& meet dozens of singles today!

User blogs

A few months back, robotic process automation (RPA) unicorn UiPath raised a huge $750 million round at a valuation of around $35 billion. The capital came ahead of the company’s expected IPO, so its then-new valuation helped provide a measuring stick for where its eventual flotation could price.

UiPath then filed to go public. But today the company’s first IPO price range was released, failing to value the company where its final private backers expected it to.

In an S-1/A filing, UiPath disclosed that it expects its IPO to price between $43 and $50 per share. Using a simple share count of 516,545,035, the company would be worth $22.2 billion to $25.8 billion at the lower and upper extremes of its expected price interval. Neither of those numbers is close to what it was worth, in theory, just a few months ago.

According to IPO watching group Renaissance Capital, UiPath is worth up to $26.0 billion on a fully diluted basis. That’s not much more than its simple valuation.

For UiPath, its initial IPO price interval is a disappointment, though the company could see an upward revision in its valuation before it does sell shares and begin to trade. But more to the point, the company’s private-market valuation bump followed by a quick public-market correction stands out as a counter-example to something that we’ve seen so frequently in recent months.

Is UiPath’s first IPO price interval another indicator that the IPO market is cooling?

Remember Roblox?

If you think back to the end of 2020, Roblox decided to cancel its IPO and pursue a direct listing instead. Why? Because a few companies like Airbnb had gone public at what appeared to be strong valuation marks only to see their values rocket once they began to trade. So, Roblox decided to raise a huge amount of private capital, and then direct list.

Cybersecurity training startup Hack The Box, which emerged originally from Greece, has raised a Series A investment round of $10.6 million, led by Paladin Capital Group and joined by Osage University Partners, Brighteye Ventures, and existing investors Marathon Venture Capital. It will use the funding to expand. Most recently it launched Hack The Box Academy.

Started in 2017, Hack The Box specializes in using ‘ethical hacking’ to train cybersecurity techniques. Users are given challenges to “attack” virtual vulnerable labs in a simulated, gamified, and test environment. This approach has garnered over 500,000 platform members, from beginners to experts, and brought in around 800 organizations (such as governments, Fortune 500 companies, and academic institutions) to improve their cyber-adversarial knowledge.

Haris Pylarinos, Hack The Box Co-Founder and CEO said: “Everything we do is geared around creating a safer Internet by empowering corporate teams and individuals to create unbreakable systems.”

Gibb Witham, Senior Vice President, Paladin Capital Group commented: “We’re excited to be backing Hack The Box at this inflection point in their growth as organizations recognize the increasing importance of an adversarial security practice to combat constantly evolving cyber attacks.”

Hack The Box competes with Offensive Security, Immersive Labs,

INE, and eLearnSecurity (acquired by INE).

Hack The Box is using a SaaS business model. In the B2C market it provides monthly and annual subscriptions that provide unrestricted access to the training content and in the B2B market, it provides bi-annual and annual licenses which provide access to dedicated adversarial training environments with value-added admin capabilities.

Rivian, the Amazon-backed EV manufacturer aiming to bring an electric pickup to market later this year, has partnered with Samsung SDI as its battery cell supplier, the company said Monday.

The two companies did not disclose the value of the deal or its term length, but in a statement released Monday Rivian said it had been working with Samsung SDI “throughout the vehicle development process.”

Rivian pointed out that its anticipated R1T pickup and R1S SUV, which Rivian calls “adventure vehicles,” require a battery module and pack that can handle extreme temperatures and durability use cases.

South Korea-based Samsung SDI already supplies battery cells to other automakers. In 2019, the company signed a $3.2 billion deal with BMW Group for a 10-year supply agreement.

“We’re excited about the performance and reliability of Samsung SDI battery cells combined with our energy-dense module and pack design,” Rivian CEO Rj Scaringe said in a statement. “Samsung SDI’s focus on innovation and responsible sourcing of battery materials aligns well with our vision.”

