& meet dozens of singles today!

User blogs

By now, all companies are fundamentally data driven. This is true regardless of whether they operate in the tech space. Therefore, it makes sense to examine the role data management plays in bolstering — and, for that matter, hampering — productivity and collaboration within organizations.

While the term “data management” inevitably conjures up mental images of vast server farms, the basic tenets predate the computer age. From censuses and elections to the dawn of banking, individuals and organizations have long grappled with the acquisition and analysis of data.

By understanding the needs of all stakeholders, organizations can start to figure out how to remove blockages.

One oft-quoted example is Florence Nightingale, a British nurse who, during the Crimean war, recorded and visualized patient records to highlight the dismal conditions in frontline hospitals. Over a century later, Nightingale is regarded not just as a humanitarian, but also as one of the world’s first data scientists.

As technology began to play a greater role, and the size of data sets began to swell, data management ultimately became codified in a number of formal roles, with names like “database analyst” and “chief data officer.” New challenges followed that formalization, particularly from the regulatory side of things, as legislators introduced tough new data protection rules — most notably the EU’s GDPR legislation.

This inevitably led many organizations to perceive data management as being akin to data governance, where responsibilities are centered around establishing controls and audit procedures, and things are viewed from a defensive lens.

That defensiveness is admittedly justified, particularly given the potential financial and reputational damages caused by data mismanagement and leakage. Nonetheless, there’s an element of myopia here, and being excessively cautious can prevent organizations from realizing the benefits of data-driven collaboration, particularly when it comes to software and product development.

Taking the offense

Data defensiveness manifests itself in bureaucracy. You start creating roles like “data steward” and “data custodian” to handle internal requests. A “governance council” sits above them, whose members issue diktats and establish operating procedures — while not actually working in the trenches. Before long, blockages emerge.

Blockages are never good for business. The first sign of trouble comes in the form of “data breadlines.” Employees seeking crucial data find themselves having to make their case to whoever is responsible. Time gets wasted.

By itself, this is catastrophic. But the cultural impact is much worse. People are natural problem-solvers. That’s doubly true for software engineers. So, they start figuring out how to circumvent established procedures, hoarding data in their own “silos.” Collaboration falters. Inconsistencies creep in as teams inevitably find themselves working from different versions of the same data set.

The first season of The Mandalorian last year wasn’t just a great show, it was the result of an entirely new paradigm in film and TV production. Stagecraft, the enormous LED-wall volume ILM used to shoot that season has since been expanded and updated to be better, faster, and easier to use.

In a behind-the-scenes video, directors and others from the production weigh in on how the system makes everything easier, and enumerate the improvements for the 2.0 version.

The most recognizable piece of Stagecraft is “the volume,” an enormous space inside a two stories and a roof of high-resolution LED-based displays. With physical sets placed in the center, the feeling of being in a larger space is real — and if you shoot it right, you can’t tell a virtual background from a real one.

Fundamentally this is huge, allowing “on location” shoots to combine with intricate sets (and regardless of weather or travel schedules), but far more gracefully than the soundstages or portable green screens that actors have stood in front of for decades. Not only that but it pulls together many disparate parts of the production process into one shared process.

“What’s wonderful about this system is now everyone is on the same page,” said Robert Rodriguez, who directed several episodes of the show (as well as numerous films), in the ILM video. “It inspires the actors, it inspires the filmmaker to now see what they’re shooting. You know, it’s like you’re painting with the lights on finally.”

But while it would be difficult to call Stagecraft anything but a rousing success, it’s still very much a work in progress. As an end-to-end system it must integrate with dozens of renderers, color suites, cameras, pre- and post-production software, and of course the LED walls themselves, which are always improving.

“By the second season, ILM developed some software that was specific to this technology and to what the hardware was capable of,” said Jon Favreau, executive producer of the show and indefatigable patron of new technology in cinema.

There were lots of specific requests from various members of the team, plus the usual bug squashing and performance improvements, leading to an improved workflow. Plus the volume itself has gotten bigger and better.

“It also has forced us into having a more efficient workflow that draws pre-production, post-production, production, all into one continuous pipeline,” Favreau said. Not only is it more natural and better looking than ordinary location or green screen techniques, it’s faster — they’re working through 30-50 percent more script pages per day, which any producer will tell you is unbelievable.

