& meet dozens of singles today!

User blogs

The venture capital scene in the North African tech ecosystem will be absolutely buzzing right now with the announcement of two large VC funds in the space of two days. Today, Algebra Ventures, an Egyptian VC firm, announced that it has launched its $90 million second fund.

Four years ago, Algebra Ventures closed its first fund of $54 million, and with this announcement, the firm hopes to have raised a total of $144 million when the second fund closes (with first close by Q3 2021). If achieved, Algebra will most likely have the largest indigenous fund from North Africa and arguably in Africa.

According to the managing partners — Tarek Assaad and Karim Hussein, the first fund was an Egyptian-focused fund. Still, the firm made some selective investments in a few companies outside the country. The second fund will be similar — Egypt first, Egypt focused, but allocating investments in East and West Africa, North Africa and the Middle East.

Assaad and Hussein launched the firm in 2016 as one of Egypt’s first independent venture capital funds. It wasn’t easy to start one at the time, and it took the partners two years to close the first fund.

“Raising a venture capital fund in Egypt in 2016, in all honesty, was a pain. There was no venture capital to speak of back then,” Assaad told TechCrunch. “The high-flying startups back then were raising between $1 million and $2 million. We decided to take the bull by the horn and raise from very established LPs.”

These LPs include Cisco, the European Commission, Egyptian-American Enterprise Fund (EAEF), European Bank for Reconstruction and Development (EBRD), International Finance Corporation (IFC) and private family offices. From the first fund, Algebra backed 21 startups in Egypt and MENA, and according to the firm, six of its most established companies are valued at over $350 million and collectively generate more than $150 million in annual revenue. It hopes to back 31 startups from the second fund.

Algebra says it’s sector-agnostic but has a focus on fintech, logistics, health tech and agritech. Although the firm has invested in startups in seed and Series B stages, Algebra is known to be an investor in startups looking to raise Series A investments.

Another appealing proposition from Algebra lies in the fact that it owns an in-house team focused on talent acquisition — in operations, marketing, finance, engineering, etc., for portfolio companies.

The firm’s ticket size remains unchanged from the first fund and will continue to cut checks ranging from $500,000 to $2 million. However, some aspects as to how the firm handles operations might change according to the partners.

“One of the lessons learned in our first fund is that we see that there are more interesting opportunities and great entrepreneurs in the seed stage. And given that we’re more on the ground in Egypt, sometimes we wait for them to mature to Series A. But going forward, we might need to build relationships with those we find exceptional at the seed level and also expand our participation on the Series B level, too,” Hussein said on how the firm will act going forward.

Karim Hussein (Managing partner, Algebra Ventures)

Hussein adds that the company will also be doubling down on its talent acquisition network. Typically, Algebra helps portfolio companies hire C-level executives, and while it plans to continue doing so, the firm might adopt a startup studio model — pairing some professionals to start a company that eventually gets Algebra’s backing and support.

The reason behind this stems from the next set of companies Algebra will be looking to invest in. According to Hussein, the partners at Algebra have studied successful businesses in other emerging markets for some time and want to identify parallels in North Africa where the firm can invest.

“In cases where the firm can’t find those opportunities, we may spur some of those in the network to start building those businesses and capture those opportunities,” he remarked.

Before Algebra, Hussein has been involved with building some successful tech companies in the U.S. Primarily an engineer after bagging both bachelors and doctorate degrees from Carnegie Mellon University and MIT, respectively, he ventured into the world of startup investing and crazy valuations after working for a consulting company in the dot-com era.

He would go on to start Riskclick, a software company known for its commercial insurance applications. The founders sold the company to Skywire before Oracle acquired the company to become part of its suite of insurance services. After some time at WebMD, Hussein returned to Egypt and began mentoring startups as an angel investor. Alongside other angel investors, he started Cairo Angels, an angel investor network in Egypt, in 2013.

