& meet dozens of singles today!

User blogs

“Your board will never be the same.”

With that prediction, Nigel Travis, board director and former CEO of Dunkin’ and Papa John’s, kicked off a recent discussion about the future of corporate governance with chief executives and current and aspiring board members.

Just as countless aspects of corporate life have been reshaped over the course of the last year, boards of directors are undergoing significant and lasting transformation. Through our conversations with more than 500 business leaders and work on nearly 300 board searches over the last year, as well as findings from our recent board benchmarking study, we’ve identified five trends in the boardrooms of the United States’ high-growth private companies.

1. Board diversity is imperative

Historically, board members have been tapped from the personal networks of those already in the boardroom. This approach optimizes for trust and convenience at the expense of diversity.

We expect to see continued improvement when it comes to racial and ethnic diversity in the years ahead.

As pressure to diversity the boardroom mounts and societal challenges underscore the risks of the all-male board, companies are starting to take a more inclusive approach to board design. They are reaching outside their networks to appoint women and people of color, discovering that it’s not a pipeline problem — it’s a network problem. In one year’s time, the percentage of late-stage private companies with all-male boards declined from 60% to 49%.

While that’s progress, the fact that nearly half of the most heavily funded venture-backed companies lack a single woman on the board underscores the enormous work still to be done. Today, only 11% of high-growth private company board seats are held by women and only 3% by women of color.

However, we expect to see continued improvement when it comes to racial and ethnic diversity in the years ahead. Demand for Him For Her referrals to female board candidates nearly quadrupled in that last quarter of 2020 compared with a year prior, and among the new directors appointed, a quarter identify as Black or African American.

2. Source candidates from across the entire C-suite

When seeking independent directors, boards have traditionally favored CEO experience. Given the gender imbalance among CEOs, preference for that title instantly tips the scales in favor of male candidates.

As boards look to add women, many have discovered the value of taking a more strategic approach to defining criteria for the next director. Instead of relying on the CEO title as a proxy for the desired qualities, boards now conduct a gap analysis, identifying the mix of key competencies that would be most valuable.

The result: a rich pipeline of executive operators who contribute strategic perspective combined with cutting-edge best practices. In addition to CFOs ready to chair an audit committee, we’ve had requests for operators with go-to-market expertise, product leaders known for driving innovation, and people officers who know how to build corporate culture. We’ve even helped companies seeking, for example, business-savvy doctors, nurses and law-enforcement officers to bring the voice of their customers into the boardroom.

3. Independents come earlier

As CEOs look to add diversity and operating expertise to their boards, many are adding independent directors at an earlier stage. How early? “It’s never too early to have an independent director on the board,” according to Brad Garlinghouse, CEO of Ripple, where the first independent was appointed only a year after the company’s founding.

Over the last year, the percentage of the heavily funded private companies with at least one independent director grew from 71% to 84%, and the percentage of board seats held by independents grew from 20% to 25%, according to the 2020 Study of Gender Diversity on Private Company Boards. Among the board searches we’ve conducted for privately held companies, more than 40% were Series B or earlier.

4. The board Zoom is here to stay

The pandemic drove boards onto screens, but even when health risks are mitigated, many will continue to convene virtually at least some of the time. The last year has caused companies to rethink the role of the physical office, and the importance of the physical boardroom is getting new scrutiny. Though most CEOs and directors will still favor in-person attendance for formal board meetings, we expect a new tolerance for remote participation and an increase in ad-hoc virtual meetings.

Beyond reduced travel and ease of scheduling, there’s a hidden benefit to virtual meetings that leaders would be wise to exploit: the reduced opportunity cost of more attendees. The impact of “another body in the boardroom” has long been an argument against allowing company executives to attend board meetings. We expect that, with a virtual format, CEOs will take advantage of the development opportunity to expose more of their leaders to board discussions.

On the flip side, virtual meetings require a more conscious effort to build relationships. Boards will need to balance the convenience of virtual meetings with the value of in-person interactions in building rapport and fostering collaborative decision-making.

5. Stakeholder capitalism takes root

Propelled by increasing pressure in the public markets and by the growing number of consumers who make value-based purchasing decisions, private company boards will give sustainability more overt consideration in their decision-making. In his annual letter, BlackRock CEO Larry Fink pointed to evidence of a “sustainability premium” for companies that outperform their industry peers on ESG measures. As public companies standardize on metrics and disclosure around ESG performance, that discipline will extend into the boardrooms of companies that aim to compete in the global marketplace.

