the founders decided to launch the company in January 2020. They also closed an undisclosed pre-seed round to kickstart operations.

On its website, it is described as “a procurement platform that provides a transparent process for hotels and restaurants to get the best quality products at the best possible price.” But Kara has a more fanciful description: The Amazon Prime for restaurants in Africa.

Customers can order anything ranging from bread to grains and meat to vegetables on the website. The order notification goes to the farms or food manufacturers, gets processed, and delivery is done within 24 hours.

“Why we call ourselves that is because we are deliberate about fulfilling our orders to restaurants and hotels in less than 24 hours. As most of us know, this is similar to how Amazon Prime prioritizes delivery,” he commented.

The speed and timely manner in which Vendease carries out its operations are such that it currently completes 80% of on-time and one-time deliveries across all orders.

Image Credits: Vendease

To further highlight how effective the company has been thus far, Kara claims that a good number of the 100 businesses using Vendease went from procuring only one type of produce to 80% of their catalog in two months.

As much as Vendease helps restaurants a lot, it also looks out for the vendors and farmers involved in the supply chain. Typically it takes two to three months for these set of customers to get the payments and this happens because restaurants and hotels take too long to balance their books before making payments. In effect, farmers and vendors mark up their prices to mitigate losses, making products more expensive for restaurants and hotels.

While growing up, Kara and Fayankin were on both sides of the vicious cycle. Growing up on a farm and helping his parents with livestock and crop care, Kara knows what it means to be owed for a long time.

“Those experiences help fuel what I do right now. Then, we had a problem selling our products and most times we ended up consuming them because we didn’t have enough off-takers. Even when you did, they’ll owe for six months. And this problem still exists to date.”

On the other side of the marketplace is Olumide, who grew up in a hotel and restaurant business. He runs and handles procurement activities and his experience is vital to how Vendease handles issues around unreliable and expensive supply of food produce. But now they are helping these customers reduce the waiting time to days.

Although they would’ve wanted to solve these problems earlier, their careers strayed toward media and energy. However, it has brought them back, and they’re solving additional problems they didn’t recognise in the past. They soon figured that customers couldn’t track most of their orders and be certain of what they got alongside the supply and cost issues.

Vendease has built all that to help these businesses digitize, track and automate their procurement and inventory management processes. It also helps with logistics, warehousing, quality control and financing where restaurants can buy goods and pay later.

In the next five years, the one-year-old company wants to be the operating system for food supplies in Africa. Kara talks of plans to expand to other African cities in the coming months but is tight-lipped on the names. As Demo Day approaches, the team will be looking to raise some money and follows Egypt’s Breadfast as the only restaurant-focused companies from Africa (although they have very different business models) that the accelerator has funded.

Across the street from Suzhou North, a high-speed railway station in a historic city near Shanghai, a futuristic M-shaped building easily catches the eye of anyone passing by. It houses the headquarters of the five-year-old Chinese autonomous driving startup, Momenta.

Like other major Chinese cities, Suzhou, which is famous for its serene canals and classical gardens, offers subsidized offices and policy support to attract high-tech firms. It seems to have chosen well. Momenta exceeded $1 billion in valuation in two years and became one of the most-funded driving companies in China. The startup has a dazzling list of investors, from Kai-Fu Lee’s Sinovation Ventures, the government of Suzhou, to Mercedes-Benz maker Daimler.

Momenta recently closed another massive round, which nears $500 million and lifts its total funding to over $700 million. The investment marks an important step towards the firm’s international expansion, its chief of business development Sun Huan told TechCrunch. In a few months’ time, Sun will head to Stuttgart, the German hometown of Mercedes-Benz, and open Momenta’s first European office.

The new funding, a Series C round, was led by Chinese state-backed automaker SAIC Motor, Toyota and Bosch, an indication of the traditional auto monoliths’ conviction to smart driving.

“The auto industry needs to develop more advantages when confronting Tesla’s marketing today, so they are paying more attention to autonomous driving,” Momenta’s founder and CEO Cao Xudong told TechCrunch.

