& meet dozens of singles today!

User blogs

SaaS to support mid-sized companies’ financial planning with real-time data and native collaboration isn’t the sexiest startup pitch under the sun but it’s one that’s swiftly netted Abacum a bunch of notable backers — including Creandum, which is leading a $7M seed round that’s being announced today.

The rosters of existing investors also participating in the round are Y Combinator (Abacum was part of its latest batch), PROFounders, and K-Fund, along with angel investors such as Justin Kan (Atrium and Twitch co-founder and CEO); Maximilian Tayenthal (N26 co-founder and co-CEO & CFO); Thomas Lehrman (GLG co-founder and ex-CEO), Avi Meir (TravelPerk co-founder and CEO); plus Jenny Bloom (Zapier CFO and Mailchimp ex-CFO) and Mike Asher (CFO at Neo4j).

Abacum was founded last year in the middle of the COVID-19 global lockdown, after what it says was around a year of “deep research” to feed its product development. They launched their SaaS in June 2020. And while they’re not disclosing customer numbers at this early stage their first clients include a range of scale-up companies in the US and in Europe, including the likes of Typeform, Cabify, Ebury, Garten, Jeff and Talkable.

The startup’s Spanish co-founders — Julio Martinez, a fintech entrepreneur with an investment banking background, and Jorge Lluch, a European Space Agency engineer turned CFO/COO — spotted an opportunity to build dedicated software for mid-market finance teams to provide real-time access to data via native collaborative that plugs into key software platforms used by other business units, having felt the pain of a lack of access to real-time data and barriers to collaboration in their own professional experience with the finance function.

The idea with Abacum is to replace the need for finance teams to manually update their models. The SaaS automatically does the updates, fed with real-time data through direct integrations with software used by teams dealing with functions like HR, CRM, ERP (and so on) — empowering the finance function to collaborate more easily across the business and bolster its strategic decision-making capabilities.

The startup’s sales pitch to the target mid-sized companies is multi-layered. Abacum says its SaaS both saves finance teams time and enables faster-decision making.

“Prior to using Abacum, finance analysts in our clients were easily spending 50% to 70% of their time in manual tasks like downloading files from different systems, copy&pasting them in massive spreadsheets (that crash frequently), formatting the data by manually adding and removing rows, columns and formats, connecting the data in a model prone to manual error (e.g. vlookups & sumifs),” Martinez tells TechCrunch. “With Abacum, this entire manual part is automatically done and the finance professionals can spend their time analyzing and adding real value to the business.”

“We enable faster decisions that were not possible prior to Abacum. For instance, some of our clients were updating their cohort analysis on a quarterly basis only because the associated manual tasks were too painful. With us, they’re able to update the analysis weekly and take better decisions as a result.”

The SaaS also supports decisions in another way — by applying machine learning to business data to generate estimates on future performance, providing an AI-based reference point based on historical data that finance teams can use to inform their assumptions.

And it aids cross-business collaboration — allowing users to share and gather information “easily through workflows and permissions”. “We see that this results in faster and richer decisions as more stakeholders are brought into the process,” he adds.

Martinez says Abacum chose to focus on mid-market finance teams because they face “more challenges and inefficiencies” vs the smaller (and larger) ends of the market. “In that segment, the finance function is underinvested — they face the acute complexities of scaling companies that become very pressing but at the same time they are still considered a support function, a back-office,” he argues.

“Abacum makes finance a strategic function — we deliver native collaboration to finance teams so that they become the trusted business partner they want to be. We also see that the pandemic has accelerated the need for finance teams to collaborate effectively and work remotely,” he adds.

He also describes the mid market segment as “fairly unpenetrated” — claiming many companies do not yet having a solution in place.

While competitors he points to when asked about other players in the space are long in the tooth in digital terms: Adaptive Insights (2003); Host Analytics (2001); and Anaplan (2008).

Commenting on the seed round in a statement, Peter Specht, principal at Creandum, added: “The financial planning processes in many companies are ripe for disruption and demand more automation. Abacum’s slick solution empowers finance teams to be more collaborative, efficient and better informed with access to real-time data. We were impressed by their user-friendly product, the initial hiring of top talent, and crucially the strong founders and their extensive operational experience — including as CFOs and entrepreneurs who have experienced the problem first-hand. We are delighted to be part of Abacum’s journey to empower global SMEs to bring their financial operations to new levels.”

Abacum’s seed financing will be ploughed into product development and growth, per Martinez, who says it’s focused on wooing finance teams in the US and Europe for now.

Butter, a startup registered in Denmark but operating fully remote, is building an “all-in-one” platform for planning and running virtual workshops.

