& meet dozens of singles today!

User blogs

Energy consumption has become the latest flashpoint for cryptocurrency. Critics decry it as an energy hog while proponents hail it for being less intensive than the current global economy.

One such critic, DigiEconomist founder Alex de Vries, said he’s “never seen anything that is as inefficient as bitcoin.”

On the other side of the debate, research by ARK Investment Management found the Bitcoin ecosystem consumes less than 10% of the energy required for the traditional banking system. While it’s true the banking system serves far more people, cryptocurrency is still maturing and, like any industry, the early infrastructure stage is particularly intensive.

The cryptocurrency mining industry, which garnered almost $1.4 billion in February 2021 alone, is not yet unusually terrible for the environment compared to other aspects of modern life in an industrialized society. Even de Vries told TechCrunch that if eco-conscious regulators “took all possible actions against Bitcoin, it’s unlikely you’d get all governments to go along with that” mining regulation.

“Ideally, change comes from within,” de Vries said, adding he hopes Bitcoin Core developers will alter the software to require less computational energy. “I think Bitcoin consumes half as much energy as all the world’s data centers at the moment.”

According to the University of Cambridge’s bitcoin electricity consumption index, bitcoin miners are expected to consume roughly 130 Terawatt-hours of energy (TWh), which is roughly 0.6% of global electricity consumption. This puts the bitcoin economy on par with the carbon dioxide emissions of a small, developing nation like Sri Lanka or Jordan. Jordan, in particular, is home to 10 million people. It’s impossible to say how many people use bitcoin every month, and they certainly use it less often than residents in Amman use Jordanian dinars. But CoinMetrics data indicates more than 1 million bitcoin addresses are active, daily, out of up to 106 million accounts active in the past decade, as tallied by the exchange Crypto.com.

“We get the total population of unique bitcoin (BTC) and ether (ETH) users by counting the total number of addresses from listed exchanges, subtracting addresses owned by the same users on multiple exchanges,” said a Crypto.com spokesperson. “We then further reduce this number by accounting for users who own both ETH and BTC.”

That’s a lot of people using these financial networks. Plus, many bitcoin mining businesses rely on environmentally friendly energy sources like hydropower and capturing natural gas leaks from oil fields. A mining industry veteran, Compass Mining COO Thomas Heller, said Chinese hydropower mines in Sichuan and Yunnan get cheaper electricity during the wet season. They continue to use hydropower all year, he added, although it’s less profitable during the annual dry season.

“The electricity price outside of May to October [wet season] is much more expensive,” Heller said. “However, some farms do have water supply in other parts of the year.”

The best way to make cryptocurrency mining more eco-friendly is to support lawmakers that want to encourage mining in regions that already have underutilized energy sources.

Basically, cryptocurrency mining doesn’t inherently produce extra carbon emissions because computers can use power from any source. In 2019, the digital asset investing firm CoinShares released a study estimating up to 73% of bitcoin miners use at least some renewable energy as part of their power supply, including hydropower from China’s massive dams. All of the top five bitcoin mining pools, consortiums for miners to cooperate for better profit margins, rely heavily on hydropower. This statistic doesn’t impress de Vries, who pointed out that Cambridge researchers found renewable energy makes up 39% of miners’ total energy consumption.

“I put one solar panel on my power plant, I also have a mixture of renewable energy,” de Vries said.

In terms of geographic distribution, Cambridge data indicates Chinese bitcoin mining operations represent around 65% of the network’s power, called hashrate. In some regions, like China’s Xinjiang province, bitcoin miners also burn coal for electricity. Beyond cryptocurrency mining, this province is known for human rights abuses against the Uighur population, which China is violently suppressing as part of a broader struggle to capitalize on the region’s natural resources. When critics sound the alarm about cryptocurrency mining and energy consumption, this is often the dynamic they’re concerned about.

On the other hand, North American miners make up roughly 8% of the global hashrate, followed closely by miners in Russia, Kazakhstan, Malaysia and Iran. Iranian President Hassan Rouhani called for the creation of a national bitcoin mining strategy in 2020, aiming to grow the Islamic nation’s influence over this financial system despite banking sanctions imposed by the United States.

Wherever nations and organizations offer the most profitable mining regulations, those are the places where bitcoin mining will proliferate. Chinese dominance, to date, can be at least partially attributed to government subsidies for the mining industry. As such, nations like China and Norway offer subsidies that incentivize bitcoin miners to use local hydropower sources.

As the Seetee research report by Aker ASA, a $6 billion public company based in Norway, said: “The financiers of mining operations will insist on using the cheapest energy and so by definition it will be electricity that has no better economic use.”

The best way to make cryptocurrency mining more eco-friendly is to support lawmakers that want to encourage mining in regions that already have underutilized energy sources.

When it comes to North America, Blockstream CEO Adam Back says his company’s mining facilities, with 300 megawatts in mining capacity, rely on a mix of industrial power sources like hydropower. He added Blockstream is exploring solar-powered bitcoin mining options as a sort of “retirement home” for outdated machines.

“With solar energy, if you’re only online 50% of the time, that’s something to consider in terms of the cost analysis,” Back said. “That’s a better option for older machines, after you’ve already recouped the costs of the equipment.”

Due to surging cryptocurrency prices, there’s now a global shortage of bitcoin mining equipment, Back added, with demand outpacing supply and production taking up to six months per machine. Emma Todd, founder of the consultancy MMH Blockchain Group, said the shortage is driving up the price of mining machines.

