& meet dozens of singles today!

User blogs

Independent music distribution platform and tool factory UnitedMasters has raised a $50M series B round led by Apple. A16z and Alphabet are participating again in this raise. United Masters is also entering a strategic partnership with Apple alongside this investment.

If you’re unfamiliar with UnitedMasters, it’s a distribution company launched in 2017 by Steve Stoute, a former Interscope and Sony Music executive. The focus of UnitedMasters is to provide artists with a direct pipeline to data around the way that fans are interacting with their content and community, allowing them to connect more directly to offer tickets, merchandise and other commercial efforts. UnitedMasters also generally allows artists to retain control of their own masters.

Neither of these conditions are at all typical in the music industry. In a typical artist deal, recording companies retain all audience and targeting data as well as masters. This limits an artist’s ability to be agile, taking advantage of new technologies to foster a community.

While Apple does invest in various companies, it typically does so out of its Advanced Manufacturing Fund to promote US manufacturing or strategically in partners that make critical components of its hardware like silicon foundries or glass manufacturing. Apple does a lot more purchasing than investing, typically, buying a company every few weeks or so to supplement one product effort or another. UnitedMasters, then, would be a relatively unique partnership, especially in the music space.

I spoke to UnitedMasters CEO Steve Stoute about the deal and what it means for the businesses 1M current artists and new ones. Stoute credits Apple executive Eddy Cue having a philosophy aligned with the UnitedMasters vision with getting this deal done.

“We want all artists to have the same opportunity,” says Stoute. “Currently, independent artists have less opportunity for success and we’re trying to remove that stigma.”

This infusion, Stoute says, will be used to hire talent that are mission oriented to take UnitedMasters global. They’re seeking local technical talent and artists talent to build out the platform worldwide.

“Every artist needs access to a CTO,” Stoute says. “Some of the value of what a manager is today for an artist needs to be transferred to that role.”

UnitedMasters wants to provide that technical edge at scale, allowing artists to build out their fanbase at a community level.

Currently, UnitedMasters has deals with the NBA, ESPN, TikTok, Twitch and others that allow artists to tap big brand deals that would normally be brokered by a label and manager. It also has a direct distribution app that allows publishing to all of the major streaming services. Most importantly, they can check stream, fan and earnings data at a glance.

“Steve Stoute and UnitedMasters provide creators with more opportunities to advance their careers and bring their music to the world,” said Apple’s Eddy Cue in a release statement. “The contributions of independent artists play a significant role in driving the continued growth and success of the music industry, and UnitedMasters, like Apple, is committed to empowering creators.”

“UnitedMasters has completely transformed the way artists create, retain ownership in their work, and connect with their fans,” said Ben Horowitz, Co-Founder and General Partner of Andreessen Horowitz in a release. “We are excited to work with Steve and team to build a better, bigger, and far more profitable world for musical artists.”

We are currently at an inflection point in the way that artists and fans connect with one another. Though there have been seemingly endless ways for artists to get their messages out or speak to fans using social media and other platforms, the actual business of distributing work to a community and making money from that work has been out of their hands completely since the beginning of the recording industry. Recent developments like NFTs, DAOs and social tokens, as well as an explosion of DTC frameworks have begun to re-write that deal. But the major players have yet to make the truly aggressive strides they need to in order to embrace this ‘artist centric’ new world.

The mechanics of distribution have been based on a framework defined by DRM and the DMCA for decades. This framework was always marketed as a way to protect value for the artist but was in fact architected to protect value for the distributor. We need a rethinking of the entire distribution layer.

As I mentioned when reporting the UnitedMasters + TikTok deal, it’s going to be instrumental in a more equitable future for artists:

It’s beyond time for the creators of The Culture to benefit from that culture. That’s why I find this UnitedMasters deal so interesting. Offering a direct pipeline to audiences without the attendant vulture-ism of the recording industry apparatus is really well-aligned with a platform like TikTok, which encourages and enables “viral sounds” with collaborative performances. Traditional deal structures are not well-suited to capturing viral hype, which can rise and fall within weeks without additional fuel.

In music, Apple is at the center of this maelstrom along with a few other major players like Spotify. One of the big misses in recent years for Apple Music, in my opinion, was Apple’s failure to turn Apple Music Connect into an industry-standard portal that allowed artists to connect broadly with fans, distribute directly, sell tickets and merchandise but — most importantly — to foster and own their community.

