& meet dozens of singles today!

User blogs

Digital identity services — used as a key link between organizations to verify that you are who you say you are online and individuals logging into those services — have come into their own in this past year. The pandemic has precipitated a shift where many services we might have used in person are now accessible via the web and apps, but at the same time, the amount of cybercrime aimed at abusing that environment is on the rise, and both trends fuel a stronger demand for ID verification tools. Now, one of the companies that provides digital identity products is announcing a large round of funding, underscoring both the market size and its ambitions to be a central player in that space.

Jumio, which has built a platform that provides a variety of digital identity tools and technology — using biometrics, machine learning, computer vision, big data, and more to run checks on ID documents, log-ins, suspicious financial activity, prevent identity theft and more — has closed a $150 million round of funding, money that it will use to build more tools available on its platform, and to double down on customer growth after a big year for the company.

Currently, the company’s primary business is B2B: it provides tools to enterprise customers like HSBC to manage digital identity verification. Some of the areas where it will be investing include expanding its AI capabilities to do more anti-money laundering work, and to look at building a B2C product, using the data, tools and network of customers that it has to help individuals better manage their identities online.

“I think the big thing is that the foundation of the internet is identity not anonymity,” said CEO Robert Prigge in an interview, who said the trend of digital transformation has spurred that chane. “It’s been a big shift over the last couple of years. People wanted to originally hide behind anonymity, but now identify is the keystone. Whether it’s online banking or social networks, you need to be able to establish trust remotely.”

Of course, anonymity still is there, just in a different form: data protection regulations are all about making sure that we can stay private if we so choose as we use the tools that are now the norm. That presents the challenge and opportunity for a company like Jumio: how to navigate the push for identity while still providing a way to do that with privacy protections in mind.

The funding is coming from a single investor, Great Hill Partners, which will be joining Centana and Millennium as shareholders in the company. The valuation is not being disclosed but CEO Robert Prigge noted a few details that he believes point to the company’s position right now.

He confirmed that Jumio made $100 million in revenues last year; this is the first money the company has raised in nearly five years after bringing in a modest $16 million in 2016; and this looks to be the largest single round ever raised for a digital identity company.

However, given the market environment and the advances of tech, there has been quite a lot of momentum in the space, and a number of other digital identity and anti-money laundering (AML) prevention startups have been launching, growing and raising money — they include just in the last year ForgeRock ($96 million round), Onfido ($100 million), Payfone ($100 million), ComplyAdvantage ($50 million), Ripjar ($36.8 million) Truework ($30 million), Zeotap ($18 million), Persona ($17.5 million) — so I wouldn’t be surprised if this is not an outlier at the end of the day. Acquisitions like Equifax buying Kount earlier this year, meanwhile, point to encroaching competition from other areas like credit rating agencies.

Jumio is notable among this group for being one of the bigger and older players. Prigge said that currently has around 1,000 customers, including some of the very biggest enterprises like the banking group HSBC, United Airlines and the telecoms operator Singtel, and it is active in 200 countries.

It’s also notable for having developed a platform approach, where it offers a range of different kinds of tools. This is in contrast to many others, which — partly as newer entrants — are focusing on more specific technology or addressing a narrower aspect of what is a pretty complex problem. That said, the company’s earliest work seems to still be the mainstay of what it does. The number of documents that it can “read” to begin the process of verifying users now numbers about 3,500. That has propelled more than 300 million verifications made on Jumio’s platform.

“Almost all vendors verify you are who you say you are, not that it’s really you. That is why the biometrics is so important.

In our case we see it as a holistic onboarding,” Prigge said. “We are one of the only AML and KYC [know your customer] providers.” The AML tools came by way of an acquisition the company made last year, of Beam Solutions.

This funding round, nevertheless, is a big step up for a company that has, in fact, seen a lot of ups and downs.

To be very clear Prigge is very explicit when he says that the Jumio he runs has nothing to do with an older incarnation of the company.

Jumio the first came into existence around a decade ago and raised nearly $40 million in funding from investors like Andreessen Horowitz and Eduardo Saverin as an early player in mobile payments, with technology that could use the camera on a phone to scan cards and IDs to enable the payments. That business ran into a lot of hot water for mis-stating financial results and mostly likely other related things, and eventually it filed for bankruptcy in March 2016. Saverin apparently wanted to buy the business — if only to encourage other buyers to come out of the woodwork — eventually Centana did, at a bargain price of $850,000.

