& meet dozens of singles today!

User blogs

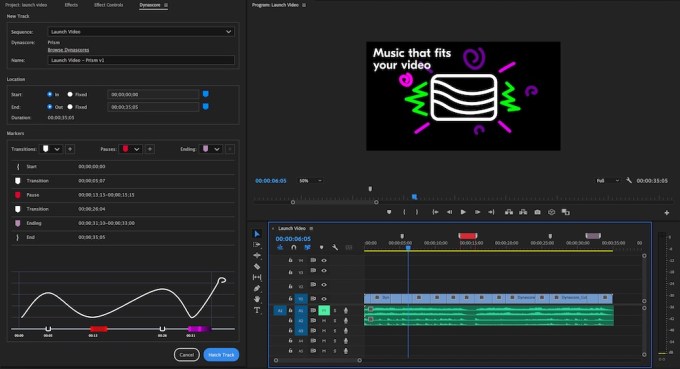

Howard Lerman, the co-founder and CEO of Yext, has a new startup called Wonder Inventions, which is officially launching its first product today — Dynascore.

Let’s focus on Dynascore first. Lerman said he and his team created the product to solve the problem of the ever-growing demand for video content, which often relies on stock music. But by its nature, stock music isn’t designed for a specific video or a specific length, which can lead to some awkward fits, or require producers to edit their videos to match the music since “you can’t just chop three seconds out of a song and put it together.”

Dynascore, however, can take an existing piece of music and adapt it to a video of any length. It can also adjust the music to put the transitions, pauses and endings where you want them.

Lerman and his team demonstrated this for me, taking a fitness commercial and fitting different pieces of music to it, as well as adjusting the length of the commercial and where the transitions fell. Each time, Dynascore would generate a new version of the track that flowed well with the commercial (though I got the sense that if you’ve picked the wrong song for the video, no amount of adjustment can help).

To achieve this, Lerman said Dynascore examines a song and breaks it down to “the smallest unit of music that makes musical sense,” which it calls at a “morphone.” So depending on the specifications, it can assemble those morphones in ways that maximize what the company calls “musicoherence” — basically, to make sure it still flows like a real song.

Image Credits: Dynascore

Lerman emphasized that that Dynascore’s technology isn’t trying to write music from scratch. Instead, it’s adapting human compositions — there are Masterworks, a.k.a. classic compositions that are in the public domain, as well as around 1,000 original compositions to start.

“There’s a lot of companies out there that use AI to write music,” he said. “They train their models on Bach, Mozart and Beethoven, but the stuff that comes out of it is trash […] The critical breakthrough we realized is that computers cannot write music, the same way that AI can’t write a film and can’t write a book. But AI can reconstruct music in a way that the human ear responds to.”

After a free trial, pricing for Dynascore starts at $19 per month. It’s available as a desktop app for Mac and Windows, as well as an extension for editing software Adobe Premiere Pro. The company has also built a Developer API to integrate into other apps, starting with video builder Biteable and marketing production tool Rocketium.

Dynascore is just the first product that we should expect from Wonder Inventions, which Lerman said will develop a whole portfolio of new products.

Image Credits: Dynascore

“We’re not starting Wonder Inventions for a single idea,” he said. “Wonder Inventions is 20 master inventors who are some of the most creative and brilliant and people we’ve ever met, and they will develop many products that will have synergies.”

Lerman himself is serving as Wonder’s chairman while he remains CEO at Yext, which he described as his full-time job. When pressed on whether there’s a unifying vision for the company beyond making cool stuff, he replied, “Thirty years ago, when people started a business, it would be about the company. Now when a company is started, it’s about the product” — something he attributed to venture capitalists’ focus on a single, scalable idea.

“I don’t think any VC would fund Dynascore — it’s too goofy and someone would look at the [total addressable market] and say, ‘I don’t think this is a multi-billion dollar category,'” Lerman continued. He doesn’t necessarily disagree with that assessment, but he added, “It can be great first product, with more hits to come.”

There’s been a lot of investment in machine learning startups recently as companies try to push the notion into a wider variety of endeavors. Comet, a company that helps customers iterate on models in an experimentation process designed to eventually reach production, announced a $13 million Series A today.

Scale Venture Partners led the round with help from existing investors Trilogy Equity Partners and Two Sigma Ventures. The startup has raised almost $20 million, according to Crunchbase data.

Investors saw a company that has grown revenue over 500% over the last year, says Gideon Mendels, co-founder and CEO. “Things have been working very well for us. On the product side, we’ve continued to double down on what we call experimentation management where we are really tracking these models — data that came into them, the hyper parameters and helping teams to debug and understand what’s going on with their models,” he said.