I plan to dig deeper into the technical improvements and pipelines that ILM, Disney, Unreal, and other companies have put together to make this all possible. In the meantime you can watch the behind the scenes video below:

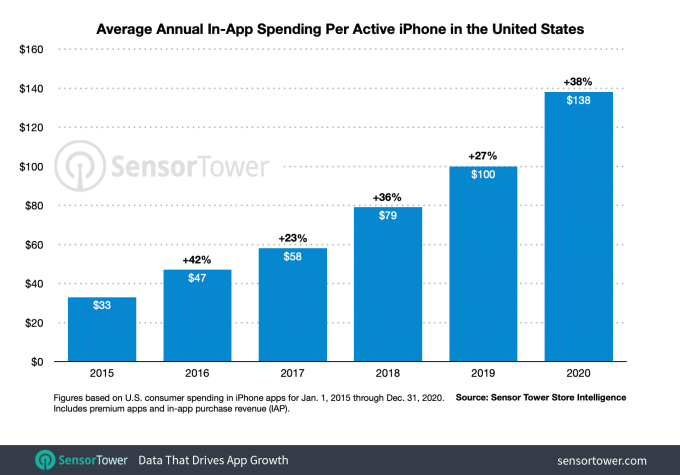

U.S. consumers spent an average of $138 on iPhone apps last year, an increase of 38% year-over-year, largely driven by the pandemic impacts, according to new data from app store intelligence firm Sensor Tower. Throughout 2020, consumers turned to iPhone apps for work, school, entertainment, shopping, and more, driving per-user spending to a new record and the greatest annual growth since 2016, when it had then popped by 42% year-over-year.

Sensor Tower tells TechCrunch it expects the trend of increased consumer spend to continue in 2021, when it projects consumer spend per active iPhone in the U.S. to reach an average of $180. This will again be tied, at least in part, to the lift caused by the pandemic — and, particularly, the lift in pandemic-fueled spending on mobile games.

Image Credits: Sensor Tower

Last year’s increased spending on iPhone apps in the U.S. mirrored global trends, which saw consumers spend a record $111 billion on both iOS and Android apps, per Sensor Tower, and $143 billion, per App Annie, whose analysis had also included some third-party Android app stores in China.

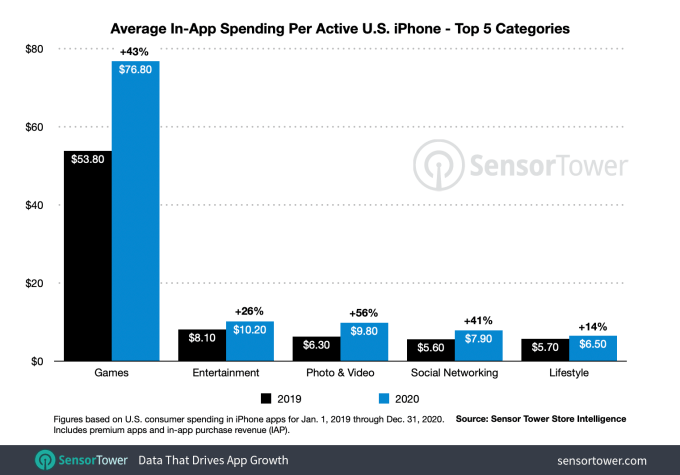

In terms of where U.S. iPhone consumer spending was focused in 2020, the largest category was, of course, gaming.

In the U.S., per-device spending on mobile games grew 43% year-over-year from $53.80 in 2019 to $76.80 in 2020. That’s more than 20 points higher than the 22% growth seend between 2018 and 2019, when in-game spending grew from $44 to $53.80.

U.S. users spent the most money on puzzle games, like Candy Crush Saga and Gardenscapes, which may have helped to take people’s minds off the pandemic and its related stresses. That category averaged $15.50 per active iPhone, followed by casino games, which averaged $13.10, and was driven by physical casinos closures. Strategy games also saw a surge in spending in 2020, growing to an average of $12.30 per iPhone user spending.

Image Credits: Sensor Tower

Another big category for in-app spending was Entertainment. With theaters and concerts shut down, consumers turned to streaming apps in larger numbers. Disney+ had launched in late 2019, just months ahead of the pandemic lockdowns and HBO Max soon followed in May 2020.

Average per-device spending in this category was second-highest, at $10.20, up 26% from the $8.10 spent in 2019. For comparison, per-device spending had only grown by 1% between 2018 and 2019.

Other categories in the top five by per-device spending included Photo & Video (up 56% to $9.80), Social Networking (up 41% to $7.90) and Lifestyle (up 14% to $6.50).

These increases were tied to apps like TikTok, YouTube, and Twitch — the latter which saw 680% year-over-year revenue growth in 2020 on U.S. iPhones, specifically. TikTok, meanwhile, saw 140% growth. In the Lifestyle category, dating apps were driving growth as consumers looked to connect with others virtually during lockdowns, while bars and clubs were closed.

Overall, what made 2020 unique was not necessarily what apps people where using, but how often they were being used and how much was being spent.

App Annie had earlier pointed out that the pandemic accelerated mobile adoption by two to three years’ time. And Sensor Tower today tells us that the industry didn’t see the same sort of “seasonality” around spending in certain types of apps, and particularly games, last year — even though, pre-pandemic, there are typically slower parts of the year for spending. That was not the case in 2020, when any time was a good time to spend on apps.

