& meet dozens of singles today!

User blogs

Neighbor, which operates a self-storage marketplace, announced Wednesday that it has raised $53 million in a Series B round of funding.

Fifth Wall led the financing, which notably also included participation from returning backer Andreessen Horowitz (a16z) and new investors DoorDash CEO Tony Xu and StockX CEO Scott Cutler. Xu and Cutler will join former Uber CEO Ryan Graves as investors and advisors to the Lehi, Utah-based startup. A16z led Neighbor’s $10 million Series A in January of 2020.

At a time when the commercial real estate world is struggling, self-storage is an asset class that continues to perform extremely well. Neighbor’s unique model aims to repurpose under-utilized or vacant space — whether it be a person’s basement or the empty floor of an office building — and turn it into storage.

Colton Gardner, Joseph Woodbury and Preston Alder co-founded Neighbor.com in 2017 with the mission of giving people a more accessible and personal alternative to store their belongings.

Image Credits: Neighbor

The $40 billion self-storage industry is ripe for a shake-up, considering that most people are used to renting space out of buildings located in not necessarily convenient locations.

Neighbor has developed a unique peer-to-peer model, connecting “renters” in need of storage space with “hosts” in their neighborhood who are willing to lease storage space in their home, garage or even driveway. The company says it has hosts on the platform making more than $50,000 a year in passive income.

“We really grew into a national business over the last year and now have active renters in more states than Public Storage, which is a $43 billion publicly traded company,” CEO Woodbury said.

Neighbor makes money by charging a service fee (a sliding-scale percentage) of each rent. Its algorithms provide suggested rental fees for hosts.

COVID has only accelerated Neighbor’s business, with revenue growing “5x” and organic reservations increasing “7x” year over year.

“If you think about it, fundamentally on the demand side, everyone’s moving out of these major metro areas like New York and San Francisco, and are moving to these more rural locations. All that moving activity has created a lot more storage demand,” Woodbury told TechCrunch. “In addition to that, people are just spending more time at home and cleaning out their homes more. And they no doubt need storage as a result of that.”

It also doesn’t hurt that the company claims the self-storage offered on its marketplace on average is priced about 40% to 50% less than traditional storage facilities.

Neighbor also partners with commercial real estate operators to turn their under-utilized or vacant retail, multifamily or office space into self-storage. This provides new revenue streams to landlords hurting from the pandemic keeping so many people at home. And that increased demand led to Neighbor’s commercial real estate footprint growing 10x in 2020.

With its new capital, the company plans to expand its nationwide network of hosts and renters as well as continue to spread awareness of its marketplace.

“We have tens of millions of square feet of self storage on the platform,” Woodbury said. “The beauty of that square footage is that it’s in every single state. But we want to continue to expand nationally and as we grow and mature, we’ll turn our eyes globally as well.”

Interestingly, before leading the round for Neighbor, Fifth Wall approached the company about business development opportunities. Partner Dan Wenhold said he offered to introduce the concept to the real estate venture firm’s LPs, which include more than 65 of the world’s largest owners and operators of real estate from 15 countries. For example, Fifth Wall partners Acadia Realty Trust and Jamestown are already onboarding properties onto Neighbor’s platform.

“We are sort of the bridge between the largest owners and operators of physical real estate assets and the most disruptive technologies that are impacting those property managers and landlords, Wenhold said. “And Neighbor fits perfectly into that thesis for us.”

After introducing Neighbor to a short list of Fifth Wall’s strategic LP partners, the feedback the firm got “was fantastic,” Wenhold said.

“A lot of owners in retail, office and even multi-family expressed interest in working with Neighbor to help monetize space,” he added.

The company’s mission also has a sustainable component considering that creating self-storage space out of existing property can help minimize the amount of new construction that takes place.

Fifth Wall, Wenhold added, is aware of the waste and the emissions that come from the construction process to build new space and admires Neighbor’s role in minimizing that.

“Our firm ardently pursued the opportunity to invest in a transformative proptech business like Neighbor,” he said.

Nigeria remains a largely cash-dominated country. There are over 100 million adult Nigerians, of which more than half have little or no access to financial services.

Today, Bankly, a Nigerian fintech startup digitizing cash for the unbanked, announced that it has closed a $2 million seed round. Founded by Tomilola Adejana and Fredrick Adams in 2018, Bankly is digitizing the informal thrift collections system known with different names such as esusu or ajo in Nigeria.

In the absence of a banking system nearby or a disregard for one, the unbanked resort to these traditional systems because they work completely offline. The system allows them to collate and save cash with a thrift collector responsible for disbursing funds when due.

However, there are issues around this system. First is the security issues that arise when the thrift collector goes missing with the money or is feared dead, leaving no clue where the savings are kept. There’s also limited access where members cannot consistently save if absent from a particular location. The third is the lack of customer data since most don’t have an online banking presence.

