& meet dozens of singles today!

User blogs

Benitago Group, a startup looking to build a big portfolio of Amazon brands, is announcing that it has raised $55 million in new funding — most of it in the form of credit lines to fund acquisitions, plus an equity investment.

“We want to take these brands and growth them and run them a lot more efficiently,” said co-founder Santiago Nestares.

Other startups have also raised big rounds to roll up Amazon FBA (Fulfillment by Amazon) businesses, but Nestares told me that Benitago is different because it’s not just focused on “financial arbitrage.” Instead, it has created a detailed, repeatable blueprint to continue growing these business.

Nestares and his co-founder Benedict Dohmen (they each gave the company a few syllables for its name) started Benitago while students at Dartmouth, with the back pain brand Supportiback. The company has subsequently expanded into categories like beauty, maternity and nutrition, but Nestares said they funded that growth with revenue, without raising much outside capital before now.

As a result, team members may not have been experts in, say, orthopedics, but they’ve succeeded because they’re “hyper-focused” on how brands can grow on Amazon, becoming what Nestares described as “Amazon natives.”

The process usually starts with a comprehensive look at the competitive landscape and what customers are saying in their reviews. Then, Nestares said, “We design everything around Amazon, from the feature selection to the way we create the colors in the packaging [to] the way the product fits in an Amazon box.”

The company said that when it acquires brands, the process only takes a few weeks, and that the previous owners retain a financial stake in the brand’s continued growth.

“This isn’t a passive financial play, it’s an an impact growth play,” Nestares added.

Amazon is unlikely to lose its e-commerce dominance anytime soon, but Nestares acknowledged that building Benitago’s business on a single platform is its “biggest risk.” At the same time, he suggested that the risks aren’t the same as, say, those faced by companies who are threatened any time Google changes its search algorithm.

“I think Amazon is different, because Amazon has the same goal as you: To sell to the customer as much as they can,” he said.

Benitago currently operates five brands with more than 100 total products. With the new funding, that number could increase dramatically — Nestares said there are 12 new brands in development, while he’s also hoping to acquire another 25 or more brands by the end of the year.

CoVenture led the equity funding and provided one of the credit lines.

China’s largest question and answer platform Zhihu began trading in New York at $9.5 per share at the lower end of its IPO range, valuing the company at about $5.3 billion.

The aggregate offering size of Zhihu’s IPO and the concurrent private placements is $772.5 million, assuming the underwriters do not exercise their option to purchase additional ADSs. With Zhihu’s sizable flotation, some Silicon Valley executives and investors may start to pay more attention to this ten-year-old company from China that was once simply regarded as the “Quora of China.”

Q&A remains at the core of Zhihu, which means “do you know” in classical Chinese, but the service has become much more than the American counterpart that was founded two years before it.

“I think Quora is a good product, but I think Quora today still equals Quora ten years ago,” said Kai-Fu Lee, whose investment firm Sinovation Ventures is a seed investor in Zhihu and is the company’s largest outside shareholder with a 13% stake.

“Zhihu has already grown up and is on the path to becoming a multifaceted super app centered around knowledge, while Quora is still a question and answer website with an app,” added Lee, an AI expert and an avid Zhihu contributor himself.

Asides from facilitating Q&As, Zhihu has also dabbled in premium content, live videos, e-commerce, online education, among other forms that it believes are ripe for sharing knowledge.

Today, Zhihu generates about 70-80% of its revenues from advertising, according to its prospectus, though other businesses like membership and e-commerce are growing financial contributors, a sign that it’s working to diversify monetization streams.

The willingness of Chinese startups to “reinvent themselves and cannibalize their own success” is what differentiates them from American companies, Lee observed.

“Because they know if they don’t do that, their challenger will, and they are ambitious towards building the super app as a dream. I think American entrepreneurs tend to build something really good and light, partner with other companies and stay in their comfort zone,” said the investor who was the president of Google China in the late 2000s.

“I really think that Silicon Valley and U.S. entrepreneurs should look to China for ideas or inspirations of doing things differently.”

Conflict of interest

From 2019 to 2020, Zhihu’s monthly active users grew from 48 million to 68.5 million, an indication that the platform has thrived beyond the small clientele of Chinese tech elites, investors and academics whom it first attracted. A new mother could be on Zhihu asking for postnatal tips and a Foxconn worker may be on the site sharing her factory stories.

Zhihu’s revenue increased from 670.5 million yuan ($102 million) in 2019 to 1.4 billion yuan in 2020, while its net loss shrank from 1 billion yuan to 517.6 million yuan. It may seem at first that commercialization is at odds with Zhihu’s principle rooted in open user collaboration. Oftentimes, answerers are not economically incentivized but simply participating for leisure. But Zhihu is for-profit from day one and needs income after all.

