& meet dozens of singles today!

User blogs

Sarah Kunst, founding partner at Cleo Capital, has worn many hats. She’s been an entrepreneur, served on plenty of boards, is a contributing author at Marie Clare, has been a senior advisor to Bumble and worked as a consultant in marketing, business development and more.

With all that experience, she knows all too well that the process of fundraising starts well before your first pitch meeting. That’s why we’re so excited to have Kunst join us at Early Stage in July to discuss how to get ready to fundraise.

This isn’t the first time Kunst has discussed the topic with us. On a recent episode of Extra Crunch Live, Kunst and one of her portfolio company founders Julia Collins described how to conduct the process of fundraising.

For example, there is a story to tell, metrics to share and an art to building momentum before you ever start filling your calendar. That all requires preparation, and Kunst will outline how to go about that at our event in July.

Early Stage is going down twice this year, with our first event taking place tomorrow! Here’s a look at some of the topics we’ll be covering:

Fundraising

- Bootstrapping Best Practices (Tope Awotona and Blake Bartlett, Calendly)

- Four Things to Think About Before Raising a Series A (Bucky Moore, Kleiner Perkins)

- How to Get An Investor’s Attention (Marlon Nichols, MaC Venture Capital)

- How to Nail Your Virtual Pitch Meeting (Melissa Bradley, Ureeka)

- How Founders Can Think Like a VC (Lisa Wu, Norwest Venture Partners)

- The All-22 View, or Never Losing Perspective (Eghosa Omoigui, EchoVC Partners)

Operations:

- Finance for Founders (Alexa von Tobel, Inspired Capital)

- Building and Leading a Sales Team (Ryan Azus, Zoom CRO)

- 10 Things NOT to Do When Starting a Company (Leah Solivan, Fuel Capital)

- Leadership Culture and Good Governance (David Easton, Generation Investment Management)

The cool thing about Early Stage is that it’s heavy on audience Q&A, ensuring that everyone gets the chance to ask their own specific questions. Oh, and ticket holders get free access to Extra Crunch.

Interested? You can buy a ticket here.

On the same day that Deliveroo’s IPO fizzled at the start of trading, Compass announced via a fresh S-1 filing that it will reduce the number of shares in its impending flotation and sell them at a lower price.

Taken together, the various market signs could point to a modest to moderate cooling in the tech IPO market.

The move by Compass, a venture-backed residential brokerage, to lower its implied public-market valuation and sell fewer shares is a rebuke of the company’s earlier optimism regarding its valuation and ability to raise capital. The company’s IPO is still slated to generate as much as a half-billion dollars, so it can hardly be called a failure if it executes at its rejiggered price range, but the cuts matter.

Especially when we consider several other factors. The Deliveroo IPO, as discussed this morning, was impacted by more than mere economics. And there are questions regarding how interested seemingly more conservative countries’ stock exchanges will prove in growth-oriented, unprofitable companies.

But added to the mix are recent declines in the valuation of public software companies, effectively repricing the value of high-margin, recurring revenue. The reasons behind that particular change are several, but may include a rotation by public investors into other asset categories, or an air-letting from a sector that may have enjoyed some valuation inflation in the last year.

In that vein, SMB cloud provider DigitalOcean’s own post-IPO declines from its offering price are a bit more understandable, as is a lack of a higher price interval from Kaltura, a video-focused software company, as it looks to list.

Taken together, the various market signs could point to a modest to moderate cooling in the tech IPO market. For a host of companies looking to debut via a SPAC, that could prove to be bad news.

Trump’s daughter-in-law Lara Trump promoted a new interview with the former president on Facebook and Instagram Tuesday, but a workaround to Trump’s ban on two of the world’s most popular social networks wasn’t long for this world.

She was apparently swiftly cautioned by Facebook that anything posted “in the voice of President Trump” is not currently allowed on Facebook or Instagram and would be subject to removal. Trump himself remains banned on Facebook pending a decision by the Oversight Board, the external governing body the company set up to tackle it thorniest platform policy decisions.