“There was a massive gap in the market. We were putting in a bit of small angel money to these businesses but there were no VCs to take them to the next level. So I met up with Tarek and the rest is Algebra,” he said.

Assaad is also an engineer. He obtained his bachelors in Egypt before switching careers by going to Stanford Graduate School of Business. He continued on that path working for some Bay Area companies before his return to Egypt. On his return, he became a managing partner at Ideavelopers, a VC firm operating a $50 million fund since 2009. The firm has had a couple of good success stories, the most notable being fintech startup Fawry. Fawry is now a publicly traded billion-dollar company and Assaad was responsible for the investment which realized a $100 million exit for Ideavelopers in 2015.

Tarek Assaad (Managing partner, Algebra Ventures)

With Algebra, both partners are pioneering local investments in the region. Some of its portfolio companies are the most well-known companies on the continent — health tech startup Vezeeta; social commerce platform Brimore; logistics startup Trella; ride-hailing and super app Halan; food discovery and ordering platform Elmenus; fintech startup, Khazna; and others.

The firm’s latest raise and $144 million capital amount is one of the largest funds dedicated to African startups. Other large Africa-focused funds include the $71 million fund recently closed by another Egyptian firm, Sawari Ventures; Partech’s $143 million fund; Novastar Ventures’ $200 million fund; and the $71 million Tide Africa Fund by TLcom Capital.

These funds have been very pivotal to the growth of the African tech ecosystem in terms of funding. Last year, African startups raised almost $1.5 billion from both local and international investors, according to varying reports. This number was just half a billion dollars six years ago.

However, regardless of the period — 2015 or 2021 — African VC investments have always been largely dominated by foreign investors. But VC firms like Algebra Ventures are showing that local investors can cumulatively raise nine-figure funds or attempt to do so. Obviously, this will provide more startups with more funds and pave the way for indigenous and local VCs to at least increase their participation to nearly equal levels when compared to international investors.

Two-year-old CRED has become the youngest Indian startup to be valued at $2 billion or higher.

Bangalore-based CRED said on Tuesday it has raised $215 million in a new funding round — a Series D — that valued the Indian startup at $2.2 billion (post-money), up from about $800 million valuation in $81 million Series C round in January this year.

New investor Falcon Edge Capital and existing investor Coatue Management led the new round. Insight Partners and existing investors DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group, and Sofina also participated in the new round, which brings CRED’s total to-date raise to about $443 million.

TechCrunch reported last month that CRED was in advanced stages of talks to raise about $200 million at a valuation of around $2 billion.

CRED operates an app that rewards customers for paying their credit card bills on time and gives them access to a range of additional services such as credit and a premium catalog of products from high-end brands.

An individual needs to have a credit score of at least 750 to be able to sign up for CRED. By keeping such a high bar, the startup says it is ensuring that people are incentivized to improve their financial behavior. (More on this later.)

The startup today serves more than 6 million customers, or about 22% of all credit card holders — and 35% of all premium credit card holders — in the world’s second largest internet market.

Kunal Shah, founder and chief executive of CRED, told TechCrunch in an interview that the startup intends to become the platform for affluent customers in India and not limit its offerings to financial services.

He said the startup’s e-commerce service, for instance, is growing fast. He attributed the early success to customers appreciating the curation of items on CRED and merchants courting higher ticket size transactions.

CRED will deploy the fresh funds to scale its revenue channels and do more experimentations, he said.

When asked if CRED would like to serve all credit card users in India, Shah said the selection criteria limits the startup from doing so, but he said he was optimistic that more users will improve their scores in the future.

The startup, unlike most others in India, doesn’t focus on the usual TAM — hundreds of millions of users of the world’s second-most populated nation — and instead caters to some of the most premium audiences.