There’s a persistent fallacy swirling around that any startup growing pain or scaling problem can be solved with business development. That’s frankly not true.

Business development is rarely, if ever, the solution to succeeding in a crowded industry, differentiating an offering or delivering a truly exceptional customer experience. But standing up an effective BD operation that brings in sustainable revenue and helps validate product-market fit can be the difference between survival and failure for a startup.

Business development is rarely, if ever, the solution to succeeding in a crowded industry, differentiating an offering or delivering a truly exceptional customer experience.

I’ve had the opportunity to lead business development functions at three companies experiencing three very different stages of growth: Yelp, Stitcher and TrialPay.

At Yelp, I served as vice president of business development and corporate development for seven years. The business development team I was brought in to lead was a core business unit with accountability to the COO, CEO and board. During my tenure, I was involved in securing around 200 partnerships with companies like Apple, Amazon, Microsoft and Samsung, as well as with scores of organizations ranging from early-stage startups to corporate giants.

Yelp was on its way to becoming a go-to source of information and customer value before I arrived. But partnerships like the one I secured with Apple made Yelp into a global market leader.

At Stitcher, I took on business development as central to my role as a company founder. While it may seem like an early phase to go all-in on BD, the partnerships with music and media companies that I orchestrated in the earliest days were essential to the company’s very survival. Stitcher is an example of a company where early BD investment made sense because of the dual importance of brand name involvement in concept validation and rising above podcast market congestion.

At TrialPay, an e-commerce platform acquired by Visa in 2015, there was already an established founding team and business model to involve customers in the marketing and payment of offerings by the time I showed up. In fact, I was brought in to run business development because the company was approaching an inflection point: There was pressure internally from investors and externally from customers to expand TrialPay’s network of merchants in order to diversify commercial offerings more rapidly.

The need for business development was directly tied to consumer demand and the company’s own position between growth funding rounds.

When to go all-in on BD — and when to avoid it

There are certain market conditions that make it smart for companies to invest in BD as a growth engine and others that signal it’s best to place money, talent and time elsewhere.

You should invest in business development early when your startup’s early success depends on it. For example, at Stitcher, we wanted — and perhaps needed — early buy-in from large media companies who created the podcast content we were going to feature. We didn’t want to get in the same murky legal territory early music startups had gotten into, like Napster.

Are you ready to do whatever it takes to move the needle and drive your startup forward? Then you’re ready for TechCrunch Disrupt 2021. The leading tech conference focused on founders takes place September 21-23. There’s nothing like the thrill that comes from discovering early-stage startups and Disrupt is the world’s top launch platform.

The three days of Disrupt 2021 will be jam-packed not only with experts, panel discussions, exhibitors and the leading tech makers, shakers and investors from around the globe — it’ll be packed with value and opportunity.

Let’s talk value. Right out of the gate, you’ll receive a 3-month membership to Extra Crunch — free — when you purchase a Disrupt pass (excluding the Expo Pass). That’s a $45 value-add.

Extra Crunch, a members-only community created by TechCrunch, is specifically designed to help founders and startup teams get and stay ahead. You’ll enjoy articles on startup investment trends, fundraising, late-stage startups and more. You’ll receive weekly startup investor surveys, private tech market analysis, how-tos on fundraising and growth, topical newsletters and other exclusives delivered daily.

Membership also entitles you to Extra Crunch Live, our weekly virtual event series, discounts on TechCrunch events, discounts from software partners and more. Whew — that should keep your fingers on the pulse of everything startup.

Let’s talk even more value. Take advantage of super early-bird pricing on Founder, Innovator and Investor passes, and you can attend Disrupt 2021 for less than $100. But don’t procrastinate. Buy your pass before this time-sensitive offer disappears on May 13, 11:59 pm (PST).

Let’s talk opportunity. You’ll find it in every corner of Disrupt. Whether you’re networking on the fly in our virtual platform’s chat feature or curating your own meetings using CrunchMatch, our AI-powered networking platform, you’ll connect with people eager to collaborate, educate, learn and inspire. It’s a great way to expand your network.

The all-new Startup Alley is ground zero for opportunity — exhibitors can gain valuable media exposure, attract customers, schedule product demos and track leads. Plus, the TechCrunch editorial team will choose two stand-out exhibiting startups to compete in Startup Battlefield for the $100,000 prize. And check out the new Startup Alley+ opportunity here. Exhibiting at Disrupt is an opportunity you don’t want to miss.

The world-famous Startup Battlefield pitch competition is another huge opportunity, and we’ll start accepting applications for the 2021 cohort in Q2.

Opportunity meets value at Disrupt 2021 on September 21-23. You’re ready to do whatever it takes, so jump on this chance to attend for less than $100. Buy your super early-bird pass before May 13, 11:59 pm (PST). Then sit back and enjoy that tasty, ExtraCrunch(y) membership.

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.