In addition to the funding, the company is also announcing an expansion of the platform to follow the models into post production with a product they are calling Comet Model Production Monitoring (MPM).

“The model production monitoring product essentially focuses on models post production. The original product was more around how multiple offline experiments are modeled during training, while MPM is focused on these models once they hit production for the first time,” Mendels explained.

Andy Vitus, partner at investor Scale Venture Partners, sees model lifecycle management tooling like Comet’s as a developing market. “Machine learning and AI will drive the future of enterprise software, and ensuring that organizations have full visibility and control of a model’s life cycle will be imperative to it,” Vitus said in a statement

As the company grows, it’s opening a new engineering hub in Israel in addition to its office in NYC. While these offices are closed for now, Mendels says that they will have a hybrid office when the pandemic ebbs.

“Moving forward we are planning to have an office in New York City and another office in Tel Aviv. But we’re not going to require anyone to work from the office if they choose not to, or, they can come in a couple days a week. And we’re still going to support hires from around the world.”

Box announced this morning that private equity firm KKR is investing $500 million in the company, a move that could help the struggling cloud content management vendor get out from under pressure from activist investor Starboard Value.

The company plans to use the proceeds in what’s called a “dutch auction” style sale to buy back shares from certain investors for the price determined by the auction, an activity that should take place after the company announces its next earnings report in May. This would presumably involve buying out Starboard, which took a 7.5% stake in the company in 2019.

Last month Reuters reported that Starboard could be looking to take over a majority of the board seats when the company board meets in June. That could have set them up to take some action, most likely forcing a sale.

While it’s not clear what will happen now, it seems likely that with this cash, they will be able to stave off action from Starboard, and with KKR in the picture be able to take a longer term view. Box CEO Aaron Levie sees the move as a vote of confidence from KKR in Box’s approach.

“KKR is one of the world’s leading technology investors with a deep understanding of our market and a proven track record of partnering successfully with companies to create value and drive growth. With their support, we will be even better positioned to build on Box’s leadership in cloud content management as we continue to deliver value for our customers around the world,” Levie said in a statement.

Under the terms of the deal, John Park, Head of Americas Technology Private Equity at KKR, will be joining the Box board of directors. The company also announced that independent board member Bethany Mayer will be appointed chairman of the board, effective on May 1st.

Earlier this year, the company bought e-signature startup SignRequest, which could help open up a new set of workflows for the company as it tries to expand its market. With KKR’s backing, it’s not unreasonable to expect that Box, which is cash flow positive, could be taking additional steps to expand the platform in the future.

Box stock was down over 8% premarket, a signal that perhaps Wall Street isn’t thrilled with the announcement, but the cash influx should give Box some breathing room to reset and push forward.

While Nigeria and Kenya have been at the forefront of African fintech innovation, activities in Egypt are beginning to shape up nicely. Right now, Egypt is home to a burgeoning fintech startup ecosystem, and today, one of its biggest players, Paymob announced that it has completed an $18.5 million Series A round.

In July 2020, Paymob raised $3.5 million as its first tranche of Series A investment. An additional $15 million was raised from the same investors led by Dubai-based VC firm Global Ventures. Other investors include Egyptian investment fund A15 and Dutch development bank FMO.

The total raise of $18.5 million is the largest Series A round in Egypt yet and one of the largest equity rounds in North Africa.

“We are delighted to lead this momentous fintech fundraise in the region. Paymob has a perfect combination of high-quality technology, product customers increasingly cannot do without, and an outstanding management team, “Basil Moftah, general partner at Global Ventures, said of the investment. “Their market opportunity is also huge; Egypt’s transformation to a cashless society is being enabled by the unique products Paymob has built.”

Paymob was founded in 2015 by Alain El Hajj, Islam Shawky, and Mostafa El Menessy. The platform helps online and offline merchants to accept payments from their customers via several products and solutions. It offers a payment gateway that merchants can plugin into their sites or mobile application using its APIs. For offline merchants, Paymob has a POS solution where they can receive in-store card payments.

The company also has a payment links feature where merchants share links with their customers to receive payments that are received using mobile wallets. And according to the company, 85% of mobile wallets transactions carried out in Egypt is processed by its infrastructure. It also claims to be the largest payment facilitator in the country.

Asides from Egypt, Paymob is also present in Kenya, Pakistan, and Palestine. CEO Shawky says the company has plans to expand into more Sub-Saharan African countries. However, that will come after focusing on the Gulf Cooperation Council (GCC) to gain a large market share.