Private companies drive innovation in nearly every corner of the economy, yet their boardrooms have remained remarkably unchanged over the last several decades. We expect that 2020 will prove to be an inflection point in corporate boardrooms; this period of board transformation will be defined by increased diversity and inclusion and a growing emphasis on sustainable value creation. As these initiatives take root, beneficiaries will include not just the companies and their investors, but employees, customers, suppliers and society at large.

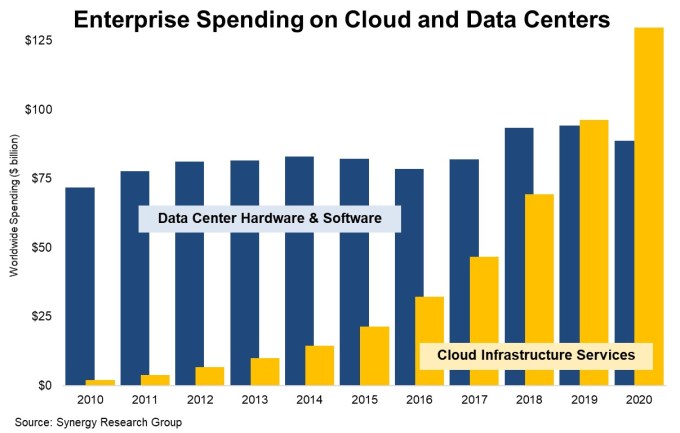

There is a prevailing notion that while the cloud infrastructure market is growing fast, the vast majority of workloads remain on prem. While that could be true, new research from Synergy Research Group found that cloud infrastructure spending surpassed on prem spending for the first time in 2020 — and did so by a wide margin.

“New data from Synergy Research Group shows that enterprise spending on cloud infrastructure services continued to ramp up aggressively in 2020, growing by 35% to reach almost $130 billion. Meanwhile enterprise spending on data center hardware and software dropped by 6% to under $90 billion,” the firm said in a statement.

While the numbers have been trending toward the cloud for a decade, the spending favored on prem until last year when the two numbers pulled even, according to Synergy data. John Dinsdale, chief analyst and research director at Synergy says that this new data shows that CIOs have shifted their spending to the cloud in 2020.

“Where the rubber meets the road is what are companies spending their money on, and that is what we are covering here. Quite clearly CIOs are choosing to spend a lot more money on cloud services and are severely crimping their spend on on-prem (or collocated) data center assets,” Dinsdale told me.

Chart: Synergy Research Group

The total for on prem spending includes servers, storage, networking, security and related software required to run the hardware. “The software pieces included in this data is mainly server OS and virtualization software. Comparing SaaS with on-prem business apps software is a whole other story,” Dinsdale said.

As we see on prem/cloud numbers diverging in this way, it’s worth asking how these numbers compare to research from Gartner and others that the cloud remains a relatively small percentage of global IT spend. As workloads move back and forth in today’s hybrid world, Dinsdale says that makes it difficult to quantify where it lives at any given moment.

“I’ve seen plenty of comments about only a small percentage of workloads running on public clouds. That may or may not be true (and I tend more towards the latter), but the problem I have with this is that the concept of “workloads” is such a fungible issue, especially when you try to quantify it,” he said.

It’s worth noting that the pandemic has led to companies moving to the cloud much faster than they might have without a forcing event, but Dinsdale says that the trend has been moving this way over years, even if COVID might have accelerated it.

Whatever numbers you choose to look at, it’s clear that the cloud infrastructure market is growing much faster now than its on premises counterpart, and this new data from Synergy shows that CIOs are beginning to place their bets on the cloud.

Brian Brackeen, the founder and former CEO of facial recognition startup Kairos, has made his way back to the company following his ouster in 2018. Brackeen is now chairing the company’s scientific advisory board, where he’ll help to address and eliminate issues of racial bias from the technology.

While that’s not the company’s explicit mission — it’s to provide authentication tools to businesses — algorithmic bias has long been a topic the company, especially Brackeen, has addressed.

But what happened in the time leading up to his ouster and the events that followed was quite the whirlwind.

In 2018, Kairos’ board of directors forced Brackeen out of his role as CEO, citing willful misconduct as the cause for his termination. In addition to forcing him out of the company he founded, Kairos sued Brackeen, alleging the misappropriation of corporate funds and misleading shareholders.

