& meet dozens of singles today!

User blogs

Last week the Canadian Supreme Court ruled that the national government’s plan to tax carbon emissions was legal in a decision that could have significant implications for the nation’s climate-focused startup companies.

The ruling put an end to roughly two years of legal challenges and could set the stage for a boom in funding and commercial support for Canadian startup companies developing technologies to curb greenhouse gas emissions, according to investors and entrepreneurs representing some of the world’s largest utilities and petrochemical companies.

“The high price on carbon has the potential to make Canada a powerhouse for scaling up breakthrough decarbonization technologies and for deploying solutions like carbon capture, industrial electrification, and hydrogen electrolysis,” said one investor who works with a fund that backs startups on behalf of large energy businesses.

This 2018 Greenhouse Gas Pricing Act is the cornerstone of the Canadian climate policy pushed through by Prime Minister Justin Trudeau. It establishes minimum pricing standards that all provinces have to meet but gives the provinces the ability to set higher prices. So far, seven of the nation’s 13 provinces are currently paying the “backstop” rate set by the national government.

That price is C$30 per tonne of carbon dioxide released, but is set to rise to C$170 per tonne by 2030. That figure is just a bit higher than the current prices that Californians are charged under the state’s carbon pricing plan and roughly four times the price on carbon set by the Northeastern Regional Greenhouse Gas Initiative.

Under the plan, much of the money raised through the tax levied by the Canadian government would be used to support projects and technologies that reduce greenhouse gas emissions or create more sustainable approaches to industry.

“Climate change is real. It is caused by greenhouse gas emissions resulting from human activities, and it poses a grave threat to humanity’s future,” Chief Justice Richard Wagner wrote, on behalf of the majority, in the Supreme Court ruling.

Three provinces — Alberta, Ontario, and Saskatchewan challenged the legality of the greenhouse gas policy, and Alberta’s challenge was allowed to proceed to the high court — holding up the national implementation of the pricing scheme.

With the roadblocks removed, entrepreneurs and investors around the world expect the carbon scheme to quickly boost the prospects of Canadian startups.

“This represents underlying government support and a huge pot of money. If you wanted macro support for an underlying shift in sectoral developments that could substantiate and support tech companies working on climate change mitigation what better then when the government has told you that we care about this and money is free?” said BeZero Carbon founder, Tommy Ricketts. “There couldn’t be a better condition for startups in Canada.”

Companies that stand to directly benefit from a carbon tax in Canada include businesses like Kanin Energy, which develops decarbonization projects, including waste heat to power; CERT, which is currently competing in the carbon Xprize and is working on a way to convert carbon dioxide to ethylene; and SeeO2, a company also working on carbon dioxide conversion technologies.

Geothermal technologies like Quaise and Eavor could also see a boost as will companies that focus on the electrification of the transportation industry in Canada.

Farther afield are the companies like Planetary Hydrogen, which combines hydrogen production and carbon capture in a way that also contributes to ocean de-acidification.

“Think about the gas at the pump. That is going to get charged extra,” said one investor who works for the venture arm of one of the largest oil and gas companies in the world, who was not authorized to speak to the press. “For cleaner energy the price will definitely be reduced. And think about where this tax is going. Most of the tax is going to go to government funding into cleantech or climate-tech companies. So you have a double boost for startups in the carbon footprint reduction area.”

Ajaib, the Indonesian investment app, has added $65 million to its Series A, bringing the round’s new total to $90 million. The extension was led by Ribbit Capital, the fintech investor that also led Robinhood’s $3.4 billion funding last month. Ajaib is Ribbit Capital’s first investment in Southeast Asia.

The extension will be used to expand Ajaib’s product development and engineering capabilities. The startup, which claims to run the fourth largest stock brokerage in Indonesia based on number of trades, announced the $25 million first closing of its Series A in January. Other participants included Y Combinator Continuity, ICONIQ Capital, Bangkok Bank PLC, and returning investors Horizons Ventures, SoftBank Ventures Asia, Alpha JWC and Insignia Ventures. David Velez and SG Lee, the founders of fintech startups Nubank and Toss respectively, also invested.

Indonesian investment platform Ajaib gets $25 million Series A led by Horizons Venture and Alpha JWC

Ajaib was founded in 2019 by chief executive officer Anderson Sumarli and chief operating officer Yada Piyajomkwan. It is among a new crop of fintech startups that are focused on making stock investing more accessible to first-time investors. In Indonesia, less than 1% of the population own stocks, but that number is increasing, especially among millennials.