Regional expansion (with an imminent entry into Saudi Arabia this year) is one of Paymob’s objectives following this raise. Per a statement released by the company, it will also use the investments to expand its merchant network, meet increasing demand, and improve product offerings.

The pandemic presented one of the best opportunities for fintechs all over the world to achieve massive growth. For Paymob, it claims to have grown its monthly revenue over 5x last year. The company also recorded a total payment volume of more than $5 billion from over 35,000 local and international merchants like Swvl, LG, Breadfast, and Tradeline.

This growth allowed the fintech company to raise the second tranche of investment after closing just $3.5 million initially. Shawky told TechCrunch that the deal materialized after the company’s investors and management witnessed an “unprecedented growth” driven by the pandemic “in addition to the new initiatives launched by regulators, which encouraged them to increase their investment to meet our increasing demand.

As earlier iterated, fintech is on the rise in Egypt with startups like Moneyfellows, NowPay, Raseedi, Flick providing lending, payments, wealth and personal finance management services, etc.

The Egyptian fintech ecosystem also got a major boost when incumbent fintech Fawry became a publicly-traded unicorn for the first time. Since launching in 2007, Fawry has been the largest online payment platform in the country and offers a variety of services ranging from mobile wallet to banking services. Will Fawry’s longstanding presence pose a challenge to Paymob’s quest to become a dominant fintech as well? Shawky doesn’t think so.

“Paymob’s major competitor is cash. With only a small percentage of the economy operating in digital forms, we believe the opportunity of truly transforming cash into digital is yet to be unlocked,” he said.

That said, the raise follows the launch of two funds — Algebra Ventures and Sawari Ventures in what can be described as an exciting week for startups and VCs in the country.

A startup that began its journey in India 15 years ago, helping businesses reach and engage with users through texts said on Thursday it has attained the unicorn status and is also profitable.

San Francisco-headquartered Gupshup has raised $100 million in its Series F financing round from Tiger Global Management, which valued the 15-year-old startup at $1.4 billion.

The startup operates a conversational messaging platform, which is used by over 100,000 businesses and developers today to build their own messaging and conversational experiences to serve their users and customers.

Gupshup, which has raised $150 million to date and concluded its Series E round in 2011, says each month its clients send over 6 billion messages.

“The growth in business use of messaging and conversational experiences, transforming virtually every customer touchpoint, is an exciting secular trend,” said John Curtius, a partner at Tiger Global Management, in a statement. “Gupshup is uniquely positioned to win in this market with a differentiated product, a clear and sustainable moat, and an experienced team with a proven track record. In addition to its market leadership, Gupshup’s unique combination of scale, growth and profitability attracted us.”

Tens of millions of users in India, including yours truly, remember Gupshup for a different reason, however. For the first six years of its existence, Gupshup was best known for enabling users in India to send group messages to friends. (These cheap texts and other clever techniques enabled tens of millions of Indians to stay in touch with one another on phone a decade ago.)

That model eventually became unfeasible to continue, Beerud Sheth, co-founder and chief executive of Gupshup, told TechCrunch in an interview.

“For that service to work, Gupshup was subsidizing the messages. We were paying the cost to the mobile operators. The idea was that once we scale up, we will put advertisements in those messages. Long story short, we thought as the volume of messages increases, operators will lower their prices, but they didn’t. And also the regulator said we can’t put ads in the messages,” he recalled.

That’s when Gupshup decided to pivot. “We were neither able to subsidize the messages, nor monetize our user base. But we had all of this advanced technology for high-performance messaging. So we switched from consumer model to enterprise model. So we started to serve banks, e-commerce firms, and airlines that need to send high-level messages and can afford to pay for it,” said Sheth, who also co-founder freelance workplace Elance in 1998.

Over the years, Gupshup has expanded to newer messaging channels, including conversational bots and it also helps businesses set up and run their WhatsApp channels to engage with customers.

Sheth said scores of major firms worldwide in banking, e-commerce, travel and hospitality and other sectors are among the clients of Gupshup. These firms are using Gupshup to send their customers with transaction information, and authentication codes among other use cases. “These are not advertising or promotional messages. These are core service information,” he said.

The startup, which had an annual run rate of $150 million, will use the fresh capital to broaden its product offering and court clients in more markets. Sheth said a similar use case with businesses he saw in India a decade ago is playing out in many emerging markets, opening avenue of growth for the business messaging platform.

“Gupshup’s mission is to build the tools that help businesses better engage customers through mobile messaging and conversational experiences. As we work towards our mission, we are delighted with this investment from Tiger Global, given its incredible track record of making big, bold, successful bets on innovative, category-defining companies worldwide,” he said.