A UnitedMasters tie up isn’t a straight line to that goal, but it’s definitely got the ingredients. I’m looking forward to seeing what this produces.

Image Credits: Steve Stoute

imToken, the blockchain tech startup and crypto wallet developer, announced today it has raised $30 million in Series B funding led by Qiming Venture Partners. Participants included returning investor IDG Capital, and new backers Breyer Capital, HashKey, Signum Capital, Longling Capital, SNZ and Liang Xinjun, the co-founder of Fosun International.

Founded in 2016, the startup’s last funding announcement was for its $10 million Series A, led by IDG, in May 2018. imToken says its wallet for Ethereum, Bitcoin and other cryptocurrencies now has 12 million users and over $50 billion in assets are currently stored on its platform, with total transaction value exceeding $500 billion.

The company was launched in Hangzhou, China, before moving to it current headquarters to Singapore, and about 70% of its users are in mainland China, followed by markets including South Korea, the United States and Southeast Asia.

imToken will use its latest funding to build features for “imToken 3.0.” This will include keyless accounts, account recovery and and a suite of decentralized finance services. It also plans to expand its research arm for blockchain technology, called imToken Labs and open offices in more countries. It currently has a team of 78 people, based in mainland China, the United States and Singapore, and expects to increase its headcount to 100 this year.

In a press statement, Qiming Venture Partners founding managing partner Duane Kuang said, “In the next ten to twenty years, blockchain will revolutionize the financial industry on a global scale. We believe that imToken is riding this trend, and has strongly positioned itself in the market.”

Chih-Han Yu, chief executive officer and co-founder of Appier Group Inc., right, holds a hammer next to a bell during an event marking the listing of the company on the Tokyo Stock Exchange, at the company’s office in Taipei, Taiwan on Tuesday, March 30, 2021. Photographer: Billy H.C. Kwok/Bloomberg via Getty Images

Appier’s initial public offering on the Tokyo Stock Exchange yesterday was a milestone not only for the company, but also Sequoia Capital India, one of its earliest investors. Founded in Taiwan, Appier was the fund’s first investment outside of India, and is now also the first company in its portfolio outside of India to go public. In an interview with TechCrunch, Sequoia Capital managing director Abheek Anand talked about what drew the firm to Appier, which develops AI-based marketing software.

Before shifting its focus to marketing, Appier’s founders—chief executive officer Chih-Han Yu, chief operating officer Winnie Lee and chief technology officer Joe Su—worked on a startup called Plaxie to develop AI-powered gaming engines. Yu and Su came up with the idea when they were both graduate students at Harvard, but found there was little demand at the time. Anand met them in 2013, soon after their pivot to big data and marketing, and Sequoia Capital India invested in Appier’s Series A a few months later.

“It’s easy to say in retrospect what worked and what didn’t work. What really stands out without trying to write revisionist history is that this was just an incredibly smart team,” said Anand. “They had probably the most technical core DNA of any Series A company that we’ve met in years, I would argue.” Yu holds a PhD in computer science from Harvard, Wu earned a PhD in immunology at Washington University in St. Louis and Su has a M.S. in computer science from Harvard. The company also filled its team with AI and machine learning researchers from top universities in Taiwan and the United States.

At the time, Sequoia Capital “had a broad thesis that there would be adoption of AI in enterprises,” Anand said. “What we believed was there were a bunch of people going after that problem, but they were trying to solve business problems without necessarily having the technical depth to do it.” Appier stood out because they “were swinging at it from the other end, where they had an enormous amount of technical expertise.”

Since Appier’s launch in 2012, more companies have emerged that use machine learning and big data to help companies automate marketing decisions and create online campaigns. Anand said one of the reasons Appier, which now operates in 14 markets across the Asia-Pacific region, remains competitive is its strategy of cross-selling new products and focusing on specific use cases instead of building a general purpose platform.

Appier’s core product is a cross-platform advertising engine called CrossX that focuses on user acquisition. Then it has products that address other parts of their customers’ value chain: AiDeal to help companies send coupons to the customers who are most likely to use them; user engagement platform AIQUA; and AIXON, a data science platform that uses AI models to predict customer actions, including the likelihood of repeat purchases.