“For example, a Bitmain Antminer S9 mining machine that used to cost $35 – $55 in July 2020 on the secondary market, now costs about $275 – $300,” Todd said. “This means that most, if not all mining companies looking to purchase new or secondary equipment, are all experiencing the same challenges. As a result of the global chip shortage, most new mining equipment that is scheduled to come out in the next few months, will almost certainly be delayed.”

Critics like de Vries point out that, due to market forces, industrial miners are unlikely to reduce their power consumption with new machines, which are more efficient.

“If you have more efficient machines but earn the same money, then people just run two machines instead of one,” de Vries said.

And yet, because cryptocurrency prices are rising faster than new miners can be constructed, Back said “retiring” old machines with renewable energy sources becomes more profitable than simply abandoning them for new equipment. In addition, Back said, robust bitcoin mining infrastructure can support communities rather than draining resources. This is because bitcoin miners can help store and arbitrage energy flows.

“You can turn miners on and off if you get to a surge prices situation, you can use the power for people to heat their homes if that’s more urgent or more profitable,” Back said. “Bitcoin could actually support power grids.”

Meanwhile, just north of the Canadian border, Upstream Data president Steve Barbour said a growing number of traditional oil and gas companies are quietly ramping up their own bitcoin mining operations.

This puts the bitcoin economy on par with the carbon dioxide emissions of a small, developing nation like Sri Lanka or Jordan.

“Right now it’s hydro and coal. That’s the majority of the big industrial mining. But on the global scale, that’s going to shift more toward any cheap power, including natural gas,” Barbour said. “Oil fields already have cheap energy with the venting flares, the waste gas, there’s potential for approximately 160 gigawatts [of mining power] this year.”

Upstream Data helps oil companies set up and operate bitcoin miners in a way that captures waste and low quality gas, which they couldn’t sell before, totaling 100 deployments across North America. These companies rarely go public with their bitcoin mining operations, Barbour said, because they’re concerned about attracting negative press from Bitcoin critics.

“They are definitely concerned about reputational risk, but I think that’s going to change soon because you have big, credible companies like Tesla involved with Bitcoin,” Barbour said.

Even within the cryptocurrency industry, there are many people who dislike how power-intensive bitcoin mining is and are experimenting with different mining methods. For example, the Ethereum community is trying to switch to a “proof-of-stake” (PoS) mining model, powering the network with locked up coins instead of Bitcoin’s intensive “proof-of-work” (PoW) model.

As the name might suggest, PoW requires a lot of computational “work.” That’s what miners do, lots and lots of math problems that are so difficult the computers require a lot of electricity. With regards to Ethereum, which currently runs on PoW but will theoretically run on PoS in a few years, there are hundreds of thousands of daily active addresses, sometimes half as many as Bitcoin. Like Bitcoin, a few industrial mining projects with facilities in China generate more than half of the Ethereum network’s power. Each Ethereum transaction requires nearly as much energy as two American households use per day.

“What I like about the Ethereum community is at least they are thinking about how to solve the problem,” de Vries said. “What I don’t like is they’ve been talking about it for a few years and haven’t been able to actually do it.”

The Ethereum ecosystem uses enough energy every year to power the nation of Panama. Like Bitcoin, each Ethereum transaction costs enough for electricity costs that the money could also buy a nice lunch. Both of these networks require enough power to fuel small countries, although Ethereum usually has less than half of the million daily users that Bitcoin has. It’s clear cryptocurrency transactions require more power than Visa transactions. However, a cryptocurrency isn’t just a payments company. It is a whole currency system.

If the bitcoin market cap were ranked as a country, by the value of the money supply, Bitcoin would come in fifth place behind Japan. And that’s not even considering adjacent ecosystems like Ethereum. In short, power consumption in the global Bitcoin economy is comparable to that of some other industrialized financial systems. It is inefficient, as de Vries points out, as are many of the systems used in emerging economies. Out of millions of users, thousands of people around the world rely on cryptocurrency for income. They are generally optimistic about the cryptocurrency ecosystem, believing it will become more efficient as the technology matures.

“I see Bitcoin mining increasingly playing a role in the transition to a clean, modern and more decentralized energy system,” said one such Canadian business consultant, Magdalena Gronowska. “Miners can provide grid balancing and flexible demand-response services and improve renewables integration.”

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Earnings season is coming to a close, with public tech companies wrapping up their Q4 and 2020 disclosures. We don’t care too much about the bigger players’ results here at TechCrunch, but smaller tech companies we knew when they were wee startups can provide startup-related data points worth digesting. So, each quarter The Exchange spends time chatting with a host of CEOs and CFOs, trying to figure what’s going on so that we can relay the information to private companies.

Sometimes it’s useful, as our chat with recent fintech IPO Upstart proved after we got to noodle with the company about rising acceptance of AI in the conservative banking industry.

This week we caught up with Yext CEO Howard Lerman and Smartsheet CEO Mark Mader. Yext builds data products for small businesses, and is betting its future on search products. Smartsheet is a software company that works in the collaboration, no-code and future-of-work spaces.

They are pretty different companies, really. But what they did share this time ’round the earnings cycle were macro notes, or details regarding their forward financial guidance and what economic conditions they anticipate. As a macro-nerd, it piqued my interest.

Yext cited a number of macroeconomic headwinds when it reported its Q4 results. And tying its future results somewhat to an uncertain macro picture, the company said that it is “basing [its] guidance on the business conditions [it sees for itself] and [its] customers currently, with the macro economy, which remains sluggish, and customers who remain cautious,” per a transcript.

