& meet dozens of singles today!

User blogs

GM is adding an electric Chevrolet Silverado pickup truck to its lineup, as the automaker pushes to deliver more than 1 million electric vehicles globally by 2025.

GM President Mark Reuss said Tuesday that the Chevrolet Silverado electric full-size pickup will be based on the automaker’s Ultium battery platform and will have an estimated range of more than 400 miles on a full charge. It should be noted this is GM’s forecast not an official EPA figure.

GM is positioning the full-sized pickup for both consumer and commercial markets. Reuss said that retail and fleet versions of the Silverado electric pickup will be offered with a variety of options and configurations.

“I’m particularly excited about its potential in the fleet and commercial space, a crucial part of the EV market, especially initially,” Reuss said during a presentation at the company’s Factory ZERO assembly plant in Detroit and Hamtramck.

The electric Silverado will go head to head with Ford’s upcoming electric F-150. And while new EV entrant Rivian is not going after the commercial market, its electric RT1 pickup will also provide competition in the space. Rivian, which is expected to begin deliveries of its electric pickup this summer.

The news also follows a string of announcements over the past 18 months, including the GM’s Ultium battery platform and the launch of BrightDrop, an a new business unit to offer commercial customers — starting with FedEx — an ecosystem of electric and connected products. BrightDrop will begin with two main products: an electric van called the EV600 with an estimate range of 250 miles and a pod-like electric pallet dubbed EP1.

Last year, GM committed more than $27 billion to EV and AV product development, including $7 billion in 2021 and plans to launch 30 EVs globally by the end of 2025, with more than two-thirds available in North America.

Reuss said that the company will build the Silverado electric pickup truck at the company’s Factory ZERO assembly plant in Detroit and Hamtramck, Michigan. He confirmed that the GMC Hummer EV SUV, which was unveiled over the weekend, will also be built at the factory. GM renamed its Detroit-Hamtramck assembly plant “Factory ZERO” in October 2020 and later said it would invest $2.2 billion in the factory to produce a variety of all-electric trucks and SUVs.

The facility, which is is undergoing a complete renovation and retooling and has expanded to more than 4.5 million square feet, will also produce the GMC Hummer EV pickup and the Cruise Origin, a purpose-built, all-electric and shared self-driving vehicle. Production of the GMC Hummer EV pickup will begin later this year.

Twitter is abuzz with the news that Topps, a company perhaps best known for making collectible trading cards, is going public via a SPAC.

The reverse merger with its chosen blank-check company values the combination on an equity basis at $1.163 billion. That makes Topps some sort of unicorn. And because it has both e-commerce and digital angles, Topps is technically a fruit tech company.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Why do we care? We care because Topps and its products are popular with the same set of folks who are very excited about creating rare digital items on particular blockchains. Yes, the baseball card company is going public in a debut that could easily be read as a way to put money into the NFT craze without actually having to buy cryptocurrencies and go speculating itself.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

So let’s have a small giggle as we go through the Topps deck and then ask if the company is being valued on its actual, and modestly attractive, present-day business or on possible revenues from future NFT-related activities.

So, trading cards

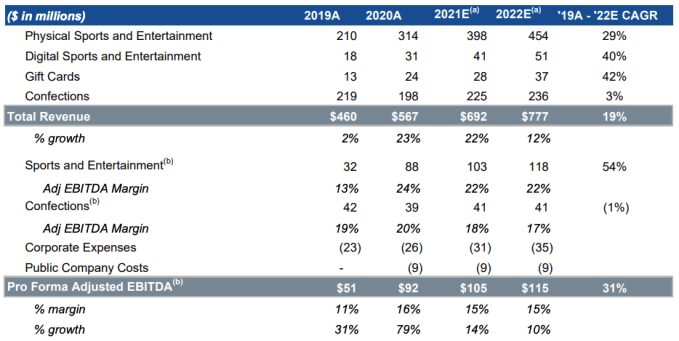

What is Topps? A mix of business units that it breaks down into four categories: Physical Sports and Entertainment (trading cards), Digital Sports and Entertainment (digital collectibles, apps and games), Gift Cards (gift cards for external brands), and Confections (candy).