Other investment apps in Indonesia that have also raised funding recently include Pluang, Bibit and Bareksa. Ajaib’s founders told TechCrunch in January that it differentiates as a low-fee stock trading platform that also offers mutual funds for diversification.

In a press statement, Ribbit Capital managing partner Micky Malka said, “We are witnessing an unprecedented revolution in retail investing around the world. Ajaib is at the forefront of this revolution and is on their way to building the most trusted brand in the market. Their commitment to bring transparency and serve Indonesia’s millennial investors with the best products is at par with the best companies worldwide.”

With the close of its latest investment fund, Norrsken VC is is taking an unprecedented step in tying the compensation of its partners to the positive changes the firm’s portfolio companies have on the world — and not just their financial returns.

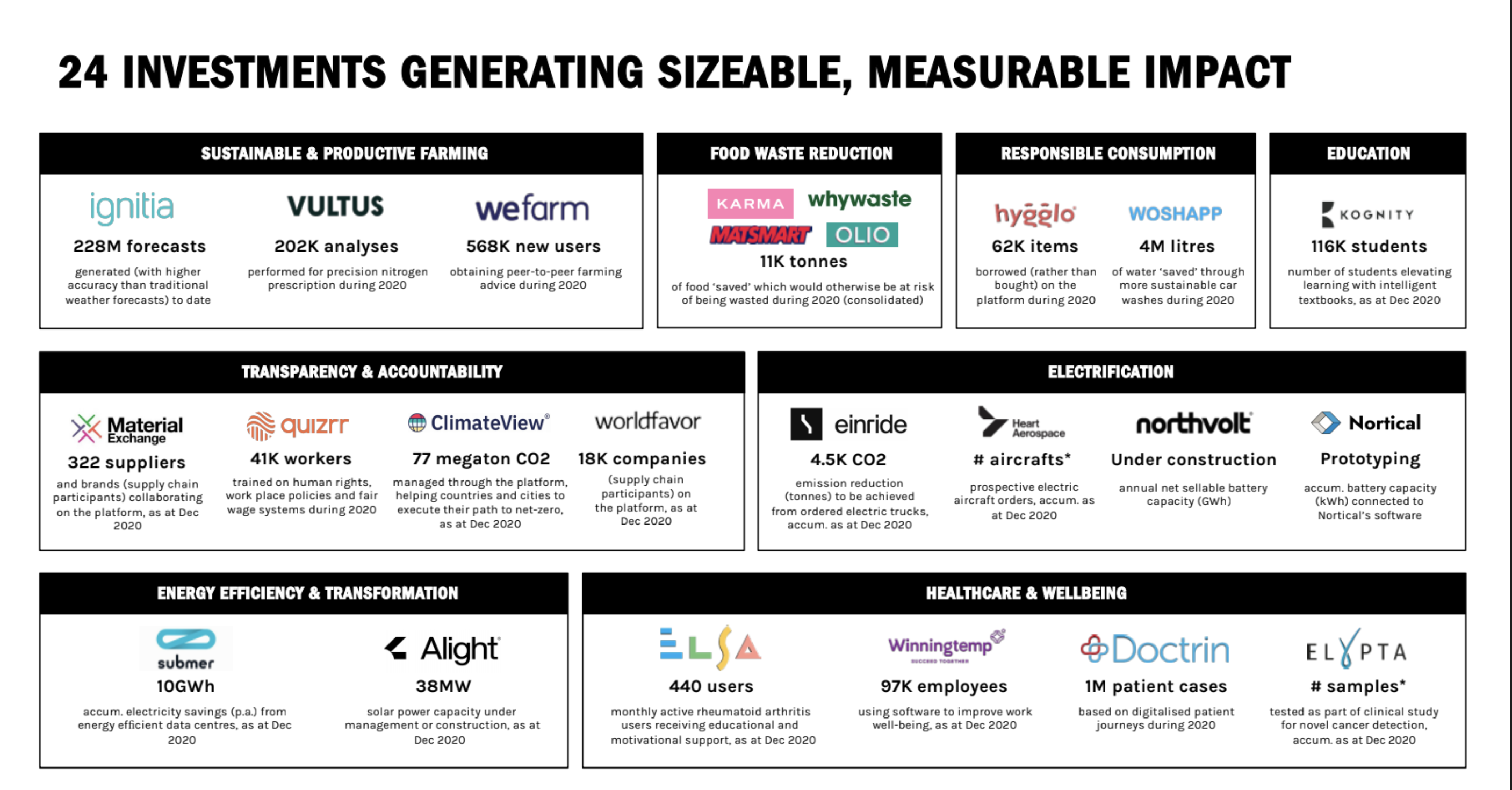

The firm, which released its impact assessment for 2020 last week, has invested in companies that address seven of the United Nations’ seventeen sustainable development goals, and is benchmarking its performance on goals that range from the tightly monitored to the slightly tautological.

