& meet dozens of singles today!

User blogs

While the governments of the United States and China are pushing policies for technological decoupling, private tech firms continue to tap resources from both sides. In the field of autonomous vehicles, it’s common to see Chinese startups — or startups with a strong Chinese link — keep operations and seek investments in both countries.

But as these companies mature and expand globally, their ties to China also come under increasing scrutiny.

When TuSimple, a self-driving truck company headquartered in San Diego, filed for an initial public offering on Nasdaq this week, its prospectus flagged a regulatory risk due to its Chinese funding source.

On March 1, the Committee on Foreign Investment in the United States (CFIUS) requested a written notice from TuSimple regarding an investment by Sun Dream, an affiliate of Sina Corporation, which runs China’s biggest microblogging platform Sina Weibo. Sun Dream is TuSimple’s largest shareholder with 20% Class A shares. Charles Chao and Bonnie Yi Zhang, respectively the CEO and CFO of Weibo, are both members of TuSimple’s board.

If the U.S. government concludes that Sun Dream’s investment poses a threat to the national security of the country, the investor may be told to divest from TuSimple, the filing notes.

Several China-based autonomous driving upstarts, including WeRide.ai, Pony.ai and AutoX, keep research labs in California and have secured regulatory permits to test in the U.S., but most don’t seem to have apparent commercial plans in the country.

TuSimple, on the other hand, is focused on the U.S. for now, with 50 of its Level 4 semi-trucks hauling in the U.S. and 20 operating in China.

“Their strong Chinese background could hobble their U.S.-focused strategy,” an executive from a Chinese autonomous vehicle startup told TechCrunch, asking not to be named.

TuSimple cannot comment because it’s in the pre-IPO quiet period.

This kind of roadblock is hardly new to China-related tech firms coveting the U.S. market (or its allies). In a more famous instance, CFIUS opened a national security probe into ByteDance’s $1 billion acquisition of Musical.ly, which was folded into TikTok. As of last December, the agency was “engaging with ByteDance” to complete a divestment, Reuters reported.

While self-driving ventures can divest to shed their Chinese association, it may be more complicated to achieve short-term supply chain independence in an industry with tight global ties, as an executive from Momenta pointed out.

UI-licious’ co-founders, chief technology officer Eugene Cheah (left) and chief executive officer Shi Ling Tai (right)