What Bankly has done is to digitize their whole process of collating money and allow these unbanked people to save using online and offline methods.

Over the past 18 months, the company has been building out its distribution and agent networks. Here, customers can deposit and withdraw cash with a Bankly agent anytime. This solves the issue of access as there are thousands of agents in these cash-dependent communities.

When the information of this new set of customers is collected and saved on its platform, Bankly starts to build engaging communities where these people can collectively save their income with the agents. Slowly, an online banking presence is built for them.

With most of their money in a bank and little or no cash to buy airtime or make payments, they would frequently opt to access these services online via their mobile phones.

Image Credits: Bankly

Onboarding these new set of customers means they get to save and transact more over time. This opens up access to credit and with more value created, there’s a new set of banked people, which leads to financial inclusion in the long run.

“The first phase is building agent networks which is good but that’s not the goal,” CEO Adejana said to TechCrunch. “Just in the same way mobile inclusion happened, you need to then focus on acquiring customers who, after transferring cash to their mobile accounts, use it to buy airtime or make payments. We call that the three-phase process. The distribution first, then focusing on the consumer, after that full digitization. This is how we reach financial inclusion.”

With its insights into customer behaviour and transactions, Bankly also provides “data-as-a-service” to other service providers to offer tailored products and services to Nigeria’s informal sector.

Bankly operates like a traditional bank but with fewer assets, revenue, customers and operational costs. But because it doesn’t spend a lot in acquiring customers and building physical presences, it can pass on those cost savings to customers as interests and still make decent margins.

Agents on the platform also take commissions for any transaction a customer makes through them. This time last year, the company had a little over 2,000 agents across the country. Now, that number has grown to 15,000.

The company still plans to add more agents with the new investment received. To increase its 35,000 customer base in cash-dependent communities, Bankly will also provide direct-to-consumer products in the coming months.

L-R: Fredrick Adams (CPO) and Tomilola Adejana (CEO)

In Bankly’s three years of operation, Adejana cites finding the right partners, talent, and most importantly, the right investors as challenges that the company has faced. Due to the nature of Bankly’s business, Adejana didn’t accept some of the investments offered to the company and only let in investors who aligned with the company’s plans for the unbanked.

“We’ve had to be patient to make sure that we were talking to people who deeply understand the problem and are passionate about solving it and are not about getting returns as soon as possible,” she said.

These investors include co-leads Vault, the holding company of VANSO, a fintech that was sold to Interswitch in 2016; and African payments company Flutterwave. While both companies have pioneered the technology the banked enjoy by building payment rails, they’ve done little to move the needle for the unbanked. With Bankly, there’s a chance to do so.

“Given our over twenty years experience in Nigeria’s fintech industry and previous exits, we strongly believe that Bankly understands the nuanced needs of this market — not to mention the team, strategy, and technology — to succeed in bringing affordable financial services to the unbanked. We are delighted to participate in this financing round as Bankly moves into its next growth stage,” Idris Alubankudi Saliu, partner at Vault said.

For Flutterwave, this marks its first disclosed investment into another company. When it raised a $170 million Series C last month, CEO Olugbenga Agboola mentioned to TechCrunch that Flutterwave might explore some partnerships with smaller companies and potential acquisitions in the coming years. So while the investment comes as a surprise, it’s not rare to see startups invest in other startups, particularly in the ones they hope to acquire in the future—case in point, Stripe and Paystack.

Other investors who took part in the round include Plug and Play Ventures, Rising Tide Africa and Chrysalis Capital.

Bankly aims to grow its customer base to 2 million unbanked Nigerians over the next three years. The goal is to support the Central Bank of Nigeria’s National Financial Inclusion Strategy of increasing the number of banked Nigerians from 60% to 80% by 2020. A year on, that strategy is yet to be actualized. But Adejana says Bankly is working with these regulators towards a more realistic target of 2025.

“We’re thrilled to have closed this milestone fundraise and to have such seasoned fintech investors who understand the market join us on this journey to bank Nigeria’s unbanked. Now we have built the agent network and are poised to serve customers directly via offline and online channels. Partnerships, collaboration, and a deep understanding of the needs of the unbanked will be vital to our success,” said Adejana.

Before Bankly, the CEO was an investment banker but it was during her masters’ program in Sydney she got into the world of fintech. After returning to Nigeria, Adejana worked on a product that offered loans to small businesses, then later joined Accion Venture Lab, a program focused on products that foster financial inclusivity. It was there Bankly started.

The product has caught on well. And while there are lots of fintech products in the Nigerian market pitching to reach the unbanked, Bankly remains one of the very few that can boldly stake a claim to that.