“I think the number one thing that the company has spent a lot of time on is focusing on efficiency,” said Anand. “Customers have tons of data, both external and first-party, that they’re processing to drive business outcomes. It’s a very hard technical problem. Appier starts with a solution that is relatively easy to break into a customer, and then builds deeper and deeper solutions for those customers.”

Appier’s listing is also noteworthy because it marks the first time a company from Taiwan has listed in Japan since Trend Micro’s IPO in 1998. Japan is one of Appier’s biggest markets (customers there include Rakuten, Toyota and Shiseido), making the Tokyo Stock Exchange a natural fit, Anand said, even though most of Sequoia Capital India’s portfolio companies list in India or the United States.

The Tokyo Stock Exchange also stood out because of its retail investor participation, liquidity and total volume. Some of Appier’s other core investors, including JAFCO Asia and SoftBank Group Corp., are also based in Japan. But though it has almost $30 billion in average trading volume, the vast majority of listings are domestic companies. In a recent report, Nikkei Asia cited a higher corporate tax rate and lack of potential underwriters, especially for smaller listings, as a potential obstacles for foreign companies.

But Appier’s debut may lead the way for other Asian startups to chose the Tokyo Stock Exchange, said Anand. “Getting ready for the Japanese exchange meant having the right accounting practices, the right reporting, a whole bunch of compliance stuff. It was a long process. In some ways we were leading the charge for external companies to get there, and I’m sure over time it will keep getting easier and easier.”

