& meet dozens of singles today!

User blogs

Meesho said on Monday it has raised $300 million in a new financing round led by SoftBank Vision Fund 2 as the Indian social commerce startup works to become the “single ecosystem that will enable all small businesses to succeed online.”

The new round — a Series E — gives the five-year-old startup a valuation of $2.1 billion, up from about $600 million – $700 million in the 2019 Series D investment. The Indian startup, which has raised about $490 million to date, said existing investors Facebook, Prosus Ventures, Shunwei Capital, Venture Highway, and Knollwood Investment also participated in the new round.

This appears to be Shunwei Capital’s first investment in an Indian startup in nearly a year. New Delhi last year introduced a rule to require its approval before a Chinese investor could write a check to an Indian firm.

Bangalore-based Meesho operates an eponymous online marketplace that connects sellers with customers on social media platforms such as WhatsApp, Facebook and Instagram. Its offerings include order management, taking care of logistics, online payments, real-time shop updates, and allowing businesses to get their customers to subscribe.

The startup claims to have a network of more than 13 million entrepreneurs, a majority of whom are women, from hundreds of Indians towns who largely deal with apparel, home appliances and electronics items.

If Meesho's mission has to be put in a short phrase, it'd be: "financial independence of women".

So, it's only apt that @meeshoapp has first been featured in Play Store on Women's Day by Google India, and now in Independence Day spotlight.

Recognition of real impact at scale! pic.twitter.com/jcFz2ZOrDA

— Sudhanshu Shekhar (@sdhskr) August 10, 2019

Meesho said it will deploy the fresh capital to help 100 million individuals and small businesses in the country to sell online. “In the last one year, we have seen tremendous growth across small businesses and entrepreneurs seeking to move their businesses online,” said Vidit Aatrey, co-founder and chief executive of Meesho, in a statement.

“We have been closely tracking Meesho for the last 18 months and have been impressed by their growth, daily engagement metrics, focus on unit economics and ability to create a strong team. We believe Meesho provides an efficient platform for SME suppliers and social resellers to onboard the e-commerce revolution in India and help them provide personalized experience to consumers,” said Sumer Juneja, partner at SoftBank Investment Advisers, in a statement.

In a recent report, UBS analysts identified social commerce and business-to-business marketplaces as potential sources of competition to e-commerce firms such as Amazon and Flipkart in India.

Social commerce is one prominent bets to take on modern e-commerce that has struggled to make inroads in India, despite billions of dollars ploughed by Amazon and Flipkart. Another bet is digitizing neighborhood stores in the country — without so much of the social element — that dot tens of thousands of towns, cities and villages in India. Global giants Facebook and Google are backing both the horses.

“Globally, SoftBank has always been excited to back founders that provide unique solutions for the local market. By using the power of artificial intelligence and machine learning, Meesho has created a platform for many small business owners to sell to the next cohort of internet users. We look forward to being a part of this journey,” said Munish Varma, Managing Partner at SoftBank Investment Advisers, in a statement.

Meesho said on Monday it has raised $300 million in a new financing round led by SoftBank Vision Fund 2 as the Indian social commerce startup works to become the “single ecosystem that will enable all small businesses to succeed online.”

The new round — a Series E — gives the five-year-old startup a valuation of $2.1 billion, up from about $600 million in 2019 Series D investment. The Indian startup, which has raised about $490 million to date, said existing investors Facebook, Prosus Ventures, Shunwei Capital, Venture Highway, and Knollwood Investment also participated in the new round.

Bangalore-based Meesho operates an eponymous online marketplace that connects sellers with customers on social media platforms such as WhatsApp, Facebook and Instagram. The startup claims to have a network of more than 13 million entrepreneurs, a majority of whom are women, from hundreds of Indians towns who largely deal with apparel, home appliances and electronics items.

Meesho said it will deploy the fresh capital to help 100 million individuals and small businesses in the country to sell online. “In the last one year, we have seen tremendous growth across small businesses and entrepreneurs seeking to move their businesses online,” said Vidit Aatrey, co-founder and chief executive of Meesho, in a statement.