Lerman told The Exchange that it was not clear when the world would open — something that matters for Yext’s location-focused products — so the company was guiding for the year as if nothing would change. Wall Street didn’t love it, but if the economy improves Yext won’t have high hurdles to jump over. This is one tack that a company can take when it talks guidance.

Smartsheet took a slightly different approach, saying in its earnings call that its “fiscal year ’22 guidance contemplates a gradual improvement in the macro environment in the second half of the year.” Mader said in an interview that his company wasn’t hiring economists, but was instead simply listening to what others were saying.

He also said that the macro climate matters more in saturated markets, which he doesn’t think that Smartsheet is in; so, its results should be more impacted by things more like “the secular shift to the cloud and digital transformation,” to quote its earnings call.

What the economy will do this year matters quite a lot for startups. An improving economy could boost interest rates, making money a bit more expensive and bonds more attractive. Valuations could see modest downward pressure in that case. And venture capital could slow fractionally. But with Yext forecasting as if it was facing a flat road and Smartsheet only expecting things to pick up pace from Q3 on, it’s likely that what we have now is mostly what we’ll get.

And things are pretty damn good for startups and late-stage liquidity at the moment. So, smooth sailing ahead for startup-land? At least as far as our current perspective can discern.

We still have a grip of notes from Splunk CEO Douglas Merritt on how to take an old-school software company and turn it into a cloud-first company, and Jamf CEO Dean Hager about packaging discrete software products. More to come from them in fits.

Various and sundry

There were rounds big and small this week. Companies like Squarespace raised $300 million, while Airtable raised $277 million. On the smaller-end of the spectrum, my favorite round of the week was a modest $2.9 million raise from Copy.ai.

But there were other rounds that TechCrunch didn’t get to that are still worth our time. So, here are a few more for you to dig into this weekend:

- A so-called pre-Series A round for Lilli, a U.K.-based startup that uses sensors and other tech to track the well-being of folks who might need help to live on their own. Using tech to take care of folks is always good by me. The deal was worth £4.5 million, per UKTN.

- An IPO for Tuya, a Chinese software company that raised $915 million in its American debut. Chinese IPOs on American indices were once a big deal. They are less frequent now. Surprised that I missed this one, but, hey, there’s been a lot going on.

- And the Republic round, worth $36 million, that is banking on the recently-expanded American crowdfunding regulations. Some startups have seen success with the approach, including Juked.gg.

Upcoming attractions

Next week is Y Combinator Demo Day week, so expect a lot of early-stage coverage on the blog. Here’s a preview. From The Exchange we’re looking back into insurtech (with data from WeFox and Insurify), and talking about Austin-based software startup AlertMedia’s decision to sell itself to private-equity instead of raising more traditional capital.

And to leave you with some reading material, make sure you’ve picked through our look at the valuations of free-trading apps, the issues with dual-class shares, the recent IPO win for the New York scene and how unequal the global venture capital market really is.

Closing, this BigTechnology piece was good, as was this Not Boring essay. Hugs, and have a lovely respite,

A proposed witness list filed by Apple for its upcoming trial against game-maker Epic reads like a who’s who of executives from the two companies. The drawn out battle could well prove a watershed moment from mobile app payments.

The two sides came to loggerheads when the Fortnite maker was kicked out of the App Store in August of last year after adding an in-game payment system designed to bypass Apple’s – along with Apple’s cut of the profiles.

Epic has accused Apple of monopolist practices pertaining to mobile payment. Apple, meanwhile, has argued that Epic broke the App Store agreement in order to increase its revenue.

Filed late last night by the hardware giant, the document includes top executives from bot sides. For Apple, the list includes CEO Tim Cook, Software Engineering SVP Craig Federighi and Apple Fellow, Phil Schiller. On team Epic, it’s Tim Sweeney and VP Mark Rein. Executives from Microsoft, Facebook and NVIDIA are also included, for good measure.

In a statement provided to TechCrunch, Apple notes,

Our senior executives look forward to sharing with the court the very positive impact the App Store has had on innovation, economies across the world and the customer experience over the last 12 years. We feel confident the case will prove that Epic purposefully breached its agreement solely to increase its revenues, which is what resulted in their removal from the App Store. By doing that, Epic circumvented the security features of the App Store in a way that would lead to reduced competition and put consumers’ privacy and data security at tremendous risk.

The trial is expected to kick off May 3. We’ve reached out to Epic for additional comment.

In an Extra Crunch Live this past week, Cleo Capital founding partner Sarah Kunst broke down what founders can learn from Supreme, a sought-after streetwear brand. She argued that founders, similar to Supreme, should build a brand around themselves that is so well-respected and has clout that whenever they start something new, investors will line up.

“A Supreme shirt that costs $100 bucks in the store will cost $1,000 online so, as an investor, I am just a kid on the street corner flipping sportswear,” Kunst mentioned. “Who do I think is going to be an investment with such velocity that getting in early is going to be more than worth it as they grow.”

I think this is the best framing I’ve seen about how to drum up excitement for a startup as a founder. FOMO isn’t a strategy, it’s a tactic. What really works, as Kunst alluded to, is when founders can point to key insights they’ve had throughout their career beyond the context of a fundraising process. In other words, anyone can create a nice t-shirt and slap a logo on it. Which founder in this sector is going to give it meaning? It might be the one with the big former exit, the one that was the first Black woman to ever build a unicorn, or the one that was on the ground facing the pain point they now want to solve.