Financial investors leading the round were the Singaporean sovereign fund Temasek and Alibaba founder Jack Ma’s Yunfeng Capital. Other participants included Mercedes-Benz AG, Xiaomi founder Lei Jun’s Shunwei Capital, Tencent, Cathay Capital and a few undisclosed institutions. It’s rare to see Tencent and Alibaba (or their affiliates) co-invest.

Be pragmatic

Despite the sizable financial injection, Cao said that “autonomous driving companies can no longer rely solely on fundraising to burn cash.”

Mega-fundraising has become common in the capital-intensive autonomous vehicle world. Momenta’s Chinese rivals Pony.ai has amassed over $1 billion within five years and four-year-old WeRide.ai has raised over $500 million. Like Momenta, the two firms have nabbed investments from big automakers. Pony.ai also counts Toyota as an investor, and WeRide is backed by Renault-Nissan-Mitsubishi.

Momenta declined to disclose its latest valuation. For reference, Pony.ai hit $5.3 billion in its November fundraising round.

TechCrunch went on a test ride with Momenta / TechCrunch

Momenta prides itself on what it calls a “two-legged” business model. Unlike some peers that concentrate resources on ‘Level 4,’ or real driverless passenger cars, Momenta is selling semi-automated driving software to carmakers while investing in more advanced tech that is years from mass adoption.

It also tries to cap expenses by crowdsourcing data from auto partners instead of building its own car fleets, which helps save billions of dollars, the company has reiterated. By accumulating driving data at scale, Momenta gets to finetune its algorithms through a self-correcting system. The more data it has, the better its machine becomes at driving.

“It works like a flywheel,” Cao said, using a tech industry jargon first popularized by Jeff Bezos to explain Amazon’s growth.

Driver’s habit

During a test ride TechCrunch went on, where a safety driver was present but did not intervene, a Momenta-powered Lincoln maneuvered through a neighborhood of Suzhou dotted by jaywalkers, unleashed dogs, speeding scooters and reckless truck drivers. When the sedan slowed down at a highway entrance ramp, other cars zipped past us. It felt as if we were going too slowly, but in fact all the human-steered cars were going well above the 40km/h speed limit.

“Some drivers may want the autonomous driving car to be more aggressive, so we are also exploring a system that learns from individual style,” said Jiang Yunfei, an R&D engineer at Momenta who went on the ride. “Of course, on the condition that the car is obeying traffic rules.”

A tablet next to the dashboard showed what our car was capable of seeing and predicting on the road with a set of mass-produced sensors. “Prediction relies on data,” noted Sun. “If we build our own car fleets, it will be very costly to keep the data-driven approach.”

Momenta has joined in the ranks of companies piloting robotaxis on China’s urban roads. It aims to remove some safety drivers from its robotaxis, which it jointly operates with auto partners, in 2022 and expects all of its vehicles to go driverless in 2024. By then, the company will have significantly reduced labor costs and reach a positive operating margin per vehicle.

Automate globally

Momenta has kept a quiet public profile since its inception and rarely talked about its customers except for its partnership with Toyota on high-definition maps, which predated the investment. What Cao could say was the company has fostered “deep collaborations” with carmakers and Tier-1 suppliers across China, Germany and Japan.

By the end of 2021, multiple customers will start mass-producing mid-to-high-end cars equipped with Momenta’s software. And by 2024 or 2025, Momenta’s solutions could be powering millions of vehicles, which should provide a steady stream of driving data to the startup.

“Electrification is no longer enough to differentiate one high-end car brand from another because the motors and batteries they used are quite similar. The key differentiator now is intelligence,” said the founder.

When asked whether Momenta worries about challenges faced by Chinese firms amid geopolitical tensions and continuing U.S.-China technological decoupling, Jijay Shen, who recently joined Momenta as vice president of sales and marketing, said such situations are “uncontrollable” and “regulatory compliance” is the priority for entering any new market.

“The human race was able to achieve significant technological progress in the last ten years exactly because tech companies from different countries are building on top of each other,” said Shen, who spent over a decade at Huawei and was formerly CEO of the telecoms giant’s Ireland business.

“But because of geopolitical factors, many markets will begin to consider self-subsistence in the short term… I can’t conclude what is better, but I think the whole ecosystem and supply chain need to think what’s better — self-subsistence or interdependence.”