“We have been closely tracking Meesho for the last 18 months and have been impressed by their growth, daily engagement metrics, focus on unit economics and ability to create a strong team. We believe Meesho provides an efficient platform for SME suppliers and social resellers to onboard the e-commerce revolution in India and help them provide personalized experience to consumers,” said Sumer Juneja, partner at SoftBank Investment Advisers, in a statement.

In a recent report, UBS analysts identified social commerce and business-to-business marketplaces as potential sources of competition to e-commerce firms such as Amazon and Flipkart in India.

This is a developing story. More to follow…

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday? Sign up here.

Happy Saturday, everyone. I do hope that you are in good spirits and in good health. I am learning to nap, something that has become a requirement in my life after I realized that the news cycle is never going to slow down. And because my partner and I adopted a third dog who likes to get up early, please join me in making napping cool for adults, so that we can all rest up for Vaccine Summer. It’s nearly here.

On work topics, I have a few things for you today, all concerning data points that matter: Q1 2021 M&A data, March VC results from Africa, and some surprising (to me, at least) podcast numbers.

On the first, Dan Primack shared a few early first-quarter data points via Refinitiv that I wanted to pass along. Per the financial data firm, global M&A activity hit $1.3 trillion in Q1 2021, up 93% from Q1 2020. U.S. M&A activity reached an all-time high in the first quarter, as well. Why do we care? Because the data helps underscore just how hot the last three months have been.

I’m expecting venture capital data itself for the quarter to be similarly impressive. But as everyone is noting this week, there are some cracks appearing in the IPO market, as the second quarter begins that could make Q2 2021 a very different beast. Not that the venture capital world will slow, especially given that Tiger just reloaded to the tune of $6.7 billion.

On the venture capital topic, African-focused data firm Briter Bridges reports that “March alone saw over $280 million being deployed into tech companies operating across Africa,” driven in part by “Flutterwave’s whopping $170 million round at a $1 billion valuation.”

The data point matters as it marks the most active March that the African continent has seen in venture capital terms since at least 2017 — and I would guess ever. African startups tend to raise more capital in the second half of the year, so the March result is not an all-time record for a single month. But it’s bullish all the same, and helps feed our general sentiment that the first quarter’s venture capital results could be big.

And finally, Index Ventures’ Rex Woodbury tweeted some Edison data, namely that “80 million Americans (28% of the U.S. 12+ population) are weekly podcast listeners, +17% year-over-year.” The venture capitalist went on to add that “62% of the U.S. 12+ population (around 176 million people) are weekly online audio listeners.”

As we discussed on Equity this week, the non-music, streaming audio market is being bet on by a host of players in light of Clubhouse’s success as a breakout consumer social company in recent months. Undergirding the bets by Discord and Spotify and others are those data points. People love to listen to other humans talk. Far more than I would have imagined, as a music-first person.

How nice it is to be back in a time when consumer investing is neat. B2B is great but not everything can be enterprise SaaS. (Notably, however, it does appear that Clubhouse is struggling to hold onto its own hype.)

Look I can’t keep up with all the damn venture capital rounds

TechCrunch Early Stage was this week, which went rather well. But having an event to help put on did mean that I covered fewer rounds this week than I would have liked. So, here are two that I would have typed up if I had had the spare hours:

- Striim’s $50 million Series C. Goldman led the transaction. Striim, pronounced stream I believe, is a software startup that helps other companies move data around their cloud and on-prem setups in real time. Given how active the data market is today, I presume that the TAM for Striim is deep? Quickly flowing? You can supply a better stream-centered word at your leisure.

- Kudo’s $21 million Series A. I covered Kudo last July when it raised $6 million. The company provides video-chat and conferencing services with support for real-time translation. It had a good COVID-era, as you can imagine. Felicis led the A after taking part in the seed round. I’ll see if I can extract some fresh growth metrics from the company next week. One to watch.

And two more rounds that you also might have missed that you should not. Holler raised $36 million in a Series B. Per our own Anthony Ha, “[y]ou may not know what conversational media is, but there’s a decent chance you’ve used Holler’s technology. For example, if you’ve added a sticker or a GIF to your Venmo payments, Holler actually manages the app’s search and suggestion experience around that media.”