We get into how to build a fundraising process, the concept of soft-circling an investor and what Kunst says is one of her biggest pet-peeves in a pitch deck on the site, but I wanted to give you that sneak peek for now.

- Pregame Y Combinator Demo Day with Equity

- The lightning-fast Series A (that was 3 years in the making)

- Hear how Poshmark went from Series A to the public markets with Manish Chandra and Mayfield’s Navin Chaddha

Saying ‘yes, please’ to no code

This week, Airtable was valued at $5.77 billion from a fresh Series E fundraise.

Here’s what to know: As we discussed on Equity, Airtable is far more than a savvy Excel sheet with bells and whistles. It is one of the leaders in the no-code movement, and founder Howie Liu recently opened up its API to promote developer innovation atop its platform.

- 3 steps to ease the transition to a no-code company

- Okay, the GPT-3 hype seems pretty reasonable

- AI fintech products are operating at scale and investor interest is maturing

Image Credits: Cadalpe (opens in a new window) / Getty Images

A seedy asset class

Per Climate Editor Jonathan Shieber, farmland could become the next big asset class modernized by marketplace startups.

Here’s what to know: One startup, AcreTrader, is trying to create a Robinhood for buying farmland, which I think is indicative of how lucrative some view a patch of land. CEO Carter Malloy thinks that while private equity often gets press for being in the land game, most land is owned by smaller ownership through families.

“Over the last few months, we’ve consistently seen our offering sizes grow while our funding windows shrink, showcasing the fast-growing desire surrounding this resilient asset class,” he said.

- Shell’s Gamechanger Accelerator selects three companies for its energy transition accelerator

- New markets emerge for carbon accounting businesses as cities like LA push proposals

More places for investors to throw their money reminds me of two other stories for you to check out:

- Gumroad wants to make equity crowdfunding mainstream

- Crowdfunding limits are poised to change next week, but most VCs aren’t paying attention — yet

A green row celery field in the Salinas Valley, California USA. Image Credits: Pgiam (opens in a new window)/ Getty Images

Around TechCrunch

Consider these upcoming notes as the coupon section for your early-stage founder and investor dreams.

First up, I’m tossing you a discount code to our TechCrunch Early Stage conference, our two-day virtual event for founders, investors and operators. Use code “TCARTICLE” to get 20% off your ticket so you can attend super cool events like how to bootstrap with Calendly’s Tope Awotona and OpenView’s Blake Bartlett, how to pitch your Series A fundraise with Kleiner Perkins’ Bucky Moore, and finance for founders with Alexa von Tobel.

Secondly, we are already well into planning TechCrunch Disrupt 2021! Grab super early-bird passes for less than $100, to attend our all-virtual event.

Thirdly, thank you for all the support. DM me any questions you might have, and I really hope to see your lovely faces there.

Across the week

Seen on TC

Uber under pressure over facial recognition checks for drivers

5 trends in the boardrooms of high-growth private companies

Forget medicine, in the future you might get prescribed apps

Tech companies should oppose the new wave of anti-LGBTQ legislation

Seen on EC

Social+ payments: Why fintechs need social features

Snowflake gave up its dual-class shares, should you?

MaaS transit: The business of mobility as a service

Survey: Share feedback on Extra Crunch

Talk next week,

N

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, there was a lot of headline-making app ecosystem news, including Google’s impactful decision to drop its Play Store commissions, an App Store lawsuit over scammy apps with fake ratings, battles over Apple’s App Tracking Transparency and the arrival of a notable new feature on YouTube — a TikTok rival called Shorts.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Top Stories

Developer sues Apple over lost revenue due to App Store scams

Image Credits: TechCrunch

Kosta Eleftheriou, a co-founder of the Fleksy keyboard app, has been raising awareness about App Store scams in recent weeks, after his own app was targeted by copycat subscription scammers leveraging fake ratings and reviews to gain traction. This week, Eleftheriou filed a lawsuit that attempts to hold Apple accountable for his own app’s lost revenue, saying that Apple promises developers a safe and trustworthy marketplace, but then allows these scammers to operate to the detriment of legitimate apps like his own. Though some news articles positioned the case as some sort of antitrust lawsuit, it’s really more focused on scammers and the accountability Apple has for how its App Store operates, which apps are listed and how well it’s managed and policed. Eleftheriou is asking Apple to compensate him for his lost revenue and other damages as a result of Apple’s ill-run app marketplace, as well as what he claims are unfair App Review rejections.

