& meet dozens of singles today!

User blogs

Cross-border payments startup dLocal has raised $150 million at a $5 billion valuation, less than seven months after securing $200 million at a $1.2 billion valuation.

This means that the five-year-old Uruguayan company has effectively quadrupled its valuation in a matter of months.

Alkeon Capital led the latest round, which also included participation from BOND, D1 Capital Partners, and Tiger Global. General Atlantic led its previous round, which closed last September and made dLocal Uruguay’s first unicorn and one of Latin American’s highest-valued startups.

DLocal connects global enterprise merchants with “billions” of emerging market consumers in 29 countries across Asia-Pacific, the Middle East, Latin America and Africa. More than 325 global merchants, including e-commerce retailers, SaaS companies, online travel providers and marketplaces use dLocal to accept over 600 local payment methods. They also use its platform to issue payments to their contractors, agents, and sellers. Some of dLocal’s customers include Amazon, Booking.com, Dropbox, GoDaddy, MailChimp, Microsoft, Spotify, TripAdvisor, Uber and Zara.

In conjunction with this latest round, dLocal has named Sumita Pandit to the role of COO. Pandit is former global head of fintech and managing director for JP Morgan, who also had experience at Goldman Sachs.

“Sumita is a highly respected and accomplished fintech investment banker, and she’s played a pivotal role advising some of the world’s most successful fintech companies as they’ve scaled to become global leaders,” said dLocal CEO Sebastián Kanovich in a written statement.

Meanwhile, former COO Jacobo Singer has been promoted to president of dLocal.

The company plans to use its new capital to enhance its technology and continue to expand geographically.

Alkeon General Partner Deepak Ravichandran believes that emerging markets represent some of the fastest growth opportunities in digital payments.

“However, as global merchants look to access these markets, they are often faced with a complex web of local payment methods, cross-border regulations, and other operational roadblocks,” he said in a written statement. “dLocal’s unique platform empowers merchants with a single integrated payment solution, to reach billions of customers, accept payments, send payouts, and settle funds globally.”

The first quarter of 2021 was a busy season for technology exits. Coming off a hot period in the final quarter of 2020, it was no surprise that tech upstarts pursued liquidity through a variety of mechanisms as the new year began.

There were IPOs, there were direct listings, there were PE deals. Hell, we even saw enough SPACs that we lost track of a few; amid all the noise, you’ll miss the occasional note no matter how well-tuned your ear.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Each path is still open for later-stage startups to pursue exits: The IPO market was welcoming until a few minutes ago and private equity firms are stacked with cash and willing to pay higher multiples than they might in more normal times. And there are sufficient SPACs to take the entire recent Y Combinator class public.

Choosing which option is best from a buffet’s worth of possibilities is an interesting task for startup CEOs and their boards.

DigitalOcean went public via a traditional IPO, raising a slug of capital in the process. The SMB-focused public cloud company likely felt like a somewhat obvious IPO candidate when you read its results. The Exchange spoke with the company’s CEO, Yancey Spruill, about the choice.

DigitalOcean went public via a traditional IPO, raising a slug of capital in the process. The SMB-focused public cloud company likely felt like a somewhat obvious IPO candidate when you read its results. The Exchange spoke with the company’s CEO, Yancey Spruill, about the choice.

Latch, in contrast, decided that a SPAC was its best route out the gate. The Exchange caught up with the company’s CFO, Garth Mitchell, about the transaction and why it made sense for his company.

And, finally, The Exchange spoke with AlertMedia’s founder and CEO, Brian Cruver, about his decision to sell his Texas-based company to a private equity firm.

To prevent this post from reaching an astronomic word count, we’ll give a brief overview of each deal and then summarize the company’s views about why their liquidity choice was the right one.

Three paths to liquidity

Kicking off with DigitalOcean, a few notes: First, the company has been pretty darn public about its growth in the last few years. We knew that it had an annualized run rate of around $200 million in 2018, $250 million in 2019 and around $300 million in the first half of 2020. It later announced that it hit that mark in May of last year.

So when DigitalOcean decided to go public, we weren’t bowled over. The company wound up pricing at $47 per share, the high end of its range. Since then, its stock has struggled somewhat, falling below $37 per share before recovering to $43.80 at the end of trading yesterday.