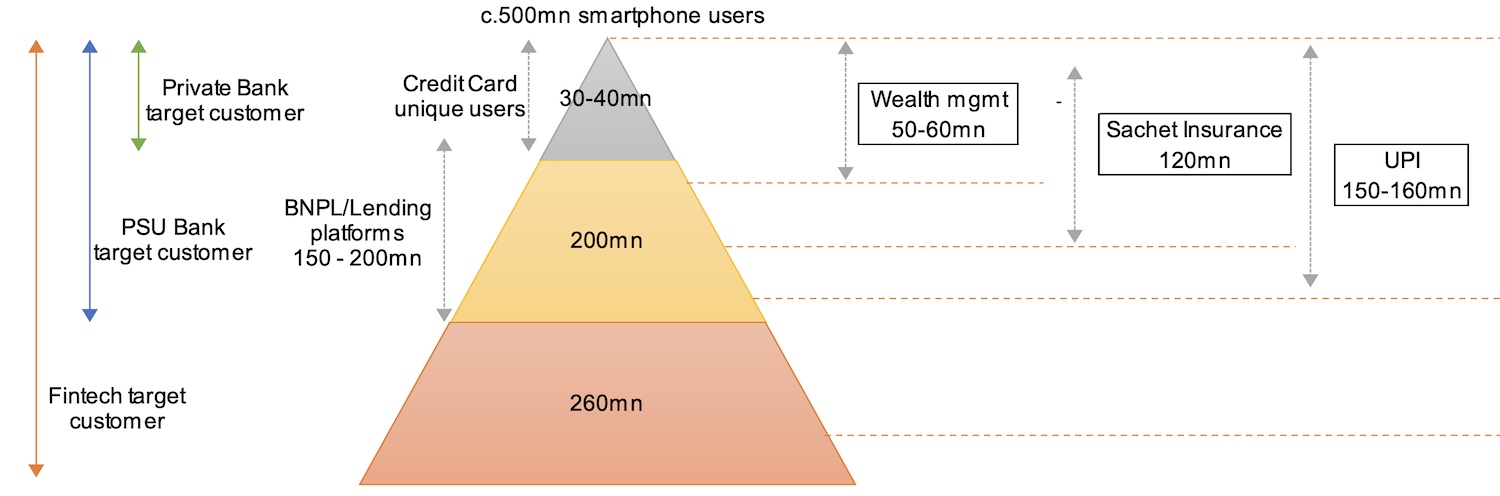

Consumer segmentation and addressable market for fintech firms in India (BofA Research)

“India has 57 million credit cards (vs 830 million debit cards) [that] largely serves the high-end market. The credit card industry is largely concentrated with the top 4 banks (HDFC, SBI, ICICI and Axis) controlling about 70% of the total market. This space is extremely profitable for these banks – as evident from the SBI Cards IPO,” analysts at Bank of America wrote in a recent report to clients.

“Very few starts-ups like CRED are focusing on this high-end base and [have] taken a platform-based approach (acquire customers now and look for monetization later). Credit card in India remains an aspirational product. The under penetration would likely ensure continued strong growth in coming years. Overtime, the form-factor may evolve (i.e. move from plastic card to virtual card), but the inherent demand for credit is expected to grow,” they added.

CRED has become one of the most talked about startups in India, in part because of the pace at which it has raised money of late and its growing valuation. Some users have said that CRED no longer offers them the perks it used a year ago.

Shah said CRED is addressing those concerns. A recent feature, which allows customers to use CRED points at third-party stores, for instance, has made the reward more appealing, he said.

This is a developing story. More to follow…

Charles, a Berlin-based startup that offers a “conversational-commerce” SaaS for businesses that want to sell on WhatsApp and other chat apps, has raised €6.4 million in funding.

Led by Accel and HV Capital, the seed funding will be used by the company to scale and meet existing demand for its conversational commerce platform.

Launched in 2020 by Artjem Weissbeck and Andreas Tussing after the pair had run a year-long experiment running a store in WhatsApp, Charles enables businesses to sell products and services via WhatsApp and other chat apps in order to “increase conversion rate, customer loyalty and ultimately revenue”.