I feel old.

And in case you are not paying enough attention to Latin American tech, this $150 million Uruguayan round should help set you straight.

Various and sundry

Finally this week, some good news. If you’ve read The Exchange for any length of time, you’ve been forced to read me prattling on about the Bessemer cloud index, a basket of public software companies that I treat with oracular respect. Now there’s a new index on the market.

Meet the Lux Health + Tech Index. Per Lux Capital, it’s an “index of 57 publicly traded companies that together best represent the rapidly emerging Health + Tech investment theme.” Sure, this is branded to the extent that, akin to the Bessemer collection, it is tied to a particular focus of the backing venture capital firm. But what the new Lux index will do, as with the Bessemer collection, is track how a particular venture firm is itself tracking the public comps for their portfolio.

That’s a useful thing to have. More of this, please.

Amazon kicked off the holiday weekend by backtracking slightly on a social media offensive that unfolded in the waning days of a historic unionization vote. The earlier comments reportedly arrived as Jeff Bezos was pushing for a more aggressive strategy.

Along with taking on Senators Bernie Sanders and Elizabeth Warren, the Amazon News Twitter account went toe to toe with Congressman, Mark Pocan. The Wisconsin Democrat cited oft-reported stories of Amazon workers urinating in bottles in reaction to comments from Consumer CEO, Dave Clark.

“You don’t really believe the peeing in bottles thing, do you?” the account asked. “If that were true, nobody would work for us. The truth is that we have over a million incredible employees around the world who are proud of what they do, and have great wages and health care from day one.”

1/2 You don’t really believe the peeing in bottles thing, do you? If that were true, nobody would work for us. The truth is that we have over a million incredible employees around the world who are proud of what they do, and have great wages and health care from day one.

— Amazon News (@amazonnews) March 25, 2021

The Congressman’s initial response was pithy and to the point: “[Y]es, I do believe your workers. You don’t?”

Subsequent reports have served to cement those stories. One called the urination issue “widespread” among Amazon drivers, adding that defecation had also, reportedly, become a problem. Last night, the company offered a mea culpa of sorts, saying it “owe[s] an apology to Representative Pocan.”

Things break down a bit from there. Amazon’s apology acknowledges that workers peeing in bottles is a thing, but appears to imply that it’s limited to drivers and not the fulfillment center staff at the center of this large scale unionization effort. From there, the company adds that drivers peeing in bottles is an “industry-wide issue and is not specific to Amazon.”

The company helpfully includes a list of links and tweets that are, at very least, an indictment of the gig economy and the treatment of blue collar workers, generally. Essentially, Amazon is admitting to being a part of the problem, while working to spread the blame across an admittedly faulty system.

Reports of workers urinating in bottles also go beyond drivers, including stories of warehouse employees resorting to the act in order to meet stringent quotas.

“A typical Amazon fulfillment center has dozens of restrooms, and employees are able to step away from their work station at any time,” company writes in the post attributed to anonymous Amazon Staff. “If any employee in a fulfillment center has a different experience, we encourage them to speak to their manager and we’ll work to fix it.”

Union vote counting for the company’s Bessemer, Alabama warehouse began last week. Results could have a wide-ranging impact on both Amazon and the industry at large.

NASA’s SBIR program regularly doles out cash to promising small businesses and research programs, and the lists of awardees is always interesting to sift through. Here are a dozen companies and proposals from this batch that are especially compelling or suggest new directions for missions and industry in space.

Sadly these brief descriptions are often all that is available. These things are often so early stage that there’s nothing to show but some equations and a drawing on the back of a napkin — but NASA knows promising work when it sees it. (You can learn more about how to apply for SBIR grants here.)