While that took a portion of the business (mainly branding, a business concept and some employees) out of bankruptcy, the legacy Jumio remained in a bankruptcy process is, almost exactly five years to the date, still ongoing, partly because the original founder is being accused of destroying documents needed to finally conclude that mess.

The fact that Great Hill Partners is doing the investing here is notable. It’s mostly a PE firm that has been doing an increasing amount of investing in tech companies, which is part of a bigger trend, where more PE firms are getting involved in rounds for later-stage startups.

“Jumio has an incredible foundation – an expert management team, deep product roadmap and a global reach that is positioning the company for significant growth as the volume of online transactions and interactions, and associated fraud, is reaching record-highs. In particular, we have deep conviction in the company’s AI-enabled identity verification solution Jumio Go and KYC orchestration platform,” said Nick Cayer, partner at Great Hill Partners, in an emailed interview. “Jumio will need to both keep pace with incredible demand for online identity verification services, and of course outlast new and evolving competition in the space. We have strong conviction that Jumio has the right management team, innovative product roadmap and group of supporting investors to maintain leadership in the space.”

According to the World Bank, more than one billion people in South and East Asia lack access to a bank account. For many, this makes it is difficult to secure loans and other services because they don’t have traditional financial records like a credit score. Jeff’s loan brokerage platform was created to make it easier for financial service providers to integrate alternative data scoring, allowing them reach more potential borrowers.

The startup, which launched its app in Vietnam last year, announced today it has raised $1 million, led by the Estonian Business Angels Network (EstBAN). The funding will be used to enter other Southeast Asian markets, including Indonesia and the Philippines, and introduce new products, like free credit score and insurance offers, digital discount coupons and mobile wallet cashbacks. Other participants in the round included Startup Wise Guys; Taavi Tamkivi, the founder of Salv who formerly held lead roles at TransferWise and Skype; and angel investors from European on-demand ride platform Bolt.

Jeff currently claims more than 300,000 users in Vietnam. Though it is based in Latvia, Jeff will continue focusing on unbanked people in South and Southeast Asia, said founder and chief executive officer Toms Niparts. Its goal is to build a “super app” that combines personalized loan comparisons with other services like e-commerce, mobile top-ups and online discounts, Niparts told TechCrunch in an email.

Before starting Jeff, Niparts was CEO of Spain for Digital Finance International, a fintech company that is part of the Finstar Financial Group, which has investments in more than 30 countries. This gave Niparts the chance to “learn about the similarities and differences of financial services from the inside in different markets,” he said.

In particular, he saw that in Southeast Asian countries, most loan applicants “were rejected not because of bad credit history, low income or other similar reasons, but because there was not enough data about them.” While some lending companies have developed pilot projects for alternative data scoring, the process is often time-consuming, complicated and expensive.

“This is a massive problem in a big part of the world, and it makes absolute sense to build it as a centralised solution,” Niparts said.

In Vietnam, Jeff currently has between 12 to 15 active partners at a time (the number changes because lenders occasionally turn off demand, a standard industry practice), and is adding another eight to 10. In total, the company now has about 80 to 100 potential partners in its Vietnam pipeline, and part of its new funding will be used to expand its team to speed up the onboarding process.

In Indonesia, Jeff has identified about 40 potential partners, “but so far we have only been scratching the surface,” said Niparts. “The Indonesian market is considerably larger than what we have seen in Vietnam, and the forecast is we will grow the pipeline to 150-200 banks and partners in 2021.”

The company’s selling point hinges on its ability to accurately measure creditworthiness based on alternative data. For lenders, this means more pre-qualified leads and access to a larger customer segment.

“Building a credit score is a never-ending process, and we are at the very early stages of it. What we have right now is mainly around publicly accessible information and client-consented data,” Niparts said. This includes behavioral analytics, smart devices meta data, data from social media and other sources that have open APIs.

As Jeff grows, it also plans to make partnerships with mobile wallets, telecom companies and consumer apps. It is developing a lender toolkit that includes bank portal and lender API to reduce the amount of time needed to integrate with the app.