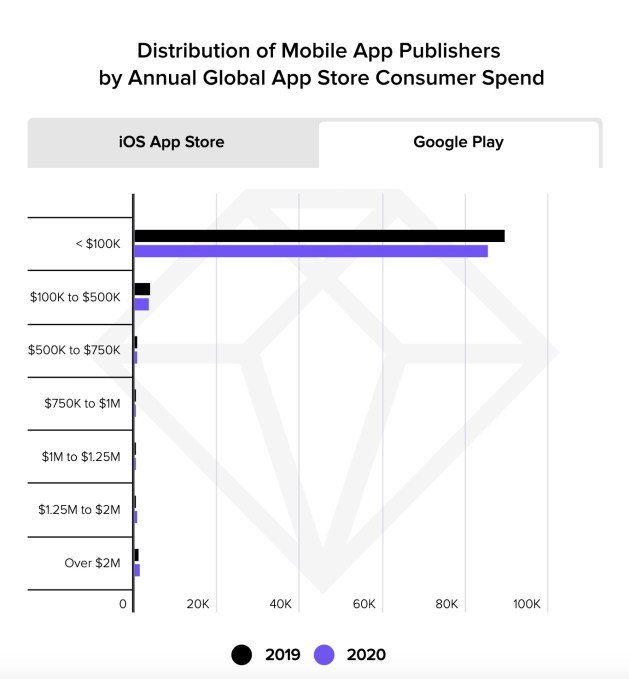

Google Play drops commissions to 15% on some earnings

Google Play Store screen

Google has followed Apple’s lead in reducing commissions for the Google Play store. But in its case, it has dropped commissions from 30% to 15% on developers’ first $1 million in revenue. Apple, by comparison, starts charging 30% once the developer tops $1 million. Google said 99% of developers who sell goods and services through the Play Store will see a 50% reduction in fees. According to App Annie data, very few Google Play developers make more than $1 million — in fact, only 2,035 developers do on Google Play, compared with 3,611 on iOS. To put this in perspective in terms of revenue, developers making up to $1 million in consumer spend only comprised 5% of total Google Play consumer spend in 2020, the firm noted.

Apple’s ATT scores a win in France

Apple fended off an attempt by advertisers in France who wanted to derail the IDFA change in iOS, which will require users’ permission in order to track them. The complaint had attempted to contrast Apple’s ATT (App Tracking Transparency) requirements for third parties with Apple’s own, where its first-party apps are allow to track by default for the purpose of personalizing ads in various Apple apps. France’s competition regulator decided Apple’s plans “don’t appear to be abusive” and said it can’t intervene just because some apps may see a negative impact. But the authority did say it will investigate Apple further to determine if any of its changes are “self-preferencing.”

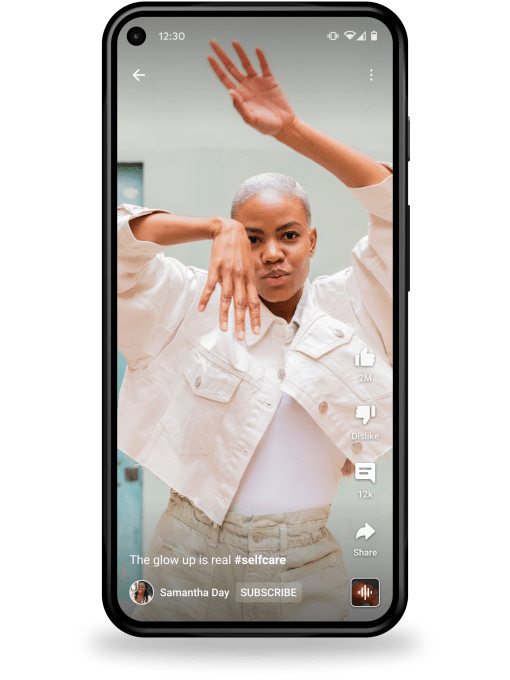

YouTube launches its TikTok rival in the U.S.

Image Credits: YouTube

The short-form video experience known as YouTube Shorts first launched in India, where TikTok has been banned, in September. It’s now coming to the U.S. in its first major expansion. The feature, still in beta, offers a very TikTok-like experience both in terms of recording content and viewing. Users can tap to record video segments for up to 60-second long videos, and use a small handful of editing features like text captions, countdown timers and speed controls. Meanwhile, viewing the videos is also presented in a TikTok-like format with vertical feeds of video where you can double-tap to like, duck into comments or tap on hashtags or sounds to participate in trends.

YouTube believes the feature has potential because it’s connected to the larger YouTube ecosystem, including YouTube Music and the main platform itself — you can subscribe to YouTube channels right from Shorts, for example. But Shorts lacks a lot of what makes TikTok successful for the time being, like its numerous AR effects and editing tools, sound sync and its ability for creators to react and respond to other videos through stitches and duets.

Weekly News

Platforms: Apple

Apple will allow the Russian government to pre-install apps on the iPhone starting on April 1, 2021. In accordance with a new law, Apple users will be shown a dialog box at setup that prompts them to install web browsers, antivirus, messenger and email apps. Users can choose to deselect these apps or delete them from the device later.

Report claims Apple may soon deliver standalone iOS security updates. According to code found in the latest iOS 14.5 beta, Apple could be preparing to introduce a way to update older iPhones with critical security updates without requiring users to download new versions of iOS. This could be helpful in patching older devices where users don’t download iOS updates for fear of slowing down their phone.

Apple says the App Store now supports 300K jobs in the U.K., up 10% YoY, as well as 250K jobs in Germany and another 250K in France. The figures were released in response to increased antitrust scrutiny by regulators, as a way to demonstrate the App Store’s contribution to local economies.

Platforms: Google

Image Credits: App Annie

App Annie data shows how few Google Play developers will pay the higher 30% commission after the policy change, announced this week. Google says developers’ first $1 million in revenue will be commissioned at 15%, not 30%. This covers the vast majority of the Play Store’s developer base, as only 2,035 developers make $1 million or more.

Google updates its People API, which will replace the Contacts API being deprecated on June 15, 2021. The new API will now support two new endpoints for batch mutates and Contacts searches, the company said.

Google updates its parental controls for Android, Family Link. The updates acknowledge that not all screen time is the same, by allowing parents to set some apps — like those used for virtual school — as “always allowed” and not counting toward daily limits. It also updated reporting to better show where kids were spending time outside of these necessary apps.