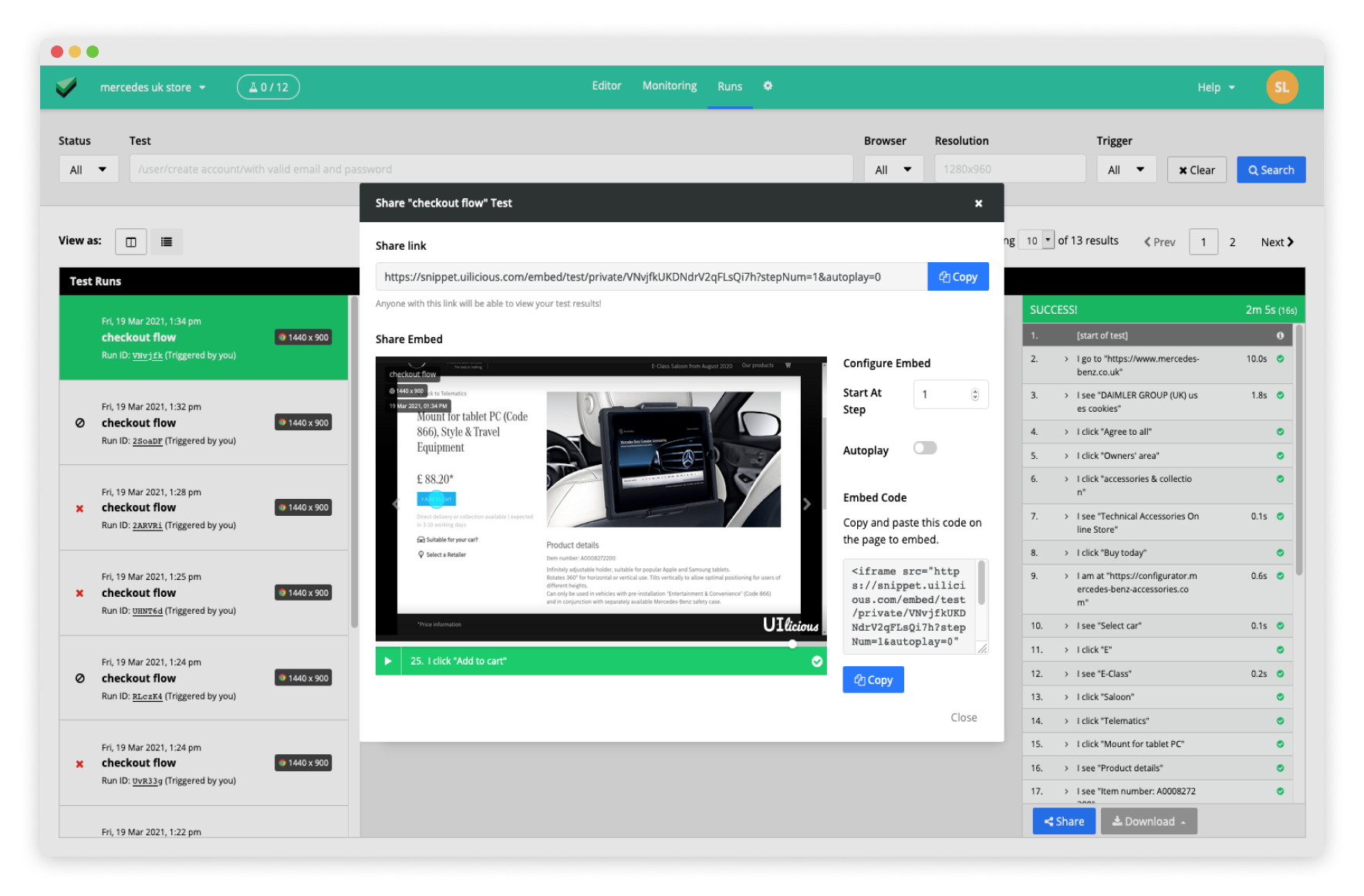

UI-licious, a Singapore-based startup that simplifies automated user interface testing for web applications, announced today it has raised $1.5 million in pre-Series A funding. The round was led by Monk’s Hill Ventures and will be used to grow UI-licious’ product development and marketing teams.

Founded in 2016 by Shi Ling Tai and Eugene Cheah, UI-licious serves companies of all sizes, and its current clients include Daimler, Jones Lang LaSalle and tech recruitment platform Glints.

Tai, UI-licious’ chief executive officer, said that about 90% of software teams around the world rely on manual testing, which is both time-consuming and expensive. UI-licious enables users to write test scripts in pseudocode, or a language that is similar to plain English and therefore accessible to people with little programming experience.

Software teams can then schedule how often the tests run. UI-licious’ proprietary smart targeting test engine supports all browsers and allows the same scripts to be run even if there are changes in a web application’s user interface or underlying code. It also produces detailed error reports to reduce the time needed to find and fix a bug.

When asked how UI-licious compares to other automated user interface testing solutions, Tai told TechCrunch, “Coded solutions require a trained engineer to inspect the website’s code to write the test scripts. The problem is that most software testers are not trained programmers, sometimes they may be the marketing or sales team that owns the project. And while there are other no-code solutions that allow non-programmers to record their actions and replay it, such tests tend to become obsolete quickly as the UI changes.”

UI-licious’ selling point is that “it is designed to make it accessible for anyone to automate UI testing and set up error alerts without needing to know how to code,” she added. “UI-licious also reduces the effort to maintain the tests as the UI code changes with its smart targeting test engine.”

In press statement, Monk’s Hill Ventures partner Justin Nguyen said, “Co-founders Shi Ling and Eugene have developed a product to address the quality assurance issues that have plagued the software automation industry for decades,” adding that “the team’s experience as software engineers has equipped them with the technical knowledge and insights to build a simple and robust tool that empowers manual testers to automate testing and detect bugs before users do.”