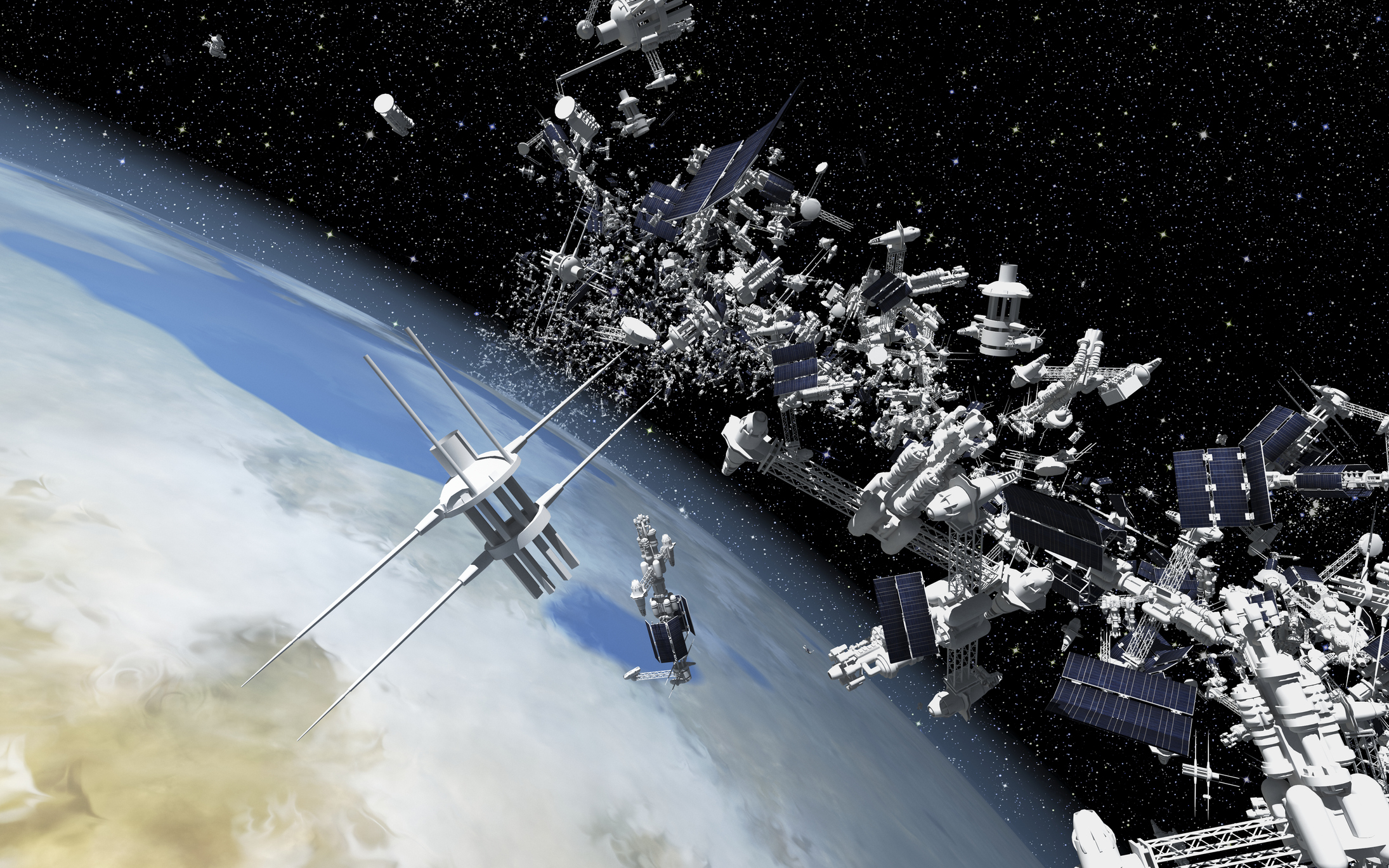

Martian Sky Technologies wins the backronym award with Decluttering of Earth Orbit to Repurpose for Bespoke Innovative Technologies, or DEORBIT, an effort to create an autonomous clutter-removal system for low Earth orbit. It is intended to monitor a given volume and remove any intruding items, clearing the area for construction or occupation by another craft.

Ultrasonic additive manufacturing

There are lots of proposals for various forms of 3D printing, welding, and other things important to the emerging field of “On-orbit servicing, assembly, and manufacturing” or OSAM. One I found interesting uses ultrasonics, which is weird to me because clearly, in space, there’s no atmosphere for ultrasonic to work in (I’m going to guess they thought of that). But this kind of counterintuitive approach could lead to a truly new approach.