Those rules apply to any accounts or pages associated with the Trump campaign as well as any belonging to former surrogates for the campaign, two categories that Lara Trump’s account falls into. Facebook confirmed to TechCrunch that screenshots depicting emails from the company were legitimate.

Facebook does still make a news exemption for Trump, presumably for something more akin to a 60 Minutes interview, but in this case he was being interviewed by someone involved in his campaign who then planned to promote the video on a campaign-associated account.

While Facebook won’t host the video itself, Lara Trump opted for a workaround to the workaround, linking to the interview on Rumble, a video sharing website that saw an influx of Trump supporters late last year.

She also posted to the video on The Right View, a web-based show previously produced by the Trump campaign that the Washington Post describes as “a sort of pro-Trump answer to ABC’s ‘The View.'”

Fox News announced this week that it would bring Lara Trump into the fold, hiring the member of the Trump family on as a paid contributor.

Picture it. It’s September, and you’re at TechCrunch Disrupt 2021 about to present your virtual elevator pitch to thousands of attendees around the world. In the short span of 120 seconds, your company will become known to a rapt audience of early-startup influencers including potential customers, investors, tech icons and the media.

An awesome opportunity, amirite? Don’t just picture it — make it happen by exhibiting in Startup Alley. Yes, it really is that easy. Every early-stage startup that exhibits in Startup Alley gets to pitch to the Disrupt audience.

It’s not only a tremendous opportunity to practice, pitching at Disrupt can have long-term benefits. Don’t just take our word for it. Jessica McLean, the director of marketing and communications at Infinite-Compute, talks about her company’s experience pitching last year at Disrupt 2020.

“Startup Alley exhibitors got to pitch to attendees, and we were thrilled with how it went. I recorded the pitch, and now we just shoot potential investors a quick video saying, “take a look at our CEO pitching at Disrupt 2020.” It’s a great piece of marketing collateral.”

Along with the epic exposure that comes from pitching at Disrupt, Startup Alley exhibitors also have a shot at being interviewed during one of the many hour-long Startup Alley Crawls. Each tech category gets its own crawl — we’ll post the specific times in the agenda closer to the show’s opening — and TechCrunch journalists will interview a select number of exhibiting founders from each category.

Here’s yet another reason to buy a Startup Alley Pass sooner rather than later. Your pass makes you eligible to participate in Startup Alley+, a curated experience designed to help founders increase their opportunities for exposure and business growth. Only 50 companies — chosen by TechCrunch — will form this cohort, and there’s no additional cost. Here’s the kicker — the benefits start months before Disrupt 2021 begins. Learn more about the Startup+ experience here.

Did you know that TechCrunch editors award two Startup Alley exhibitors with a Startup Battlefield Wild Card? Those founders get to compete for $100,000 in the always-epic Startup Battlefield competition. Who knows? You might follow in the steps of RecordGram. That startup, chosen from Startup Alley as a Wild Card, went on to win the Startup Battlefield competition.

Bottom line: Exhibiting in Startup Alley is a savvy strategy. You’ll pitch your company to a global audience, gain valuable exposure, meet and connect with influencers and potential customers. Win-win-win.

TechCrunch Disrupt 2021 takes place on September 21-23. If you want to take advantage of every opportunity, there’s just one item to cross off your to-do list. Apply for Startup Alley before the early-bird price ($199) expires on May 13 at 11:59 pm (PST).