In terms of scale, the company’s physical goods and confection businesses are by far its leading revenue drivers. Here’s the data:

Image Credits: Topps investor presentation

First, observe that the company’s pro forma adjusted EBITDA nearly doubled from 2019 to 2020. That’s an aggressive expansion in hyper-adjusted profitability. And note how much the company’s physical sports business grew from 2019 to 2020; a nearly 50% gain helped the company grow nicely last year.

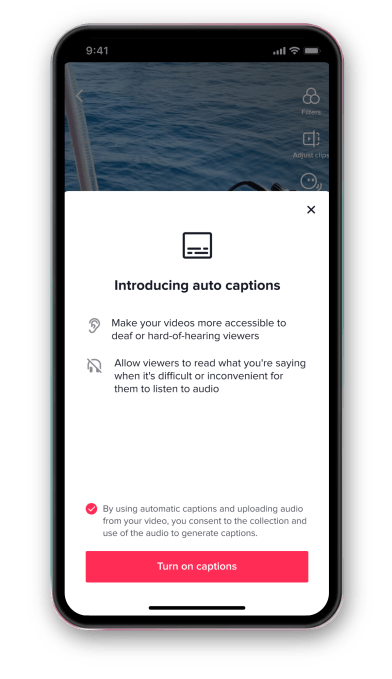

TikTok this morning announced the launch of a new feature designed to make its app accessible to people who are hard of hearing or deaf. The company is today debuting auto captions — a feature that, when enabled, will automatically transcribe the speech from a video so viewers can read what’s being said in the video as an alternative to listening. Initially, auto captions will support American English and Japanese, with additional languages coming in the months ahead, TikTok says.

To use auto captions, the creator will select the option on the editing page after they’ve either uploaded or recorded a video. They can then edit the text that’s generated in order to correct any mistakes before the video is published.

Image Credits: TikTok

Though largely designed for accessibility purposes, auto captions can also help those who want to watch TikTok videos without the sound — for example, when you’re around other people you don’t want to disturb, but lacking headphones. They can also be useful for those watching videos where they’re not fluent in the language being spoken, as it’s sometimes easier to understand what’s said when you can also read the words.

Already, many in the TikTok community had embraced captioning by adding text overlays to their videos or using third-party subtitling tools. The text-to-speech trend, where text on screen is read in a Siri-like voice, has remained a popular technique among creators, too.

But the auto captions tool will work differently from existing options because it can be turned on and off by the viewer. That means you wouldn’t have to see the video captions if you don’t want to. To turn the captions off, you’ll first open the share panel, then tap the captions button to disable them.

Image Credits: TikTok

TikTok says it will be working to spread the word among its creator community about the new addition to encourage users to make their videos accessible to a wider audience.

Auto captions are now one of several accessibility features TikTok has launched, alongside creator warnings when they produce videos that could trigger photosensitive epilepsy and a photosensitivity feature that allows users to skip photosensitive content. The app also offers a text-to-speech feature and a feature to replace animated thumbnails with static images.

TikTok says it’s currently undergoing an accessibility assessment to identify additional areas for improvement, as well, and has worked with the organization The Deaf Collective, to increase awareness towards the talent and conversations taking place in Deaf communities on its app.

The European Union may investigate Facebook’s $1BN acquisition of customer service platform Kustomer after concerns were referred to it under EU merger rules.

A spokeswoman for the Commission confirmed it received a request to refer the proposed acquisition from Austria under Article 22 of the EU’s Merger Regulation — a mechanism which allows Member States to flag a proposed transaction that’s not notifiable under national filing thresholds (e.g. because the turnover of one of the companies is too low for a formal notification).

The Commission spokeswoman said the case was notified in Austria on March 31.

“Following the receipt of an Article 22 request for referral, the Commission has to transmit the request for referral to other Member States without delay, who will have the right to join the original referral request within 15 working days of being informed by the Commission of the original request,” she told us, adding: “Following the expiry of the deadline for other Member States to join the referral, the Commission will have 10 working days to decide whether to accept or reject the referral.”

We’ll know in a few weeks whether or not the European Commission will take a look at the acquisition — an option that could see the transaction stalled for months, delaying Facebook’s plans for integrating Kustomer’s platform into its empire.

Facebook and Kustomer have been contacted for comment on the development.

The tech giant’s planned purchase of the customer relations management platform was announced last November and quickly raised concerns over what Facebook might do with any personal data held by Kustomer — which could include sensitive information, given sectors served by the platform include healthcare, government and financial services, among others.