Robots watch each other’s backs

Doing OSAM work will likely involve coordinating multiple robotic platforms, something that’s hard enough on Earth. TRAClabs is looking into a way to “enhance perceptual feedback and decrease the cognitive load on operators” by autonomously moving robots not in use to positions where they can provide useful viewpoints of the others. It’s a simple idea and fits with the way humans tend to work — if you’re not the person doing the actual task, you automatically move out of the way and to a good position to see what’s happening.

3D printed Hall effect thrusters

Hall effect thrusters are a highly efficient form of electric propulsion that could be very useful in certain types of in-space maneuvering. But they’re not particularly powerful, and it seems that to build larger ones existing manufacturing techniques will not suffice. Elementum 3D aims to accomplish it by developing a new additive manufacturing technique and cobalt-iron feedstock that should let them make these things as big as they want.

Venus is a fascinating place, but its surface is extremely hostile to machines the way they’re built here on Earth. Even hardened Mars rovers like Perseverance would succumb in minutes, seconds even in the 800F heat. And among the many ways they would fail is that the batteries they use would overheat and possibly explode. TalosTech and the University of Delaware are looking into an unusual type of battery that would operate at high temperatures by using atmospheric CO2 as a reactant.

When you’re going to space, every gram and cubic centimeter counts, and once you’re out there, every milliwatt does as well. That’s why there’s always a push to switch legacy systems to low size, weight, and power (low-SWaP) alternatives. Intellisense is taking on part of the radio stack, using neuromorphic (i.e. brainlike – but not in a sci-fi way) computing to simplify and shrink the part that sorts and directs incoming signals. Every gram saved is one more spacecraft designers can put to work elsewhere, and they may get some performance gains as well.

Astrobotic is becoming a common name to see in NASA’s next few years of interplanetary missions, and its research division is looking at ways to make both spacecraft and surface vehicles like rovers smarter and safer using lidar. One proposal is a lidar system narrowly focused on imaging single small objects in a sparse scene (e.g. scanning one satellite from another against the vastness of space) for the purposes of assessment and repair. The second involves a deep learning technique applied to both lidar and traditional imagery to identify obstacles on a planet’s surface. The team for that one is currently also working on the VIPER water-hunting rover aiming for a 2023 lunar landing.

Bloomfield does automated monitoring of agriculture, but growing plants in orbit or on the surface or Mars is a little different than here on Earth. But it’s hoping to expand to Controlled Environment Agriculture, which is to say the little experimental farms we’ve used to see how plants grow under weird conditions like microgravity. They plan to use multi-spectral imaging and deep learning analysis thereof to monitor the state of plants constantly so astronauts don’t have to write “leaf 25 got bigger” every day in a notebook.

The Artemis program is all about going to the Moon “to stay,” but we haven’t quite figured out that last part. Researchers are looking into how to refuel and launch rockets from the lunar surface without bringing everything involved with them, and Exploration Architecture aims to take on a small piece of that, building a lunar launchpad literally brick by brick. It proposes an integrated system that takes lunar dust or regolith, melts it down, then bakes it into bricks to be placed wherever needed. It’s either that or bring Earth bricks, and I can tell you that’s not a good option.

Several other companies and research agencies proposed regolith-related construction and handling as well. It was one of a handful of themes, some of which are a little too in the weeds to go into.

Another theme was technologies for exploring ice worlds like Europa. Sort of like the opposite of Venus, an ice planet will be lethal to “ordinary” rovers in many ways and the conditions necessitate different approaches for power, sensing, and traversal.

NASA isn’t immune to the new trend of swarms, be they satellite or aircraft. Managing these swarms takes a lot of doing, and if they’re to act as a single distributed machine (which is the general idea) they need a robust computing architecture behind them. Numerous companies are looking into ways to accomplish this.

You can see the rest of NASA’s latest SBIR grants, and the technology transfer program selections too, at the dedicated site here. And if you’re curious how to get some of that federal cash yourself, read on below.