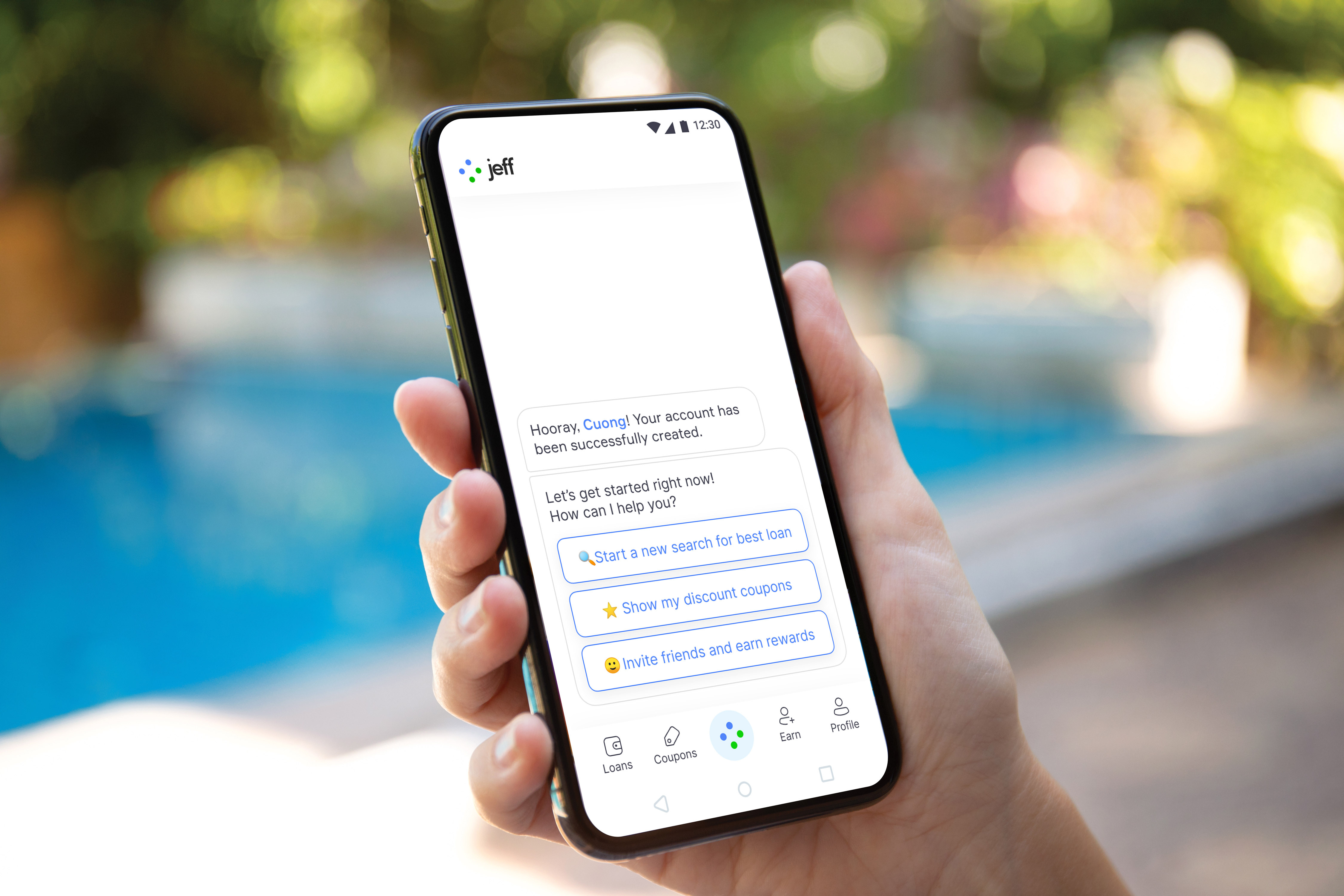

Borrowers sign up for Jeff with the app’s chatbot and can start getting offers once they enter basic information like their name, contact information, the amount they want to borrow and the purpose of the loan. But adding more details and data sources to their profiles, which are screened by multiple lenders at once, increases their chances of approval, and unlocks more offers. This may include uploading documents, connecting social media accounts or consenting to share their smart device metadata.