Back in February, the Irish Council for Civil Liberties (ICCL) wrote to the Commission and national and EU data protection agencies to raise concerns about the proposed acquisition — urging scrutiny of the “data processing consequences”, and highlighting how Kustomer’s terms allow it to process user data for very wide-ranging purposes.

“Facebook is acquiring this company. The scope of ‘improving our Services’ [in Kustomer’s terms] is already broad, but is likely to grow broader after Kustomer is acquired,” the ICCL warned. “‘Our Services’ may, for example, be taken to mean any Facebook services or systems or projects.”

“The settled caselaw of the European Court of Justice, and the European data protection board, that ‘improving our services’ and similarly vague statements do not qualify as a ‘processing purpose’,” it added.

The ICCL also said it had written to Facebook asking for confirmation of the post-acquisition processing purposes for which people’s data will be used.

Johnny Ryan, senior fellow at the ICCL, confirmed to TechCrunch it has not had any response from Facebook to those questions.

We’ve also asked Facebook to confirm what it will do with any personal data held on users by Kustomer once it owns the company — and will update this report with any response.

In a separate (recent) episode — involving Google — its acquisition of wearable maker Fitbit went through months of competition scrutiny in the EU and was only cleared by regional regulators after the tech giant made a number of concessions, including committing not to use Fitbit data for ads for ten years.

Until now Facebook’s acquisitions have generally flown under regulators’ radar, including, around a decade ago, when it was sewing up the social space by buying up rivals Instagram and WhatsApp.

Several years later it was forced to pay a fine in the EU over a ‘misleading’ filing — after it combined WhatsApp and Facebook data, despite having told regulators it could not do so.

With so many data scandals now inextricably attached to Facebook, the tech giant is saddled with customer mistrust by default and faces far greater scrutiny of how it operates — which is now threatening to inject friction into its plans to expand its b2b offering by acquiring a CRM player. So after ‘move fast and break things’ Facebook is having to move slower because of its reputation for breaking stuff.

The energy giant Shell has joined a slew of strategic investors including All Nippon Airways, Suncor Energy, Mitsui, and British Airways in funding LanzaJet, the company commercializing a process to convert alcohol into jet fuel.

A spin-off from LanzaTech, one of the last surviving climate tech startups from the first cleantech boom that’s still privately held, LanzaJet is taking a phased investment approach with its corporate backers, enabling them to invest additional capital as the company scales to larger production facilities.

Terms of the initial investment, or LanzaJet’s valuation after the commitment, were not disclosed.

LanzaJet claims that it can help the aviation industry reach net-zero emissions, something that would go a long way toward helping the world meet the emissions reductions targets set in the Paris Agreement.

“LanzaJet’s technology opens up a new and exciting pathway to produce SAF using an AtJ process and will help address the aviation sector’s urgent need for SAF. It demonstrates that the industry can move faster and deliver more when we all work together,” said Anna Mascolo, President, Shell Aviation, in a statement. “Provided industry, government and society collaborate on appropriate policy mechanisms and regulations to drive both supply and demand, aviation can achieve net-zero carbon emissions. The strategic fit with LanzaJet is exciting.”

LanzaJet is currently building an alcohol-to-jet fuel facility in Soperton, Ga. Upon completion it would be the first commercial scale plant for sustainable synthetic jet fuel with a capacity of 10 million gallons per year.

The fuel is made by using an ethanol inputs — something that Shell is very familiar with. It’s also something that the oil giant has in ready supply. Through the Raízen joint venture in Brazil, Shell has been producing bio-ethanol for over ten years.

The company expects that its sustainable fuel will be mixed with conventional fossil jet fuel to power airplanes in a lower carbon intensity way. Roughly 90% of the company’s production output will be aviation fuel, while the remaining 10% will be renewable diesel, the company said.

LanzaJet’s SAF is approved to be blended up to 50% with fossil jet fuel, the maximum allowed by ASTM, and is a drop-in fuel that requires no modifications to engines, aircraft, and infrastructure. Additionally, LanzaJet’s SAF delivers more than a 70% reduction in greenhouse gas emissions on a lifecycle basis, compared to conventional fossil jet fuel. The versatility in ethanol, and a focus on low carbon, waste-based, and non-food /non-feed sources, along with ethanol’s global availability, make LanzaJet’s technology a relevant and enduring solution for SAF.