Offering video software and other features dedicated to workshopping, the idea is to pull people away from using more generic tools, such as Zoom and Microsoft Teams, which, arguably, aren’t well suited to workshops. It’s also an idea that will be welcomed by many remote workers trapped in a groundhog day full of back-to-back Zooms — and one that has already attracted venture capital.

Backing Butter’s seed round of $2.75 million, which is being disclosed today, is Project A. Others investing in the burgeoning startup are Des Traynor, co-founder and chief strategy officer of Intercom (amongst other angels). It adds to $440,000 previously raised through a mix of equity funding from Morph Capital, venture debt from The Danish Growth Fund and grants from Innovation Fund Denmark.

Butter co-founder and CEO Jakob Knutzen tells me that workshop facilitators, such as strategy consultants, HR trainers and design sprinters, typically have two problems: technical overload and a lack of energy in the workshops.

The former includes having to juggle too many tools needed to plan, run and disseminate a workshop, coupled with unintuitive interfaces and an inability to set up elements of a workshop in advance. The lack of “energy” when delivering workshops virtually is likely a harder nut to define and then crack, but anyone who has taken part in an online workshop has likely experienced it.

“We solve these in two ways,” says Knutzen, “[with an] all-in-one tool that helps facilitators prepare, run and debrief the workshop in one place, [and] a delightful design that supports facilitators in delivering a more human experience… 90% of our users comment on this; Zoom fatigue is real”.

Image Credits: Butter

You get started in Butter by creating and setting up a “room,” including optionally creating an agenda, polls and timers, as well as various customisation, such as a welcome page, image and (yes) music. Next, you invite workshop participants via an automatically generated link that can easily be shared.

On the day, participants join directly in their browser and the workshop leader runs the workshop using the agenda they created as the main guiding point. Butter also supports various third-party integrations, such as for white boarding, note taking, etc. After the session, facilitators can access a “recap” in the room overview with a chat transcript, recording and poll results, etc.

Adds the Butter CEO: “Down the line, we’ll make this even more ‘full workshop flow’ — [including] more of the planning part, having a full pre-workshop space for participants, building out the post-workshop experience, etc. But for now, we’ve doubled down on making the ‘during’ part flow smoothly”.

To that end, Butter is yet to monetise, but will adopt a SaaS model. Meanwhile, Knutzen cites competitors as established but generalist platforms, such as Zoom and Teams; legacy specialist platforms, such as Adobe Connect and Webex for Training; and other startups trying to solve the same problem (e.g. Toasty.ai, circl.es and VideoFacilitator).

“We differentiate ourselves by being laser focused on workshops,” he says.

TrueLayer, the London startup that offers a developer-friendly platform for companies, including other fintechs, to utilise open banking, is disclosing $70 million in new funding.

The Series D round is led by new investor Addition. Existing investors, including Anthemis Group, Connect Ventures, Mouro Capital, Northzone and Temasek, also participated. New investors include Visionaries Club, Zack Kanter (CEO Stedi), Daniel Graf (ex-Uber, Google, Twitter) and David Avgi (ex-CEO SafeCharge, CEO UniPaaS).

TrueLayer says the Series D brings the total investment to date to $142 million. The injection of capital will be used to continue scaling its open banking network, which brings together payments, financial data and identity to enable companies to build new products that improve “how we spend, save, and transact online”.

This will include further development of premium open banking-based services that go beyond simply accessing open banking APIs and will enable more innovation across financial services, including embedded finance and payments more generally.

To do this, and to support what it says is growing demand, TrueLayer is expanding its engineering, product and commercial teams. In the past 12 months, the fintech has expanded its services across 12 European markets.

Over the years, TrueLayer CEO and co-founder Francesco Simoneschi and I have often pontificated on what open banking’s killer use case or use cases may turn out to be. We may finally have our answer: payments.

That’s because one aspect of open banking is payment initiation, which lets an authorised third party initiate the transfer of money out of your bank account on your behalf as an alternative to card payments, which were never built with online payments in mind.

“We believe open banking payments will become the default way to pay online, replacing other payment methods in the next five years,” says Simoneschi. “Open banking is digitally native and mobile-first, moving money at a fraction of the cost, securely and conveniently, while also delivering a vastly better consumer experience”.

The past year has also exposed some of the problems with existing payments methods, as people have turned to digital channels to manage every aspect of their lives. “The problem is cards,” says the TrueLayer CEO, “which weren’t designed for online and have been retrofitted into current online payment flows. Newer digital approaches such as Google Pay or Apple Pay paper over those cracks but don’t change the fundamentals”.

Simoneschi says the company has seen the use of its payments API grow rapidly as more consumers embrace instant bank payments. Volumes grew by 600x over the last year, driven by more and more companies adopting open banking payments, including the likes of Revolut, Trading 212, Freetrade and Nutmeg.