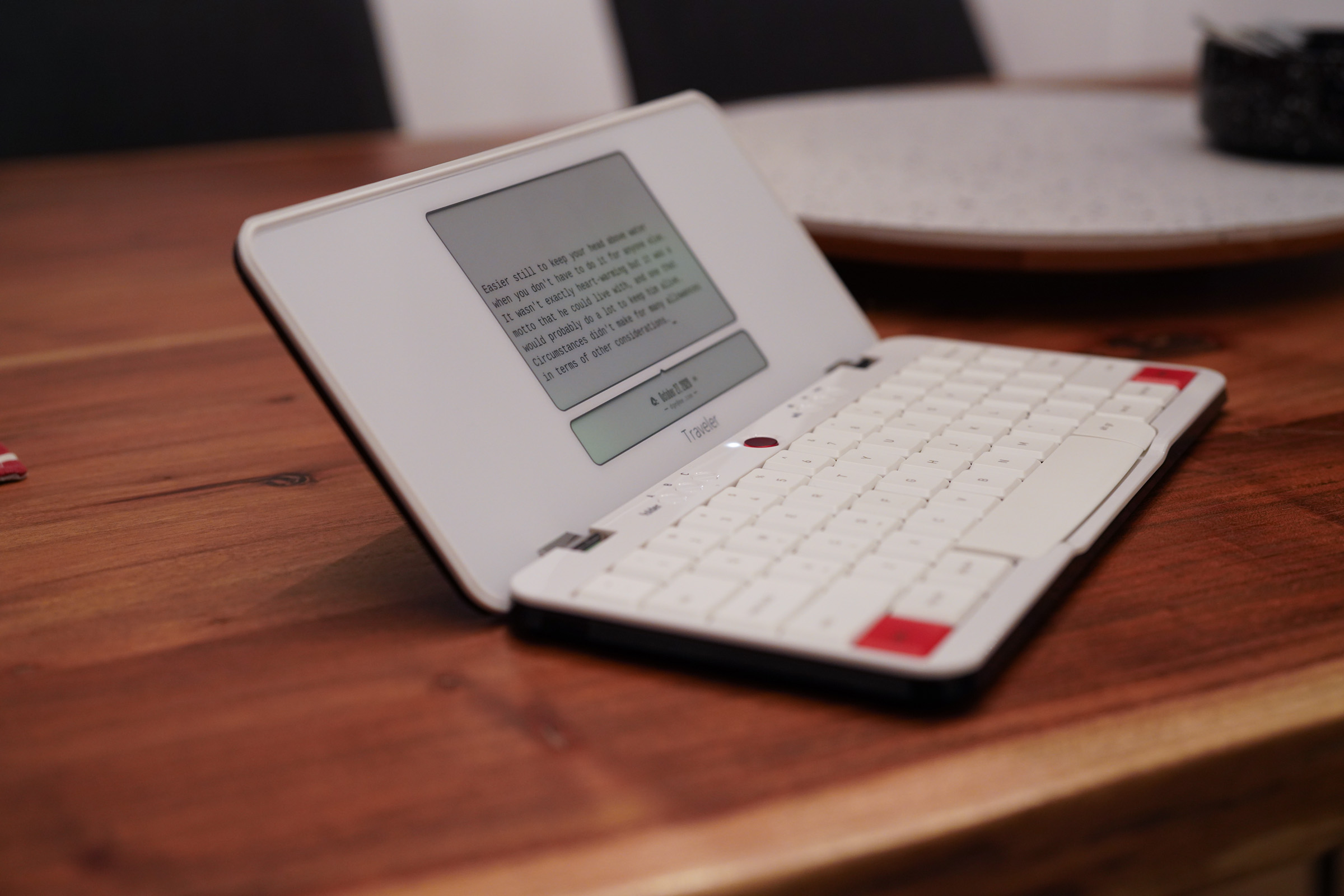

“It’s a little bit of a messy story,” Adam Leeb says with a laugh. The story that landed Astrohaus in Detroit on two separate occasions is a bit tangled, certainly. The hardwre startup’s cofounder and CEO isn’t the sort of hometown cheerleader you often encounter when speaking with executives who’ve opted to keep their organizations outside cities like San Francisco or New York.

Hailing from Detroit’s outer suburbs, Leeb cofounded the company in the Motor City in Fall 2014 with Patrick Paul. Astrohaus’s first – and best known – product was born as an attempt to offer users a “distraction-free writing experience.”

“I’m not even a writer,” Leeb says of the product’s inception. “What interests me about the product – what got me going – is yes, it’s about writing, but common among all of the things I’m interested in, is it’s more about process and productivity. That’s something I’m super passionate about. And making things easier that get out of your way and are really fun to use.”

