& meet dozens of singles today!

User blogs

As the world changes rapidly, so too do the most traditional of industries. That includes property tech and insurtech. Luckily for us, two of the top minds in those spaces are joining us on an upcoming episode of Extra Crunch Live.

On April 21 at noon PT/3pm ET, Fifth Wall’s Brendan Wallace and Hippo’s Assaf Wand will hang out with us to discuss fundraising across these evolving verticals and explain specifically how fundraising went down for Hippo. The duo will also take a look at pitch decks sent in by the audience and give their live feedback. (If you’d like your deck to be featured on a future episode of Extra Crunch Live, hit up this link.)

But first, a little more information on our guests.

Brendan Wallace is cofounder and managing partner at Fifth Wall, one of the top VC firms dealing in property tech, future of work, new retail and more. Fifth Wall portfolio companies include OpenDoor, Classpass, AllBirds, Clutter, Eden, Lime, and Lyric, among others.

Before Fifth Wall, Wallace was an entrepreneur himself, cofounding Identified (acquired by Workday) and Cabify, a huge ridesharing service in Latin America. He was also an angel investor, with investments in Bonobos, Dollar Shave Club, Lyft, and SpaceX, to name a few.

The TL;dr version on Wallace is that he’s been around the block in the tech world plenty of times, and has experience across a variety of sectors. There’s lots to learn here.

Assaf Wand is cofounder and CEO of Hippo, a home insurance provider for the digital age. Wand is also a serial entrepreneur, founding a company that designed and developed consumer products called Sabi. It was acquired in 2015.

Interestingly, Wand has also worn the hat of an investor, serving as strategic investor for Intel Capital and also spending time at McKinsey as a consultant.

Hippo has raised more than $700 million from investors that include Bond, Felicis, Comcast and Horizons.

Wallace invested in Hippo’s Series B round, and we’re anxious to hear why Wand and Wallace chose each other, how they work together today, and what advice they have for founders looking to raise capital and scale their businesses.

The episode goes down at noon PT/3pm ET on April 21 and is free to all who want to check it out live. On-demand access to the content is reserved for Extra Crunch members only. Register to come hang out with us here.