Enough of all that. Why did the company choose to go public via a traditional IPO? Spruill said his company looked at SPAC deals and direct listings. It selected the IPO route because it fit the company’s goals of generating a broad base of shareholders while creating a branding opportunity.

The cost of an IPO is comparable, he added, to other exit options. Spruill also praised the IPO process itself, noting that its rigorous requirements made DigitalOcean a better company.

Earlier in our chat, I asked Spruill a question that I put to every CEO on IPO day: How are you feeling? It’s a bit of a sop, but it sometimes elicits insights from executives and founders who, after weeks of discussing their companies’ inner workings, are asked a rare personal question.

Spruill said he felt incredible and that nothing could replicate an IPO as the culmination of so much work put into building a company and its team. If you add up the wins and losses over time, with more of the former than the latter, and can cross the finish line with the right metrics and market, you can earn a spot to be “grilled” by the “best investors,” he said.

Those investors put $750 million or so into his company, Spruill added. Funds that it can use to retire debt and free up more cash flow. Not a bad day, I’d say.

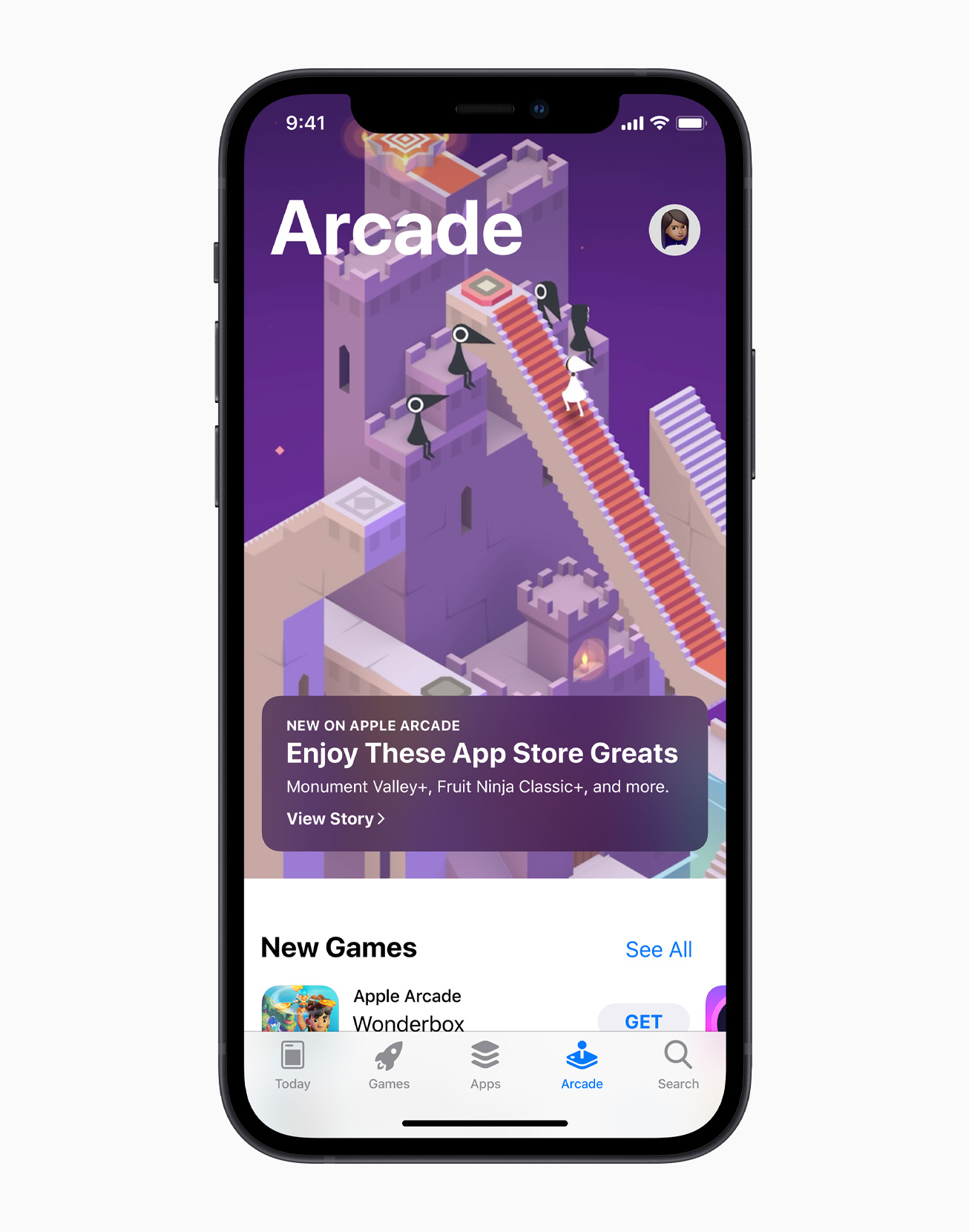

Apple has announced an expansion for its subscription gaming service Apple Arcade. In addition to exclusive game releases, the company is adding two new categories — Timeless Classics and App Store Greats.

In the ‘App Store Greats’ category, you can find some well-known iPhone games that have been released over the past decade, such as Threes+, Mini Metro+, Monument Valley+, Fruit Ninja Classic+, Cut the Rope Remastered and Badland+.

This is an interesting move as Apple has focused on exclusive titles so far. Arguably, some Apple Arcade games are sequels of popular App Store games — I’d put Mini Motorways and Rayman Mini in this category for instance.

But Apple is changing its stance and essentially buying a back catalog of App Store games. Some of them are still available on the App Store, while others have become incompatible with modern iOS versions due to framework and hardware updates. 64-bit processors have rendered many games incompatible for instance.

As always, Apple isn’t just putting free games behind a paywall. These are brand new downloads on the App Store. You get the full game without any ad or in-app purchase.

In addition to old school App Store games, Apple is also adding ‘Timeless Classics’ games. It’s a selection of board games and classic puzzle games that are included in your subscription. Games include Backgammon+, Chess Play & Learn+, Good Sudoku+, Tiny Crossword+, etc.