The SaaS connects chat app APIs, such as WhatsApp and Messenger, with shop and CRM systems, like Shopify, SAP and HubSpot, all delivered through a user-friendly interface. The idea is to make it easier for businesses to meet their customers on the channels they already use and to bridge the gap between sales enquiries and support, and actual conversions.

” ‘Traffic’ and with it ‘conversion’ will exponentially move from the streets (retail) and the browser/native apps into chat apps,” says Weissbeck. “Thereby, conversational commerce will be the third big pillar of commerce, gluing together all channels and unlocking the full potential of personalization via the unique identification of customers via their phone number”.

This transition, argues the Charles founder, creates “tremendous challenges and opportunities” for companies in terms of customer journey design and the tech stack, which to date — Asia, aside — has been predominantly tailored around webshops and e-mail.

“Ultimately our technology provides the operating system for companies to master this challenge,” adds Tussing. “The core of our software integrates chat apps with shop/CRM backends in an intuitive interface that puts the human chat sales agent in the center, supported by chatbots and AI”.

Luca Bocchio, partner at Accel, says that conversational commerce is emerging as a “critical channel for brands,” and is a trend that will reshape the way brands interact with customers. [This is] paving the way for potential new category-defining tools to emerge,” he says, noting that Charles has the potential to be one of those tools.

“When we talk to potential clients it’s mostly existing customer service tools like Zendesk who are starting to add chat apps as an additional channel,” says Weissbeck, when asked to cite direct competitors. “These tools are usually built upon a ‘ticketing’ logic, optimized to solve customer inquiries as quickly as possible and with a clear focus on service cases, not sales”.

In contrast, Weissbeck says Charles is built upon a “feed” logic, showing customer interaction as an ongoing conversation and end-to-end relationship — in the same way as the customer sees it.

“Further we deeply integrate into shop/CRM-backends to make it easy for agents to sell product and create carts or contracts — all in a very design-driven and intuitive interface, that is fun to use for the agent and puts her/him in the center,” says Tussing. “Supported by chatbots, not replaced”.

Meanwhile, the revenue model is simple enough: Businesses pay a monthly base fee to cover Charles’ fixed costs and on top of this the startup earns money on conversions. “We take a small share of the net sales, ensuring we are co-incentivised,” explains Weissbeck.

Egyptian-based VC firm Sawari Ventures has closed its $71 million fund for North Africa’s rapidly growing startup ecosystem.

The firm first announced its fund in 2018, when it closed an initial $35 million (which subsequently increased to $41 million) in hopes to close at $70 million, per Menabytes. The investors in the first tranche included CDC (which forked over $12 million), European Investment Bank, Proparco and the Dutch Good Growth Fund.

Having closed an additional $30 million, Sawari Ventures’ total raise is $1 million more than its original target. And it has added a range of new backers that includes Banque Misr, Banque du Caire, Ekuity, Misr Insurance Group, National Bank of Egypt and Suez Canal Bank.

Ahmed El Alfi, Hany Al-Sonbaty and Wael Amin launched Sawari Ventures in 2010. Before venturing into the world of venture capital, El Alfi and Al-Sonbaty were investment professionals in the Egyptian tech space for more than two decades. Amin, meanwhile, was a founder of a tech company called ITWorx that made notable acquisitions in the Egyptian tech ecosystem.

In addition to Egypt, Sawari Ventures focuses on Morocco and Tunisia. For the firm, these three countries represent one of the best investment opportunities around given the mismatch between the capital available (amounts and variation at every stage) and the market opportunity. They also share common traits such as language, culture, business, governance norms and market dynamics, making it easier for cross-border cooperation.