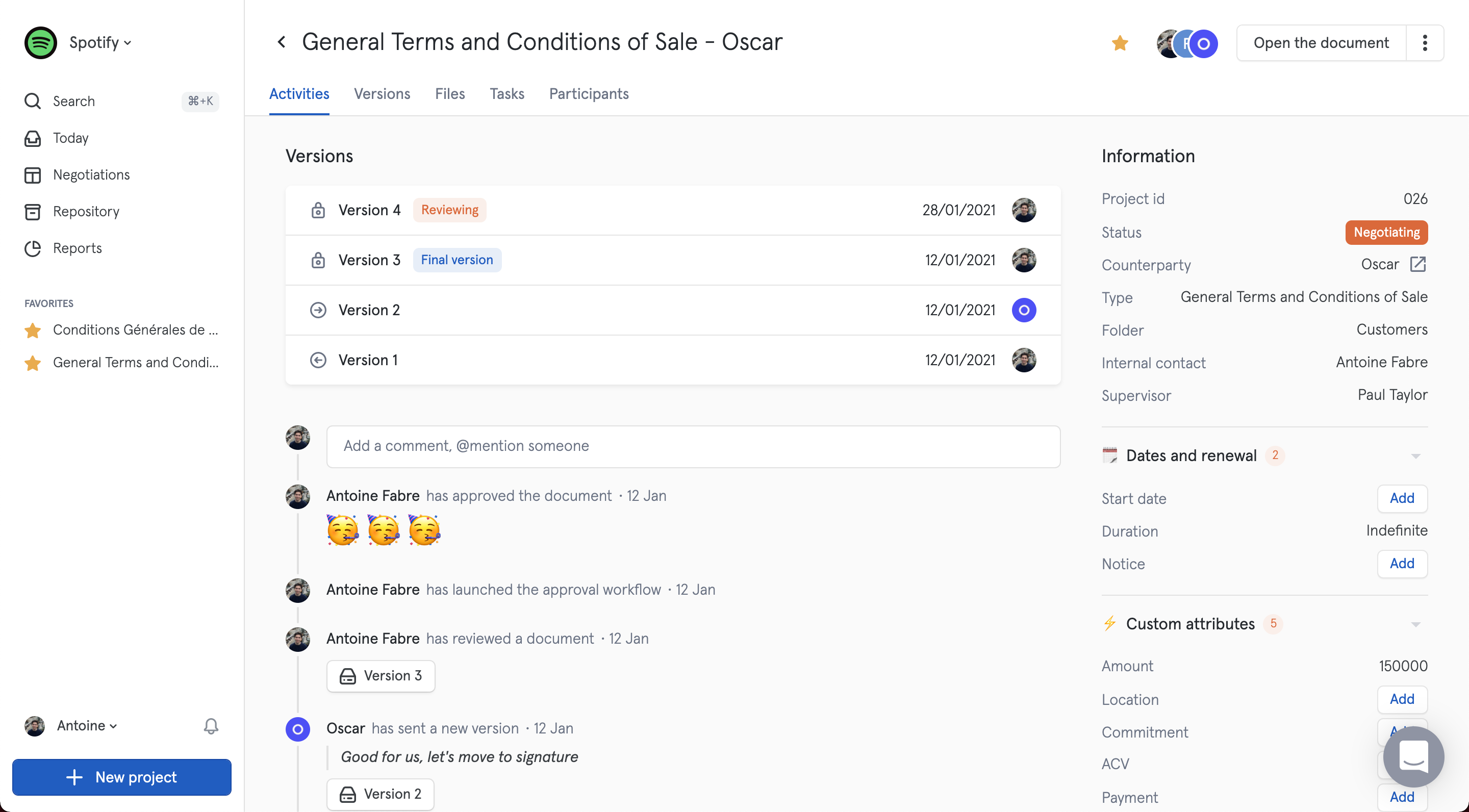

Meet Leeway, a French startup that is building an end-to-end software-as-a-service solution for your contracts. Leeway lets you centralize all your contracts in a single repository, go through multiple negotiation steps and trigger a DocuSign event for the signature.

The company raised a $4.2 million seed round from HenQ, Kima Ventures as well as several business angels, such as the founders of Algolia, Eventbrite, Spendesk, MeilleursAgents, Livestorm and Luko.

If you’re working for the legal department of your company, you’re probably working with multiple tools. Chances are you’re using Microsoft Word to write a contract, a cloud service to store and share the contract with your teammates and business partners, an e-signature and archival service.

Leeway is optimizing this worklfow at every step. First, you can store all your contracts on Leeway. In addition to making it easier to find a contract later down the road, you can get reminders when a contract is about to expire so that you can renew a contract.