Those games should definitely help when it comes to reducing churn. Some people just like playing chess over and over again. They might start subscribing to play some chess and pay an Apple Arcade subscription just to keep using the same app.

Overall, Apple is dropping 32 games today and Apple Arcade has more than 180 games in its catalog. Apple originally launched the service in September 2019. You can download Apple Arcade games for $4.99 per month and there’s no additional in-app purchases. Games are available on the iPhone, the iPad, the Apple TV and macOS. Up to six family members can play with a single Apple Arcade subscription and you can also access Apple Arcade with an Apple One subscription.

Apple has been betting heavily on subscription services, such as Apple Music, Apple TV+, Apple Fitness+ and Apple News+. While some of those services have been very successful, such as Apple Music, the company is still adding more and more content to other services to prove that you should subscribe over the long haul. And today’s Apple Arcade update should definitely help for its game subscription service.

Image Credits: Apple

Mike Barile spent two years and racked up nearly $20,000 in credit card debt to bring his first startup, Backflip, to life.

The former management consultant had spent years toiling in the startup grind, first at Uber, then, after taking a coding academy bootcamp through AppAcademy (where Barile met his co-founder, Adam Foosaner), at Google and at a failed cryptocurrency startup.

Burned by the crypto experience, Barile was casting about for his next thing, and trying to find a way to scrape up some rent money, when he hit on the idea for Backflip. The experience of selling electronics online was still shady and Barile and Foosaner thought there had to be a better way.

That way became Backflip. It offers customers cash on delivery for their used electronics — anything from Androids to Xboxes and Apple devices to Gameboys.

“When I first started working on backflip back in March 2019, I met this kid named Chris and he wanted to buy some of my old iPhones. He had been a student at USF and as a side hustle he started buying used devices and would refurbish them and then either sell them himself or sell them to an official reseller,” said Barile. “Chris started making so much money he dropped out of school. That was a holy shit moment. He can make a lot of money doing this and he’s doing a really good thing.”

The problem, said Barile, was safety. “He’s got all these devices he’s acquiring paying cash for and he’s driving all around town… Everyone who works in the [refurbish and resell] industry has at least one story about getting robbed at gunpoint.”

Backflip solved that problem by being the intermediary between buyers and sellers and taking a small commission for managing the transaction.