The other day, I attended a celebration of one of the pioneers of collaboration technology, Ray Ozzie. The father of Lotus Notes, Ozzie left Lotus and his startup firm Iris after a hostile takeover by IBM, and eventually joined Microsoft when that company acquired his next startup, Groove. By “attended” I mean a virtual event put on by the Computer History Museum in Silicon Valley. Ray’s peers and partners gathered in a Zoom chat, with a tour of Ray’s early days including amazing hardware like a touchscreen based enterprise chat system called Plato, and these strange things called floppy disks with the earliest source code for DOS and other prehistoric things called operating systems.

At Microsoft, Ray soon became one of several CTOs, and eventually took the role of Chief Software Architect as he helped midwife the company’s move toward the Web and away from its dominant Office suite. Politically, he faced the twin power centers in Redmond: Office and Windows, the latter of which has receded in strategic importance as mobile technologies like iOS and Android took over in the wake of Apple’s iPhone success. But there’s no doubt that Ray’s elevation allowed Bill Gates, who spoke movingly about Ray at the CHM, to pivot to focus with his wife on the philanthropy role at their Foundation. Talk about just in time, as Bill’s voice in the battle against the pandemic has often been a trusted beacon of hope and science in a sea of denial, misinformation, and well, you know the rest.

In his gracious speech, Ray mentioned Gates, Lotus founder Mitch Kapor, and a name less well known to many, Dave Winer. I’m not positive why Dave was called out, but I’m sure it had something to do with Winer’s work championing the development of blogging, RSS, and its attachment extensions that birthed podcasting. In today’s climate of media streaming, newsletters, and live conversation-casting a la Clubhouse, surviving the pandemic means marshaling our tools to work and live more deeply and richly from anywhere. Talk about just in time.

Clubhouse is under attack in the Twitterverse, with some suggesting it’s just another outlet for the noise of social media, or a business idea destined for landfill in the wake of the next shiny object. Clubhouse counterattacked with another overflow megasession from Facebook’s Zuckerberg and the CEOs of Spotify and Shopify. The messaging app Telegram pushed a voice chat 2.0 release with tools for inviting speakers, listeners, raising your hand to speak, and recording built in. The stampede continues, but to what end? Like NFTs, a grifters’ paradise?

Perhaps we’re experiencing a massive multiplayer game where collaborative innovations are being combined and redefined on the fly. One Clubhouse session materialized with one of the big thinkers in mobile, Benedict Evans. After several years as an analyst at Andreessen Horowitz (A16Z) , he’s moved back to London and gone paid newsletter with some of his 150,000 plus subscribers to his weekly free version. Struggling as I am with rising subscription costs, I’ve been making do with waiting for some of his firewalled essays to play off in the free version. But here was a session with Benedict and another former A16Z analyst focused on NFTs and crypto, Morgan Beller.

The talk was at a torrid clip, but meta across both the upside possibilities and the context of earlier innovations that seemed heavy on the gamble but paid off. This was vintage Evans in a casual setting where he gave me a ton of signal, bouncing off an analyst I immediately followed after ten minutes or so, adding her to a notification stream the next time she joined in. At one point, the moderator pinged me to invite me to join in, but thankfully I chose the “maybe later” option so I could go back to desperately trying to keep up with the flow. Maybe later when I actually know something by learning from people who live and breathe this stuff. I can’t even be sure what fungible means so far.

It was not your average big ticket press conference; it was access to people steeped in their interests and willing to be measured against the astuteness of their observations. The social following tools ostensibly produce more effective notifications based on providing interruptions the listener is willing to accept. The size of the crowd is manageable (50 -100) and drafts off the characteristics of not just who is on stage but who’s listening and in what combinations. It’s a mixture (I hope) of follows plus percentage of successful clicks on targeted notifications.