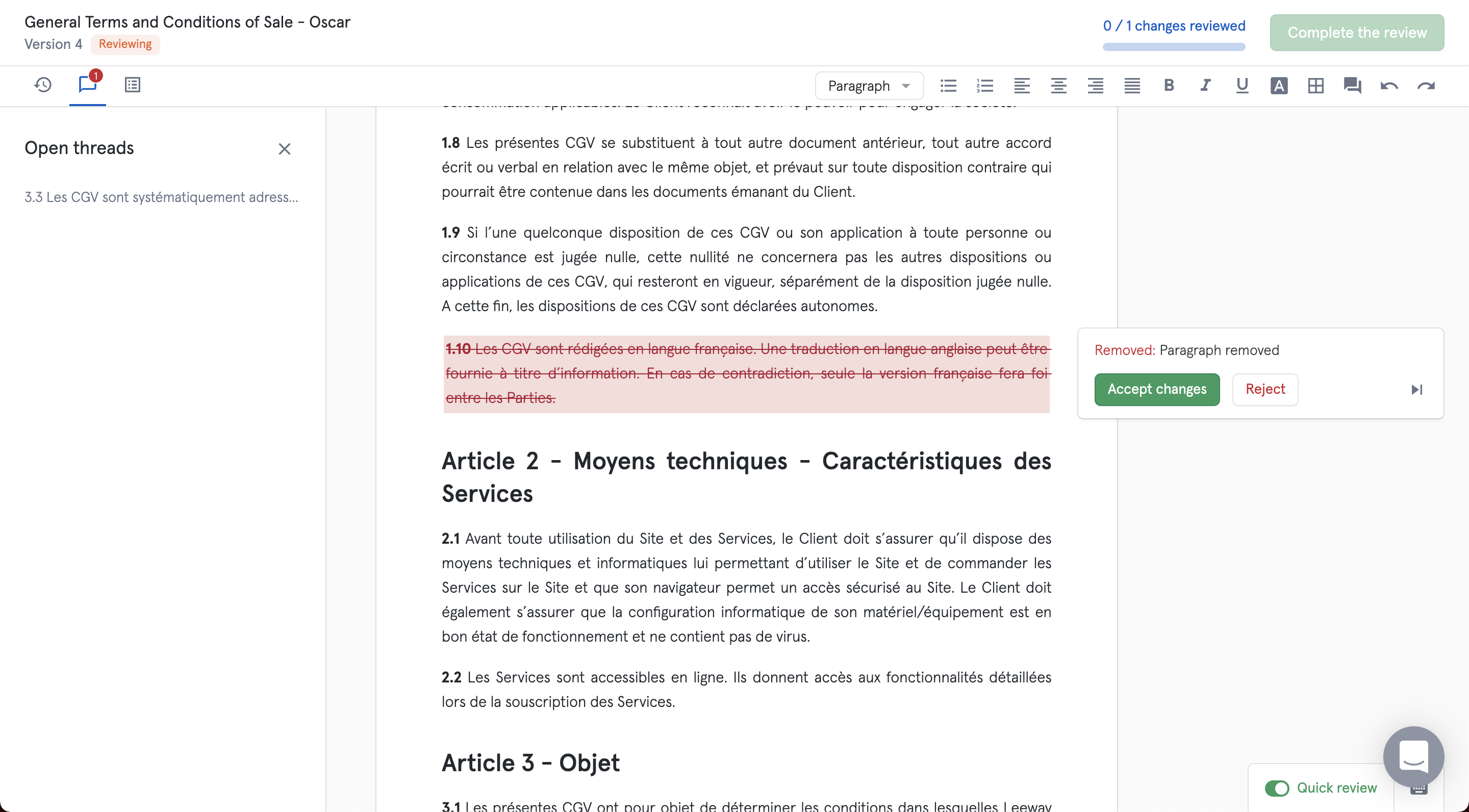

Second, you can edit your contract from Leeway directly. For instance, a manager can review a contract and write changes in Leeway’s interface. The employee can then start a revision and save a new version of the contract.

After that, you can send the contract from the same interface. Administrators can set up approval workflows so that several people need to approve a contract before it is signed. As everything is centralized, you can get an overview of all your contracts that are currently in the pipeline.

Image Credits: Leeway

Up next, Leeway is thinking about integrating conditional clauses within the product. Usually, big companies have several versions of the same clause — very favorable, favorable, not so favorable, etc. When a client is negotiating, Leeway customers could switch the clause from very favorable to favorable for instance.

Right now, around 30 companies are using Leeway to manage their contracts. Clients include Voodoo, Evaneos, Ifop and Fitness Park. “We have a very specific customer base — the legal department of companies with 100 to 500 employees,” co-founder and CEO Antoine Fabre told me.

It doesn’t mean that smaller and bigger companies shouldn’t be using Leeway. But companies with less than 100 employees don’t necessarily have a full-fledged legal department. The sales team or the finance department could act as the legal-ish team. But Leeway still has a lot of room to grow.

Image Credits: Leeway

The team behind Cortado Ventures thinks there’s plenty of untapped investment opportunity in the Midwest. To change that, it’s raised $20 million in what appears to be Okalhoma’s largest venture fund to date.

The firm is led by partners Nathaniel Harding, David Woods and Mike Moradi. In a Medium post, Harding (an angel investor and former oil and gas entrepreneur) recalled how he an Moradi had been discussing the need for an Oklahoma-based venture capital fund back in 2017.