It’s a always delicate matter to balance a product’s commercial and user interests. The bottom line is to be vigilant and deliberate about the kind of ads or sponsored content allowed on the platform. Restrain could mean smaller advertising revenue, but a medical ad scandal that hit Chinese search giant Baidu back in 2016 showed how easily user trust could be lost. Well-placed and responsible ads, on the other hand, could bring greater returns for both advertisers and the platform.

On the innovative side, not all users have appreciated Zhihu’s new features. Zhihu has recently upped its ante on short videos, which have become the default format through which many Chinese users receive information, thanks to more affordable connectivity and industry forerunners like Douyin and Kuaishou. But some users argue that short videos by nature verge on entertainment and are obtrusive for the more serious, text-focused Zhihu.

Zhihu has other interests to balance. Its shareholders include Tencent, Baidu and Kuaishou, which are “super apps” themselves for their extensive functionalities. They all have traffic deals with Zhihu. For example, Zhihu content is surfaced in the search results on WeChat, which has its own search engine.

While joining hands with giants could drive user growth for a smaller player, dependence on outsiders could also constrain a startup, forcing it to give away significant shares too early and joggle the interests of multiple allies, who could be rivals themselves.

Lee declined to comment on Zhihu’s relationship with any specific partner, but he did indicate that Zhihu doesn’t currently have an “overreliance” on partners and that the firm keeps “natural working business relationships with them.”

“That also speaks to the purity and the ambition of the Zhihu team, that it hopes to maintain more independence by making more friends,” said Lee.

We’ve seen a lot of trend lines moving throughout 2020 and into 2021 around automation, workflow, robotic process automation (RPA) and the movement to low-code and no-code application building. While all of these technologies can work on their own, they are deeply connected and we are starting to see some movement towards bringing them together.

While the definition of process automation is open to interpretation, and could include things like industrial automation, Statista estimates that the process automation market could be worth $74 billion in 2021. Those are numbers that are going to get the attention of both investors and enterprise software executives.

Just this week, Berlin-based Camunda announced a $98 million Series B to help act as a layer to orchestrate the flow of data between RPA bots, microservices and human employees. Meanwhile UIPath, the pure-play RPA startup that’s going to IPO any minute now, acquired Cloud Elements, giving it a way to move beyond RPA into API automation.

Not enough proof for you? How about ServiceNow announcing this week that it is buying Indian startup Intellibot to give it — you guessed it — RPA capabilities. That acquisition is part of a broader strategy by the company to move into full-scale workflow and automation, which it discussed just a couple of weeks ago.

Meanwhile at the end of last year, SAP bought a different Berlin process automation startup, Signavio, for $1.2 billion after announcing new automated workflow tools and an RPA tool at the beginning of December. Microsoft is in on it too, having acquired process automation startup Softmotive last May, which it then combined with its own automation tool PowerAutomate.

What we have here is a frothy mix of startups and large companies racing to provide a comprehensive spectrum of workflow automation tools to empower companies to spin up workflows quickly and move work involving both human and machine labor through an organization.

The result is hot startups getting prodigious funding, while other startups are exiting via acquisition to these larger companies looking to buy instead of build to gain a quick foothold in this market.

Cathy Tornbohm, Distinguished Research Vice President at Gartner, says part of the reason for the rapidly growing interest is that these companies have stayed on the sidelines up until now, but they see an opportunity and are using their checkbooks to play catch up.

“IBM, SAP, Pega, Appian, Microsoft, ServiceNow all bought into the RPA market because for years they didn’t focus on how data got into their systems when operating between organizations or without a human. [Instead] they focused more on what happens inside the client’s organization. The drive to be digitally more efficient necessitates optimizing data ingestion and data flows,” Tornbohm told me.

For all the bluster from the big vendors, they do not control the pure-play RPA market. In fact, Gartner found that the top three players in this space are UIPath, Automation Anywhere and Blue Prism.

But Tornbohm says that, even as the traditional enterprise vendors try to push their way into the space, these pure-play companies are not sitting still. They are expanding beyond their RPA roots into the broader automation space, which could explain why UIPath came up from its pre-IPO quiet period to make the Cloud Elements announcement this week.

Dharmesh Thakker, managing partner at Battery Ventures, agrees with Tornbohm, saying that the shift to the cloud, accelerated by COVID-19, has led to an expansion of what RPA vendors are doing.

“RPA has traditionally focused on automation-UI flow and user steps, but we believe a full automation suite requires that ability to automate processes across the stack. For larger companies, we see their interest in the category as a way to take action on data within their systems. And for standalone RPA vendors, we see this as validation of the category and an invitation to expand their offerings to other pillars of automation,” Thakker said.