“As we evolve, new integrations and compatible accounts from other service providers—such as utilities, food delivery, and more—will be regularly added,” said Niparts.

Jeff’s partners currently offer near-prime, peer-to-peer and digital lending services that include unsecured consumer loans, installment loans and motorbike financing. It plans to add more loan products, and is also working on its first insurance collaborations, credit cards and other bank-grade products.

“Our ambition for Jeff is to become a super app, where people can not only get access to financial services that were previously unavailable to them, but also tap in other benefits and discounts,” Niparts said. “This is also a great way to learn more about creditworthiness and what’s on demand. Every new interactions gives us more data and insights to further evolve the accuracy and value added of Jeff’s credit score.”

The number of fintech startups focused on financial inclusion is on the rise across Southeast Asia. Jeff’s competitors fall into two main categories. The first are comparison portals like TopBank, TheBank and GoBear (which recently announced it is closing), that allow users to compare financial providers and banks, but don’t focus on enabling them to access services. The second are companies like CredoLab, Seon and Kalap that provide third-party services like single data-source insights and fraud prevention, but “do not have control over the customer journey,” Nipsart said.

Jeff’s goal is to “be a one-stop shop for both,” he added. “We provide both clients, as well as deeper insights about them for banks and other partners using our platform. At the same time, we are the main point of interaction for the users, which not only solves the main need of comparing financial services and accessing them, but also offers an increasing range of other discounts and benefits.”

While much of the recent wave of relentless hype around NFTs — or non-fungible tokens — has been most visibly manifested in high-dollar art auctions or digital trading cards sales, there’s also been a relentless string of chatter among bullish investors who see a future that ties the tokens to the future of social media and creator monetization.

Much of the most spirited conversations have centered on a pre-launch project called BitClout, a social crypto-exchange where users can buy and sell tokens based on people’s reputations. The app, which launches out of private beta tomorrow morning, has already courted plenty of controversy inside the crypto community, but it’s also amassed quite a war chest as investors pump tens of millions into its proprietary currency.

Early backers of the platform’s BitClout currency include a who’s who of Silicon Valley investors including Sequoia Capital and Andreessen Horowitz, the startup’s founder tells TechCrunch. Other investors include Chamath Palihapitiya’s Social Capital, Coinbase Ventures, Winklevoss Capital and Reddit co-founder Alexis Ohanian. A report in Decrypt notes that a single wallet connected to BitClout has received more than $165 million worth of Bitcoin deposits suggesting that huge sums have already poured into the network ahead of its public launch.

BitClout falls into an exploding category of crypto companies that are focusing on tokenized versions of social currency. Others working on building out these individual tokens include Roll and Rally, which aim to allow creators to directly monetize their internet presence and allow their fans to bet on them. Users who believe in a budding artist can invest in their social currency and could earn returns as the creator became more famous and their coins accrued more value.

“If you look at people’s existing relationships with social media companies, it’s this very adversarial thing where all the content they produce is not really theirs but it belongs to the corporation that doesn’t share the monetization with them,” BitClout’s founder, who refers to themselves pseudonymously as “diamondhands,” tells TechCrunch. (There’s been some speculation on their identity as a former founder in the cryptocurrency space, but in a call with TechCrunch, they would not confirm their identity.)

The BitClout platform revolves around the BitClout currency. At the moment users can deposit Bitcoin into the platform which is instantly converted to BitClout tokens and can then be spent on individual creators inside the network. When a creator gets more popular as more users buy their coin, it gets more expensive to buy denominations of their coin. Creators can also opt in to receive a certain percentage of transactions deposited into their own BitClout wallets so that they continue to benefit from their own success.

The company’s biggest point of controversy hinges on what has been opt-in and what has been opt-out for the early group of accounts on the platform. Most other social currency offerings are strictly opt-in. Users come to the platform in search of a way to create tokens that allow them to monetize a fanbase and build a social fabric across multiple platforms. The thought being that if the platforms own the audience then you are at their mercy.

BitClout has taken an aggressive growth strategy here, turning that model on its head. The startup has pre-populated the BitClout network with 15,000 accounts after scraping information from popular public Twitter profiles. This means that BitClout users can buy shares of Kim Kardashian’s social coin or Elon Musk’s without those individuals ever having signed up for a profile or agreeing to it. This hasn’t been well-received by all of those who unwittingly had accounts set up on their behalf including many crypto-savvy users who got scooped up in the initial wave of seeding.