They’d planned to launch the firm — which makes seed and Series A investments — just about a year ago, and the pandemic only gave them a greater sense of urgency.

“With the pandemic threatening Oklahoma’s economy, more attention than ever was placed on the need to diversify our economy and create future-ready tech jobs,” Harding said. “There was also a sense that innovation and startups would multiply, and that technology disruption and adoption would accelerate. In fact, we contend that there has never been a better time to start a new company. Our investors sensed this too.”

Although the firm’s first fund only recent hit its cap of $20 million, it has already invested in nine startups including text marketing company RespondFlow in Tulsa, Dallas-based Socialwyze (which helps underemployed people find flexible work) and hybrid materials startup Mito Material Solutions in Stillwater.

Cortado was created with the thesis that the region was “underfunded,” but Harding told me it doesn’t have any geographic restrictions on investments.

“We look at companies from anywhere,” he said. “We care more about what the companies does and less about where they’re located.”

Harding suggested that Oklahoma is particularly rich in entrepreneurs with a background in traditional industries like energy, aerospace, agriculture and manufacturing. And being based in Oklahoma City hasn’t stopped Cortado from backing founders from diverse backgrounds — he said the majority of the portfolio is led by women, people of color and first-generation immigrants.

Asked whether the regional ecosystem will also need more later-stage firms to fund the growth of successful startups, Harding said, “Funding at the early stage is often very local, but funding at later stages, once you get to nine figure valuations — you’re a known commodity. Once you’re getting to a Series C and D […] you have a global market for investments.”

Zapp, one of a number of startups currently battling it out in London and beyond by promising to let you order everyday items on-demand from its own delivery-only stores, has quietly raised a new round of funding from leading VCs, TechCrunch has learned.

According to multiple sources, Silicon Valley’s Lightspeed and Europe’s Atomico (the VC firm started by Skype founder Niklas Zennström) have invested in Zapp’s unannounced Series A. Those same sources have also confirmed that Zapp has raised around $100 million in total, including via an earlier seed round.

In addition to Lightspeed and Atomico, other investors in Zapp include 468 Capital, and Burda, alongside notable angels such as Mato Peric, Christopher North (former Amazon UK CEO), and Stefan Smalla (Westwing CEO). One source tells me that the startup’s Series A is the first deal that consumer-focused partner, Sasha Astafyeva, has led on Atomico’s behalf since joining the London-headquartered VC firm.

“We’re relentlessly focused on delighting our customers and generally do not comment on our capital structure. We are excited to bring Zapp to millions of customers in London and beyond this year,” said Zapp, in a statement issued to TechCrunch when asked about the Series A and list of investors.

Started last summer, Zapp’s founders are Joe Falter, who was part of the founding team at Jumia where he led the on-demand services business through to the group’s IPO, and Navid Hadzaad, who most recently was a product leader at Amazon’s Seattle HQ after founding GoButler and scaling several ventures at Rocket Internet. The leadership team also spans ex-employees of Deliveroo, Just Eat, Dominoes and Tesco, to name just a few.

Zapp operates a vertical or “dark store” model, seeing it set up its own micro fulfillment centers. They include several locations in London already: Kensington, Chelsea, Fulham, Notting Hill, Hammersmith, Shepherd’s Bush, Shoreditch, Islington and Angel.

Shunning the gig economy model used by companyies like Deliveroo, Zapp employs its riders directly. It also emphasises sustainability and utilises an all-electric fleet.

From what we can glean online and through conversations with sources, Zapp also looks to be focusing less on fresh food/groceries and more on convenience a la goPuff in the U.S., thus targeting impulse purchases rather than trying to usurp the traditional grocery shop. This is in contrast to many of the other dark store competitors, although there is clearly cross-over in all of the offerings from a multitude of players.

Alongside Zapp, dark store operators in London alone include Getir, Gorillas, Jiffy, Dija and Weezy — with some also raising and deploying significant amounts of capital, including, in some instances, employing heavy discounting as the land grab accelerates.