To truly attain financial inclusion in Nigeria, Adejana believes the onus lies with the fintechs to have long-term views just as the telcos and fast-moving customer goods did in the past. This increases the pie of customers fintechs can serve instead of taking a slice of an existing one. “For financial services to reach the last mile, it has to be distributed the same way fast-moving consumer goods are distributed,” she added.

Indonesian social commerce app KitaBeli’s team, including founders Prateek Chaturvedi (seated, left front row and Ivana Medea Tjandra (center front row)

KitaBeli, an Indonesian social commerce app for group buying, announced today it has raised a $10 million Series A. The round was led by Gojek’s investment arm Go Ventures, with participation from returning investors AC Ventures and East Ventures. KitaBeli currently focuses on selling fresh produce and fast-moving consumer goods (FMCG) in areas outside of Indonesia’s major cities, including to people who have never shopped online before.

Launched in March 2020 in Jarkata, KitaBeli then entered the cities of Solo and Malang. Its new funding will be used to expand KitaBeli’s operations in Java, growing its logistics network and developing its mobile app. KitaBeli claims it has grown 80% month over month since launch, with a cost-per-install rate of just 10 cents USD per customers.

Unlike other social e-commerce apps, including ChiliBeli and Woobiz in Indonesia, that build networks of resellers or agents who market items through their social media profiles and take a cut of sales, KitaBeli’s buyers place orders directly through its app, participating in group deals for lower prices. For farmers and suppliers, KitaBeli’s value comes from the ability to reach new customers in more areas of Indonesia. It says users spend an average of USD $70 per month on the app and plans to add new categories like beauty, fashion and accessories.

Co-founder and chief executive officer Prateek Chaturvedi said KitaBeli focuses on direct relationships with end customers because “this enables greater customer loyalty and the ability to become the go-to e-commerce platform for new online shoppers. We don’t run the risk of losing our customers if an agent decides to stop working with us.”

While it doesn’t have a reseller network, KitaBeli works with delivery partners for last-mile deliveries, presenting the gig as an opportunity to earn extra money. It plans to continue building its delivery network across Indonesia to help KitaBeli solve the challenges of reaching smaller cities and more rural areas.

An obvious comparison to KitaBeli is Pinduoduo, the fast-growing Chinese e-commerce player that launched in 2015 as a group-buying service for fresh produce, and also focuses on growth in smaller cities.

On the other hand, “tier 2-4 cities in Indonesia still lack the digital and logistical infrastructure that similar cities in China have,” Chaturvedi said. “Indonesian customers are also new to the internet and need to be educated on how e-commerce works.” KitaBeli’s app is designed to be approachable for first-time e-commerce shoppers, and only takes 6MB to download, making it more accessible to people who have older smartphone models or slower internet connections.

KitaBeli will continue focusing on Indonesia instead of expanding into other Southeast Asia countries because “the Indonesian market is a massive and underpenetrated market,” he added.

In a press statement, Go Ventures’ senior vice president of investments Aditya Kumar said, “E-commerce penetration beyond the large metros has remained low, predominantly because of lack of trust, poor product availability, and high logistics costs. Kitabeli is well positioned to address these challenges through the social nature of its product, accelerating online shopping for a new generation of users and bringing the benefits of e-commerce to a wider population across Indonesia.”

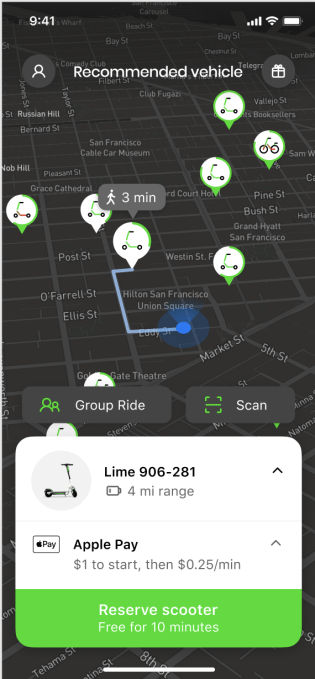

Lime is rolling out several new features, including the ability to rent electric scooters without downloading the app, in an effort to attract more riders.

The micromobility company announced Wednesday a series of product features that aims to remove barriers to entry for new users, while increasing accessibility to its vehicles. The new features include free vehicle reservations up to 10 minutes, closest vehicle recommendations and the option to view the app in dark mode.

The app-less experience is already live in more than half of Lime’s 130 markets, where developers have been monitoring and analyzing its usage. This feature is only available on e-scooters. The free vehicle reservations and recommendations features can be used when renting Lime’s e-scooters and e-bikes — and across every market and language, according to Lime developers.

“We use rider feedback to build out the app or any features associated with it,” senior product manager Vijay Murali told TechCrunch. App store reviews, customer service tickets complaining about a feature or a lack of it, customer surveys and research sessions with riders from around the world all inform the direction developers take with new features. In the case of these latest updates, Murali said the team identified three goals their customers were trying to accomplish.