At the time, Brackeen referred to the events as “a poorly structured coup,” and denied the allegations. Then, Brackeen countersued Kairos, alleging the company and its CEO Melissa Doval intentionally destroyed his reputation through fraudulent conduct. In 2019, Brackeen and Kairos settled the lawsuits. Brackeen then went on to start Lightship Capital with his wife, Candice Brackeen.

Since returning to Kairos, Brackeen has already directed Kairos to focus on what it’s calling the Bias API. The API is designed to make it easier for companies and firms to detect and address any algorithmic biases, according to Brackeen.

Brackeen is not back on a full-time basis, as he has his hands pretty full with Lightship Capital, but he said he’s generally tasked with steering the ship during quarterly meetings.

As for who’s at the helm, that role falls to Dr. Stephen Moore, who joined Kairos as its chief scientific officer in July 2018 following the company’s acquisition of Emotion Reader.

“He is a brilliant mind, and I’m excited to see a scientist in the CEO role,” Brackeen said. “We will work closely together to bring the bias work to the fore, and to make sure it’s a world-class solution. He is as deeply committed to solving the problem of bias as I am.”

Despite the drama of the past, Brackeen told TechCrunch he still considers Kairos to be his baby. It’s also worth noting that folks like Doval, who was appointed to CEO following Brackeen’s ouster, and Mary Wolff, the former COO who spearheaded the lawsuit, are gone.

“First, I will always feel a responsibility to the team, investors, and fans of Kairos,” Brackeen said as to why he’s returned. “Many of whom I was singularly responsible for. Secondly, as a society, bias can be found in everything from twitter image cropping to air dryers not turning on for black hands. It’s a painful reminder of a society that’s not fair for all. The challenge is that as AI gets to be imbedded in more and more products, we will see bias in all kinds of products. Kairos with its large dataset and years of IP, must be the firm that saves us from that dystopian future. I am uniquely situated to lead that strategy.”

SpaceX has completed what’s known as the ‘stacking’ of its first Super Heavy prototype, the extremely large next-generation first-stage rocket booster that it will eventually use to propel its Starship spacecraft to orbit and beyond. The Super Heavy Booster is about 220 feet tall – which is roughly the wingspan of a Boeing 747, or a bit taller than the Cinderella Castle at Walt Disney World in Florida.

That’s without Starship on top, which will add around another 160 feet. Super Heavy will undergo its own testing prior to flying with Starship, however, and a lot of that will be focused on assuring its fuel tanks can handle the pressurization and extreme temperatures required for keeping all that ignitable material stable prior to when the engines actually fire.

Super Heavy uses the same engines as Starship — Raptor engines, to be specific, which SpaceX created new for this generation of launch vehicle. The final version will have a total of 28 Raptor engines, but this first prototype will likely be outfitted with far fewer, and SpaceX CEO Elon Musk has confirmed that it’ll also remain grounded, as it’s intended to be use only for testing things like build and transportation mechanics.

Yes, Booster 1 is a production pathfinder, figuring out how to build & transport 70 meter tall stage. Booster 2 will fly.

— Elon Musk (@elonmusk) March 18, 2021

He did say the next prototype will fly, and while he isn’t always accurate about timelines, the Starship upper stage (i.e., the one that looks like a big grain silo with fins) is progressing quickly in its development, including with a recent test flight that ended with a near-perfect landing — minus the subsequent explosion that took out the prototype rocket entirely a few minutes after it had touched down successfully.

Musk clearly wants to move fast with Starship and Super Heavy, in part because of ambitious goals it has of serving as a provider to NASA for future human lunar landing missions as part of the Artemis program, and also because it’s still planning to fly the first commercial tourist flight of a Starship in just two short years in 2023.

Over the last few months, we’ve added a number of new Extra Crunch features at the request of the community. This includes Group Membership, expanding support to new countries like Israel and Norway, adding “sign in with Google” to improve checkout speed, and increasing login timeout so users aren’t regularly logged out of the product. Improvements will continue to come in 2021, including a new Extra Crunch Live homepage and easier ways to find the most relevant content for you.

Feedback from our community is critical as we continue to build and develop the product. We’re always looking to improve, and we’d love to get feedback on the product in its current state. If you have a few minutes, please fill out the survey below.