Since launching the firm over 10 years ago, Sawari claims to have invested in more than 30 companies, mostly in Egypt. Some of these companies include ride-hailing service SWVL, software startup Instabug, and AI chat-based personal assistant Elves, but its sweet spots are the hardware, education, healthcare, cleantech and fintech sectors.

“We try to cast a wide net given that, in essence, this is a transformative moment in emerging markets tech with the rapid digitization of the underlying economy,” a company spokesperson told TechCrunch. “So as expected, we’re seeing a great deal flow in the digitization of financial services, health care and education technologies. Also, given the engineering talent, there are unique opportunities in SaaS products, semiconductors and IoT.”

Sawari Ventures invests in growth-stage companies, in particular. But it also operates Flat6Labs, a seed VC firm akin to an accelerator that has been used to perform its seed investments since establishing both Cairo and Tunis offices in 2011 and 2016.

Image Credits: Sawari Ventures

Sawari says 10% of the now-closed investments will be earmarked for seed-stage companies as investments through Flat6Labs Cairo and Tunis. Flat6Labs Cairo will seed between 80 to 100 companies and offer follow-on investments to between 30 and 40. Flat6Labs Tunisia will seed 60 to 70 companies and offer follow-on investments for 30 to 40. The remaining 90% will be used to invest in 20 to 25 growth-stage companies across Egypt, Tunisia and Morocco, with a median investment range of $2 million to $3 million.

The investment range is a continuation of how Sawari typically cut checks for portfolio startups since closing the first tranche three years ago. The firm said it has invested between $1 million and $4 million in Elves, Brantu, and ExpandCart, Almentor, SWVL and MoneyFellows, among others.

“The Egypt-based fund is a privately held fund regulated by the Financial Regulatory Authority of Egypt (FRA), which allowed us to attract capital from top-tier local financial institutions to co-invest with foreign capital from international development financial institutions, doubling our allocation to invest in Egyptian high-growth companies to $68 million,” El Alfi said in a statement.

“Our aim is to create exceptional returns through investing in knowledge-driven companies, which have the potential of bringing transformational changes to the Egyptian economy. The fund will support local companies with dedicated capital, in addition to quality expertise from our seasoned and specialized team, and the value-add of our investors.”

Glints, the Singapore-based career platform, announced today it has raised $22.5 million in Series C funding led by Japanese human resources management firm PERSOL Holdings. The new capital will be used on Glints’ expansion in Singapore, Indonesia, Vietnam and Taiwan and hiring for its product and engineering teams.

Glints co-founder and chief executive officer Oswald Yeo said this is the largest funding round to date for a talent platform in Southeast Asia, and brings the startup’s total raised to $33 million. Other participants included returning investors Monk’s Hill Ventures, Fresco Capital, Mindworks Ventures, Wavemaker Partners, Flipkart co-founder Binny Bansal and former Goldman Sachs TMT China head and partner Xiaoyin Zhang.

Founded in 2013, Glints says it has been used by more than 1.5 million professionals and 30,000 organizations, including Gojek, Tokopedia, Starbucks and Mediacorp. Most of its current users are from the tech and financial services sectors, but Glints has a “broad horizontal focus on young to mid-level professionals,” and its long-term goal is to be sector agnostic, Yeo told TechCrunch.

One of the ways Glints differentiates from other job platforms active in its markets, like LinkedIn, JobStreet and CakeResume, is by building a “full-stack” of services for people who want to advance their careers. In addition to its job marketplace, which the company says has more than 7,000 active listings and 4 million visitors each month, Glints also offers community features and skills education, like online classes.

One of Glints’ value propositions is helping companies, especially in tech, cope with the regional talent shortage, a topic it recently covered in a comprehensive report with Monk’s Hill Ventures.

One of the solutions the report highlighted is hiring teams based in different Southeast Asian countries to address talent crunches in specific markets, like Singapore. Glints says its cross-border remote work hub, TalentHub, doubled its business in 2020 as the pandemic also made employers more open to hiring remotely.