Leeb, an MIT mechanical engineering graduate and Philips, a Michigan State graduate and software developer met through the Detroit startup community and got to work prototyping a word processing device that delivered the benefits of modern, without the sort of inherent distractions of computers and tablets that today’s writers know all too well.

The young company introduced itself to the world by way of Kickstarter, launching a campaign in 2014.

“The Hemingwrite combines the best features of all previous writing tools with the addition of modern technology,” the company wrote. “It is dedicated like a typewriter, has a better keyboard and battery life than your computer and is distraction free like a word processor. Finally, we sync your documents to the cloud in real-time so you never have to worry about saving, syncing or backing up your work.”

The product was greeted with excitement and some gentle-ribbing (and some not-so-gentle, including one review that called it “pretentious hipster nonsense”) over a $500 reinvention of the typewriter. The crowfunding community went wild, with nearly $350,000 raised. In June of 2015, the product was renamed.

“We are updating our brand with a more demonstrative name that also no longer ties us to the persona of a certain famous writer,” the company wrote in a June 2015 Kickstarter updated. Two months later, Astrohaus relocated to New York City.

“I was really itching to leave. I didn’t know how we were going to make it in Detroit,” Leeb says. “There’s not really a hardware scene and my connections were mostly in New York. I pushed Patrick – we had raised some money and gotten going, so I was like, ‘let’s move to New York.’ There’s definitely more of a hardware scene and we were definitely a part of it.”

Once again, life intervened. Philips left the company and Leeb married Kacee Must, a Detroit resident – and owner of local yoga chain, Citizen Yoga. In 2018, he found himself building Astrohaus up again in the city where it started life. Three years later, the team is still a fairly lean one, with five full time employees in Detroit and a more distributed team of contractors.

Leeb’s feelings about launching a hardware startup in Detroit are clearly mixed. He bemoans the difficult it recruiting and finding funding locally, while acknowledging a sense of local cheerleading one really finds in larger cities. “With these smaller ecosystems, you really get to know people everywhere,” he says. “Everyone is so accessible. As far as anywhere I’ve ever been, Detroit companies really cheer or each other. There’s so much Detroit pride.”

For all of the talk of returning manufacturing to Detroit, Leeb says he’s had little luck in his pursuit to get the Freewrite and subsequent products created in the U.S.

“There’s a whole other world of advanced manufacturing startups that definitely get a lot of benefits from being in a manufacturing hub,” he says. “I think for software companies and for us it’s not so beneficial. We make our goods in China, and I don’t see that changing any time soon. I have good relationships with our factories and I spend a lot of time in China. That’s what they’re geared toward. They make consumer electronics.”

Image Credits: Darrell Etherington

Leeb says he’s found the Andrew Yang-founded Venture for America nonprofit a useful source of hiring locally. In the years following Astrohaus’ launch, impressions of the city have changed radically from a depressed byproduct of rust belt boom and bust to a viable place to launch a business.

“The last 10 years, there’s a massive difference in the city,” Leeb says. “[Quicken Loans cofounder] Dan Gilbert almost single-handedly brought the city back. There are a lot of people who hate him, but the reality is that, while he wasn’t the billionaire in town, he’s the only one who heavily invested in Detroit. He consolidated all of his suburban offices and put them in downtown and he convinced all of these companies to do the same.”

The Covid-19 pandemic will no doubt continue to have repercussions, as remote work becomes the norm for many or most tech outlets. Though hardware startups will always have a compelling reason to keep things in close quarters, as companies develop and test products. For his part, Leeb says Astrohaus’ next device aims to address concerns about remote collaboration.

“I’m very aggressively starting to work on a new hardware product that is a collaboration and communication too,” he says. “It was a problem before, and now it’s such a widespread problem that I feel we’re lacking in certain communication. There’s a lot to be done there. I don’t feel as connected as we could be, even with the technology we have.”

The details for Ant’s restructuring plan after its IPO was called off have arrived. Ant Group, the fintech affiliate of Alibaba controlled by Jack Ma, will be restructuring as a financial holding company, China’s central bank said on Monday.

Ant, which provides online infrastructure for payments and other financial services, needs to “correct its anti-competitive practices” and “give consumers more options in payments methods,” the regulator said. It should also end its monopoly on user information.

More to come…