“We typically see that 1 in 3 customers choose the open banking payment option after trying it once,” he notes, revealing that for some clients, closer to 70% of their customers are using open banking as the primary payment method.

“There are a number of reasons why it makes sense for customers. For one, they don’t need to remember card details. Instead, they authenticate with their face or fingerprint on their mobile device, instantly and securely. Plus, they’ll never need to update stored details if their card is lost, stolen or expires”.

Open banking payments as a checkout option benefits merchants too, argues Simoneschi. “These payments typically convert 20% better than cards (and up to 40% with our flows) and have success rates higher than 95%, equating to millions or hundreds of millions in recovered revenue at the end of the year,” adds the TrueLayer co-founder.

Hundreds of thousands of used cars are sold in India each month. But buying one through the offline and traditional channel could prove to be a painstakingly long and high-risk process.

A Gurgaon-based startup that is attempting to improve this experience said on Thursday it has raised a new financing round.

Spinny has raised $65 million in its Series C financing round, the five-year-old Indian startup said. The new round was led by Silicon Valley-headquartered venture firm General Catalyst, while Feroz Dewan’s Arena Holdings, Think Investments, and existing investors Fundamentum Partnership — backed by tech veterans Nandan Nilekani and Sanjeev Aggarwal — and Elevation Partners participated in it.

The round, which brings Spinny’s to-date raise to over $120 million, valued the startup at about $350 million, up from about $150 million a year ago, a person familiar with the matter told TechCrunch. The startup declined to comment on the valuation.

Spinny operates a platform to facilitate sale and purchase of used cars. One of the biggest challenges people face in buying a used car is the trust factor, and Niraj Singh, co-founder and chief executive of Spinny, says the startup’s thorough and transparent inspection of the car, buying it from the owner, and then selling it to customers is addressing those concerns.

The startup says it is removing the traditional middlemen from the equation, thereby making it more affordable and reliable for customers to buy a used car. If a customer is not satisfied with the car that they have purchased from Spinny, they get their full-refund, he said.

Spinny began its journey as a marketplace for used cars, but Singh said the startup has expanded its offerings to become a full-stack platform.