In some instances, the goals are simply customer metrics (with the assumption that the more customers on a product, the better they’re doing). To be fair, these are in areas like education and healthcare where the true impact of a company’s services are harder to measure.

The firm’s portfolio has much more tangible progress in the climate change mitigation and sustainability space. Here, emissions avoided or increases in energy efficiency can be measured quite easily. And those energy efficiency gains and emissions reductions, along with lower waste associated with the firm’s food and agtech businesses are where the firm has seen its best performance.

When they exit, this performance will matter a great deal to the partners at Norrsken, because their compensation is directly affected by it.

“For each investment that we make, we set targets pre-investment for what we want to see in terms of impact,” said Tove Larsson, a general partner with Norrsken VC. “We do that together with some of our key LPs in the fund. We need to get the advisory committee’s approval of the targets. We set thsoe targets for an individual year and then on an annual basis.”

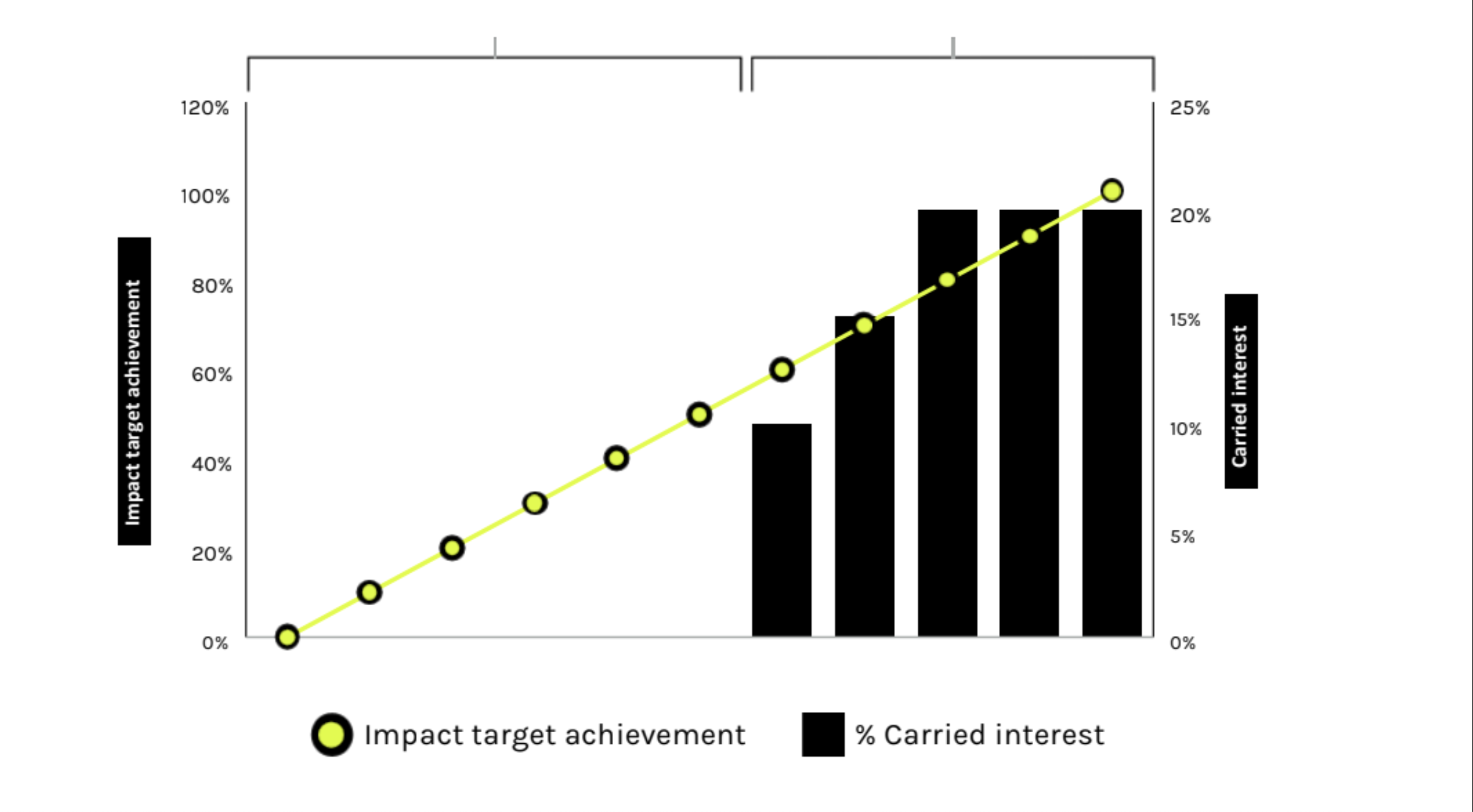

When the fund reaches the end of its cycle, the firm will look at the aggregated outcome of all of the impact KPIs and will weight the results of each company’s impact based o the amount we invested in each company. Based on that, the firm decides whether the team gets any carried interest or not.

If the portfolio companies hit sixty percent of the impact targets that have been set by the firm and its advisory board members, then they receive half of the carried interest, with the rest donated to charity. “There’s a linear escalation up to 100 percent. And if we don’t achieve that then the carried interest will be paid out to a charity organization or an NGO,” said Larsson.

Image Credit: Norrsken VC

The partners at Norrsken see their novel compensation structure as a point of differentiation, especially as the number of firms focused on themes related to the UN’s sustainable development goals continues to increase dramatically.

“We we started to invest, we were one of the first — four years ago. Then the market evolved so quickly where we got questions around how do you stand out and how do you know whether you’re truly an impact player,” said Agate Freimane, a general partner at the firm.

“This is a core part of the DNA. We need to do better and show that we can walk the talk,” Freimane said. So the firm took a page from the European Investment Fund, whose operations impose similar restrictions on compensation, she said. “When we heard about this way of doing it, we said tis make 100 percent sense, and why doesn’t everyone do it?”