This all feels like a mashup of collaborative platforms, menu items in a new operating system where ideas and tactics are tested transparently in the open. Remember our former president, who famously laundered the unthinkable in public as a way of commanding the conversation. The alphabet soup of NFTs and SPACs is difficult to separate from MLMs and such of previous eras, but eventually we’ll figure out what’s real. A good place to start is in the trenches with practitioners of this new arts yakking it up on the new media channels.

from the Gillmor Gang Newsletter

__________________

The Gillmor Gang — Frank Radice, Michael Markman, Keith Teare, Denis Pombriant, Brent Leary and Steve Gillmor. Recorded live Friday, March 19, 2021.

Produced and directed by Tina Chase Gillmor @tinagillmor

@fradice, @mickeleh, @denispombriant, @kteare, @brentleary, @stevegillmor, @gillmorgang

Subscribe to the new Gillmor Gang Newsletter and join the backchannel here on Telegram.

The Gillmor Gang on Facebook … and here’s our sister show G3 on Facebook.

H&M has been removed by major e-commerce and service apps in China after a Communist Party organization barraged it for a statement expressing “deep concern” over allegations of forced labor in Xinjiang’s cotton industry.

On Thursday morning, a search for “H&M” yielded zero results on e-commerce platforms including Alibaba’s Taobao, JD.com and Pinduoduo, Meituan’s shop-listing app Dianping, map apps from Tencent and Baidu, among other major online platforms in China.

A search for “H&M” returned zero results on Alibaba’s Taobao marketplace.

The Swedish clothing giant appears to have pulled its statement which was originally published on its website last year.

On Wednesday, the Communist Youth League, a youth division of the party known for savvy online campaigns, accused H&M of spreading rumors about the rights situation in Xinjiang on the microblogging platform Weibo.

The social media post stirred widespread outrage on the Chinese internet and has been liked 383,000 times within a day.

The Chinese government says it operates “vocational educational training centers” in Xinjiang, the far-west province home to the largely Muslim Uyghur ethnic minority group, as part of its counter-terrorism efforts.

This is a developing story.

When it comes to Steady, the platform that helps hourly workers manage their income, maximize their income, and access deals on things like benefits and financial services, the strengths of the business are clear. But it took time for founder and CEO Adam Roseman to clearly define and communicate each of them in his quest for fundraising.

To date, Steady has raised just under $30 million with investors that include Loeb.nyc, Recruit Strategic Partners, Propel Ventures and Flourish Ventures. In fact, Flourish’s Emmalyn Shaw sits on the board, having led the company’s Series A round in 2018.

As a partner at a $500 million fintech fund, her expertise in not only how fintech companies should think about fundraising but what it takes for them to be successful is invaluable. Lucky for us, we got the chance to sit down with both Steady CEO Adam Roseman and Emmalyn Shaw for a recent episode of Extra Crunch Live.

The duo were gracious enough to walk us through Steady’s Series A deck, explaining the importance of highlighting the strengths of the business. They went into detail on how Steady was successful in that during that fundraising process, and what the company could have done differently to be more effectively.

Shaw and Roseman also gave some fantastic advice for founders during the Pitch Deck Teardown, wherein speakers give their expert feedback on decks submitted by the audience. (If you’d like to have your pitch deck featured on an episode of Extra Crunch Live, hit up this link.)

Relationships first

Roseman shared that the best investors are ones that not only understand the business but understand you as a founder and a person. He explained that he and Shaw had plenty of time to get to know each other before the Series A deal.

“I’ve been a part of businesses in the past as an entrepreneur and on boards where it’s been the worst situation, especially when they don’t understand your business,” said Roseman. “Flourish took the time to understand it through and through and was entirely aligned. That makes for the best long-term partnership.”

While it’s a cliche, it remains true that investors often place bets based on a team and not an idea or a product. But what exactly makes a great team or founder? According to Shaw, it’s about vision and passion.

“In Adam’s case, he has a direction connection to what Steady is trying to do,” said Shaw. “That makes a huge difference in terms of commitment because you have ups and downs. They bring experience in terms of understanding the space, how to penetrate and scale and a deep understanding of fintech.”