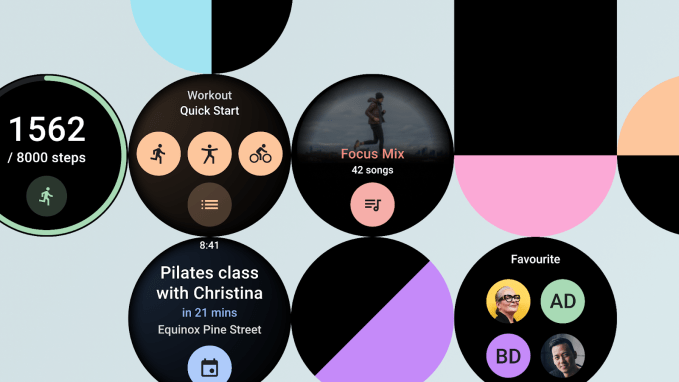

Google is now allowing third-party developers to build Tiles for Wear OS smartwatches. Tiles are small, fast-loading experiences that can deliver specific, timely information users need, but can be tapped to open a related app on the watch or phone for a deeper experience.

Image Credits: Google

E-commerce

Facebook’s Mark Zuckerberg said his company has been preparing for the Apple IDFA changes by investing in more commerce products on its own platforms, like Facebook and Instagram Shops. In a Clubhouse session on Thursday, he announced Facebook has 1 million active Shops which are used by 250 million people every month.

Social

Twitter is testing a way for users to watch YouTube videos from within the home timeline directly on iOS devices, instead of being redirected to YouTube. Finally! The test was made possible through YouTube’s iFrame Player API, which Twitter gained access to.

TikTok will no longer allow users to opt out of personalized advertising starting on April 15th. The app alerted users to the change via a notice that appeared on screen at launch. This means uses will see ads based on what they watch and engage with on TikTok.

TikTok may add a group chats feature sometime early this year, according to Reuters. The feature is already a part of the Chinese version of the TikTok app, Douyin, and would make the app more social.

Instagram adds new teen safety tools as competition with TikTok heats up. TikTok has been making its app safer for teens and this week Instagram followed suit — but instead of locking down teens accounts by default, it made it more difficult for adult predators to reach teens on Instagram, through a variety of alerts and blocking features.

Leaked recordings detail conservative donor Rebekah Mercer’s role at right-wing social app Parler, where she joined meetings to rally employees to fight against the shut down of free speech, and other matters, Bloomberg reports.

Facebook is preparing to add an age-gate to Instagram that would allow for a curated, and likely COPPA-compliant, under 13 experience, according to a report from BuzzFeed. TikTok today does the same thing, following its FTC fines. Instagram could be doing the same to ward off any FTC investigation into underage use of its app as well as to better cater to the younger users who are already on Instagram today.

Messaging

China banned Signal. The encrypted messaging app became unavailable on the mainland on March 16, following a ban of the Signal website the day prior. The app had been one of the few Western social networks that was accessible in China without a VPN.

Telegram is working on an audio experience that allows users to create voice chats in Telegram Channels that you can join either with your personal profile or channel profile. The feature is in beta testing and no official announcement has been made.

And Telegram is bringing voice chats for channels now.

Clubhouse is everywherehttps://t.co/u5cSB6VSCy pic.twitter.com/WspFNlZI11

— WABetaInfo (@WABetaInfo) March 13, 2021

Streaming & Entertainment

Clubhouse hires Instagram alum Fadia Kader as its new head of Media Partnerships and Creators. The hire follows that of OWN and Netflix alum Maya Watson to serve as head of Global Marketing, and points to an increased interest in establishing Clubhouse in the world of media. Kader’s background is in music and tech, having led music partnerships at Twitter, and having worked at Def Jam.

Clubhouse promises its accelerator participants either brand deals or $5,000 per month during its three-month program. The company plans to work with around 20 creators to help them produce, book guests and promote their shows on the platform, as well as source brand deals.

Clubhouse is also currently being investigated by France’s privacy watchdog, CNIL, in an attempt to determine whether or not GDPR will apply to the app and how it’s complying with EU rules. Germany’s regulator last month was doing something similar, as it began looking into how the app was protecting the privacy of European users and their contacts.

Premium content, entertainment and streaming have helped drive up the prices of in-app purchases (IAPs). In 2020, the median price for IAPs among the top non-game apps was $5.99, up from $3.99 in 2017. The median price of subscription IAPs alone, meanwhile, has remained flat at $9.99 over the past four years, Sensor Tower found.

AT&T will begin counting HBO Max streams through the app against data limits. The company owns HBO via WarnerMedia and was previously exempting streams from data caps, but says a California net neutrality law will now no longer allow it to do so. AT&T spoke out against a patchwork of state regulations for net neutrality, saying they will create roadblocks to pro-consumer solutions.

Gaming

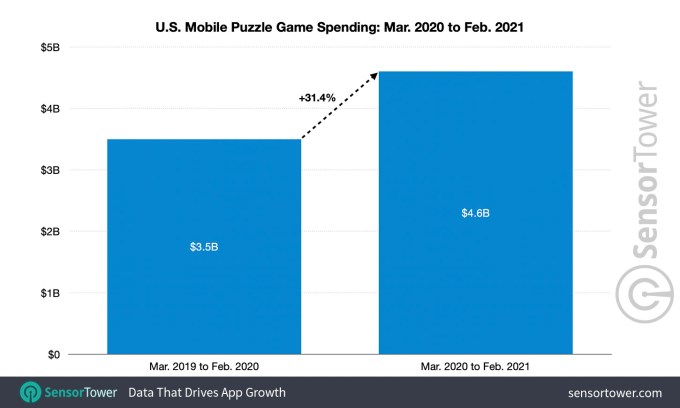

Image Credits: Sensor Tower

U.S. mobile puzzle game spending jumped 30% YoY to $4.6 billion in 2020, per a Sensor Tower report. The pandemic likely contributed to the rise, with top game Candy Crush Saga pulling in $643 million following by Homescapes and Gardenscapes.