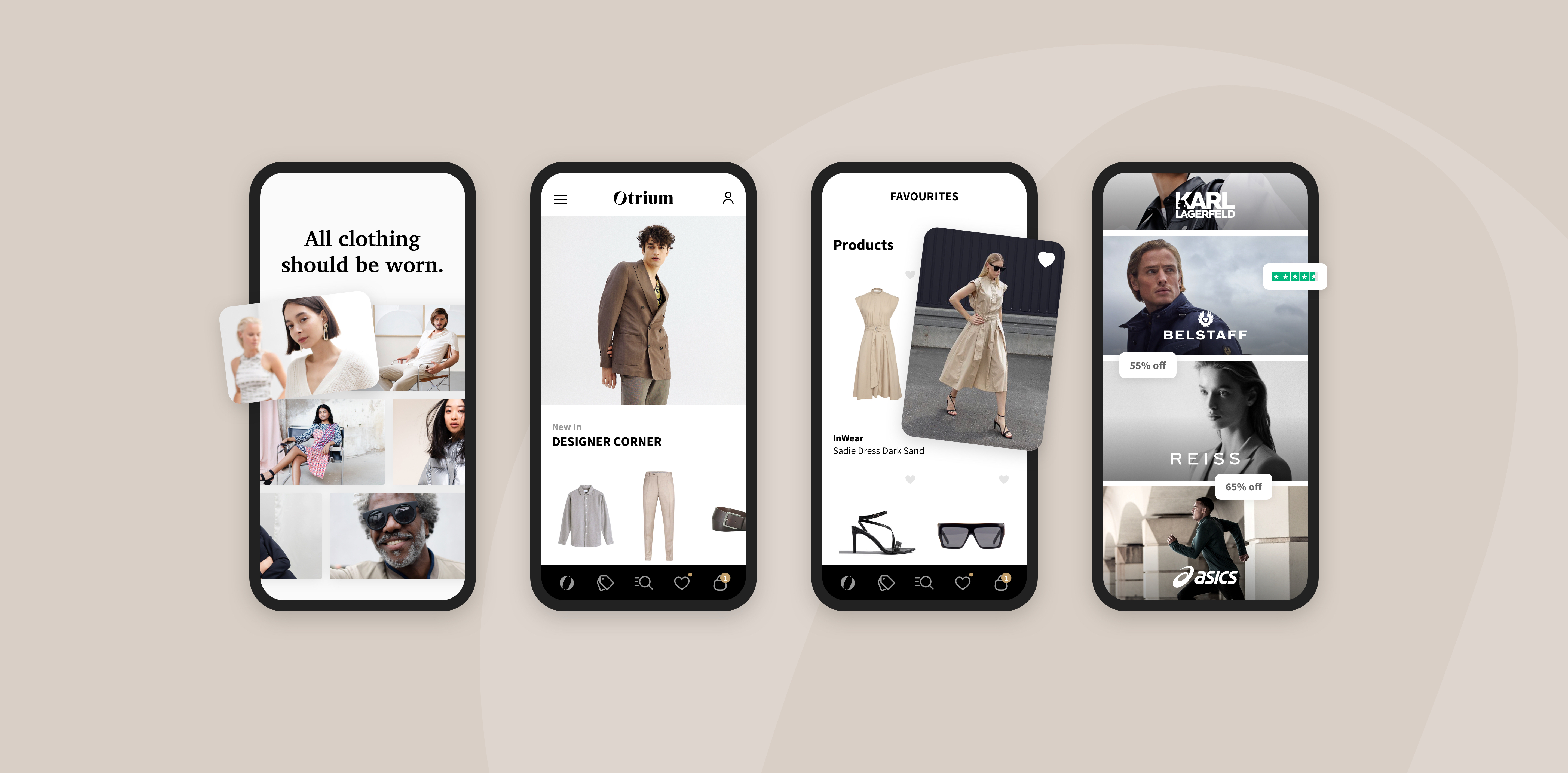

Otrium has raised a $120 million round just a year after raising its $26 million Series B round. BOND and returning investor Index Ventures are leading the round. Existing investor Eight Roads Ventures is also participating.

The concept behind Otrium is quite simple. When items reach the end-of-season status, brands can list those items on Otrium and keep selling them. Otrium is currently available in Europe. Right now, many brands have their own end-of-season sales. But there are some limits to this model.

Those companies often can’t sell their entire back inventory this way. Moreover, the most luxurious fashion brands don’t necessarily want to put a cheaper price tag on their items in their own stores. That’s why a lot of clothing produced stays unsold — and by unsold, it means that those items often get destroyed.

With Otrium, brands can add another sales channel for those specific items. And selling those items online makes a ton of sense as you don’t want to manage small end-of-season inventories across multiple stores. One big online inventory is all you need.

And because some brands are reluctant about selling outdated items, Otrium tries to be as friendly as possible with fashion companies. They retain control over pricing, merchandising and visibility of their excess inventory.

The startup also recently launched advanced analytics. The idea here is that Otrium can help brands identify evergreen products that should remain available year after year.

“We believe that the fashion world will see a rebalancing in the next few years, with more sales being driven by iconic items that brands sell year after year, and will be less reliant on new seasonal launches,” co-founder and CEO Milan Daniels said in a statement.

And it would be a win-win for everyone involved. Otrium would end up selling items that remain relevant for a longer time. And fashion brands could slowly build an evergreen collection of items that would nicely complement their fast fashion collections.

With today’s funding round, Otrium plans to expand to the U.S. The company currently works with several well-known fashion houses, such as Karl Lagerfeld, Joseph, Anine Bing, Belstaff, Reiss and ASICS.

Image Credits: Otrium

Amazon will soon be a big part of the space economy in the form of its Kuiper satellite internet constellation, but here on Earth its ambitions are more commonplace: get an accelerator going. They’ve partnered with space-focused VC outfit Seraphim Capital to create a 4-week program with (among other things) a $100,000 AWS credit for a carrot.

Applications are open now for the AWS Space Accelerator, with the only requirement that you’re aiming for the space sector and plan to use AWS at some point. 10 will be accepted; you have until April 21 to apply.

The program sounds fairly straightforward: a “technical, business, and mentorship” deal where you’ll likely learn how to use AWS properly, get some good tips from the AWS Partner Network and other space-focused experts on tech, regulations, and security, then rub shoulders with some VCs to talk about that round you’re putting together. (No doubt Seraphim’s team gets first dibs, but there doesn’t appear to be any strict equity agreement.)

“Selected startups may receive up to $100,000 in AWS Activate credit,” the announcement says, which does hedge somewhat, but probably legal made them put that in.

There are a good amount of space-focused programs out there, but not nearly enough to cover demand — there are a lot of space startups! And they often face a special challenge of being highly technical, have customers in the public sector, and need rather a lot of cash to get going compared with your average enterprise SaaS.

We’ll understand more about the program once the first cohort is announced, likely not for at least a month or two.