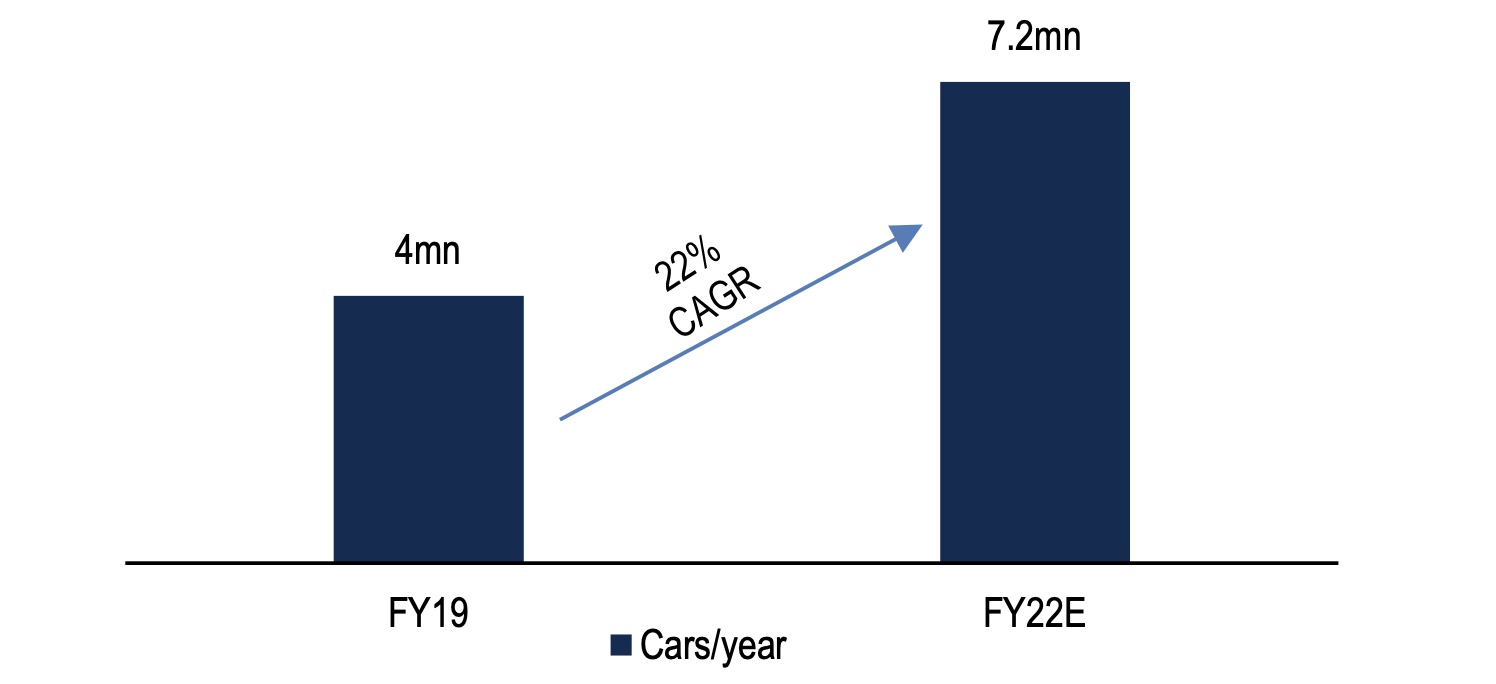

Used car marketed is estimated to grow at 22% CAGR to 7.2mn cars sold per year. (BoFA research)

Days after one of my previous conversations with Singh, New Delhi announced a months-long lockdown in the nation as it moved to contain the spread of the pandemic. Singh said the pandemic did hurt Spinny’s business for a few months, but the startup has long recovered its pre-pandemic growth figures.

The pandemic made many cautious about taking an Uber or Ola ride, and explore buying their own cars, which accelerated the growth, said Singh. It also significantly reduced the CAC (customer acquisition cost) for Spinny, he added.

“We believe Spinny is uniquely positioned to tap this opportunity–given their compelling leadership and their real market momentum. As long time investors, we’ve been impressed by how Spinny is reinventing every part of the buying process – injecting trust and safety into every aspect of the customer experience,” said Adam Valkin, General Partner at General Catalyst, in a statement.

Spinny, which was operational in five Indian cities last year, plans to expand to 15 cities by the end of 2021, and also deploy part of the fresh fund to broaden its full-stack platform, said Singh.

“Spinny has become India’s most trusted used car brand and is on its way to becoming India’s largest as well. It’s heartening to hear customers describe the experience of buying a used car from Spinny being better than that of buying a new car. This has been made possible because of Niraj and the entire Spinny team’s customer obsession and relentless execution. We are privileged to be their early partners and super excited to double down in this round,” said Mukul Arora, Partner at Elevation Capital, in a statement.

This is a developing story. More to follow later…

About a year after Beyond Meat debuted in China on Starbucks’s menu, the Californian plant-based protein company opened a production facility near Shanghai to tap the country’s supply chain resources and potentially reduce the carbon footprint of its products.

Situated in Jiaxing, a city 85 km from Shanghai, the plant is Beyond Meat’s first end-to-end manufacturing facility outside the U.S., the Nasdaq-listed company said in an announcement on Wednesday.

Over the past year, competition became steep in China’s alternative protein space with the foray of foreign players like Beyond Meat and Eat Just, as well as a slew of capital injections for domestic startups including Hey Maet and Starfield.

Beyond Meat doesn’t flinch at the rivalry. When asked by TechCrunch to comment on a story about China’s alternative protein scene, a representative of the company said “there are none that Beyond Meat considers their competitors.”

China not only has an enormous, unsaturated market for meat replacements; it’s also a major supplier of plant-based protein. Chinese meat substitute startups enjoy a cost advantage from the outset and don’t lack interest from investors who race to back consumer products that are more reflective of the tastes of the rising middle class.

Having some kind of manufacturing capacity in China is thus almost a prerequisite for any serious foreign player. Tesla has done it before to build Gigafactory in Shanghai to deliver cheaper electric vehicles. Localized production also helps companies advance their sustainability goals as it shortens the supply chain.

In Beyond Meat’s own words, the Jiaxing facility is “expected to significantly increase the speed and scale in which the company can produce and distribute its products within the region while also improving Beyond Meat’s cost structure and sustainability of operations.”

The American food-tech giant works hard on localization, selling in China both its flagship burger patties and an imitation minced pork product made specifically for the world’s largest consumer of pork. The soy- and rice-based minced pork could be used in a wide range of Chinese cuisines and is the result of a collaboration between the firm’s Shanghai and Los Angeles teams.

Besides production, the Jiaxing plant will also take on R&D responsibilities to invent new products for the region. Beyond Meat will also be unveiling its first owned manufacturing facility in Europe this year.

“We are committed to investing in China as a region for long-term growth,” said Ethan Brown, CEO and founder of Beyond Meat. “We believe this new manufacturing facility will be instrumental in advancing our pricing and sustainability metrics as we seek to provide Chinese consumers with delicious plant-based proteins that are good for both people and planet.”

Beyond Meat products can now be found in Starbucks, KFC, Alibaba’s Hema supermarket and other retail channels across major Chinese cities.