The company raised its first money at the end of 2019, but before that, Foosaner and Barile lived off of credit and used electronics.

So far, Backflip has facilitated the exchange of roughly 3,000 devices. The company handles everything from wiping a device and ensuring its quality to finding a buyer for the electronics. The company pays out roughly $150 per device and has deposited a little over $500,000 with users of the service, according to data provided by the company.

“We did all sorts of stuff to get our first few users,” said Barile. We posted ads on Facebook Marketplace and Craiglist. We started experimenting at the end of the summer with the most bare bones mobile app kind of thing. At that point it was just Adam and I,” Barile said.

Starting now, Backflip is working with UPS stores to provide in-person drop-off and packaging centers for the used electronics. Over time, Barile sees those services expanding to offer cash on delivery. “The experience will be similar to an Amazon return,” he said. “Except we’ll be paying you.”

Currently about half of the company’s inventory is used handsets and mobile devices, but Barile said that could drop to a third of inventory as word spreads about the hundred-odd pieces of electronics that Backflip is willing to

“Unlike other resale options, Backflip prioritizes the user’s time and convenience,” said Foosaner in a statement. “Forget the back-and-forth of negotiating over price and scheduling a meetup. We’re here to do all the work for the seller and make sure they get paid fairly and quickly. Backflip users can know that they’re getting the most for their devices without having to do anything other than bring them to The UPS Store or box them up at home.”

The connection to the refurbishing community started early for Barile, whose mother had a side business called “Stone Cottage Workshop” where she was flipping refurbished furniture on eBay and at local thrift stores near Barile’s bucolic New Jersey hometown.

“We want to build the Amazon of making things disappear from your apartment,” Barile said.

Ten global startups, three rounds of pitching, nine expert judges. It’s not the 12 Days of Startups (no robotic partridge in a pear tree here), it’s the TC Early Stage Pitch Off — otherwise known as day two of TC Early Stage 2021: Operations & Fundraising.

Yesterday on day one, TC Early Stage was all about invaluable how-tos. Today, it moves into a full day of action. TechCrunch vetted hundreds of applications to pitch at Early Stage 2021. Now it’s finally time for the epic battle, as these 10 exceptional startups throw down their best pitch — streamed live to a global audience including investors, press and tech industry leaders.

Each startup gets 5 minutes to pitch followed by a Q&A with their judges. The action kicks off at 9am PT with five startups participating in round one — Clocr, Pivot Market, hi.health and Fitted.

They’ll have to bring the heat to impress their panel of VC judges: Marlon Nichols (co-founder and managing general partner at MaC Venture Capital), Sarah Smith (partner at Bain Capital Ventures) and Leah Solivan (general partner at Fuel Capital).

Round two begins at 10 am PT and features FLX Solutions, Nalagenetics, The Last Gameboard, Attention Quotient and Soon. They’ll present their pitches to Lucy Deland (partner at Inspired Capital Partners), Eghosa Omoigui (founder and managing general partner at EchoVC Partners) and Neal Sáles-Griffin (managing director at Techstars).

Only three startups will make it into the final round, which starts at 11 am PT. The finalists pitch yet again — facing a new panel of judges and a more extended Q&A. Who’s judging that final round? We tapped Wen Hsieh (partner at Kleiner Perkins), Natalie Sandman (partner at Spark Capital) and Stephanie Zahn (partner at Sequoia Capital).

Then it all comes down to one standout startup. Along with global exposure, the ultimate winner receives a feature article on TechCrunch.com, a free, one-year membership to ExtraCrunch and a free Founder Pass to TechCrunch Disrupt 2021 in September.

Don’t forget the value of watching other startups pitch — and hearing the questions the judges ask them. Expert pitch feedback is invaluable, and you might just hear a few tips you can roll into your own presentation.

Ashley Barrington, founder of MarketPearl, experienced a variation on that theme at TC Early Stage 2020.

“The Pitch Deck Teardown was incredibly helpful. Hearing the investors give feedback based on their perceptions and what they look for is so valuable. And seeing the other pitch decks and how different founders presented information was both interesting and informative.”

Day two of TC Early Stage 2021 will be non-stop pitch action. Grab some popcorn, get comfy on the couch and tune in to the TC Early Stage Pitch-Off — the pitch you improve could be your own.