Health & Fitness

Apple Maps has been updated with COVID-19 vaccine locations in the U.S. Apple is sourcing data from VaccineFinder, an initiative led by Boston Children’s Hospital, which is also one of the sources Google Maps is using. Apple is allowing healthcare providers, labs and other businesses to submit their information about vaccine locations.

Facebook will label all COVID-19 vaccine posts with a pointer to official, authoritative sources of information across Facebook and Instagram. It also said it will reduce the distribution of content from users who repeatedly violated policies on vaccine misinformation or who shared debunked claims, as well as any claims that fact checkers say are “Missing Context.”

Security & Privacy

Facebook expands support for security keys to mobile users on iOS and Android. The social network has supported the use of security keys, which generate encrypted, one-time security codes, for desktop users since 2017.

California passed new regulations that ban so-called “dark patterns,” or designs used by websites and apps to frustrate or trick users into doing things they wouldn’t normally do — like subscribing to a service they didn’t want or opting-in to sharing their data with the company, for example.

An iPhone app privacy report from cloud storage company pCloud showed how much personal data is being accessed by apps. The apps collecting the most data were Facebook and Instagram, while Klarna and Grubhub tied for second place, followed by Uber and Uber Eats.

Big tech, including Apple and Google, are ramping up their lobbying in U.S. state capitals, reports The WSJ, as a number of bills that could regulate their industries are arriving in state legislatures. One of these is an app store payments bill that is going to be debated in Arizona’s Senate in the next several weeks. If passed, developers would be able to use their own payment systems for in-app purchases instead of Apple’s and Google’s systems. Other legislation is being proposed in states including Maryland and Virginia.

A government-backed consortium of Chinese companies introduced a new method for tracking iPhone users as an alternative to IDFA (paywalled source: FT). The system could be a workaround for Apple’s App Tracking Transparency, as it won’t require user permission. Tencent and ByteDance are reportedly testing the system, known as CAID.

Google finally rolls out iOS privacy labels for Chrome and Google Search. Competitor DuckDuckGo trolled the company for its delay, saying “after months of stalling, Google finally revealed how much personal data they collect in Chrome and the Google app. No wonder they wanted to hide it.” Burn!

After months of stalling, Google finally revealed how much personal data they collect in Chrome and the Google app. No wonder they wanted to hide it.

⁰

Spying on users has nothing to do with building a great web browser or search engine. We would know (our app is both in one). pic.twitter.com/lJBbLTjMuu— DuckDuckGo (@DuckDuckGo) March 15, 2021

Business, Enterprise and Productivity

App Annie partners with Snowflake and introduces a new Salesforce integration. The former allow data teams to access and transform a variety of mobile estimates, both live and continually updated. The new App Annie Intelligence Salesforce Connector, meanwhile, lets App Annie customers build a better pipeline through mobile-metric enriched CRM records.

Google Meet rolls out the tile view on iOS, to be soon followed by Android support. This view allows a user to see more of the people on the video call, even on the small screen. The app also introduced support for live captions in four new languages on mobile (French, German, Portuguese and Spanish, the latter for Spain and Latin America)

Funding and M&A

Snap acquired a Berlin-based clothing size recommendation engine Fit Analytics that helps online shoppers buy the right sized clothes. Deal terms were undisclosed. The acquisition will see over 100 Fit team members joining Snap as the company pushes into e-commerce.

Snap acquired a Berlin-based clothing size recommendation engine Fit Analytics that helps online shoppers buy the right sized clothes. Deal terms were undisclosed. The acquisition will see over 100 Fit team members joining Snap as the company pushes into e-commerce.

Riva Health raised $15.5 million in seed (!!) funding to turn your smartphone into a blood pressure monitor, in a round led by Menlo Ventures. The company is co-founded by scientist Tuhin Sinha and Siri and Viv (exited to Samsung) co-founder Dag Kittlaus. The system being developed would have users place their finger over the phone’s camera light, which would then flash, allowing the app to use the light to track the blood pressure reading.

Riva Health raised $15.5 million in seed (!!) funding to turn your smartphone into a blood pressure monitor, in a round led by Menlo Ventures. The company is co-founded by scientist Tuhin Sinha and Siri and Viv (exited to Samsung) co-founder Dag Kittlaus. The system being developed would have users place their finger over the phone’s camera light, which would then flash, allowing the app to use the light to track the blood pressure reading.

Mobile banking app Kuda raised $25 million led by Valar to become the neobank for all of Africa. The company today offers mobile-first banking services in Nigeria and has doubled its user base from its seed round to now 650,000.

Mobile banking app Kuda raised $25 million led by Valar to become the neobank for all of Africa. The company today offers mobile-first banking services in Nigeria and has doubled its user base from its seed round to now 650,000.

London-based mobile investing app Invstr raised $20 million to pair Robinhood-like commission-free stock trades with digital banking services and educational and learning tools. The app has over 1 million global users.