The startup’s founder says that this effort was largely an effort to prevent handle squatting and user impersonation but he believes that as the platform opens, a sizable pre-purchase of creator coins reserved for the owners of these accounts will entice those users to verify their handles to claim the funds.

Perhaps BitClout’s most eyebrow raising quirk is that the platform is launching with a way to invest into the platform and convert bitcoin into BitClout, but at launch there’s no way to cash out funds. The project’s founder says that it’s only a matter of time before this is resolved, and points to Coinbase and the Winkelvoss twin’s status as coin holders as a sign of future exchange support to come, but the company has no specifics to share at launch.

While the founders and investors behind the project see a bright future for social currencies on the blockchain, many in the decentralized community have been less impressed with BitClout’s early efforts to achieve viral adoption among creators in a permission-less manner.

“BitClout will make a great case study on how badly crypto projects can mess up incentive engineering when they try to monetize social networks.” Jay Graber, a decentralized platform researcher involved in Twitter’s bluesky effort, said in a tweet. “Trust and reputation are key, and if you create a sketchy platform and mess with people’s reputations without their consent it is not going to go well.”

If BitClout comes out of the gate and manages to convert enough of its pre-seeded early adopter list that there is value in joining its closed ecosystem version of a social token then it may have strong early momentum in an explosive new space that many creators are finding valuable. The concepts explored by others in the social currency space are sound, but this particular execution of it is a high-risk one. The network launches tomorrow morning so we’ll see soon enough.

If the question is #bitclout the answer is yes.

— Jordan Belfort (@wolfofwallst) March 20, 2021

Starting May 1, apps in China can no longer force users into providing excessive personal data, according to a document jointly released by a group of the country’s top regulators, the Cyberspace Administration, the Ministry of Industry and Information Technology, the Ministry of Public Security and the State Administration for Market Regulation.

It’s a common practice in China where apps ask users to provide sensitive personal information and those who decline to share are often denied access. While some of the requests are justifiable, such as one’s location information to use a navigation map, many others are unnecessary, such as one’s biometrics to make mobile payments.

In December, Chinese authorities lay out the acceptable range of data that different apps are entitled to collect, as TechCrunch reported.

All forms of apps are subject to the requirements, including the increasingly popular “mini programs,” which are lite apps accessed through an all-encompassing native app such as WeChat and Alipay without the need for an app store install, said the new document.

For now, the document appears to be a guideline at best as it does not specify how the rules should be enforced and how offenders will be punished. While it marks China’s incremental progress on data protection, regulators will have to keep updating the rules as people’s daily lives are becoming more linked to digital devices at a rapid rate.

In recent months, China has been clamping down on the technological darlings that it used to pride itself on. It introduced a sweeping antitrust law to rein in its “platform economy” and slammed anti-competition fines on Alibaba and Tencent, following Ant Group’s IPO fiasco.

Nearly five years after the launch of Pokémon Go, Niantic announced Monday that they are partnering with Nintendo to co-develop a new title based on the company’s Pikmin franchise.

Niantic says the app is being developed in their Tokyo office and will launch later this year.

“The app will include gameplay activities to encourage walking and make walking more delightful,” a press release from Niantic reads. The company notably specifies that the title will make use of their augmented reality platform to integrate the real world into the app’s experiences.

Pokémon Go has fallen out of headlines but has continued to deliver massive sums to the San Francisco gaming company, eclipsing $1 billion in revenue in 2020. In recent years, Nintendo has sought to build out their presence on mobile gaming platforms with a number of titles playing on some of their biggest franchises, but none of them have reached Pokémon Go’s level of success.

Niantic has raised nearly $500 million in capital, most recently raising at a $4 billion valuation.

1/2 We are thrilled to announce a new partnership with Nintendo to develop mobile titles built on @NianticLabs real-world AR platform, bringing Nintendo’s beloved characters to life in new ways. We’re delighted to be their exclusive partner for AR apps. https://t.co/Tzz8npCANj pic.twitter.com/R2AvE00nuN

— Megan Quinn (@msquinn) March 23, 2021