The activity we have seen across the automation and workflow space over the last year could be just the beginning of what Thakker and Tornbohm are describing, as companies of all sizes fight to become the automation stack of choice in the coming years.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

Google’s latest investment in India is a startup that is helping businesses come online.

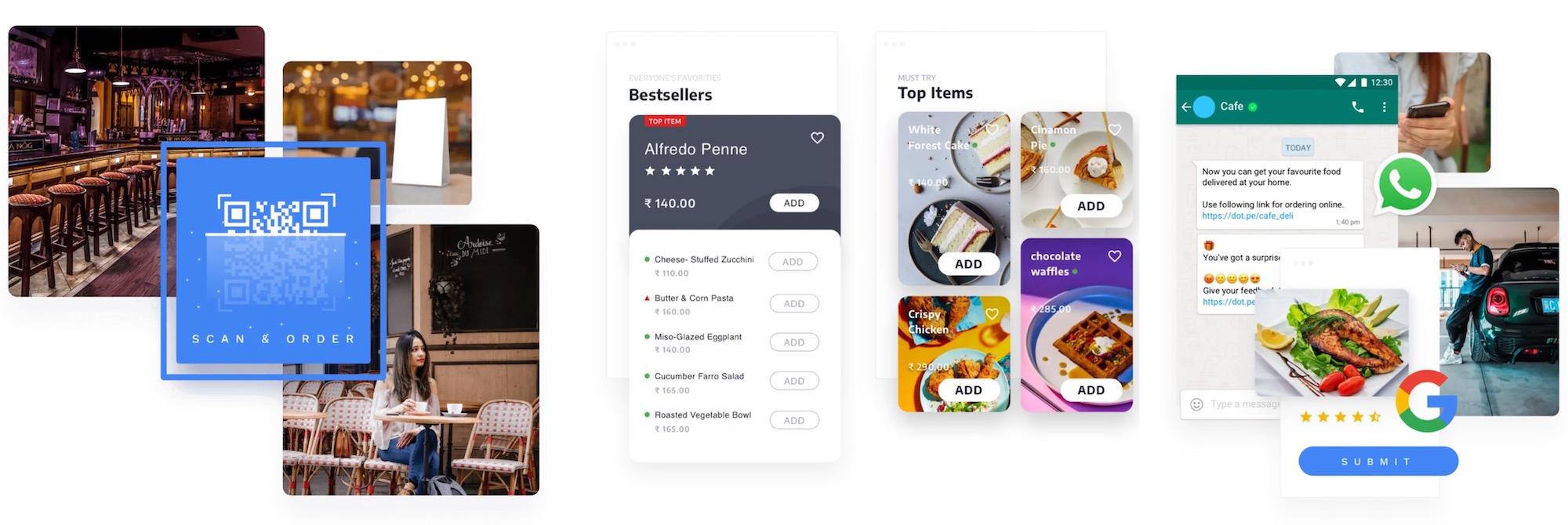

One-year-old DotPe, a Gurgaon-based startup, said on Friday it has raised $27.5 million in its Series A financing round. The round was led by PayU, with participation from existing investor Info Edge Ventures and Google.

The young startup, now valued at about $90 million, helps brick and mortar stores sell to customers online and collect payments digitally.

It’s a problem that scores of startups in India are solving today, but DotPe has some additional hooks. It helps merchants scan their inventories and quickly establish a log online.

Once the catalog is ready, a business can then make it available on WhatsApp and reach customers there. WhatsApp is the most popular smartphone app in India with over 450 million users. DotPe says it also helps businesses get visibility on Google Search.

The startup, co-founded by Shailaz Nag, formerly co-founder and managing director of PayU, also enables neighborhood stores to collect payments from walk-in customers and features tools to offer loyalty points and discounts to customers to boost engagement.

“This new partnership will empower businesses to be more discoverable, expand business avenues and conduct commerce like never before,” said Nag. “Pandemic or not, we are here to reimagine the way offline businesses work and bring the digital revolution to the doorstep of every entrepreneur.”

DotPe says its platform, which doesn’t require businesses to install an app, has amassed over 5 million merchants in the last six months. These merchants are seeing over 38% of daily orders from repeat customers, the startup said.

“In a very short time, DotPe has acquired a promising merchant base with its impeccable product experience and innovation,” said Anirban Mukherjee, CEO, PayU India.

Sanjay Gupta, VP and Country Head of Google India, said in a statement that the company’s investment in DotPe is illustrative of Google’s belief in “working with India’s start-up ecosystem towards the goal of building a more inclusive digital economy that will benefit everyone.”

Google announced a $10 billion fund for India last year, its biggest market by users. The Android-maker has invested in several startups in the country including hyperlocal delivery firm Dunzo, InMobi Group’s Glance, and DailyHunt.

DotPe said it will deploy the fresh capital to reach more merchants in India and scale its technology stack to meet the growing demand.