“The first is that many users are ready to try this new form of transport, but they don’t want to download the app and make the commitment,” said Murali. “The second is a price concern for those who ride with us frequently, and the third is about making it easier, especially in a big city, to find the closest vehicle to you.”

Image Credits: Lime

Now when a customer open the apps, they’ll be directed towards the nearest vehicle and offered the option of reserving it for free, which Murali said streamlines the process of just jumping on a scooter and helps make riding a daily habit.

The app-less riding feature is geared towards those who are new to micromobility, might not have any space on their phones to download the app or are on an expensive international data plan.

To use the feature, customers need to scanning a QR code with their camera app which connects to Apple’s App Clips or Android’s Instant App features. Customers can then confirm the ride and use Apple Pay or Google Pay to start riding. Technically, users are actually downloading a sliver of the app — only 10 megabytes versus 100 megabytes for the full app, and only for eight hours. To the average rider, it just appears as if they’re opening a file or app on their phone, which is a lot quicker than downloading the app, creating an account, adding a payment method and reading a tutorial, which takes about five minutes rather than 30 seconds.

This feature will result in less Lime app downloads, and thus less user data. But Lime says it is more interested in hard sales at the moment.

“We also see a relatively high download conversion rate,” said another senior product manager, Zach Kahn. “The reduction in friction and needing to choose a payment method or vehicle drastically increases that conversion and makes up a meaningful percentage of our first trips now.”

Kahn declined to provide conversion rates for those who were introduced to Lime via app-less rides. Murali also noted that more riders in test cities began reserving vehicles when Lime removed the cost. Previously, adoption was low at around 3%.

“It’s all about ensuring people from different segments of society, in particular underserved areas, have less friction to access Lime vehicles,” said Murali. “In an underserved community, how much a scooter costs to ride is top of mind, so removing these unnecessary reservation fees makes them more likely to ride now.”

Lime, which is backed by Uber and Alphabet, is one of the companies in the running for the coveted New York City pilot e-scooter program in the Bronx, a borough with many low-income communities and transit deserts. Each company has its own unique selling points. Superpedestrian, for example, chooses to err on the side of first-class safety features and geofencing compliance. But Murali says Lime’s leg up comes in its sheer size and ability to quickly execute new features.

“We don’t just say we put riders first, but we figure out exactly how to do it, and then we make those features and improvements in the app happen,” said Murali. “That’s what differentiates us; how much meaningful progress we are making, at what scale and how fast. We have this new tech in the form of App Clips, for example, and we tested it fast, brought a product to market and now we’re rolling it out in every market we can.”

In a statement, Lime claims to be the first micromobility company to introduce app-less riding, however Apple appears to have demoed App Clips by renting a scooter from Spin, which also responded to New York’s RFP. A spokesperson from Spin said the company is working with Apple to bring the App Clip experience to its e-scooters in the future.

Public App, a location-based social network that connects individuals to people in their vicinity, has raised $41 million in a new round, just six months after securing $35 million as the hyper-local Indian startup looks to expand its presence in the world’s second largest internet market.

A91 Partners led the new round in Public App, valuing the Indian startup at over $250 million. The Indian startup, which also operates popular news aggregator app InShorts, said some of its existing investors also participated in the round but did not identify them. Public App counts Lee Fixel’s Addition, SIG, and Tanglin Venture Partners among its investors. (The startup didn’t specify the name of the new round.)

Azhar Iqubal, founder and chief executive of Public App, said the new social network has amassed over 50 million users already and he aims to expand it outside the country eventually. The app, launched in April 2019, has already attracted individuals such as politicians and several major firms such as Amazon, HDFC Bank, and GSK that are using Public App to reach their audience.

“Public has continued to maintain best in class retention and engagement metrics while scaling. We look forward to working closely with the founders to help build an outstanding company,” said Gautam Mago, General Partner at A91 Partners, in a statement.

Public App, which is available in several major Indian languages (including Hindi, Bengali, Punjabi, Telugu, Tamil, Kannada, Malayalam, Odia, Assamese, Gujarati and Marathi), allows shop owners and other local businesses to drive e-commerce and hire local talent, and political leaders, government authorities, and media houses to reach local audiences.

“The app is already being used by over 50,000 elected officials, government authorities and citizen journalists to connect with their locality. Additionally, many local businesses have also started to use the app to reach their customers in the locality,” the startup said.

The app, which also provides entertainment and news services, sees more than 1 million videos being created on the platform each month.

The startup plans to deploy the new capital to expand its tech infrastructure, broaden its content offerings, and hire more talent.

Once thought of a crowded space, several Indian startups have launched their social networks in recent years. Kutumb, an eight-month-old startup, is in talks with Tiger Global to raise funds in a round that values it about $170 million, TechCrunch reported earlier this month.