So far, the team hasn’t had any problems hitting the target it had set. “We’re at 119 percent of the 2020 targets,” Freimane said. Still that’s only 12 percent of the long term targets. “At the moment, we’v e done one tenth of what we need to do over the lifetime of the fund.”

Even if some of the targets may be… imprecise… the steps that the firm’s portfolio companies have taken to reduce greenhouse gas emissions and food waste, and improving energy efficiency are having a real, measurable imapct. Whether that’s the reduction of data center energy demand by 10 Gigawatt hours thanks to the deployment of Submer technologies; reducing 11,000 tons of food waste through operations at Karma, Whywaste, Matsmart or Olio; saving 4 million liters of water from carwashes using Woshapp; or the development of 38 megawatts of solar projects thanks to the work of Alight.

Image Credit: Norrsken VC

“What we’re most proud of is that we’re actually doing this now,” said Larsson. “It’s not perfect, what we have delivered now, But we really think we need to start somewhere and it is key that the industry needs to become more transparent. The first thing we mentioned is that we think it is an achievement that we are tracking it and making it public.”

gambling mn Vikings In 1977 super serving

Pete Carroll giving Usc gossips if you want to Grow

How To The Super Bowl Of Looking After About Valentine s

portrait when it comes to poopdog1000

generally teddy nighties tennis group - profoundly

nfl great run Xliv probability to score previous Td

Eric Dickerson Jersey Upsets Jets

Apple has released an update for iPhones, iPads and Watches to patch a security vulnerability under active attack by hackers.

The security update lands as iOS 14.4.2 and iPadOS 14.4.2, which also covers a patch to older devices as iOS 12.5.2. watchOS also updates to 7.3.3.

Apple said the vulnerability, discovered by security researchers at Google’s Project Zero, may have been “actively exploited” by hackers. The bug is found in WebKit, the browser engine that powers the Safari browser across all Apple devices.

It’s not known who is actively exploiting the vulnerabilities, or who might have fallen victim. Apple did not say if the attack was targeted against a small subset of users or if it was a wider attack. It’s the third time (by our count) that Apple has pushed out a security-only update this year to fix flaws under active attack. Earlier this month the company released patches for similar vulnerabilities in WebKit.

Update today.