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

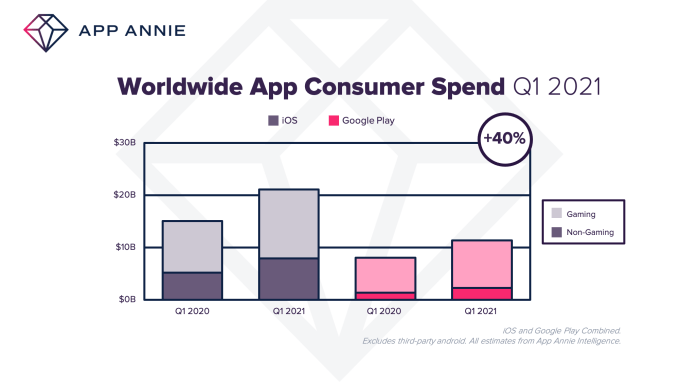

The pandemic’s remarkable impact on the app industry has not slowed down in 2021. In fact, consumer spending in apps has hit a new record in the first quarter of this year, a new report from App Annie indicates. The firm says consumers in Q1 2021 spent $32 billion on apps across both iOS and Google Play, up 40% year-over-year from Q1 2020. It’s the largest-ever quarter on record, App Annie also notes.

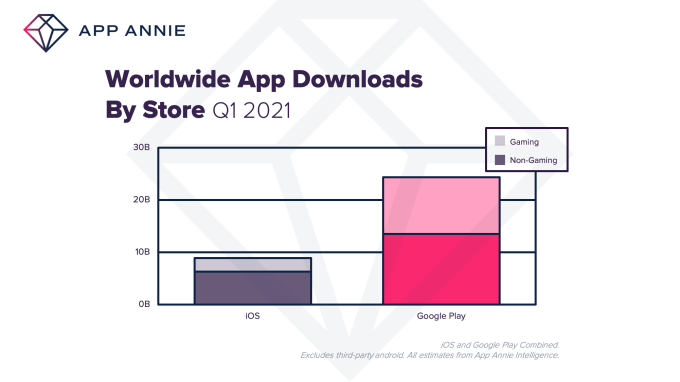

Last year saw both app downloads and consumer spend increase, as people rapidly adopted apps under coronavirus lockdowns — including apps for work, school, shopping, fitness, entertainment, gaming and more. App Annie previously reported a record 218 billion in global downloads and record consumer spend of $143 billion for the year.

Image Credits: App Annie

These trends have continued into 2021, it seems, with mobile consumers spending roughly $9 billion more in Q1 2021 compared with Q1 2020. Although iOS saw larger consumer spend than Android in the quarter — $21 billion vs. $11 billion, respectively — both stores grew by the same percentage, 40%.

But the types of apps driving spending were slightly different from store to store.

On Google Play, Games, Social and Entertainment apps saw the strongest quarter-over-quarter growth in terms of consumer spending, while Games, Photo & Video, and Entertainment apps accounted for the strongest growth on iOS.

By downloads, the categories were different between the stores, as well.

On Google Play, Social, Tools, and Fiance saw the biggest download growth in Q1, while Games, Finance and Social Networking drove download growth for iOS. Also on Google Play, other top categories included Weather (40%) and Dating (35%), while iOS saw Health and Fitness app downloads grow by a notable 25% — likely a perfect storm as New Year’s Resolutions combined with continued stay-at-measures that encouraged users to find new ways to stay fit without going to a gym.

Image Credits: App Annie

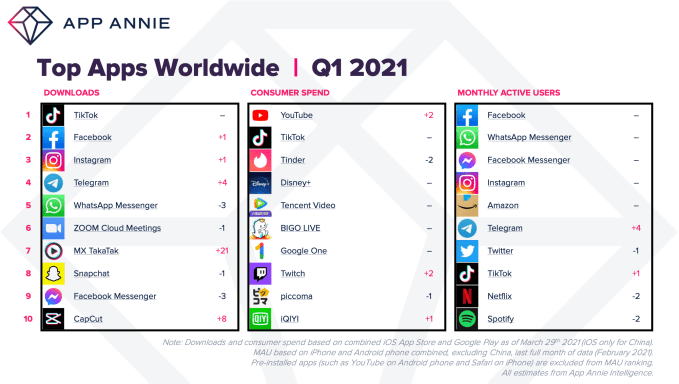

The top apps in the quarter remained fairly consistent, however. TikTok beat Facebook, in terms of downloads, and was followed by Instagram, Telegram, WhatsApp and Zoom. But the short-form video app only made it to No. 2 in terms of consumer spend, with YouTube snagging the top spot. Tinder, Disney+, Tencent Video, and others followed. (Netflix has dropped off this chart as it now directs new users to sign up directly, rather than through in-app purchases).