London-based mobile investing app Invstr raised $20 million to pair Robinhood-like commission-free stock trades with digital banking services and educational and learning tools. The app has over 1 million global users.

Investing app Gatsby raised a $10 million Series A for its Robinhood competitor. The app is aimed at younger users, offering commission-free options and stock trading and is aiming to have more than 100K accounts by the end of the year.

Investing app Gatsby raised a $10 million Series A for its Robinhood competitor. The app is aimed at younger users, offering commission-free options and stock trading and is aiming to have more than 100K accounts by the end of the year.

Digitail’s app for veterinary surgery practices raised $2.5 million in seed funding, in a round led by byFounders and Gradient Ventures (Google’s AI fund). The company currently has 2,000 vets in 16 countries using its services.

Digitail’s app for veterinary surgery practices raised $2.5 million in seed funding, in a round led by byFounders and Gradient Ventures (Google’s AI fund). The company currently has 2,000 vets in 16 countries using its services.

Match Group makes a seven-figure investment in background check nonprofit Garbo. The Tinder parent company plans to integrate its apps with Garbo’s tools, which alert users to background checks of concern to daters like assault or stalking charges, among other things.

Match Group makes a seven-figure investment in background check nonprofit Garbo. The Tinder parent company plans to integrate its apps with Garbo’s tools, which alert users to background checks of concern to daters like assault or stalking charges, among other things.

Telegram is selling more than $1 billion in debt to investors to fund its operations and pay creditors, with the promises of discounted equity if the company later goes public. The messaging app owes its creditors around $700m by the end of April, The WSJ reported.

Telegram is selling more than $1 billion in debt to investors to fund its operations and pay creditors, with the promises of discounted equity if the company later goes public. The messaging app owes its creditors around $700m by the end of April, The WSJ reported.

Downloads

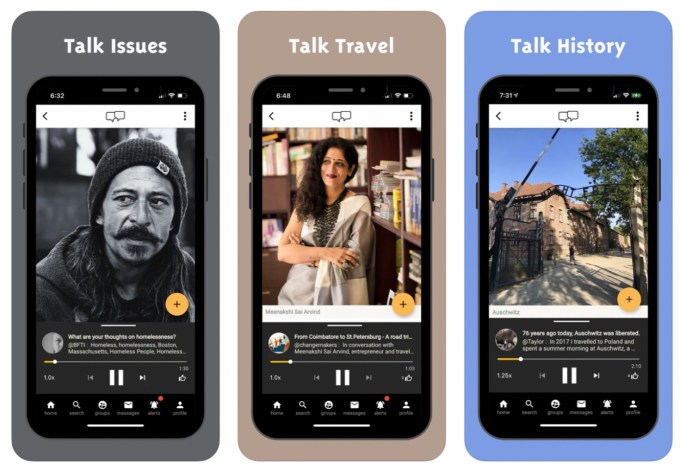

Swell

Image Credits: Swell

A new startup called Swell has a different take on voice conversations than Clubhouse. Instead of real-time conversations, Swell users engage in asynchronous chats where one user posts an audio clip of up to five minutes in length that others can listen to and then respond to with their own recording. These mini-podcasts can be private chats or public conversations. Swell is available as a free download on both iOS and Android.

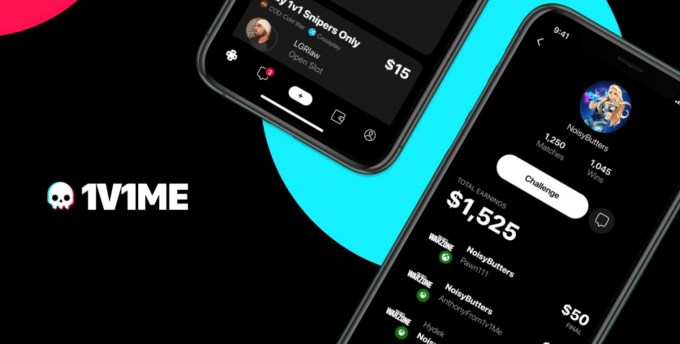

1v1Me

Image Credits: 1v1Me (opens in a new window)

1v1Me launches its app that lets anyone gamble on their ability to win in a player versus player game. The iOS app is now available in an invite-only mode, with the first invites going to creators who play games like Call of Duty and Fortnite — the first games that will be supported on the betting platform. Users can sign up for early access on the company’s website for the time being, then stalk the company on Twitter for invites.

Half Lemons

This clever iOS recipes app, Half Lemons, does that thing you’ve always wanted a recipe app to do: it serves up dish ideas using the ingredients you have at home. To use the app, you take a quick digital inventory of your kitchen in order to customize the app to deliver recipes that are specifically tailored to your own ingredients. You can then save or share the recipes, in addition to making them right away with a screen that stays powered on as you cook. Future versions of the app will help you shop for ingredients and plan meals.

Retrofy your iPhone

Image Credits: Ben Vessey (opens in a new window)

Bored with your iOS 14 customizations? Take your iPhone old-school with this super retro iOS 14 icon and wallpaper set featuring over 110 Mac OS ’84 icons and six monochromatic wallpapers. The set has been handcrafted by freelance digital product designer Ben Vessey, who many years ago had created a similar theme for “retrofying” your desktop screen. When he heard about the Shortcuts feature in iOS 14, he got to work to build a version of this retro experience for iPhone. The pack is £3.99, or £79.99 if you want to request five custom icons of your choice in addition.