Image Credits: App Annie

Though Facebook’s apps have fallen behind TikTok by downloads, its apps — including Facebook, WhatsApp, Messenger and Instagram — still led the market in terms monthly active users (MAUs) in the quarter. TikTok, meanwhile, ranked No. 8 by this metric.

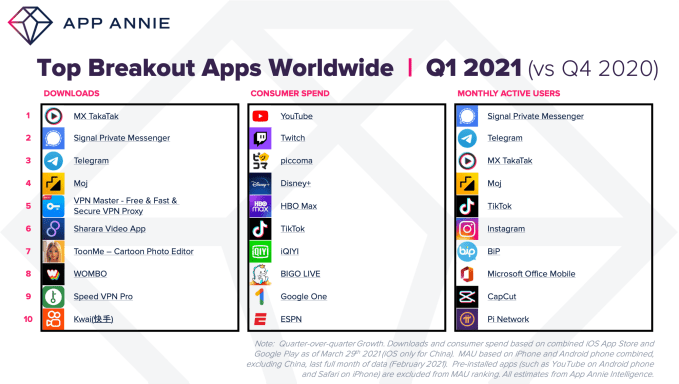

Up-and-comers in the quarter included privacy-focused messaging app Signal, which saw the strongest growth in the quarter by both downloads and MAUs — a calculation that App Annie calls “breakout apps.” Telegram closely followed, as users bailed from mainstream social after the Capitol riot. Another “breakout” app was MX TakaTak, which is filling the hole in the market for short-form video that resulted from India’s ban of TikTok.

Image Credits: App Annie

Gaming, meanwhile, drove a majority of the quarter’s spending, as usual, accounting for $22 billion of the spend — $13 billion on iOS (up 30% year-over-year) and $9 billion on Android (up 35%). Gamers downloaded about a billion titles per week, up 15% year-over-year from 2020.

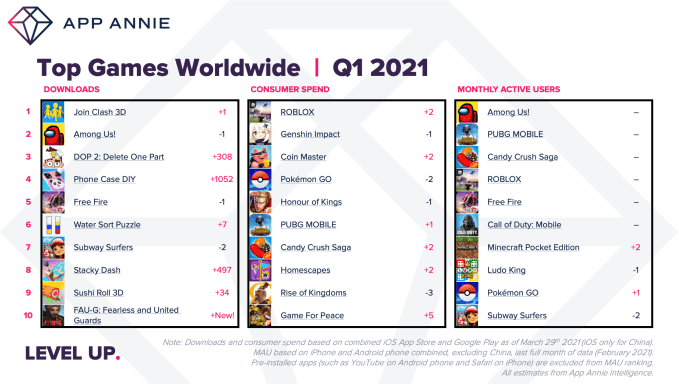

Among Us! dropped to No. 2 in the quarter by downloads, replaced by Join Clash 3D, while DOP 2: Delete One Part jumped 308 places to reach No. 3.

Image Credits: App Annie

Roblox led by consumer spend, followed by Genshin Impact, Coin Master, Pokemon Go and others. And although Among Us! dropped on the charts by downloads, it remained No. 1 by monthly active users in the quarter, followed by PUBG Mobile, Candy Crush Saga, Roblox and others.

App Annie notes that the pandemic also accelerated the mobile gaming market, with game downloads outpacing overall downloads by 2.5x in 2020. It predicts that mobile gaming will reach $120 billion in consumer spending this year, or 1.5x all other gaming formats combined.